'Liberation Day' Tariffs: How Stocks Are Reacting To The Increased Costs

Table of Contents

Impact on Specific Sectors

The Liberation Day Tariffs, implemented on [Date], significantly increased import duties on various goods, impacting numerous sectors. The manufacturing, agriculture, and technology sectors have been particularly hard hit. The increased costs of raw materials and imported components have led to decreased profitability and, consequently, affected stock prices.

- Manufacturing: Companies heavily reliant on imported parts for production, such as [Example Company A] in the automotive industry, have seen their stock prices decline by an average of [Percentage]% since the tariff implementation. [Example Company B], a major electronics manufacturer, reported a [Percentage]% decrease in quarterly profits.

- Agriculture: Farmers exporting goods face reduced demand due to higher prices in international markets. Companies like [Example Company C], a major agricultural exporter, have experienced a [Percentage]% drop in their stock value.

- Technology: While less directly impacted than other sectors, technology companies reliant on global supply chains for components experienced increased production costs, leading to reduced profit margins for companies like [Example Company D], which saw a [Percentage]% dip in stock price.

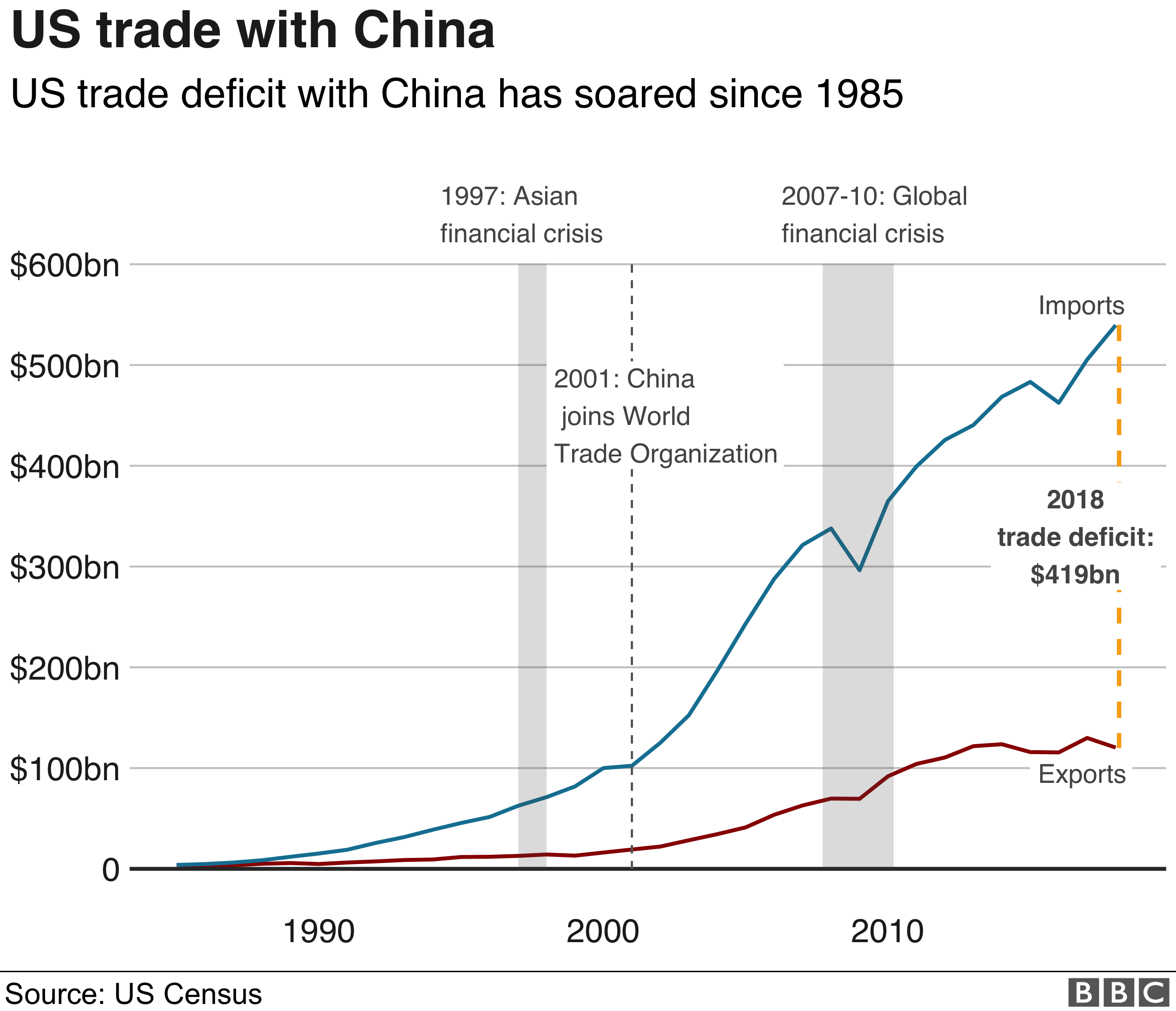

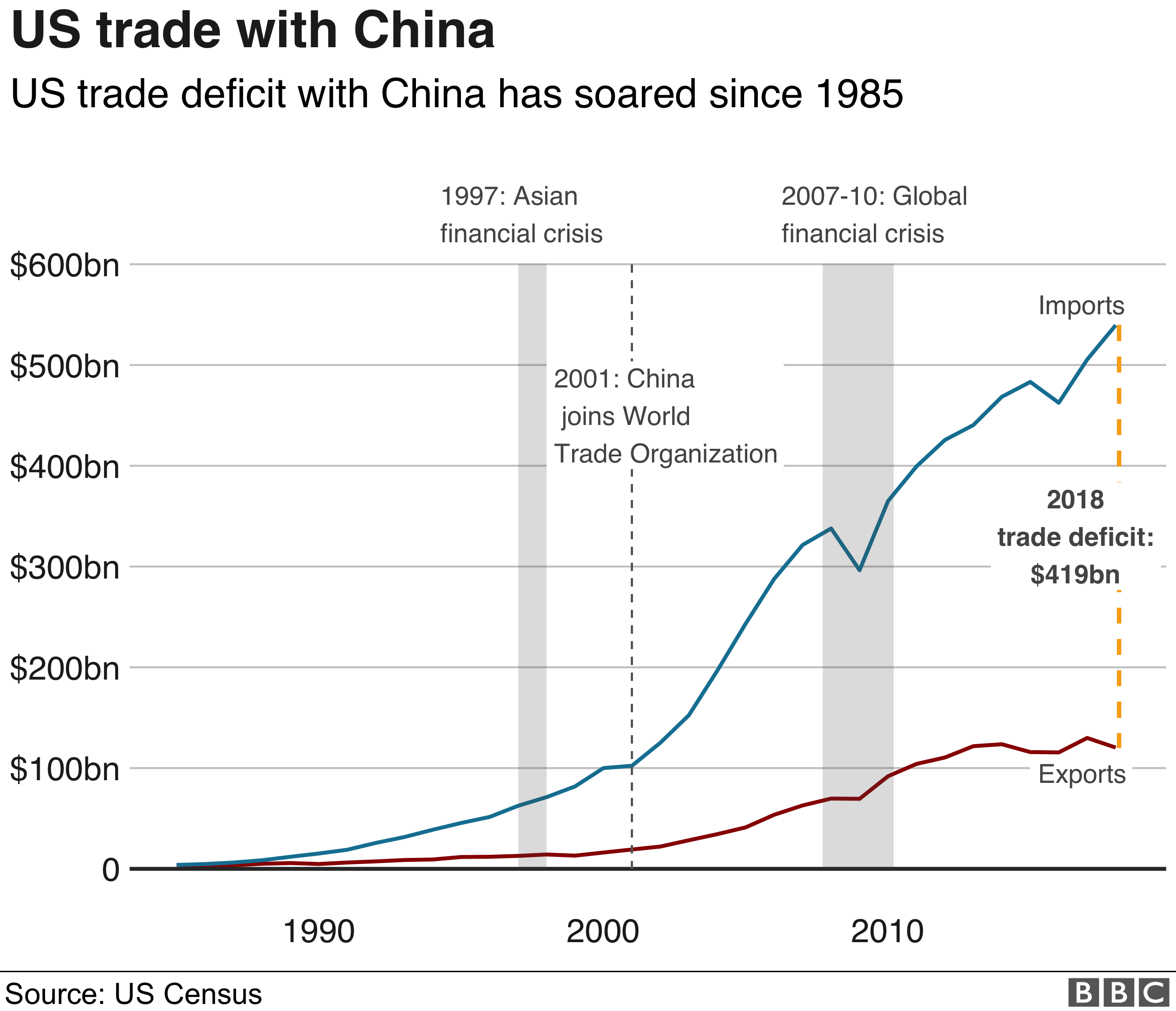

[Insert chart or graph here illustrating the performance of affected sectors post-tariff implementation. Clearly label axes and data sources.]

Investor Sentiment and Market Volatility

The announcement of the Liberation Day Tariffs triggered a wave of uncertainty among investors, leading to a significant shift in sentiment. Investor confidence plummeted, resulting in increased market volatility. This is evident in the fluctuating performance of major market indices.

- Dow Jones Industrial Average: Experienced a [Percentage]% drop immediately following the tariff announcement, before partially recovering.

- S&P 500: Showed similar volatility, with significant daily fluctuations reflecting investor uncertainty.

- Investor Response: Many investors adopted hedging strategies, such as shifting investments to safer assets like government bonds, or increasing their cash positions to weather the storm.

This heightened uncertainty underscores the need for careful risk assessment and proactive investment strategies.

Government Response and Policy Implications

The government's response to the market turmoil has been [Describe Government Response - e.g., a combination of public statements reassuring investors and exploring potential policy interventions]. While [Mention specific policy initiatives or proposed legislation], the long-term effectiveness of these measures remains uncertain.

- Public Statements: [Quote relevant statements from government officials regarding the tariffs and their economic effects].

- Potential Policy Changes: [Discuss potential policy changes, such as subsidies for affected industries or renegotiation of trade agreements]. These policy implications will continue to shape the market landscape and influence investor behavior.

Long-Term Outlook and Potential Investment Strategies

The long-term impact of the Liberation Day Tariffs remains unclear, dependent on several factors including [List key factors, e.g., global economic conditions, the government's response, and the adaptability of affected industries]. However, several potential investment strategies may be considered:

- Diversification: A well-diversified portfolio, spanning multiple sectors and asset classes, is crucial to mitigate risk in this uncertain environment.

- Value Investing: Identifying undervalued companies within affected sectors that demonstrate resilience could yield long-term gains.

- Defensive Stocks: Investing in companies less susceptible to tariff-related disruptions, such as those in the consumer staples sector, could provide stability.

Important Note: Long-term predictions are inherently uncertain. Conduct thorough research and consult with a financial advisor before making any significant investment decisions.

Conclusion: Understanding the Impact of Liberation Day Tariffs on Stocks

The Liberation Day Tariffs have had a significant and multifaceted impact on the stock market. We've seen substantial sector-specific effects, increased market volatility reflecting shifting investor sentiment, and a government response still unfolding. The long-term implications are complex and require careful analysis. Understanding the impact of these tariffs is crucial for making informed investment decisions. Conduct further research, consider your risk tolerance, and consult with financial advisors before investing in the current market climate. The dynamic nature of the market necessitates staying informed about the effects of the Liberation Day Tariffs and similar economic events to navigate this complex landscape successfully. Stay updated on the latest developments regarding the Liberation Day Tariffs and their evolving consequences.

Featured Posts

-

Thunder Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 7th

May 08, 2025

Thunder Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 7th

May 08, 2025 -

Jayson Tatum On Larry Bird Respect Inspiration And The Celtics Past

May 08, 2025

Jayson Tatum On Larry Bird Respect Inspiration And The Celtics Past

May 08, 2025 -

Real Betis Balompie Trayectoria Y Consolidacion Historica

May 08, 2025

Real Betis Balompie Trayectoria Y Consolidacion Historica

May 08, 2025 -

Sdmt Marakana Barbwza Ykhsr Asnanh Fy Nzal Enyf

May 08, 2025

Sdmt Marakana Barbwza Ykhsr Asnanh Fy Nzal Enyf

May 08, 2025 -

Lahwr Ky Ahtsab Edaltwn Ka Khatmh Tfsylat Awr Ps Mnzr

May 08, 2025

Lahwr Ky Ahtsab Edaltwn Ka Khatmh Tfsylat Awr Ps Mnzr

May 08, 2025