Klarna Announces 24% Revenue Growth In US IPO Filing

Table of Contents

Klarna's Impressive Revenue Growth and Market Position

Klarna's IPO filing detailed impressive revenue figures, solidifying its position as a leader in the US BNPL market. This substantial growth reflects the increasing consumer adoption of BNPL services and Klarna's effective strategies.

- Specific Revenue Figures: While the exact figures are subject to change pending the IPO's finalization, the reported 24% revenue growth represents a substantial increase compared to previous years. This demonstrates the company's ability to capitalize on the growing demand for alternative payment methods.

- Market Share Dominance: Klarna holds a significant market share in the competitive US BNPL market, vying with established players like Affirm and PayPal. Although precise market share data fluctuates, Klarna's substantial revenue growth indicates a strong competitive position.

- Factors Contributing to Growth: Several factors contributed to this impressive revenue surge. Increased consumer adoption of BNPL solutions, driven by convenience and flexibility, is a primary driver. Strategic partnerships with major retailers and e-commerce platforms have also expanded Klarna's reach and customer base. Furthermore, Klarna's investment in technology and marketing has played a crucial role in driving user acquisition and engagement.

- Geographical Growth: While the filing didn't break down revenue by specific US states, anecdotal evidence and market analysis suggest particularly strong growth in densely populated urban areas and regions with high online shopping penetration.

Key Highlights from Klarna's IPO Filing

Klarna's IPO filing provides a comprehensive overview of its financial health and future plans. Beyond the impressive revenue growth, other key highlights offer valuable insights into the company's trajectory.

- Financial Metrics: The filing included details on key financial metrics such as net income, operating expenses, and profitability. While profitability remains a key focus for Klarna, the filing showcased improvements in operational efficiency and a path towards sustained profitability.

- Planned Use of Funds: The IPO proceeds are expected to be used to fuel further expansion, enhance technology, and potentially facilitate strategic acquisitions. This will allow Klarna to further solidify its market position and explore new growth avenues.

- Anticipated Market Capitalization: The filing provides a range for the anticipated market capitalization, indicating a significant valuation reflecting investor confidence in Klarna's future prospects. This high valuation underscores the immense growth potential of the BNPL sector.

- Risks and Challenges: The filing also transparently addresses potential risks and challenges, including regulatory scrutiny, competition, and the cyclical nature of consumer spending. This level of transparency builds trust with potential investors.

Implications for the Buy Now Pay Later (BNPL) Industry

Klarna's success has significant implications for the broader BNPL industry and the future of financial technology.

- Industry Impact: Klarna's strong performance validates the growing appeal of BNPL services and suggests a bright future for the sector as a whole. The increased competition and innovation spurred by Klarna's success will benefit consumers through more choice and potentially lower fees.

- Growth Opportunities: Future growth opportunities for Klarna and the BNPL industry include expanding into new markets, developing innovative products and services, and forging strategic partnerships. International expansion and diversification beyond retail are key areas of potential growth.

- Regulatory Concerns: The rapid growth of the BNPL sector has also raised regulatory concerns regarding consumer protection, debt management, and financial stability. Klarna's approach to responsible lending and its engagement with regulators will be crucial in shaping the future regulatory landscape.

- Impact on Traditional Payment Methods: The increasing adoption of BNPL is likely to continue to challenge traditional payment methods like credit cards. The convenience and flexibility offered by BNPL are reshaping consumer payment preferences.

Competitive Landscape and Future Outlook

Klarna faces stiff competition from established players and emerging fintech companies. Understanding this competitive landscape is crucial to forecasting Klarna's future.

- Competitor Analysis: Klarna's performance must be analyzed against competitors like Affirm, PayPal's BNPL services, and other emerging players in the market. Competitive analysis reveals areas where Klarna excels and areas requiring further development.

- Expansion Plans: Klarna's future expansion plans likely involve further penetration of the US market, alongside international expansion into new territories. Strategic acquisitions could also play a crucial role in achieving these growth targets.

- Market Challenges and Opportunities: The BNPL market faces challenges such as managing credit risk, navigating regulatory changes, and maintaining profitability. However, opportunities abound through technological innovation, strategic partnerships, and evolving consumer preferences.

Conclusion

Klarna's successful US IPO filing, revealing a remarkable 24% revenue growth, underscores the company's strong position in the burgeoning buy now pay later market. The impressive financial performance highlights the increasing consumer adoption of BNPL services and the potential for further expansion within the US and globally. The filing provides valuable insights into the financial health of Klarna and the overall trajectory of the fintech industry.

Call to Action: Stay informed about the latest developments in the Klarna IPO and the evolving BNPL landscape. Follow our updates for further analysis and insights into Klarna's revenue growth and its impact on the financial technology sector. Learn more about the intricacies of Klarna and its future by [link to relevant article/resource].

Featured Posts

-

Walmart Recalls Baby Products And Unstable Dressers

May 14, 2025

Walmart Recalls Baby Products And Unstable Dressers

May 14, 2025 -

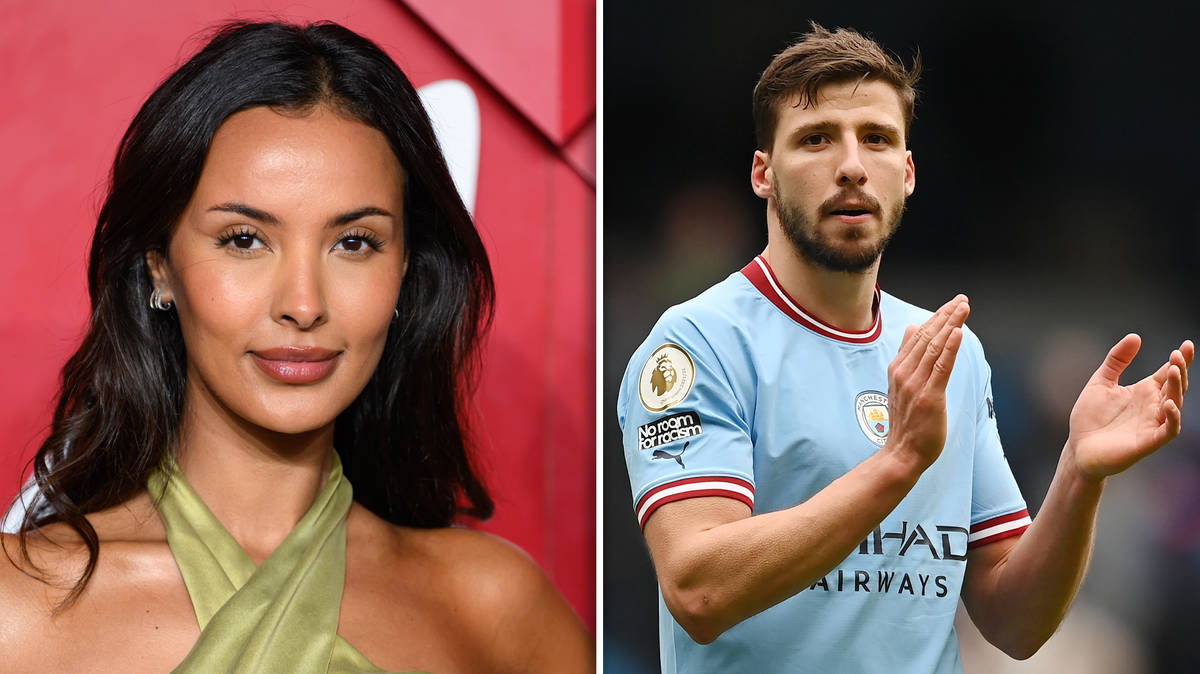

Ruben Dias And Maya Jama Relationship Official

May 14, 2025

Ruben Dias And Maya Jama Relationship Official

May 14, 2025 -

Walmart Issues Nationwide Recall Of Orvs Oysters And Electric Scooters

May 14, 2025

Walmart Issues Nationwide Recall Of Orvs Oysters And Electric Scooters

May 14, 2025 -

Oqtf A Saint Pierre Et Miquelon Le Point De Vue De Retailleau Face A La Proposition De Wauquiez

May 14, 2025

Oqtf A Saint Pierre Et Miquelon Le Point De Vue De Retailleau Face A La Proposition De Wauquiez

May 14, 2025 -

How Eurovangelists Helped Start Mfd Spring Break

May 14, 2025

How Eurovangelists Helped Start Mfd Spring Break

May 14, 2025