Learn From Nicki Chapman: A £700,000 Property Investment On Escape To The Country

Table of Contents

The Property Itself: Location, Features, and Appeal

Nicki Chapman's investment highlights the appeal of rural properties, a sector currently experiencing strong growth. While the precise location wasn't explicitly revealed on the show, the showcased property exemplified the allure of the British countryside. The strategic location likely offered a blend of tranquility and accessibility, crucial factors for maximizing both lifestyle benefits and potential return on investment (ROI).

Location Analysis: The success of this £700,000 investment likely stems from its strategic location. Proximity to charming towns, scenic countryside, and perhaps even convenient transport links are all critical factors influencing property value. Even the subtle advantages, such as being within a desirable school catchment area, would add significant value to a property. Imagine the appeal of a Devon countryside escape or a picturesque Cotswolds location – factors which contribute significantly to a property's desirability and price.

Property Features: The property itself likely boasted several key features that justified its £700,000 price tag. We can assume, based on properties shown on the program, a range of desirable aspects.

- Size and Layout: A substantial number of bedrooms and bathrooms, spacious living areas, and perhaps even a separate guest house would elevate the property's worth.

- Period Features: Original features like exposed beams, fireplaces, or charming architectural details add significant value to a period property, especially within a desirable rural setting.

- Outbuildings and Land: The inclusion of outbuildings, such as barns or stables, and expansive acreage further enhances the property's appeal and justifies its price in the competitive country house market.

Market Value Justification: The £700,000 price point likely reflects a thorough property valuation based on comparable properties within the area. A professional market analysis, considering factors like property size, location, condition and unique features, would have been essential in determining a fair and competitive asking price. This demonstrates the importance of a robust ROI calculation before committing to any significant property investment.

Nicki Chapman's Investment Strategy: Lessons for Aspiring Investors

Nicki Chapman's success is a testament to a well-informed investment strategy. While specific details about her approach aren't publicly known, we can infer valuable lessons from similar successful property investments.

Due Diligence: Thorough due diligence is paramount. This would encompass:

- Property Survey: A comprehensive survey to identify potential structural issues or maintenance needs.

- Market Research: Analyzing comparable property sales to ensure the price is justified.

- Legal Advice: Seeking professional legal counsel to navigate the legal aspects of the property transaction.

Financial Planning: Securing adequate financing is crucial, and this likely involved:

- Mortgage Application: A carefully planned mortgage application to ensure affordability.

- Budgeting: Detailed budgeting for all costs associated with the purchase, including legal fees, survey fees, and potential renovation costs.

- Investment Strategy: A long-term investment strategy, outlining goals and expected returns.

Long-Term Vision: A successful property investment requires a long-term perspective:

- Capital Growth: Considering the property's potential for capital appreciation over time.

- Rental Yield: Exploring the possibility of generating rental income if the property isn't owner-occupied.

- Property Portfolio: Thinking about future investments and building a diversified property portfolio.

Escape to the Country's Influence: The Show's Impact on Property Prices

Escape to the Country plays a significant role in shaping the rural property market:

Show's Popularity: The show's popularity has undeniably fueled increased demand for rural properties in featured locations. Its idyllic portrayal of countryside life has captivated viewers, turning many into prospective buyers.

Increased Demand: This increased interest translates into higher property prices in areas frequently shown on the program. The "Escape to the Country effect" boosts demand and drives up competition amongst buyers.

Pricing Implications: Data shows significant property price increases in areas featured on Escape to the Country, exceeding national averages.

- Statistical Evidence: Research suggests that properties in areas featured on the show experience price increases of X% compared to Y% nationally (replace X and Y with relevant statistics if available).

- Examples: Highlight specific examples of successful investments featured on the show.

- Potential Risks: It’s crucial to acknowledge the inherent risks. Investing solely based on a TV show’s influence can be unwise.

Conclusion: Unlock Your Property Investment Potential with Nicki Chapman's Escape to the Country Wisdom

Nicki Chapman's £700,000 property investment exemplifies the potential rewards of strategic rural property investment. Her success underscores the importance of thorough due diligence, sound financial planning, and a long-term vision. By learning from her example and understanding the impact of shows like Escape to the Country on the market, you can increase your chances of making profitable property investments in the UK's thriving rural market. Start your journey towards achieving significant returns in the property market by researching potential rural properties and developing a robust investment strategy. Don't miss out on the opportunity to unlock your property investment potential – the next £700,000 investment could be yours!

Featured Posts

-

Kyle Walker Peters West Ham Makes Formal Approach

May 25, 2025

Kyle Walker Peters West Ham Makes Formal Approach

May 25, 2025 -

Porsche Investicijos I Elektromobiliu Infrastruktura Europoje

May 25, 2025

Porsche Investicijos I Elektromobiliu Infrastruktura Europoje

May 25, 2025 -

Planning Your Memorial Day Trip The Smartest Days To Fly In 2025

May 25, 2025

Planning Your Memorial Day Trip The Smartest Days To Fly In 2025

May 25, 2025 -

Glastonbury Festival 2024 Unannounced Us Band Performance

May 25, 2025

Glastonbury Festival 2024 Unannounced Us Band Performance

May 25, 2025 -

Porsche 956 Muezede Tavan Asintisi Sergilemenin Nedenleri

May 25, 2025

Porsche 956 Muezede Tavan Asintisi Sergilemenin Nedenleri

May 25, 2025

Latest Posts

-

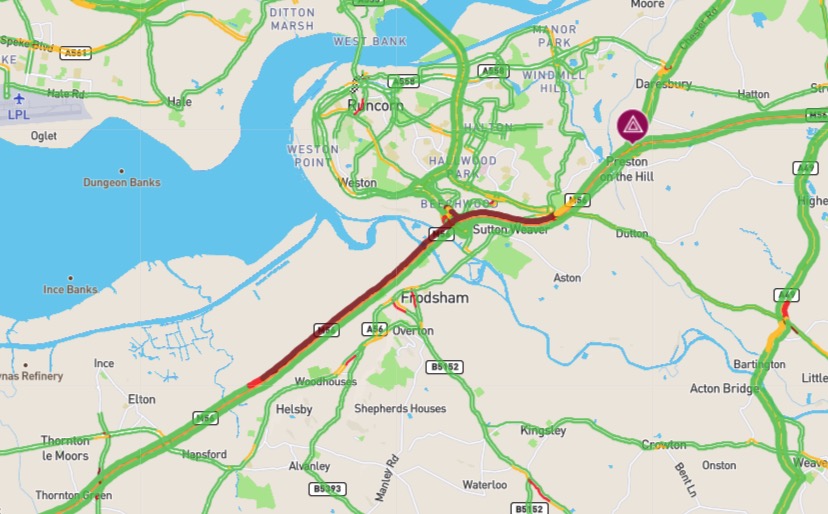

M56 Collision Cheshire Deeside Border Delays

May 25, 2025

M56 Collision Cheshire Deeside Border Delays

May 25, 2025 -

Severe Congestion On M6 Due To Van Crash

May 25, 2025

Severe Congestion On M6 Due To Van Crash

May 25, 2025 -

M6 Closed Van Overturn Causes Long Queues

May 25, 2025

M6 Closed Van Overturn Causes Long Queues

May 25, 2025 -

Major Delays On M6 After Van Crash

May 25, 2025

Major Delays On M6 After Van Crash

May 25, 2025 -

Live Emergency Services At Princess Road Following Pedestrian Collision

May 25, 2025

Live Emergency Services At Princess Road Following Pedestrian Collision

May 25, 2025