Land Your Dream Private Credit Role: 5 Key Do's And Don'ts

Table of Contents

Do's – Maximize Your Chances of Success

Do: Network Strategically within the Private Credit Industry

Building a strong network is paramount in the private credit industry. Don't underestimate the power of personal connections in securing a private credit career.

- Attend industry conferences and events: Conferences like the Private Debt Investor Forum or smaller, niche events offer excellent networking opportunities. Engage in conversations, exchange business cards, and follow up with connections afterward.

- Leverage LinkedIn to connect with professionals in private credit: Actively engage with posts, join relevant groups, and send personalized connection requests to individuals working in private credit roles you admire.

- Informational interviews are invaluable for gaining insights: Reach out to professionals for short informational interviews to learn about their experiences and gain valuable insights into the private credit market. This is an excellent way to demonstrate your genuine interest in a private credit career.

- Build relationships with recruiters specializing in private credit placements: Recruiters often have exclusive access to unadvertised private credit jobs. Nurture relationships with recruiters specializing in the finance sector, focusing on those with proven experience in private credit recruitment.

Keyword Optimization: private credit networking, private credit conferences, private credit recruitment, private credit LinkedIn

Do: Tailor Your Resume and Cover Letter to Each Private Credit Application

A generic application won't cut it in the competitive private credit space. Each application needs to showcase your understanding of the specific firm and role.

- Highlight relevant skills and experience: Focus on skills and experience directly relevant to the job description, such as financial modeling, credit analysis, and due diligence.

- Quantify your achievements with data whenever possible: Instead of simply stating your responsibilities, quantify your achievements using metrics and data to demonstrate your impact. For example, instead of saying "managed a portfolio," say "managed a portfolio of $X million, achieving a Y% return."

- Use keywords from the job description: Carefully review the job description and incorporate relevant keywords naturally throughout your resume and cover letter.

- Showcase your understanding of private credit investment strategies: Demonstrate your knowledge of different private credit strategies, such as direct lending, mezzanine financing, and distressed debt.

Keyword Optimization: private credit resume, private credit cover letter, private credit keywords, private credit investment strategies

Do: Prepare Thoroughly for Private Credit Interviews

Thorough preparation is key to acing a private credit interview. It shows your genuine interest and commitment.

- Research the firm's investment strategy and portfolio: Understand their investment focus, recent transactions, and overall performance. This demonstrates your proactive approach and deep understanding of the private credit market.

- Practice behavioral interview questions ("tell me about a time..."): Prepare compelling examples that showcase your skills and experiences using the STAR method (Situation, Task, Action, Result).

- Prepare insightful questions to ask the interviewer: Asking well-thought-out questions shows your genuine interest and engagement. Focus on questions that demonstrate your understanding of the firm and the private credit industry.

- Demonstrate a strong understanding of financial modeling and valuation: Private credit roles often require strong financial modeling skills. Be prepared to discuss your experience and proficiency in these areas.

Keyword Optimization: private credit interview questions, private credit interview preparation, private credit financial modeling, private credit valuation

Don'ts – Avoid These Common Mistakes

Don't: Neglect the Importance of Due Diligence

Due diligence applies to both the firm and your application materials. Thorough preparation is crucial.

- Thoroughly research the firm and the individuals you’ll be interviewing with: Go beyond the company website; explore news articles, LinkedIn profiles, and industry publications to gain a comprehensive understanding.

- Avoid generic cover letters and resumes: Tailor each application to the specific requirements of the job and the firm's culture.

- Demonstrate a lack of understanding of the private credit market: Stay informed about current market trends, regulations, and challenges.

Keyword Optimization: private credit due diligence, private credit research, private credit market

Don't: Underestimate the Importance of Soft Skills

Technical skills are important, but soft skills are equally crucial for success in a private credit role.

- Strong communication skills are essential: Effectively communicate complex financial information to both technical and non-technical audiences.

- Teamwork and collaboration are crucial in private credit: Private credit often involves working in teams, requiring effective collaboration and communication skills.

- Demonstrate problem-solving abilities and critical thinking: Highlight your ability to analyze complex situations, identify potential risks, and develop effective solutions.

- Show enthusiasm and a genuine interest in the role and the firm: Enthusiasm is contagious and demonstrates your commitment.

Keyword Optimization: private credit communication skills, private credit teamwork, private credit problem-solving

Don't: Be Afraid to Negotiate Your Private Credit Salary and Benefits

Knowing your worth and negotiating your compensation package is a crucial part of securing a favorable offer.

- Research industry salary benchmarks: Use online resources and networking to understand the typical salary range for private credit roles at your experience level.

- Know your worth and be prepared to discuss your compensation expectations: Have a clear understanding of your desired salary and benefits package.

- Consider the overall compensation package, including benefits: Don't only focus on base salary; consider benefits such as health insurance, retirement plans, and bonuses.

Keyword Optimization: private credit salary, private credit compensation, private credit benefits, private credit negotiation

Conclusion

Securing your dream private credit role demands a strategic and proactive approach. By following these do's and don'ts—networking effectively, crafting compelling applications, preparing thoroughly for interviews, and conducting diligent research—you significantly increase your chances of success in your private credit career. Remember to tailor your approach to each specific private credit opportunity, highlighting your unique skills and experience. Don't hesitate; start applying your newfound knowledge and land your dream private credit job today!

Featured Posts

-

Karate Full Contact Cinco Uruguayos Rumbo Al Mundial Buscan Patrocinadores

May 12, 2025

Karate Full Contact Cinco Uruguayos Rumbo Al Mundial Buscan Patrocinadores

May 12, 2025 -

Exportaciones Ganaderas Uruguayas Un Regalo Inusual Con Impacto En China

May 12, 2025

Exportaciones Ganaderas Uruguayas Un Regalo Inusual Con Impacto En China

May 12, 2025 -

Will Aaron Judge Repeat History Yankees Magazines 2024 Outlook

May 12, 2025

Will Aaron Judge Repeat History Yankees Magazines 2024 Outlook

May 12, 2025 -

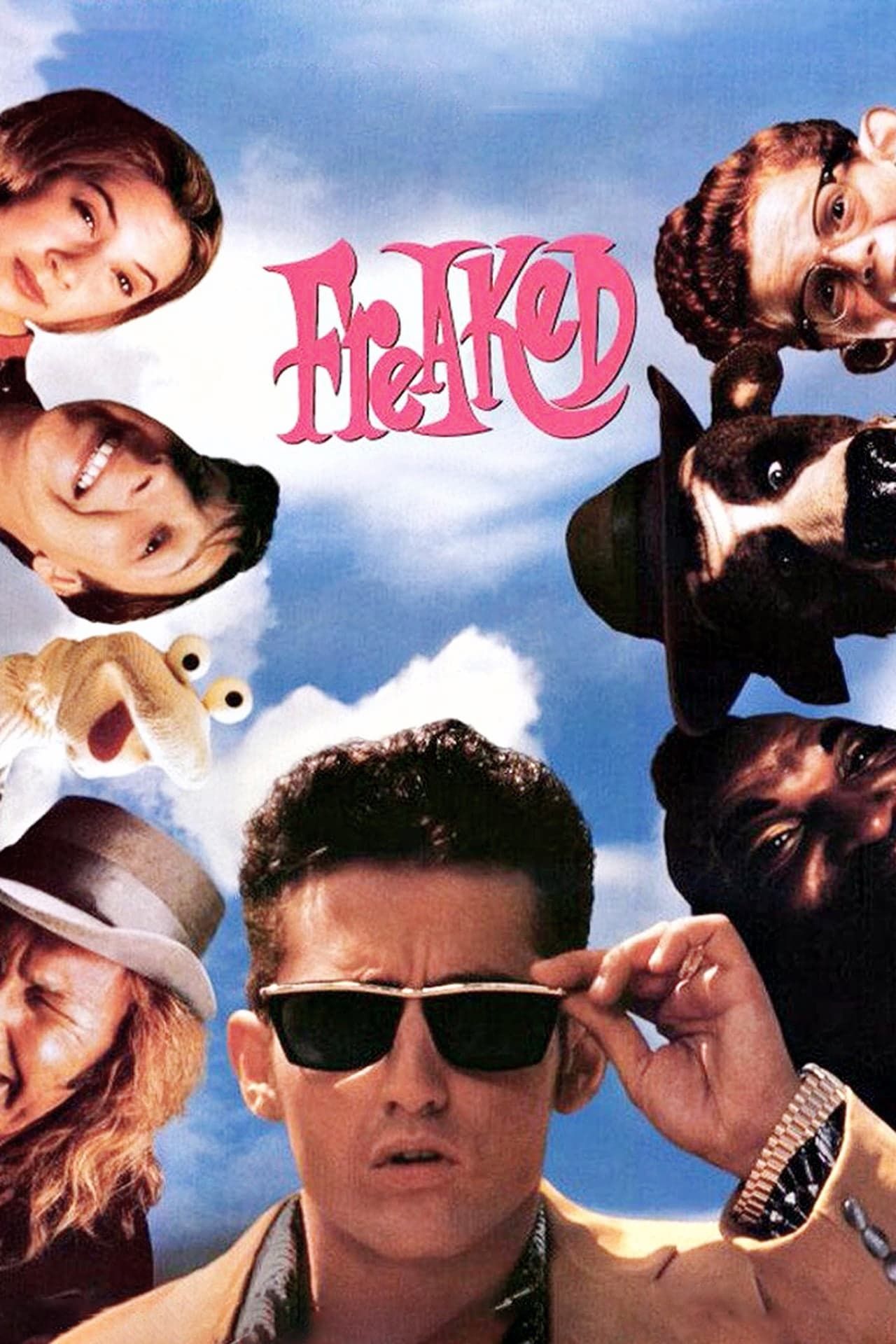

Unknown Alex Winter The Mtv Sketch Comedy Leading To Freaked

May 12, 2025

Unknown Alex Winter The Mtv Sketch Comedy Leading To Freaked

May 12, 2025 -

Skandalen Rundt Virginia Giuffre Og Prins Andrew En Analyse

May 12, 2025

Skandalen Rundt Virginia Giuffre Og Prins Andrew En Analyse

May 12, 2025

Latest Posts

-

Analyzing The Fan Response To The Kyle Tucker Trade Rumors

May 13, 2025

Analyzing The Fan Response To The Kyle Tucker Trade Rumors

May 13, 2025 -

11 10 Loss Highlights Dodgers Offensive Struggle

May 13, 2025

11 10 Loss Highlights Dodgers Offensive Struggle

May 13, 2025 -

The Kyle Tucker Report And Its Impact On Cubs Fandom

May 13, 2025

The Kyle Tucker Report And Its Impact On Cubs Fandom

May 13, 2025 -

Is A Kyle Tucker Trade Realistic For The Cubs Fan Perspective

May 13, 2025

Is A Kyle Tucker Trade Realistic For The Cubs Fan Perspective

May 13, 2025 -

Close Loss For Dodgers 11 10 Final Score

May 13, 2025

Close Loss For Dodgers 11 10 Final Score

May 13, 2025