Lagarde's Strategy: Elevating The Euro's Global Influence Via EUR/USD

Table of Contents

Monetary Policy Tools and their Impact on EUR/USD

The ECB's monetary policy tools are central to Lagarde's strategy for boosting the Euro's global influence. By carefully managing interest rates and implementing quantitative easing (QE) programs, the ECB seeks to influence the EUR/USD exchange rate and overall economic conditions within the Eurozone.

Interest Rate Adjustments

The ECB's adjustments to interest rates are a pivotal tool in influencing the EUR/USD exchange rate. These adjustments directly impact the attractiveness of the Euro to international investors.

- Higher interest rates generally attract foreign investment, increasing demand for the Euro and strengthening EUR/USD. Higher returns incentivize investors to move their capital to Eurozone assets, driving up the Euro's value.

- Conversely, lower interest rates can weaken the Euro against the dollar. Reduced returns make the Euro less attractive, leading to capital outflow and downward pressure on the EUR/USD exchange rate.

- Lagarde's decisions regarding interest rate hikes or cuts are closely scrutinized by global markets. Any hint of future policy changes can trigger significant volatility in the EUR/USD, reflecting the market's sensitivity to the ECB's actions. This underscores the crucial role of communication in managing market expectations.

Quantitative Easing (QE) and its Effects

The ECB's use of QE programs – injecting liquidity into the financial system by purchasing assets – also impacts the EUR/USD. While initially intended to stimulate economic growth, the long-term effects on the exchange rate are complex.

- QE can lead to a weaker Euro if it increases inflation faster than other major economies. Increased money supply can lead to higher inflation, potentially making Eurozone assets less attractive relative to those in countries with lower inflation.

- The tapering or ending of QE programs often has the opposite effect, bolstering the Euro. Reducing the money supply can curb inflation and increase the Euro's attractiveness to investors.

- Lagarde's communication surrounding QE programs is crucial in managing market expectations and exchange rate volatility. Transparency and clear signals about the ECB's intentions help to mitigate sudden market reactions and maintain stability in the EUR/USD.

Geopolitical Factors and their Influence on the Euro

Beyond monetary policy, geopolitical factors significantly influence the Euro's global standing and the EUR/USD exchange rate. These factors are often outside the ECB's direct control but nonetheless impact its policy decisions.

The Eurozone's Economic Health

The overall economic performance of the Eurozone significantly affects the EUR/USD. Strong economic growth tends to strengthen the Euro.

- Factors like GDP growth, inflation, and unemployment rates within the Eurozone directly influence investor confidence and exchange rates. Positive economic indicators signal stability and growth potential, making the Euro more attractive.

- Lagarde's policies aim to foster sustainable economic growth across the Eurozone, indirectly supporting the Euro's strength. Policies promoting investment, job creation, and balanced budgets contribute to a more robust Eurozone economy, boosting the Euro's value.

Global Economic Uncertainty and the EUR/USD

External factors like global crises, trade wars, and political instability can significantly impact the EUR/USD. These events often create uncertainty, impacting investor sentiment and capital flows.

- During periods of global uncertainty, investors often flock to the safety of the US dollar, weakening the EUR/USD. The dollar is often perceived as a safe haven asset during times of turmoil.

- Lagarde’s communication and actions during times of global turmoil are vital in maintaining confidence in the Euro. Strong leadership and decisive policy responses can help mitigate the negative impact of external shocks on the EUR/USD.

Lagarde's Communication Strategy and Market Sentiment

Lagarde's communication strategy is a crucial element in her broader plan to elevate the Euro's global standing. Effective communication helps manage market expectations, build confidence, and mitigate volatility in the EUR/USD.

Transparency and Market Expectations

Clear communication from the ECB President is crucial in managing market expectations and influencing the EUR/USD. Transparency fosters trust and predictability, reducing the risk of sharp market reactions.

- Forward guidance on interest rate decisions, inflation targets, and economic outlook greatly impacts investor behavior. Clear communication reduces uncertainty and allows investors to make informed decisions, minimizing volatility.

- Lagarde's press conferences and speeches are closely analyzed for clues about future monetary policy. Every statement is carefully scrutinized for hints about the ECB's intentions, underscoring the importance of effective communication.

Building Confidence in the Euro

Lagarde's communication strategy plays a key role in bolstering investor confidence in the Euro and the Eurozone economy. This confidence directly translates into a stronger EUR/USD exchange rate.

- Strong and consistent messaging helps prevent speculative attacks and maintain stability in the EUR/USD. Clear and consistent communication minimizes the potential for market manipulation and sudden shifts in the exchange rate.

- Highlighting the Eurozone's strengths and addressing its weaknesses are critical to influencing market sentiment positively. Openly acknowledging challenges while showcasing the region's strengths builds credibility and reinforces confidence in the Euro.

Conclusion

Lagarde's strategy for elevating the Euro's global influence through the EUR/USD exchange rate relies on a multifaceted approach encompassing monetary policy, adept management of geopolitical factors, and transparent communication. While external shocks are always a possibility, a strong focus on sustainable economic growth within the Eurozone, coupled with clear communication from the ECB, positions the Euro for continued strength in the global currency market. Understanding Lagarde's strategy and its impact on the EUR/USD is vital for investors and anyone interested in global finance. Stay informed about the latest ECB developments and continue analyzing the EUR/USD to better understand the ongoing efforts to elevate the Euro's global influence.

Featured Posts

-

Hailee Steinfelds Chiefs Praise During Hot Ones Challenge

May 28, 2025

Hailee Steinfelds Chiefs Praise During Hot Ones Challenge

May 28, 2025 -

Miami Marlins Edge Nationals Reach 500 Winning Percentage

May 28, 2025

Miami Marlins Edge Nationals Reach 500 Winning Percentage

May 28, 2025 -

Samsung Galaxy S25 Ultra 256 Go Le Top Produit A 967 50 E

May 28, 2025

Samsung Galaxy S25 Ultra 256 Go Le Top Produit A 967 50 E

May 28, 2025 -

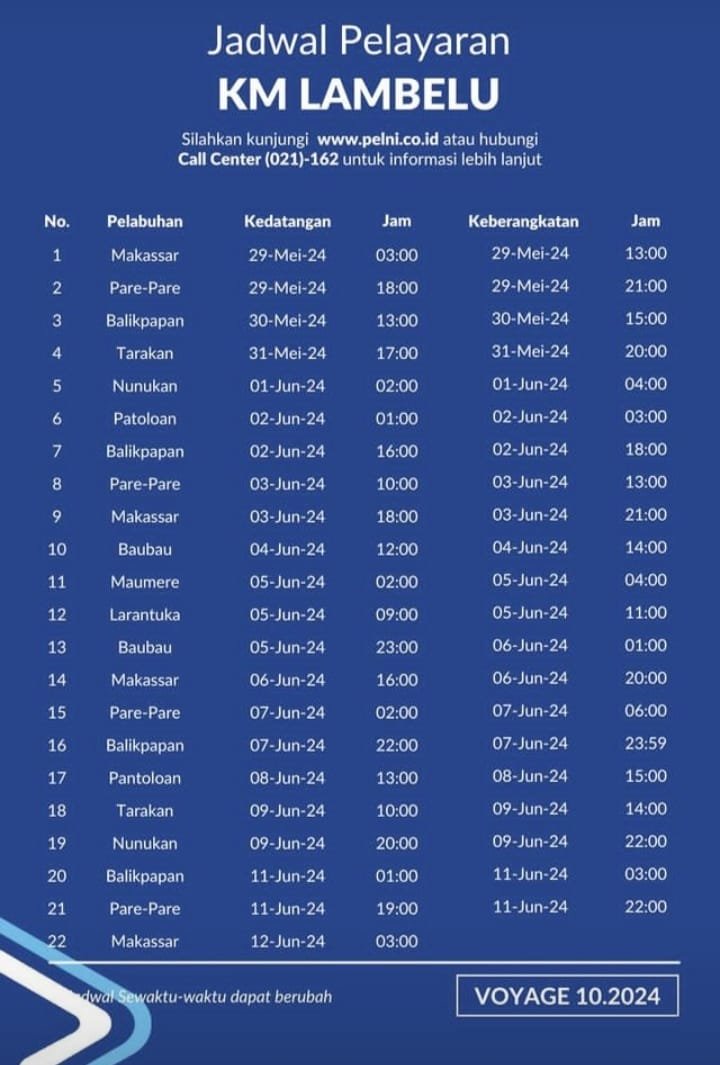

Jadwal Lengkap Kapal Pelni Km Lambelu Nunukan Makassar Juni 2025

May 28, 2025

Jadwal Lengkap Kapal Pelni Km Lambelu Nunukan Makassar Juni 2025

May 28, 2025 -

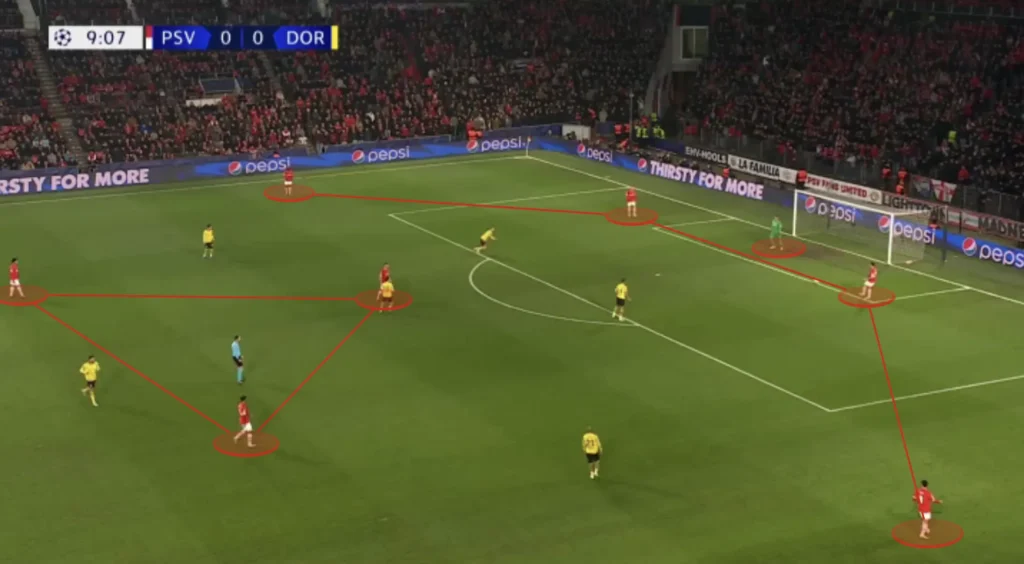

Arsenals Last Five Games Against Psv Eindhoven A Detailed Analysis

May 28, 2025

Arsenals Last Five Games Against Psv Eindhoven A Detailed Analysis

May 28, 2025