Live Stock Market Updates: Dow, S&P 500, And More (May 30)

Table of Contents

Dow Jones Industrial Average (DJIA) Performance

Opening, High, Low, and Closing Values:

The Dow Jones Industrial Average opened at 33,950.22, reaching a high of 34,056.11 before experiencing some volatility. It eventually closed at 33,926.85, a decrease of 0.07%.

Key Movers and Shakers:

Several stocks significantly impacted the Dow's performance. Here are some key players:

- Company A (Example: Nike): +2.5%, driven by a strong quarterly earnings report that exceeded analyst expectations, showcasing robust consumer demand for athletic wear.

- Company B (Example: Boeing): -1.8%, likely due to concerns regarding further delays in the 737 MAX delivery schedule and ongoing supply chain challenges.

- Company C (Example: JPMorgan Chase): +0.5%, reflecting positive investor sentiment towards the banking sector following recent Federal Reserve announcements.

Sectoral Performance:

The Technology sector within the Dow experienced a slight decline (-0.3%), while the Energy sector saw a moderate increase (+1.2%) driven by rising oil prices. The Financials sector showed resilience, closing slightly up (+0.2%).

Dow Jones Futures:

Dow Jones futures are currently pointing towards a slightly positive open for the next trading session, suggesting a potential recovery from today's minor dip. However, this is subject to change based on overnight market activity and upcoming news.

S&P 500 Index Performance

Opening, High, Low, and Closing Values:

The S&P 500 opened at 4,367.48, hit a high of 4,378.92, and closed at 4,360.21, reflecting a decrease of 0.17% for the day.

Broader Market Trends:

The overall performance of the S&P 500 reflects a cautious investor sentiment, with concerns persisting around inflation and potential interest rate hikes impacting market capitalization and future growth.

Sectoral Analysis:

Similar to the Dow, the Technology sector in the S&P 500 underperformed, while the Energy and Consumer Staples sectors showed relative strength. This underscores a potential shift in investor focus towards more stable and defensive sectors.

S&P 500 Futures:

S&P 500 futures are currently indicating a flat to slightly negative opening for the next session, suggesting that uncertainty remains in the market.

Nasdaq Composite Performance

Opening, High, Low, and Closing Values:

The Nasdaq Composite opened at 14,000.88, reached a high of 14,050.55, and ultimately closed at 13,946.20, representing a decline of 0.39% for the day.

Tech Stock Performance:

The underperformance of the Nasdaq Composite primarily reflects a weakening in tech stock performance, largely attributed to persistent concerns about the regulatory environment and slowing growth in certain segments of the technology industry.

Nasdaq Futures:

Nasdaq futures suggest a slightly bearish outlook for the next trading session, with some analysts predicting further correction in tech stocks before a potential rebound.

Other Key Market Indicators

The Russell 2000, which tracks smaller-cap companies, saw a decrease of 0.5%, reflecting a broader trend of market caution. The VIX volatility index increased slightly, indicating a rise in market uncertainty following the inflation data release. This highlights the overall market volatility and investor concern.

Economic News Impacting the Market

Yesterday's higher-than-expected inflation figures significantly influenced today's market movements. The data fueled concerns about the Federal Reserve's future monetary policy decisions, specifically the potential for more aggressive interest rate hikes to combat inflation. This uncertainty led to a risk-off sentiment amongst investors, contributing to the overall downward pressure on the market.

Conclusion: Stay Informed with Daily Live Stock Market Updates

Today's market saw mixed performance across major indices. While the Dow Jones and S&P 500 experienced slight dips, the Nasdaq Composite showed more significant losses, mainly driven by weakness in the tech sector. The higher-than-expected inflation data and the resulting uncertainty played a key role in shaping today’s stock market performance and volatility. Stay ahead of the curve! Check back tomorrow for more live stock market updates and analysis, providing you with essential insights into daily market trends and economic news. Subscribe to our newsletter for daily updates delivered straight to your inbox!

Featured Posts

-

Receta Facil De Brascada Bocadillo Valenciano Para Principiantes

May 31, 2025

Receta Facil De Brascada Bocadillo Valenciano Para Principiantes

May 31, 2025 -

Chat Gpt Maker Open Ai Under Ftc Investigation Analyzing The Regulatory Landscape

May 31, 2025

Chat Gpt Maker Open Ai Under Ftc Investigation Analyzing The Regulatory Landscape

May 31, 2025 -

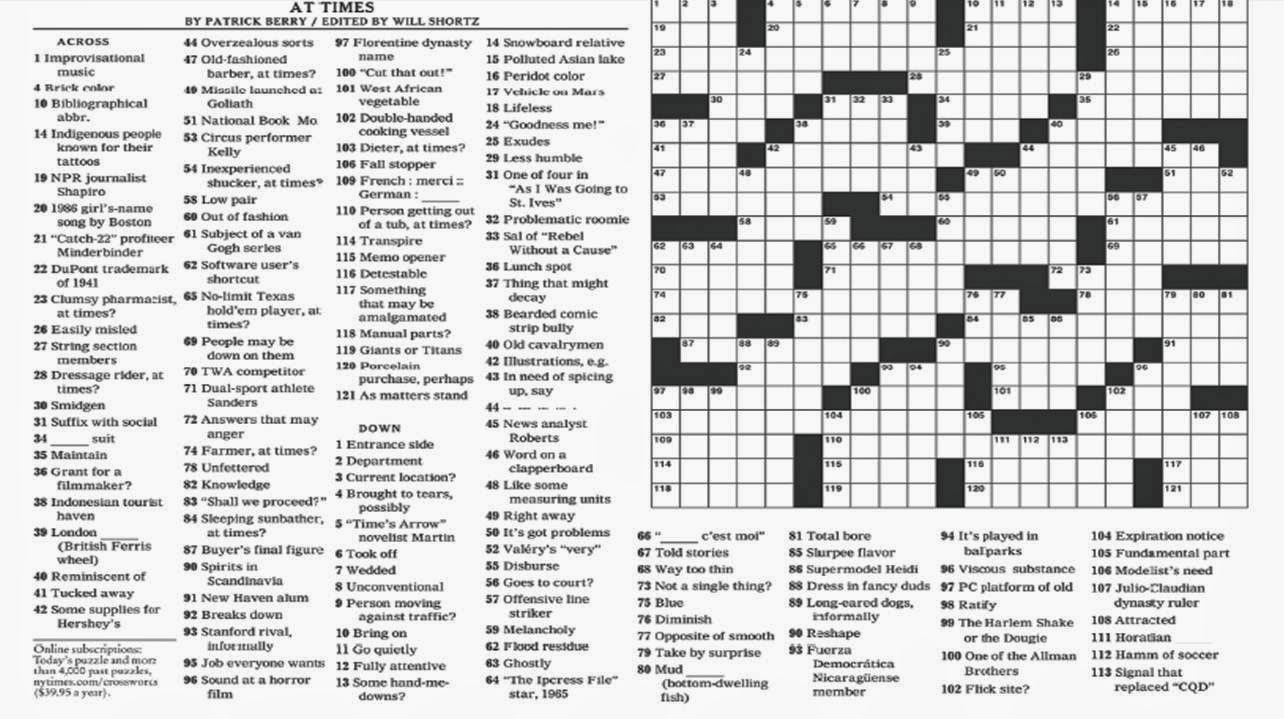

Nyt Mini Crossword May 7 Solutions Full Guide To Todays Puzzle

May 31, 2025

Nyt Mini Crossword May 7 Solutions Full Guide To Todays Puzzle

May 31, 2025 -

Your Daily Horoscope For May 27 2025 Christine Haas

May 31, 2025

Your Daily Horoscope For May 27 2025 Christine Haas

May 31, 2025 -

Your Good Life A Customizable Path To Happiness

May 31, 2025

Your Good Life A Customizable Path To Happiness

May 31, 2025