Klarna IPO: Timing, Valuation, And Potential Impact

Table of Contents

Timing of the Klarna IPO

The timeline for the Klarna IPO remains shrouded in uncertainty. Several factors have contributed to delays, making precise predictions challenging. Market conditions, particularly volatility and investor sentiment, play a significant role. A turbulent market can discourage IPOs, as demonstrated by the recent downturn affecting many tech companies. Furthermore, regulatory hurdles, both globally and within specific regions, present a significant challenge. The Buy Now Pay Later industry is facing increased scrutiny from regulators concerned about consumer debt and financial protection. Finally, Klarna's own internal performance and financial health directly influence the decision to proceed with an IPO. A strong financial performance in recent quarters will significantly increase investor confidence and pave the way for a successful listing.

- Impact of global economic uncertainty on IPO timing: Recessions and high inflation can make investors hesitant to invest in new ventures.

- Regulatory scrutiny of the BNPL industry and its effect on Klarna's IPO: Stringent regulations could impact Klarna's profitability and attractiveness to investors.

- Klarna's financial performance in recent quarters and its influence on the IPO date: Positive revenue growth and profitability will bolster investor confidence.

- Comparison to other BNPL IPOs and their timing: Analyzing the IPO experiences of competitors like Affirm and Afterpay provides valuable insights into potential timelines and challenges. Studying their paths to market can offer clues about what to expect from Klarna.

Klarna's Valuation and Potential Investor Interest

Estimating Klarna's valuation is a complex task, requiring a thorough analysis of its revenue, growth rate, market position, and the overall BNPL market outlook. Klarna's substantial user base, high transaction volume, and significant market share contribute positively to its valuation. However, intense competition within the BNPL space and ongoing regulatory uncertainty present challenges. Investors will weigh these factors alongside the company's long-term growth potential and profitability.

The investor appetite for BNPL companies remains strong, but it's crucial to consider the risks involved. Klarna's unique selling propositions, such as its extensive merchant network and innovative features, will be key factors influencing investor interest.

- Comparison of Klarna's valuation to competitors such as Affirm and Afterpay: Benchmarking against similar companies provides a framework for valuation estimations.

- Analysis of potential investor interest from venture capitalists, private equity firms, and public market investors: Understanding the different investor profiles and their investment criteria is critical.

- Discussion of the risks associated with investing in a BNPL company like Klarna: These risks include regulatory changes, competition, and the potential for increased consumer defaults.

- Factors affecting Klarna's valuation, including its user base, transaction volume, and market share: These key metrics will directly impact investor perceptions of Klarna's future prospects.

Potential Impact of the Klarna IPO on the Market

The Klarna IPO has the potential to significantly impact the BNPL sector and the broader financial technology landscape. A successful IPO could trigger increased competition, spur further innovation, and attract substantial investment into the BNPL industry. It may also set precedents for future fintech IPOs, influencing how investors value and approach other similar companies.

Furthermore, the Klarna IPO could have ripple effects on consumer spending and borrowing habits. Increased awareness and accessibility of BNPL services might lead to altered consumer behaviour and increased reliance on credit.

- Analysis of the potential impact of a successful Klarna IPO on other BNPL companies: A successful IPO could encourage other BNPL firms to pursue similar paths.

- Discussion of the potential for increased investment in the fintech sector following a successful Klarna IPO: A successful IPO could signal the strength and viability of the broader sector.

- Examination of the potential risks associated with the widespread adoption of BNPL services: Increased consumer debt and financial instability are potential downsides.

- Impact on traditional financial institutions and their response to the growing BNPL market: Traditional banks may need to adapt their strategies to compete with the growing BNPL sector.

Conclusion

The Klarna IPO remains a significant event with far-reaching consequences for the BNPL industry and the broader financial technology landscape. While the timing remains uncertain, its eventual valuation and market impact are poised to shape the future of consumer finance. Understanding the factors influencing the Klarna IPO, from market conditions to regulatory hurdles, is crucial for investors and industry stakeholders alike. Stay informed about developments surrounding the Klarna IPO to make informed decisions and capitalize on opportunities within this rapidly evolving sector. Keep up-to-date on the latest news and analysis regarding the Klarna IPO to make informed investment choices.

Featured Posts

-

Bournemouths Huijsen A Liverpool Transfer Target

May 14, 2025

Bournemouths Huijsen A Liverpool Transfer Target

May 14, 2025 -

Why Jannik Sinners Branding Lacks The Impact Of Roger Federers Rf Logo

May 14, 2025

Why Jannik Sinners Branding Lacks The Impact Of Roger Federers Rf Logo

May 14, 2025 -

Bourg En Bresse Amelioration De La Solidarite Envers Les Demandeurs D Asile

May 14, 2025

Bourg En Bresse Amelioration De La Solidarite Envers Les Demandeurs D Asile

May 14, 2025 -

Next Weeks Hollyoaks 9 Must See Spoilers

May 14, 2025

Next Weeks Hollyoaks 9 Must See Spoilers

May 14, 2025 -

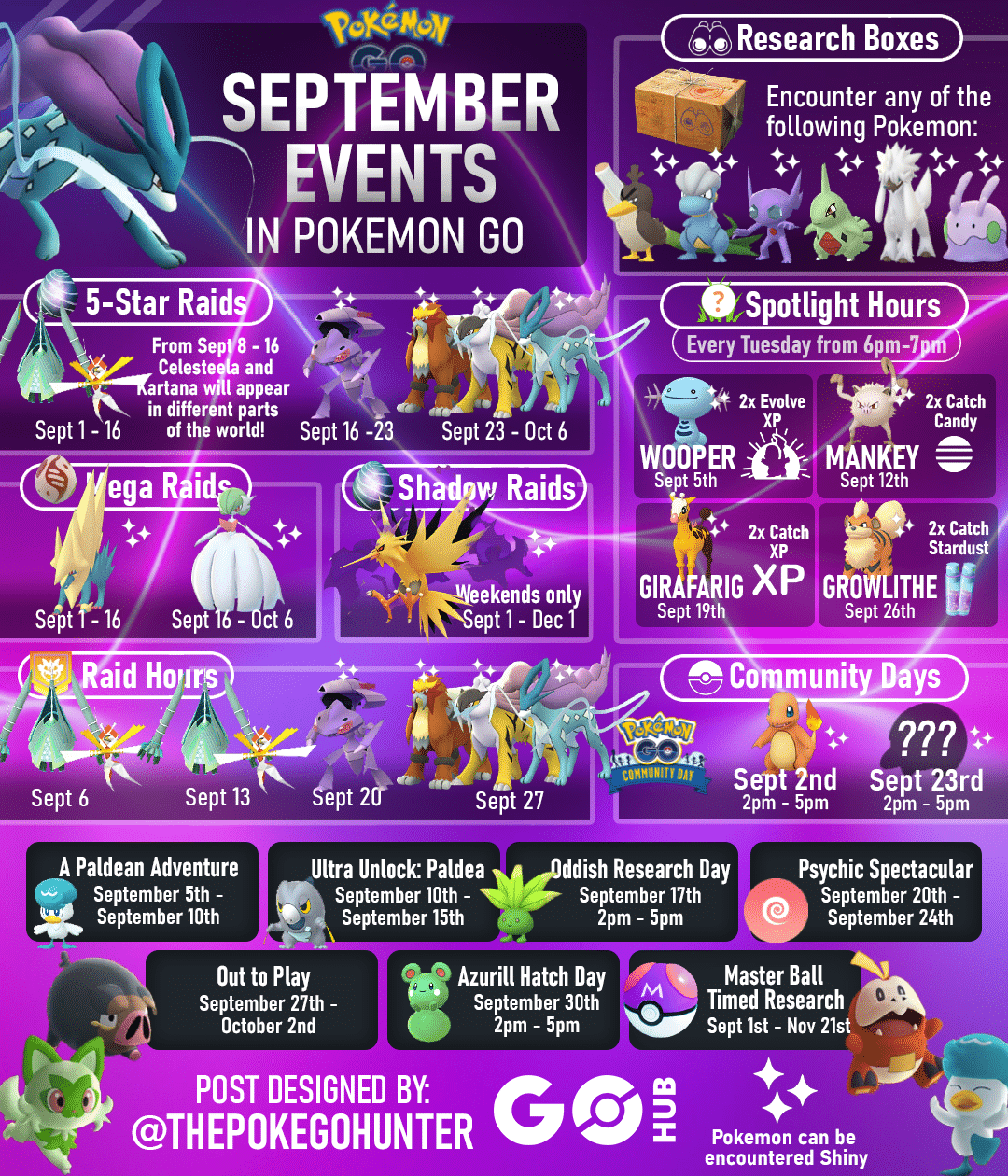

Pokemon Go May 2025 A Guide To Raids Spotlight Hours And Community Days

May 14, 2025

Pokemon Go May 2025 A Guide To Raids Spotlight Hours And Community Days

May 14, 2025