Latest Oil Market News And Analysis: May 16, 2024

Table of Contents

Global Crude Oil Price Movements

Benchmark crude oil prices, specifically Brent and West Texas Intermediate (WTI), have experienced considerable fluctuations over the past month. As of May 15th, Brent crude is trading at approximately $X per barrel, while WTI sits at around $Y per barrel (replace X and Y with actual values). These figures represent a [percentage]% change from the previous month, driven by a complex interplay of factors.

Several key elements are driving these price shifts:

- OPEC+ decisions: Recent production adjustments by the OPEC+ cartel have significantly impacted global supply.

- Geopolitical instability: Ongoing conflicts and tensions in various regions continue to disrupt oil production and transportation.

- Economic indicators: Global economic growth projections and indicators like inflation and industrial production influence demand and, consequently, prices.

- Seasonal demand: The shift towards summer driving season typically leads to increased gasoline demand, affecting overall oil prices.

Here's a breakdown of recent price movements:

- Brent crude experienced a [percentage]% increase/decrease last week.

- WTI saw a [percentage]% increase/decrease during the same period.

- Trading volumes have shown a [percentage]% increase/decrease, indicating [increased/decreased] market activity.

- The impact on gasoline and diesel prices has been a [percentage]% increase/decrease at the pump.

[Insert chart/graph illustrating price movements of Brent and WTI crude oil over the past month.]

OPEC+ and its Impact on Oil Supply

The latest OPEC+ meeting concluded with a decision to [summarize OPEC+ decision regarding production quotas]. This decision is expected to [analyze potential impact on global oil supply and prices – increase/decrease supply, lead to price stability/volatility].

Internal tensions within the cartel persist, with some member countries showing less commitment to the agreed production cuts. This lack of complete compliance could significantly affect the effectiveness of the OPEC+ strategy.

Key points regarding OPEC+ actions:

- OPEC+ has set a production target of [X] barrels per day.

- The compliance rate among member countries is currently estimated at [Y]%.

- Potential future scenarios include [list potential scenarios, e.g., further production cuts, increased production, maintaining the status quo].

Geopolitical Factors Influencing Oil Markets

Geopolitical events continue to exert significant pressure on oil markets. The ongoing conflict in [mention specific region/country experiencing conflict] is a primary driver of uncertainty. Sanctions imposed on [mention specific country] are also disrupting supply chains and impacting global oil availability.

Specific geopolitical impacts:

- The conflict in [Region] has led to a [percentage]% disruption in oil production from the region, causing prices to [increase/decrease].

- Sanctions against [Country] have reduced its oil exports by [percentage]%, leading to [positive/negative] consequences for global markets.

- Political instability in [Region] poses a significant threat to oil infrastructure and supply routes, potentially causing further price volatility.

The Impact of the Ukraine Conflict

The war in Ukraine continues to have a profound impact on the global oil market. Disruptions to Russian oil exports, coupled with concerns over broader energy security, have contributed to sustained price volatility. The conflict's long-term effects on global oil supply chains remain uncertain, adding to market uncertainty.

Demand Outlook and Economic Indicators

Global oil demand is projected to [state projected oil demand for the next quarter/year]. This forecast considers several key economic indicators:

- GDP growth in major economies is anticipated to [state projected GDP growth].

- Inflation is currently at [state current inflation rate], which [explain the impact on oil demand].

- Industrial production is showing [state the current status of industrial production – growth/decline], influencing demand for energy.

Seasonal variations: As we approach peak summer driving season in the northern hemisphere, we expect a surge in gasoline demand, which will likely exert upward pressure on overall oil prices.

Conclusion: Key Takeaways and Call to Action

In conclusion, the latest oil market news and analysis reveals a complex picture shaped by OPEC+ decisions, significant geopolitical factors, and evolving economic indicators. Price volatility is likely to persist in the near term, driven by the ongoing interplay of these forces. Understanding these dynamics is crucial for investors, businesses, and consumers alike.

To stay informed about the latest developments and receive in-depth analysis, regularly check back for our "Latest Oil Market News and Analysis" updates. Subscribe to our newsletter or follow us on social media for timely insights and informed perspectives on the ever-changing global oil market.

Featured Posts

-

Office365 Security Breach Nets Hacker Millions According To Federal Authorities

May 17, 2025

Office365 Security Breach Nets Hacker Millions According To Federal Authorities

May 17, 2025 -

Why Guests Break Red Carpet Rules A Cnn Investigation

May 17, 2025

Why Guests Break Red Carpet Rules A Cnn Investigation

May 17, 2025 -

Mitchell Robinsons Season Debut Knicks Center Returns After Ankle Surgery

May 17, 2025

Mitchell Robinsons Season Debut Knicks Center Returns After Ankle Surgery

May 17, 2025 -

Angel Reeses Emotional Tribute To Her Mother Angel Webb Reese

May 17, 2025

Angel Reeses Emotional Tribute To Her Mother Angel Webb Reese

May 17, 2025 -

Iowa Hawkeyes Hire Former D2 National Champion Ben Mc Collum

May 17, 2025

Iowa Hawkeyes Hire Former D2 National Champion Ben Mc Collum

May 17, 2025

Latest Posts

-

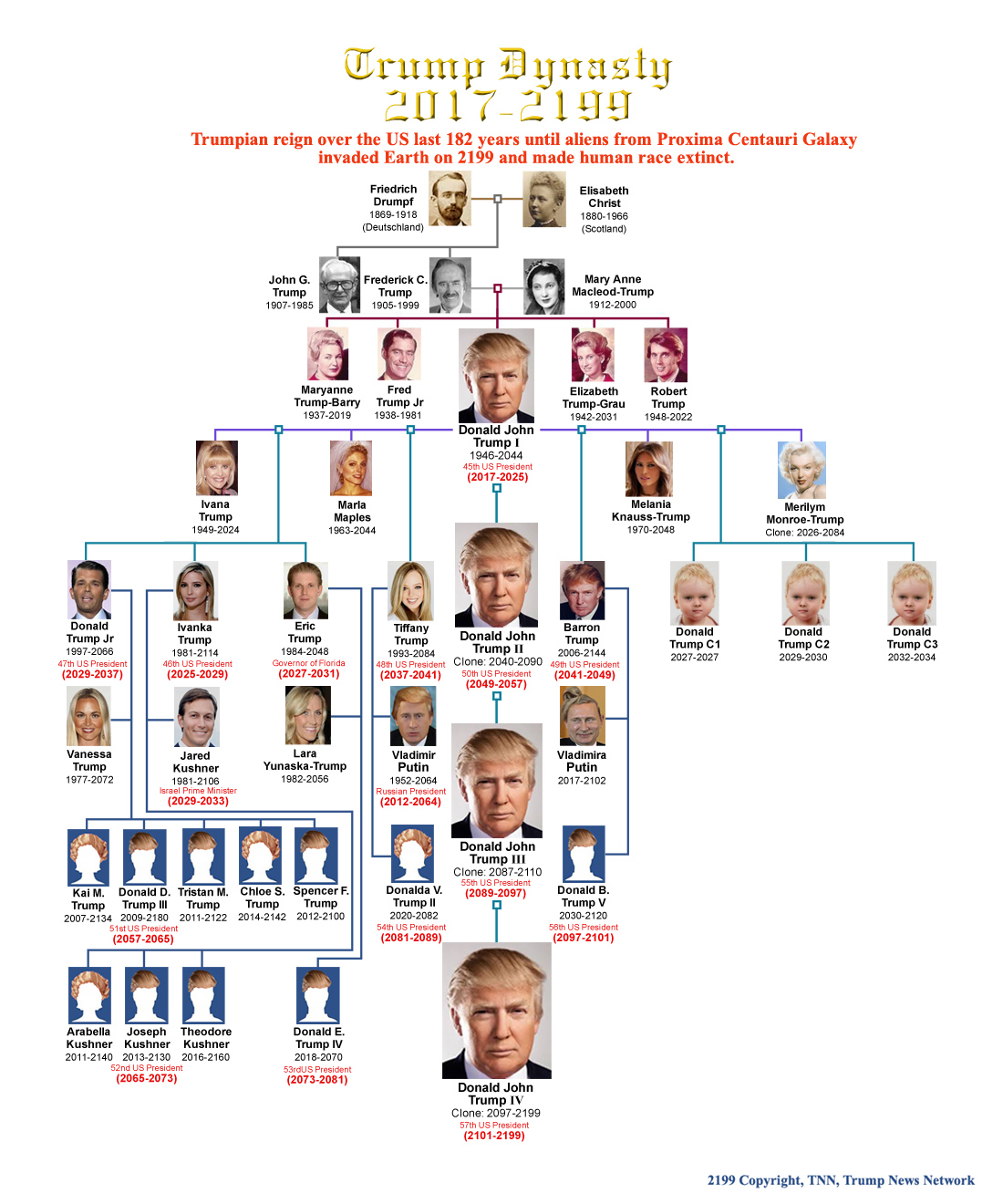

Understanding The Trump Family A Genealogy Of The Trump Dynasty

May 17, 2025

Understanding The Trump Family A Genealogy Of The Trump Dynasty

May 17, 2025 -

Donald Tramp Ta Yogo Mati Khto Bula Meri Enn Maklaud

May 17, 2025

Donald Tramp Ta Yogo Mati Khto Bula Meri Enn Maklaud

May 17, 2025 -

Meri Enn Maklaud Biografiya Materi Donalda Trampa

May 17, 2025

Meri Enn Maklaud Biografiya Materi Donalda Trampa

May 17, 2025 -

The Trump Family Tree Exploring The Presidents Lineage

May 17, 2025

The Trump Family Tree Exploring The Presidents Lineage

May 17, 2025 -

Mati Donalda Trampa Meri Enn Maklaud Zhittya Ta Biografiya

May 17, 2025

Mati Donalda Trampa Meri Enn Maklaud Zhittya Ta Biografiya

May 17, 2025