Land Your Dream Private Credit Job: 5 Do's And Don'ts To Follow

Table of Contents

5 Do's to Land Your Dream Private Credit Job

Do 1: Network Strategically within the Private Credit Industry

Networking is paramount in the private credit industry. Don't underestimate the power of building relationships. Active networking can uncover unadvertised private credit jobs and provide invaluable insights.

- Attend industry conferences and events: SuperReturn, industry-specific webinars, and smaller, niche conferences offer excellent networking opportunities. Engage actively, exchange business cards, and follow up with connections afterward.

- Leverage LinkedIn effectively: Create a compelling profile showcasing your private credit skills and experience. Join relevant groups such as "Private Debt Professionals," "Alternative Investments," and participate in discussions around private credit investing, private debt, and private equity. Connect with professionals working in your target firms.

- Informational interviews: Reaching out to professionals for informational interviews is a powerful way to learn about their career paths and gain valuable insights into specific private credit roles. These conversations can open doors to unadvertised opportunities.

- Build relationships with recruiters: Recruiters specializing in private credit placements have access to exclusive job openings. Cultivate relationships with several recruiters to expand your reach and access to hidden opportunities in the private credit market.

Do 2: Showcase Relevant Skills and Experience for a Private Credit Role

Your resume and cover letter are your first impression. Tailoring them to highlight relevant skills and experience specific to each private credit job application is crucial.

- Highlight analytical skills: Emphasize your proficiency in financial modeling, valuation, due diligence, and credit analysis. Quantify your achievements whenever possible.

- Emphasize experience: Showcase experience in credit analysis, portfolio management, underwriting, or other related fields within the private credit sector.

- Tailor your application: Each private credit job description will highlight specific requirements. Carefully read the job description and tailor your resume and cover letter to match those requirements. Use keywords from the job description.

- Quantify achievements: Instead of simply stating your responsibilities, quantify your achievements. For example, "Increased portfolio returns by 15% through improved credit risk assessment."

- Demonstrate understanding: Show your understanding of different private credit strategies, including direct lending, mezzanine financing, distressed debt, and other relevant strategies.

Do 3: Master the Art of the Private Credit Interview

The interview is your chance to shine. Thorough preparation is essential for success in securing a private credit position.

- Prepare for behavioral questions (STAR method): Practice using the STAR method (Situation, Task, Action, Result) to structure your answers to behavioral questions. This method helps provide concise and impactful responses.

- Demonstrate understanding: Showcase a strong understanding of financial markets, economic trends, and the current private credit landscape.

- Research the firm: Thoroughly research the firm, its investment strategy, its portfolio companies, and the interviewers. Demonstrate genuine interest.

- Practice technical questions: Prepare for technical questions about credit analysis, valuation, financial modeling, and other relevant technical aspects of private credit.

- Ask insightful questions: Prepare thoughtful questions to ask the interviewer. This shows your genuine interest and initiative.

Do 4: Highlight Your Understanding of Private Credit Regulations and Compliance

The private credit industry is heavily regulated. Demonstrating awareness and adherence to compliance procedures is crucial.

- Demonstrate familiarity: Show your familiarity with relevant regulatory frameworks, such as KYC/AML (Know Your Customer/Anti-Money Laundering) regulations.

- Understand compliance: Highlight your understanding of compliance procedures and risk management within the private credit sector.

- Discuss experience: If applicable, discuss your experience with KYC/AML procedures and other compliance-related tasks.

- Emphasize ethical practices: Emphasize your commitment to ethical and responsible investing practices within the private credit sector.

Do 5: Follow Up Professionally After Each Private Credit Interview

Following up demonstrates your continued interest and professionalism.

- Send a thank-you note: Send a personalized thank-you note within 24 hours of each interview.

- Reiterate interest: Reiterate your interest in the position and highlight your key qualifications.

- Maintain contact: Maintain contact with recruiters and hiring managers, but avoid excessive follow-up.

- Follow up strategically: If you haven't heard back after a reasonable timeframe, a polite follow-up email is acceptable.

5 Don'ts to Avoid During Your Private Credit Job Search

Don't 1: Neglect Networking: Relying solely on online applications is insufficient. Actively network to uncover hidden opportunities.

Don't 2: Submit Generic Applications: Tailor your resume and cover letter to each specific private credit role to maximize your impact.

Don't 3: Underprepare for Interviews: Thorough preparation is essential to showcase your skills and knowledge effectively.

Don't 4: Ignore Compliance Aspects: Demonstrate a strong understanding of regulatory requirements and ethical considerations within private credit.

Don't 5: Fail to Follow Up: Always follow up after interviews to show your continued interest and professionalism.

Conclusion

Securing your dream private credit job requires a strategic and well-planned approach. By following these "dos" and avoiding the "don'ts," you'll significantly increase your chances of landing your desired private credit career. Remember to network extensively, showcase your relevant skills, master the interview process, demonstrate understanding of regulations, and consistently follow up. Start your journey toward a successful private credit job today! Don't delay – begin your strategic private credit job search now!

Featured Posts

-

127 Years Of Brewing History Ends Anchor Brewing Companys Closure Announced

Apr 24, 2025

127 Years Of Brewing History Ends Anchor Brewing Companys Closure Announced

Apr 24, 2025 -

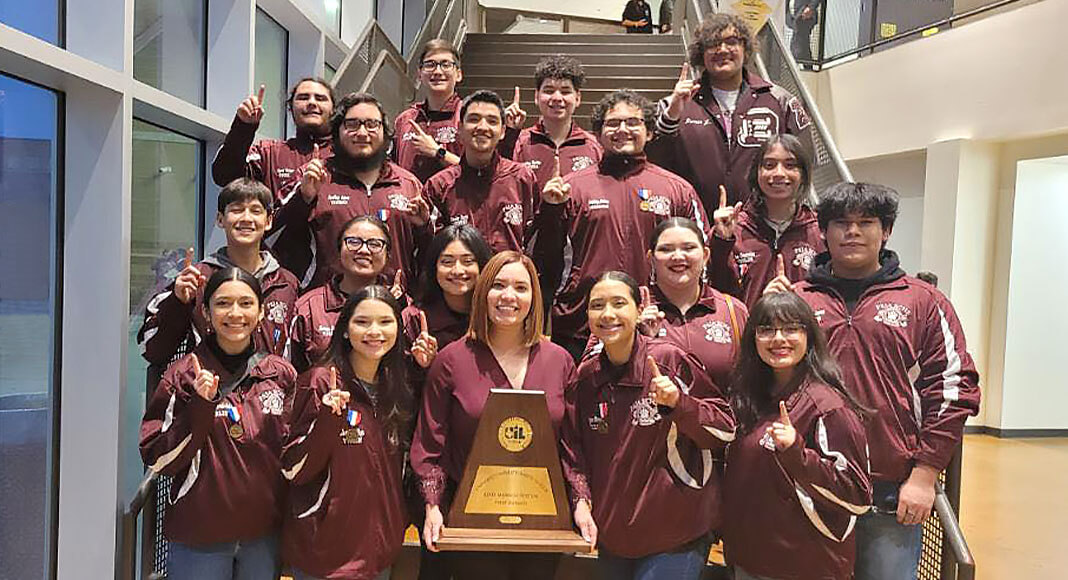

Hisd Mariachi Headed To Uil State Competition After Viral Whataburger Video

Apr 24, 2025

Hisd Mariachi Headed To Uil State Competition After Viral Whataburger Video

Apr 24, 2025 -

The Zuckerberg Trump Dynamic Impact On Social Media And Beyond

Apr 24, 2025

The Zuckerberg Trump Dynamic Impact On Social Media And Beyond

Apr 24, 2025 -

Broadcoms V Mware Acquisition An Extreme Price Hike For At And T

Apr 24, 2025

Broadcoms V Mware Acquisition An Extreme Price Hike For At And T

Apr 24, 2025 -

Legal Roadblocks And The Trump Administrations Immigration Agenda

Apr 24, 2025

Legal Roadblocks And The Trump Administrations Immigration Agenda

Apr 24, 2025