Leveraged Semiconductor ETFs: Investor Exodus Before Recent Gains

Table of Contents

The Recent Exodus from Leveraged Semiconductor ETFs

The latter half of 2022 witnessed a substantial outflow of capital from leveraged semiconductor ETFs. This sell-off wasn't a gradual decline; it was a sharp and significant retreat, reflecting growing investor unease. Several factors likely contributed to this exodus.

- Market Corrections: Broader market corrections, fueled by rising interest rates and inflation concerns, significantly impacted the tech sector, including semiconductors. Investors, seeking to reduce risk, often flee from leveraged investments first, amplifying the downturn.

- Economic Slowdown Concerns: Fears of a global economic slowdown further dampened investor sentiment. The semiconductor industry is highly cyclical, making it particularly vulnerable during economic downturns. Reduced consumer spending and decreased business investment directly impact demand for semiconductors.

- Negative Company News: Negative earnings reports from major semiconductor companies added fuel to the fire. News of production cuts, supply chain disruptions, or disappointing guidance sent shockwaves through the market, leading to further outflows from leveraged semiconductor ETFs.

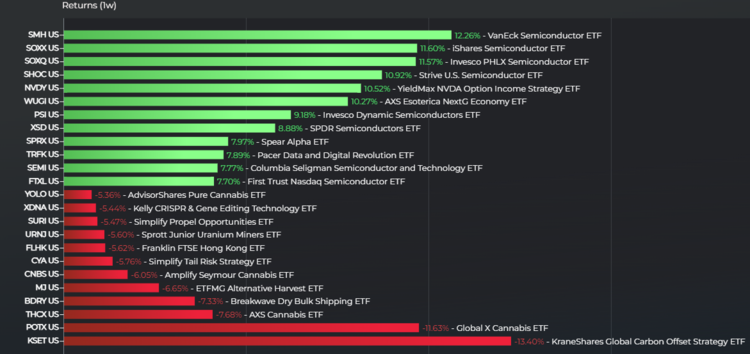

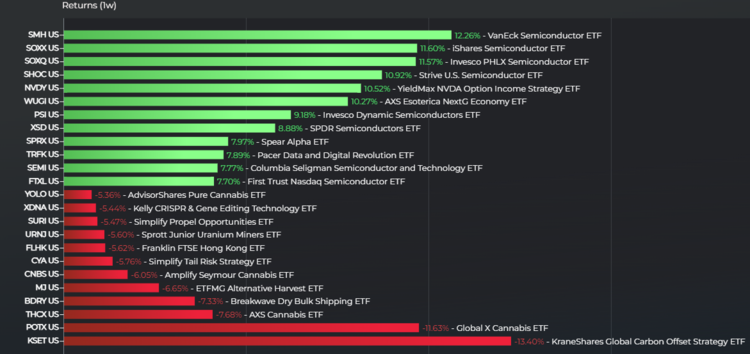

Specific examples of the sell-off:

- The SOXX (iShares PHLX Semiconductor Sector Index ETF), while not leveraged, experienced a notable decline, reflecting the broader market sentiment. Leveraged counterparts saw even steeper drops.

- Several leveraged semiconductor ETFs saw their assets under management (AUM) decline by double-digit percentages within a short period. Specific examples and data points should be included here referencing reputable financial news sources.

- Numerous market analysis reports from well-known financial institutions highlighted the significant investor exodus from leveraged semiconductor investments during this period.

Understanding the Risks of Leveraged Semiconductor ETFs

Leveraged ETFs aim to deliver a multiple (e.g., 2x or 3x) of the daily performance of an underlying index. While this can amplify gains during bullish periods, it also dramatically magnifies losses during downturns.

- Leverage Magnifies Both Gains and Losses: A 2x leveraged ETF will aim to double your daily returns, but it will also double your daily losses. This means even short-term market fluctuations can have a substantial impact.

- Amplified Volatility: The semiconductor sector is inherently volatile. Combining this inherent volatility with leverage creates an extremely risky investment. Small price swings in the underlying index can translate to large swings in the leveraged ETF.

- Volatility Drag (Compounding Daily Returns): Leveraged ETFs reset their leverage daily. Over time, this daily resetting can lead to a phenomenon known as "volatility drag," where the actual returns deviate significantly from the intended multiple, especially in volatile markets. This means you may not achieve the expected multiple of the underlying index's return, especially over longer time periods.

Regulatory Disclosures: It's crucial to note that regulatory disclosures for leveraged ETFs clearly highlight these risks. Investors should thoroughly understand these disclosures before investing.

The Recent Gains and Potential Explanations

Following the significant sell-off, leveraged semiconductor ETFs have experienced a notable price increase. This rebound presents a fascinating contrast to the previous downturn. Several factors might explain this turnaround.

- Market Recovery: A broader market recovery, driven by positive economic indicators and easing inflation concerns, has boosted investor confidence. This recovery has spilled over into the tech and semiconductor sectors.

- Positive Industry News: Positive news regarding technological advancements, increased demand from certain sectors (e.g., AI), and successful product launches has improved sentiment.

- Shift in Investor Sentiment: A shift in investor sentiment, possibly fueled by the belief that the worst is over, has led to a renewed interest in previously shunned sectors, including semiconductors.

Examples of positive industry news: Specific examples of positive news releases, such as announcements of new contracts, innovative technologies, or improved supply chain conditions, should be included here, linking to relevant sources.

Are Leveraged Semiconductor ETFs a Good Investment Now?

Whether leveraged semiconductor ETFs are a good investment currently depends entirely on individual risk tolerance, investment horizon, and market outlook.

- Pros: Potential for high returns in a bull market.

- Cons: Extreme volatility, potential for significant losses, and the complexities of daily compounding.

Alternatives: Consider diversifying into unleveraged semiconductor ETFs or individual semiconductor stocks to manage risk. Always seek professional financial advice.

Navigating the Volatility of Leveraged Semiconductor ETFs

The recent volatility surrounding leveraged semiconductor ETFs underscores the inherent risks associated with leveraged investment strategies, especially in volatile sectors like semiconductors. The significant investor shifts highlight the importance of careful risk assessment and a thorough understanding of the investment product. Remember, leverage amplifies both gains and losses. Conduct thorough research and carefully consider your investment strategy before investing in leveraged semiconductor ETFs. Understanding the risks associated with these products is crucial for informed decision-making.

Featured Posts

-

Elsbeth Season 3 What We Know So Far About The Cast And Storyline

May 13, 2025

Elsbeth Season 3 What We Know So Far About The Cast And Storyline

May 13, 2025 -

Pochemu Edinstvenniy Syn Tatyany Kadyshevoy Ne Platit Alimenty

May 13, 2025

Pochemu Edinstvenniy Syn Tatyany Kadyshevoy Ne Platit Alimenty

May 13, 2025 -

Is Adrien Brody The Ideal Magneto For The Mcu A Post Oscar Analysis

May 13, 2025

Is Adrien Brody The Ideal Magneto For The Mcu A Post Oscar Analysis

May 13, 2025 -

Slobodna Dalmacija Di Capriojeva Potpuna Promjena Iznenadila Obozavatelje

May 13, 2025

Slobodna Dalmacija Di Capriojeva Potpuna Promjena Iznenadila Obozavatelje

May 13, 2025 -

Chicago Bulls And The Nba Draft Lottery Cooper Flaggs Chances

May 13, 2025

Chicago Bulls And The Nba Draft Lottery Cooper Flaggs Chances

May 13, 2025