Klarna's Upcoming IPO: A Closer Look At The Financial Details

Table of Contents

Klarna's Financial Performance and Growth Trajectory

Klarna's success hinges on its impressive growth trajectory and key financial metrics. Analyzing these indicators provides valuable insight into the company's potential for future success and its suitability for investment.

Revenue Growth and Key Metrics

Klarna has exhibited substantial revenue growth in recent years. Key performance indicators (KPIs) like transaction volume and active users have demonstrated consistent upward trends. However, accessing precise, up-to-the-minute data requires reviewing Klarna's official financial reports. We can, however, speculate on certain trends based on publicly available information.

- Transaction Volume: Year-over-year growth in transaction volume is a crucial indicator of Klarna's expanding market reach and customer adoption of its BNPL services. While specific numbers are often kept confidential until the IPO, industry reports suggest significant increases.

- Active Users: The number of active users on the Klarna platform is a strong indicator of its user base's loyalty and growth. A growing active user base translates to increased transaction volumes and potential future revenue.

- Merchant Acquisition: Klarna's ability to onboard and retain merchants is vital for its long-term success. A higher number of merchants directly contributes to increased transaction volumes.

- Customer Acquisition Cost (CAC): A low CAC demonstrates efficiency in acquiring new customers. Analyzing Klarna's CAC is crucial in understanding its marketing effectiveness and profitability.

- Average Revenue Per User (ARPU): ARPU indicates the average revenue generated per user. A rising ARPU suggests improvements in customer engagement and product utilization.

- Market Share: Klarna holds a significant market share within the BNPL sector, but competition is fierce. Maintaining and growing this share is vital for sustaining its growth trajectory.

Profitability and Path to Profitability

While Klarna has achieved substantial revenue growth, profitability remains a key focus for investors. The company's path to profitability involves careful management of operating expenses and strategic investments.

- Operating Expenses: Klarna's significant investment in technology, marketing, and expansion has contributed to its operating expenses. However, the company aims to achieve efficiencies to improve margins.

- Margins: Analyzing Klarna's operating margins (revenue minus operating expenses) will provide a clearer picture of its profitability. A growing margin suggests increased efficiency and a stronger path to sustained profitability.

- Marketing Spending: A substantial portion of Klarna's expenses is directed towards marketing and brand building. While crucial for growth, optimizing this spending is key to improving profitability.

- Strategic Investments and Acquisitions: Klarna's acquisitions and investments in complementary technologies can both boost revenue and increase operating expenses in the short-term. The long-term success of these strategies will be crucial in achieving profitability.

- Competition: Increased competition within the BNPL sector could impact Klarna's profitability by squeezing margins and increasing marketing costs.

Valuation and Expected IPO Price Range

Determining Klarna's valuation and predicting the IPO price range requires a careful analysis of various factors. This section explores the key elements influencing these critical aspects of the Klarna IPO.

Determining Klarna's Valuation

Klarna's valuation is a complex process involving several factors and methodologies. The company's impressive growth, market position, and future prospects significantly contribute to its overall valuation.

- Discounted Cash Flow (DCF) Analysis: This method projects future cash flows and discounts them back to present value to estimate the company's worth. The accuracy of this method depends on the accuracy of future projections.

- Comparable Company Analysis: This method compares Klarna's financial metrics to those of similar publicly traded companies to estimate its valuation. The selection of comparable companies is crucial for the accuracy of this method.

- Market Position and Growth Prospects: Klarna’s strong market position and anticipated continued growth in the BNPL sector are crucial factors in its valuation. However, uncertainties regarding the future growth rate of the BNPL market represent a risk.

- Risks Affecting Valuation: Regulatory changes, increased competition, and potential economic downturns can significantly affect Klarna's valuation. Investors must carefully consider these potential risks.

Anticipated IPO Price and Market Capitalization

Speculating on the IPO price range and resulting market capitalization requires monitoring financial news and analyzing expert opinions. However, it's important to remember these are just estimates.

- Expected Share Price: Financial news outlets often provide estimations of the expected IPO price range based on pre-IPO funding rounds and comparable company analysis. However, these are not guarantees.

- Number of Shares Offered: The number of shares offered during the IPO significantly influences the overall market capitalization. This information is typically disclosed closer to the IPO date.

- Investor Demand: High investor demand can push the IPO price above the expected range, resulting in a higher market capitalization. Conversely, weak demand can lead to a lower price.

- Market Conditions: Prevailing market conditions, such as overall stock market performance and investor sentiment, greatly impact the success and pricing of the IPO. A volatile market can significantly affect the final price.

Risks and Challenges Facing Klarna

Despite its impressive growth, Klarna faces several challenges and risks that investors must consider before investing in the Klarna IPO.

Regulatory Scrutiny and Compliance

The BNPL industry is facing increasing regulatory scrutiny worldwide. Changes in consumer protection laws, data privacy regulations, and licensing requirements can significantly impact Klarna's operations and profitability.

- Consumer Protection Laws: Regulations aimed at protecting consumers from excessive debt and unfair practices are becoming increasingly common in the BNPL sector. Klarna must adapt to these changing regulations.

- Data Privacy Regulations: Klarna handles sensitive customer data, making compliance with data privacy regulations (like GDPR) crucial. Non-compliance can result in significant fines and reputational damage.

- Licensing Requirements: Depending on the jurisdiction, Klarna may need specific licenses to operate its BNPL services. Changes in licensing requirements can impact its expansion plans.

- Ongoing Investigations and Legal Challenges: Klarna, like other BNPL companies, may face investigations or legal challenges related to its operations. These legal battles can create uncertainty and affect investor sentiment.

Competition and Market Saturation

The BNPL market is rapidly growing, attracting both new entrants and established financial institutions. This intense competition poses a challenge to Klarna’s market leadership.

- Key Competitors: Klarna faces competition from other major BNPL providers like Affirm, Afterpay (now owned by Square), and PayPal. These competitors offer similar services and aggressively compete for market share.

- Strengths and Weaknesses of Competitors: Analyzing the strengths and weaknesses of Klarna's competitors is crucial to understanding its competitive position. This involves comparing their market share, technological capabilities, and customer acquisition strategies.

- Market Saturation: The risk of market saturation exists as the BNPL market matures. This could lead to decreased growth rates and increased competition for existing customers.

- Entry of Established Financial Institutions: Traditional financial institutions are entering the BNPL market, posing a significant threat to existing players. These institutions can leverage their existing customer base and financial resources.

Conclusion

Klarna's upcoming IPO presents a compelling investment opportunity, but careful consideration of its financial performance, valuation, and the risks involved is crucial. The company's impressive growth trajectory and market position are attractive features, yet regulatory scrutiny and increasing competition represent significant challenges. Understanding the key financial details outlined in this article is essential for making informed investment decisions related to the Klarna IPO. Further research into Klarna's financial statements and investor presentations is strongly recommended before committing any capital. Stay informed about the latest developments in the Klarna IPO and continue to monitor news and analysis for the most up-to-date information. Make sure to conduct thorough due diligence before making any decisions regarding the Klarna IPO.

Featured Posts

-

Tommy Fury And Jake Paul Dissecting The Daddy Remark And Its Fallout

May 14, 2025

Tommy Fury And Jake Paul Dissecting The Daddy Remark And Its Fallout

May 14, 2025 -

Joaquin Caparros Nuevo Entrenador Del Sevilla Tras El Cese De Garcia Pimienta

May 14, 2025

Joaquin Caparros Nuevo Entrenador Del Sevilla Tras El Cese De Garcia Pimienta

May 14, 2025 -

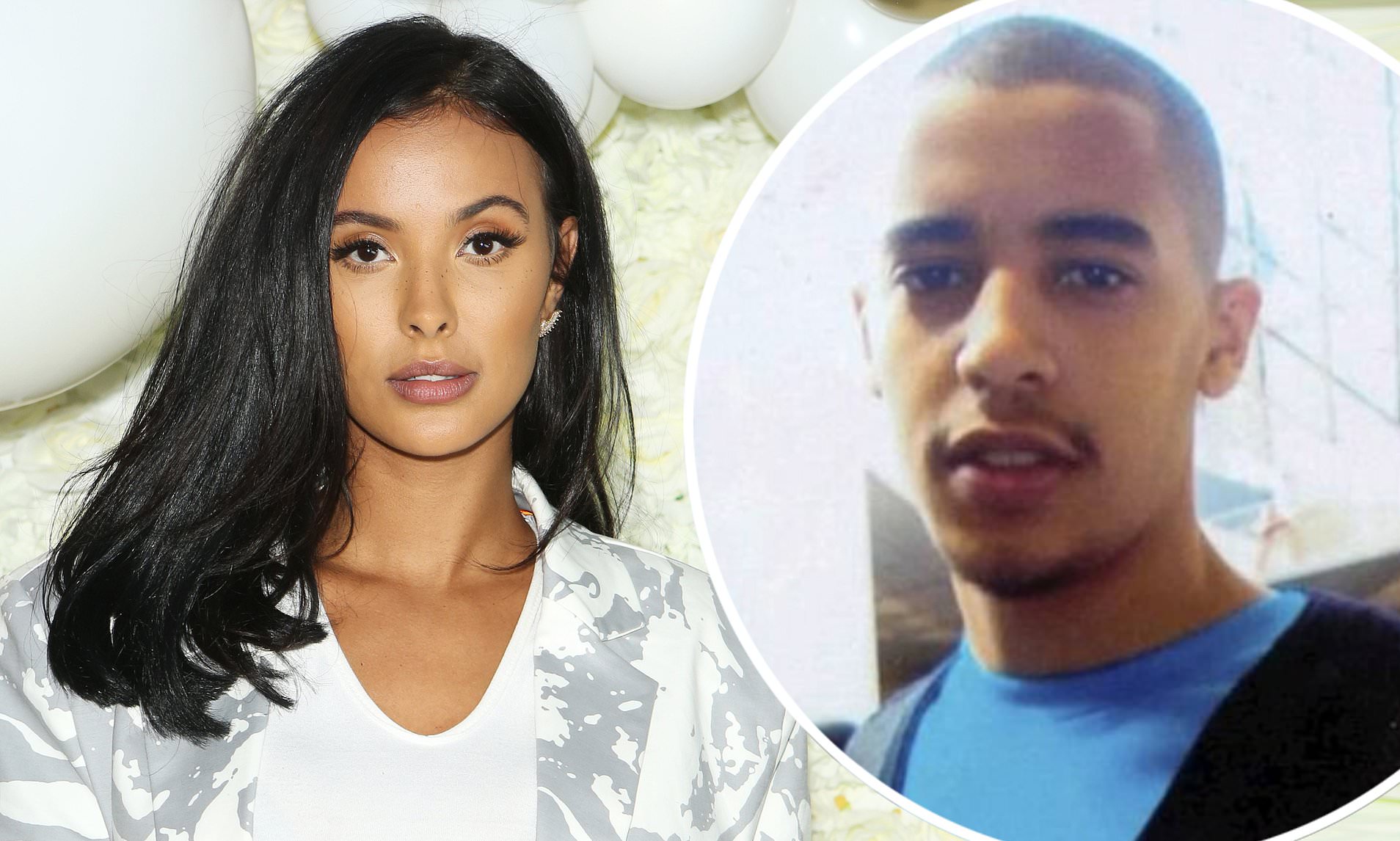

Maya Jamas New Romance Manchester City Star Confirmed

May 14, 2025

Maya Jamas New Romance Manchester City Star Confirmed

May 14, 2025 -

Mission Impossible Dead Reckoning Part Two Red Carpet Ready For Cannes

May 14, 2025

Mission Impossible Dead Reckoning Part Two Red Carpet Ready For Cannes

May 14, 2025 -

The German Election Turning The Tide Before Its Too Late

May 14, 2025

The German Election Turning The Tide Before Its Too Late

May 14, 2025