Learning From Buffett: How To Avoid Unforced Errors And Cultivate Humility

Table of Contents

Understanding and Avoiding Buffett's "Circle of Competence" Errors

Knowing your limitations is paramount to successful investing. Buffett stresses investing only within your "circle of competence"—areas you deeply understand. Stepping outside this circle often leads to significant losses. Mastering Buffett's investing principles means understanding and respecting your boundaries.

Defining Your Circle of Competence:

Knowing your limits is crucial. Buffett stresses investing only in areas you deeply understand. Don't be tempted by the allure of unknown sectors or hot trends.

- Identify your areas of expertise: What industries do you follow closely? Which companies' financial statements can you analyze with confidence? Focus on these areas.

- Research thoroughly before investing in unfamiliar sectors: If venturing outside your comfort zone is unavoidable, dedicate significant time to thorough research. Don't rely solely on marketing materials or superficial analyses.

- Avoid chasing hot trends outside your knowledge base: FOMO (fear of missing out) can lead to rash decisions. Stick to what you know, and avoid impulsive investments based on hype.

- Focus on what you know, not what you wish you knew: Honesty about your limitations is crucial. It's better to miss an opportunity than to suffer a significant loss due to a lack of understanding.

The Dangers of Overconfidence and Cognitive Biases:

Overconfidence is a significant obstacle to sound investing. Cognitive biases like confirmation bias (seeking information that confirms pre-existing beliefs) and anchoring bias (over-relying on the first piece of information received) can lead to flawed investment decisions. Understanding these biases and actively mitigating their influence is essential.

- Regularly review your investment decisions critically: Don't just track performance; analyze the reasoning behind each decision. What worked? What didn't?

- Seek diverse opinions and challenge your own assumptions: Talk to other investors, seek professional advice (though be wary of conflicts of interest), and consider opposing viewpoints to counter your own biases.

- Understand the psychological aspects of investing: Emotions such as greed and fear can cloud judgment. Learn to manage your emotional responses to market fluctuations.

- Consider the use of independent advisors for objective analysis: A fresh perspective from an unbiased professional can help identify blind spots in your analysis.

Cultivating Humility in Your Investment Approach

Humility is a cornerstone of Buffett's success. He readily admits mistakes and views losses as invaluable learning experiences. Cultivating this mindset is crucial for long-term investment success.

Accepting Losses as Learning Opportunities:

Buffett doesn't see losses as failures; rather, he sees them as opportunities for growth. Analyzing past mistakes helps refine your strategy and avoid repeating errors.

- Analyze past investment mistakes to understand the causes: What led to the loss? Was it a flaw in your analysis, a miscalculation of risk, or an unforeseen event?

- Develop a post-mortem process for every investment decision: Establish a structured way to review both successful and unsuccessful investments. This process is vital to improving your judgment.

- Don't let emotions drive your reactions to losses: Avoid panic selling. Maintain a calm and rational approach, even during market downturns.

- Adapt your strategy based on learnings: Use your experience to refine your investment approach, incorporating what you've learned from both successes and failures.

Embracing the Power of Long-Term Investing:

Patience and discipline are hallmarks of Buffett's approach. He avoids impulsive decisions driven by short-term market fluctuations. This long-term perspective is essential for building wealth.

- Focus on the long-term value of your investments: Don't get caught up in daily market noise; look for companies with strong fundamentals and long-term growth potential.

- Ignore short-term market noise and volatility: Market fluctuations are inevitable. Focus on your long-term investment strategy and avoid emotional reactions to short-term price swings.

- Develop a robust long-term investment plan and stick to it: Have a clear plan with defined goals and a well-diversified portfolio. Avoid frequent changes based on short-term market conditions.

- Regularly rebalance your portfolio as needed: Rebalancing ensures your portfolio maintains its target asset allocation over time.

The Importance of Margin of Safety:

Buffett emphasizes buying assets below their intrinsic value to build a safety net. This "margin of safety" protects against unforeseen events and market corrections.

- Thoroughly research the underlying value of investments: Don't rely on market prices alone. Understand the company's financials, competitive landscape, and long-term prospects.

- Don't overpay for assets, even seemingly attractive ones: Patience is key. Waiting for the right price can significantly enhance your returns and reduce risk.

- Develop a robust valuation model for your investments: Learn how to perform fundamental analysis and determine the intrinsic value of companies before investing.

- Look for opportunities offering a significant margin of safety: This is the cornerstone of value investing, enabling you to weather market downturns with greater resilience.

Practical Applications of Buffett's Principles

Applying Buffett's principles involves a multifaceted approach that incorporates diversification, value investing strategies, and a long-term perspective.

Building a Diversified Portfolio:

Don't put all your eggs in one basket. Diversification across different asset classes reduces risk and enhances portfolio stability.

- Spread your investments across different asset classes: Allocate your investments among stocks, bonds, real estate, and other assets based on your risk tolerance and investment goals.

- Consider diversification across industries and geographies: Don't concentrate your investments in a single industry or region. This helps mitigate risks associated with sector-specific downturns or geopolitical events.

- Regularly review and adjust your portfolio allocation: Your portfolio should be periodically reviewed to ensure it aligns with your evolving investment goals and risk tolerance.

Utilizing Value Investing Strategies:

Value investing involves identifying undervalued companies with strong fundamentals and buying them at a discount to their intrinsic value. This strategy aligns perfectly with Buffett's approach.

- Learn to analyze financial statements effectively: Understanding a company's balance sheet, income statement, and cash flow statement is vital for identifying undervalued companies.

- Identify companies with sustainable competitive advantages: Look for companies with "moats"—unique characteristics that protect them from competition.

- Invest in companies with strong management teams: A competent and ethical management team is crucial for a company's long-term success.

Conclusion

Learning from Buffett's emphasis on avoiding unforced errors and cultivating humility is key to long-term investment success. By understanding your limitations, embracing losses as learning experiences, and adopting a long-term perspective, you can significantly improve your investment outcomes. Remember to regularly review your investment strategies, constantly seek knowledge, and remain humble in the face of market uncertainty. Start applying these Buffett's investing principles today and build a more resilient and profitable investment portfolio. Master Warren Buffett's wisdom and avoid costly investment mistakes!

Featured Posts

-

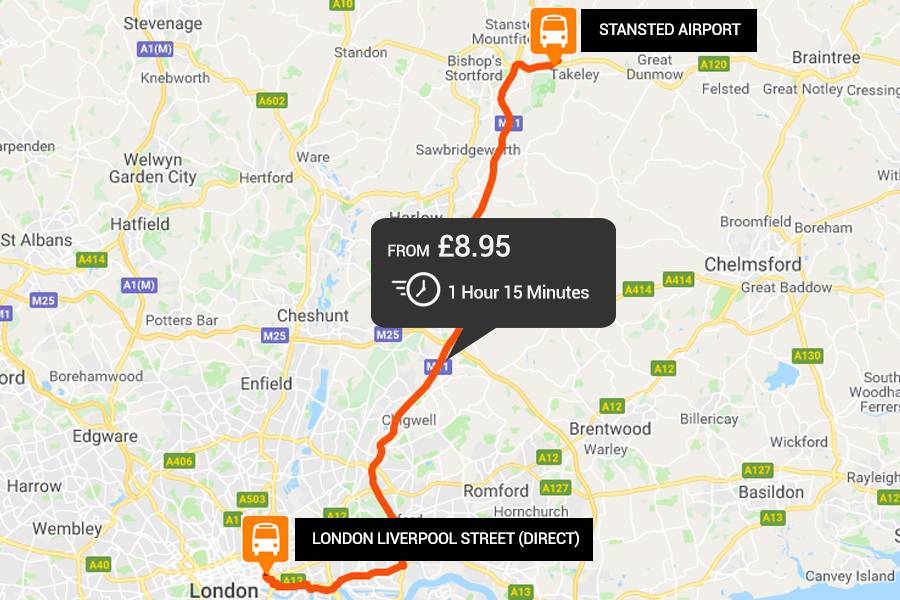

New Direct Flights From Stansted To Casablanca Everything You Need To Know

May 07, 2025

New Direct Flights From Stansted To Casablanca Everything You Need To Know

May 07, 2025 -

El Impacto Psicologico Y Fisico En Simone Biles Mi Cuerpo Se Derrumbo

May 07, 2025

El Impacto Psicologico Y Fisico En Simone Biles Mi Cuerpo Se Derrumbo

May 07, 2025 -

Notre Dame To Host Wnba Preseason Game Las Vegas Aces Vs Dallas Wings

May 07, 2025

Notre Dame To Host Wnba Preseason Game Las Vegas Aces Vs Dallas Wings

May 07, 2025 -

Alex Ovechkins Road Trip Fuel Lucky Sub Cheetos And The Pittsburgh Penguins

May 07, 2025

Alex Ovechkins Road Trip Fuel Lucky Sub Cheetos And The Pittsburgh Penguins

May 07, 2025 -

Rihanna Fuels Speculation New Romance With A Ap Rocky

May 07, 2025

Rihanna Fuels Speculation New Romance With A Ap Rocky

May 07, 2025

Latest Posts

-

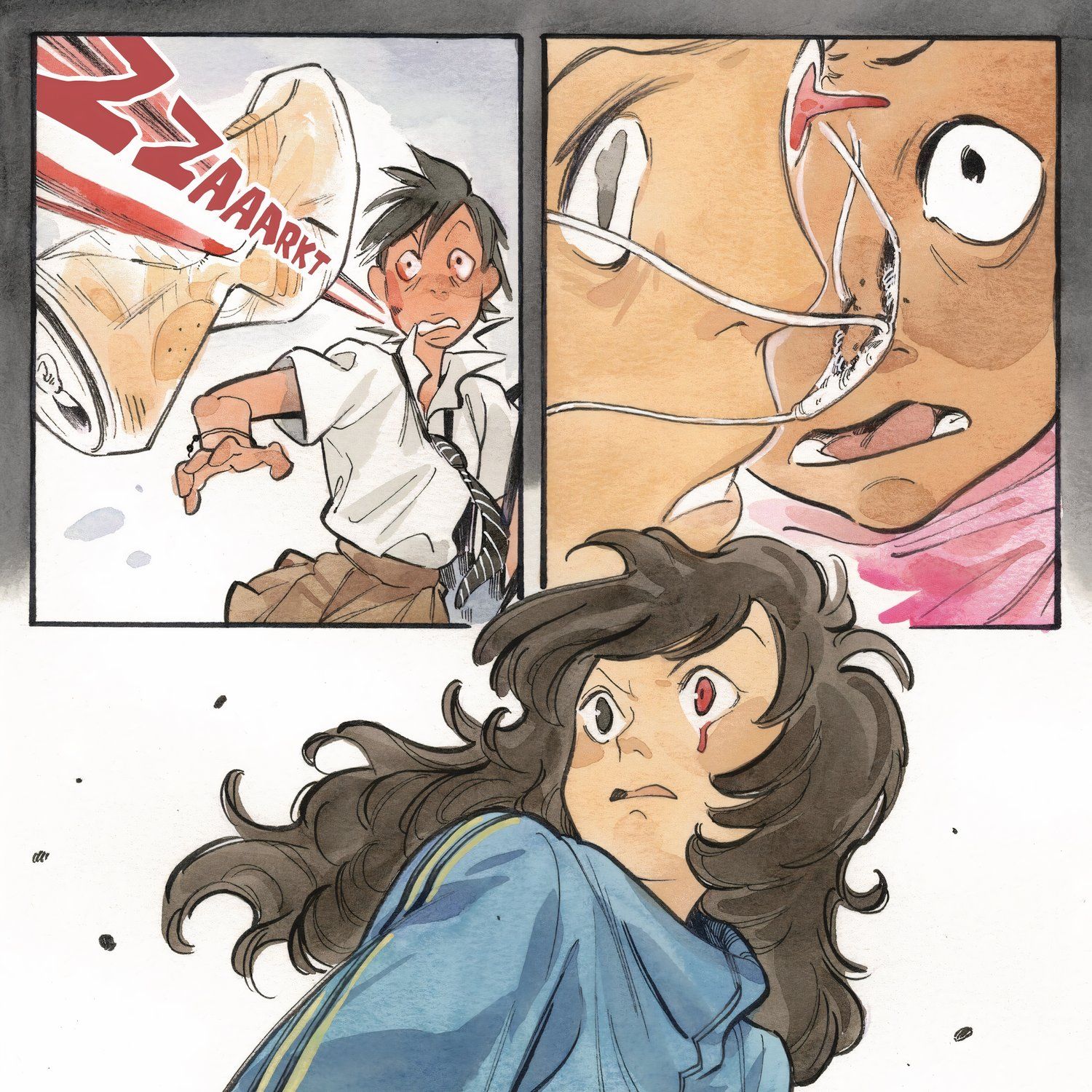

X Men Rogues Unexpected Power Mimicry

May 08, 2025

X Men Rogues Unexpected Power Mimicry

May 08, 2025 -

Analyzing The Overvalued Canadian Dollar Economic Perspectives And Recommendations

May 08, 2025

Analyzing The Overvalued Canadian Dollar Economic Perspectives And Recommendations

May 08, 2025 -

The Untold Story A Rogue One Heros Journey In The New Star Wars Show

May 08, 2025

The Untold Story A Rogue One Heros Journey In The New Star Wars Show

May 08, 2025 -

Rogue Unleashes Cyclops Powers A New X Men Development

May 08, 2025

Rogue Unleashes Cyclops Powers A New X Men Development

May 08, 2025 -

The Canadian Dollars Strength Concerns And Potential Solutions

May 08, 2025

The Canadian Dollars Strength Concerns And Potential Solutions

May 08, 2025