Klarna's US IPO Filing: 24% Revenue Surge Revealed

Table of Contents

Key Financial Highlights from Klarna's US IPO Filing

Klarna's US IPO filing showcased impressive financial results, highlighting substantial revenue growth and a strong trajectory. The 24% year-over-year revenue increase is a significant testament to the company's success in the competitive US market. This impressive figure, coupled with other key metrics presented in the IPO prospectus, paints a picture of a company poised for continued expansion. The "Klarna financials" detailed in the filing offer valuable insights for investors and industry analysts alike.

- Exact Revenue Figures: While precise figures are subject to change and depend on the final filing, reports indicate a substantial jump in revenue compared to the previous year. (Specific figures should be inserted here once available from official sources).

- Year-over-Year Growth Comparison: This 24% increase represents a significant acceleration compared to previous years' growth rates, demonstrating Klarna's ability to capture market share and scale its operations effectively.

- Key Metrics: The IPO filing also likely revealed key performance indicators such as transaction volume, active users, and average order value, providing a more comprehensive view of Klarna's financial health. These metrics, combined with revenue growth, offer a complete picture of Klarna's financial performance.

- Profitability: While many BNPL companies operate at a loss in their pursuit of rapid growth, Klarna's IPO filing likely shed light on its path to profitability, detailing its strategies for achieving sustainable financial success.

Analysis of Klarna's US Market Penetration

Klarna's US market penetration is a critical aspect of its IPO filing. The US BNPL market is highly competitive, with established players like Affirm and Afterpay vying for market share. Klarna's "Klarna's US IPO Filing" revealed its competitive positioning within this dynamic landscape. Analyzing Klarna's market share against its competitors is crucial for understanding its future growth potential.

- Market Share Statistics: While precise market share figures may not be explicitly stated, the IPO prospectus likely offers insights into Klarna's relative position within the US BNPL market. This data will be instrumental in evaluating the company’s strength against its competitors.

- Comparison with Competitors: A key aspect of assessing Klarna's performance is comparing its growth trajectory and market share with those of its key rivals, including Affirm and Afterpay. This comparative analysis will help investors understand Klarna's competitive advantages and challenges.

- Marketing Strategies: Klarna's success in the US is partly attributable to its effective marketing strategies, which are likely detailed in the IPO filing. Understanding these strategies provides valuable insights into the company’s approach to market expansion and customer acquisition.

- Growth Opportunities: The US BNPL market offers significant growth opportunities, and Klarna's ability to capitalize on these opportunities will play a key role in its future success.

Implications of the IPO Filing for Investors and the BNPL Industry

Klarna's US IPO filing has significant implications for both investors and the broader BNPL industry. The IPO valuation will provide a clear indication of investor sentiment towards Klarna and the future prospects of the BNPL sector. "Klarna's US IPO Filing" provides crucial data for assessing investment opportunities and risks.

- IPO Valuation: The anticipated valuation of Klarna post-IPO is a key indicator of investor confidence. A high valuation reflects strong investor belief in Klarna's future growth potential and market leadership.

- Potential for Future Funding Rounds: A successful IPO could pave the way for further funding rounds, allowing Klarna to accelerate its growth and expansion plans.

- Risks Associated with the BNPL Business Model: The BNPL model comes with inherent risks, such as credit risk and regulatory uncertainty. Klarna's IPO filing will likely address these risks and detail the company’s mitigation strategies.

- Impact on Other BNPL Companies: Klarna's IPO will undoubtedly impact other BNPL companies, influencing investor sentiment and competitive dynamics within the sector.

Klarna's Future Strategy and Growth Projections

Klarna's "Klarna's US IPO Filing" likely includes details about its future strategy and growth projections. This section will explore the company's roadmap for continued expansion and innovation.

- Key Strategic Initiatives: Klarna's strategic initiatives for maintaining its growth trajectory are crucial for understanding its future prospects. These initiatives likely focus on product innovation, market expansion, and strategic partnerships.

- New Product Development Plans: The IPO filing will likely reveal information regarding new product launches or enhancements to existing services. These plans will highlight Klarna's commitment to innovation and its ability to adapt to evolving market demands.

- Expansion into New Markets: Klarna may outline its plans for expansion into new geographic markets, further diversifying its revenue streams and reducing its reliance on any single market.

- Sustainability and Environmental Initiatives: Increasingly, investors are focusing on ESG (Environmental, Social, and Governance) factors. Klarna's commitment to sustainability and environmental initiatives may be highlighted in the filing.

Conclusion: Understanding the Significance of Klarna's US IPO Filing

Klarna's US IPO filing, revealing a remarkable 24% revenue surge, marks a significant milestone for the company and the BNPL industry. The filing offers valuable insights into Klarna's financial performance, market position, and future growth trajectory. Understanding the details contained within "Klarna's US IPO Filing" is essential for investors, industry analysts, and anyone interested in the future of the rapidly evolving BNPL landscape. Stay informed about further developments regarding Klarna's US IPO and the broader BNPL sector by following reputable financial news sources and industry reports. Learning more about Klarna's financial performance and future prospects will be crucial for navigating this dynamic market.

Featured Posts

-

Eurojackpot Voitto 40 000 E Suomalaiselle Onnea

May 14, 2025

Eurojackpot Voitto 40 000 E Suomalaiselle Onnea

May 14, 2025 -

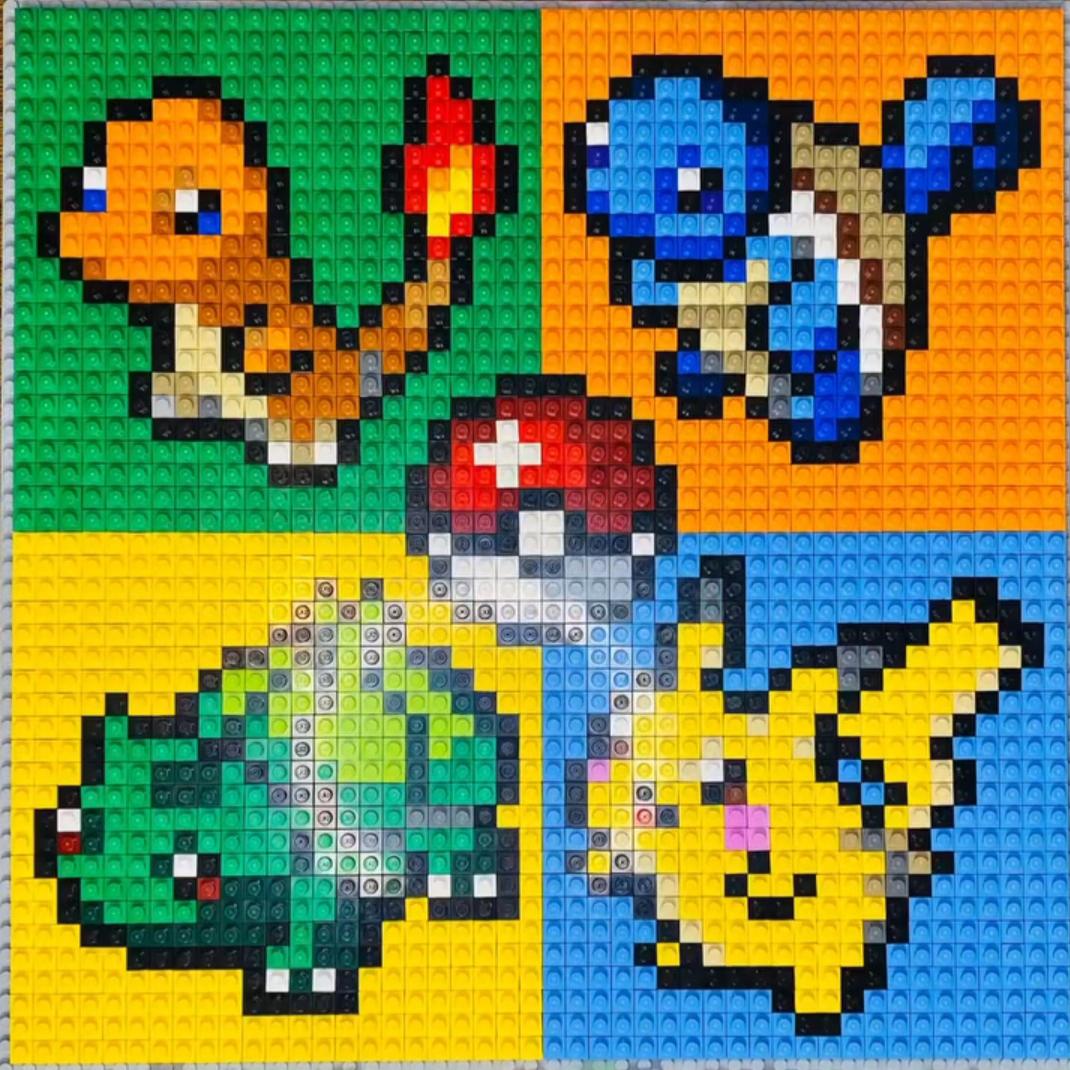

Custom Lego Gen 3 Starter Pokemon Builds

May 14, 2025

Custom Lego Gen 3 Starter Pokemon Builds

May 14, 2025 -

A Look Inside Kanye West And Bianca Censoris Relationship And Power Imbalance

May 14, 2025

A Look Inside Kanye West And Bianca Censoris Relationship And Power Imbalance

May 14, 2025 -

Experience The Ultimate Chocolate Indulgence At Lindts Central London Store

May 14, 2025

Experience The Ultimate Chocolate Indulgence At Lindts Central London Store

May 14, 2025 -

Tommy Fury Visszatert Budapestre Es Jake Paulnak Uezent Kepek

May 14, 2025

Tommy Fury Visszatert Budapestre Es Jake Paulnak Uezent Kepek

May 14, 2025