Live Stock Market Updates: Dow Futures Rise, Gold Surges Past $3500

Table of Contents

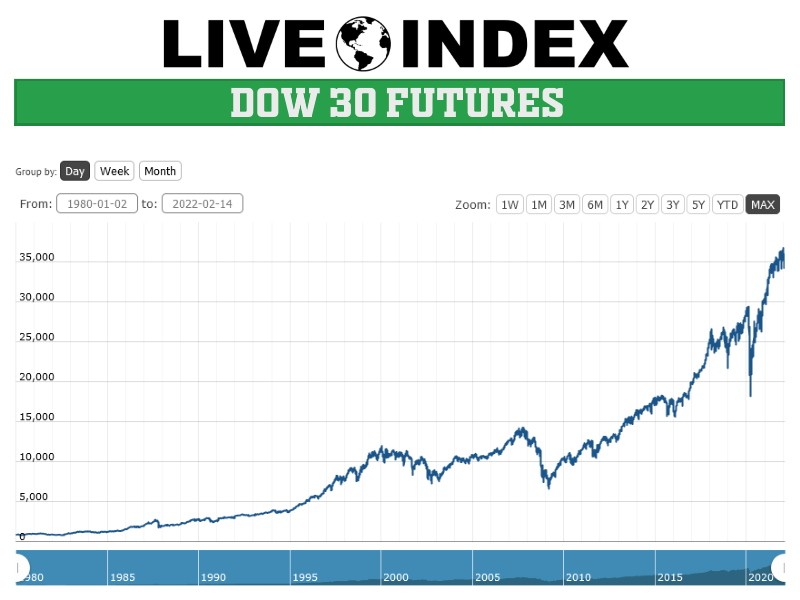

Dow Futures Experience Positive Growth

The Dow Jones Industrial Average futures have demonstrated robust growth, hinting at a potentially strong opening for the US stock market. This positive trajectory can be attributed to a confluence of factors:

-

Positive Economic Indicators: Recent economic data releases paint an optimistic picture. Stronger-than-expected employment numbers for August, coupled with a rise in consumer confidence, have injected renewed vigor into investor sentiment. These figures suggest a resilient economy, bolstering market optimism.

-

Corporate Earnings Reports: Impressive corporate earnings reports from key players across diverse sectors are contributing to the overall market buoyancy. Tech giant, Apple, exceeded expectations with its latest quarterly results, showcasing strong consumer demand for its products. Similarly, positive surprises from companies in the energy sector reflect a robust global economy.

-

Easing Inflation Concerns: While inflation remains a persistent concern, recent data suggests a potential cooling-off period. The slightly decreased inflation rate, though still elevated, is easing pressure on the Federal Reserve to implement further aggressive interest rate hikes. This tempered approach is contributing to market stability and growth.

-

Geopolitical Developments: The ongoing situation in Ukraine continues to be a key factor influencing global markets. While uncertainty remains, recent diplomatic efforts have lessened immediate concerns, providing a temporary respite for investors and allowing for a more positive market outlook. However, this remains a fluid situation requiring continuous monitoring.

Gold Prices Soar Past $3500 – A Record High

The price of gold has experienced a dramatic surge, shattering the $3500 barrier – a historic milestone. This remarkable increase is fueled by several key factors:

-

Safe-Haven Demand: Amidst persistent geopolitical uncertainty and lingering economic anxieties, investors are increasingly seeking refuge in gold, a traditional safe-haven asset. This flight to safety is driving up demand and pushing prices higher.

-

Weakening Dollar: The ongoing weakening of the US dollar is making gold, priced in dollars, more attractive to international investors. This increased foreign demand further exacerbates the upward pressure on gold prices.

-

Inflationary Pressures: Persistent inflationary pressures continue to erode the purchasing power of fiat currencies globally. Gold, a historical hedge against inflation, is becoming increasingly appealing as a store of value, driving strong investor demand.

-

Supply Chain Constraints: While not a primary driver, potential disruptions to gold mining and refining operations due to ongoing global supply chain challenges could contribute to tighter supplies and further price increases.

Implications for Investors

The current market conditions present both opportunities and challenges for investors. The surge in gold prices and the positive movement in Dow futures demand a careful and strategic approach.

-

Diversification: Maintaining a well-diversified investment portfolio remains paramount. Diversification across asset classes helps mitigate risk and navigate market volatility effectively.

-

Risk Management: Investors should meticulously assess their risk tolerance and adjust their investment strategies accordingly. This involves carefully considering the potential downsides of both gold and stock market investments.

-

Long-Term Perspective: Adopting a long-term investment horizon is crucial. Avoid making impulsive decisions based solely on short-term market fluctuations. A long-term strategy allows investors to weather market storms and benefit from sustained growth.

Conclusion

Today's live stock market updates reveal a dynamic and evolving market environment. The encouraging rise in Dow futures signals positive investor sentiment, while the remarkable surge in gold prices underscores the ongoing demand for safe-haven assets. Staying abreast of these live stock market updates is vital for making informed investment decisions. To access continuous market analysis and the latest trends, return regularly for more live stock market updates. Remember to consult a qualified financial advisor before making any investment decisions.

Featured Posts

-

Posthaste Trumps Tariffs And The Impact On Canadian Households

Apr 23, 2025

Posthaste Trumps Tariffs And The Impact On Canadian Households

Apr 23, 2025 -

Keider Monteros Rough Outing As Tigers Fall To Brewers

Apr 23, 2025

Keider Monteros Rough Outing As Tigers Fall To Brewers

Apr 23, 2025 -

Die 50 2025 Uebersicht Aller Teilnehmer Sendetermine Und Streaming

Apr 23, 2025

Die 50 2025 Uebersicht Aller Teilnehmer Sendetermine Und Streaming

Apr 23, 2025 -

Rockies Defeat Brewers 7 2 Doyles 5 Rbis Tie Career Best

Apr 23, 2025

Rockies Defeat Brewers 7 2 Doyles 5 Rbis Tie Career Best

Apr 23, 2025 -

A Comprehensive Guide To Removing Your Digital Information Online

Apr 23, 2025

A Comprehensive Guide To Removing Your Digital Information Online

Apr 23, 2025