Kato Rules Out US Treasury Sales For Trade Deal

Table of Contents

Kato's Rationale for Rejecting US Treasury Sales

Kato's reasoning for rejecting the sale of US Treasury bonds stems from a commitment to fiscal prudence and market stability. His decision reflects a deep understanding of the potential economic consequences of such a move.

-

Negative Impact on Japan's Financial Stability: Selling a significant portion of Japan's US Treasury holdings would trigger substantial market volatility. This could negatively impact the value of the yen and potentially destabilize Japan's financial system. The sheer scale of Japan's holdings makes any large-scale liquidation a risky proposition.

-

Disruption to Global Markets: A sudden and large-scale sale of US Treasury bonds by Japan would send shockwaves through global financial markets. It could lead to increased bond yields, currency fluctuations, and potentially trigger a broader sell-off in global assets. Such market instability could have unforeseen and potentially negative consequences for the global economy.

-

Dangerous Precedent: Using national assets like US Treasury bonds as bargaining chips in trade negotiations sets a dangerous precedent. It could encourage other nations to employ similar tactics, potentially destabilizing global financial markets and undermining international cooperation. This could lead to a decline in trust and make future trade negotiations more difficult.

-

Alternative Strategies: Kato likely favors alternative strategies for achieving trade deal objectives, such as diplomatic negotiations, targeted tariffs, and focusing on areas of mutual economic benefit. These approaches aim for win-win solutions rather than relying on potentially damaging financial maneuvers.

Implications for US-Japan Trade Relations

Kato's rejection of using US Treasury Sales as leverage significantly impacts the current negotiation dynamics between the US and Japan.

-

Shift in Negotiation Strategies: The US may need to reconsider its negotiating tactics and explore alternative approaches to achieve its trade objectives with Japan. This could lead to a more protracted and complex negotiation process.

-

Potential for Increased Tension: The rejection could lead to increased tension between the two countries, particularly if the US perceives this as a lack of cooperation. Open communication and a willingness to compromise will be crucial to navigating this challenge.

-

Future of the US-Japan Economic Relationship: Kato's decision underscores a potential shift in the economic relationship. It highlights the importance of mutual respect and finding solutions that don't rely on potentially destabilizing financial actions. The long-term implications for the relationship will depend heavily on how both sides handle the situation.

-

US Government Reaction: The US government's response to Kato's statement will be closely watched. Their reaction will likely shape the future trajectory of the trade negotiations and the overall bilateral relationship.

Global Market Reactions and Analysis

Kato's announcement had an immediate impact on global markets.

-

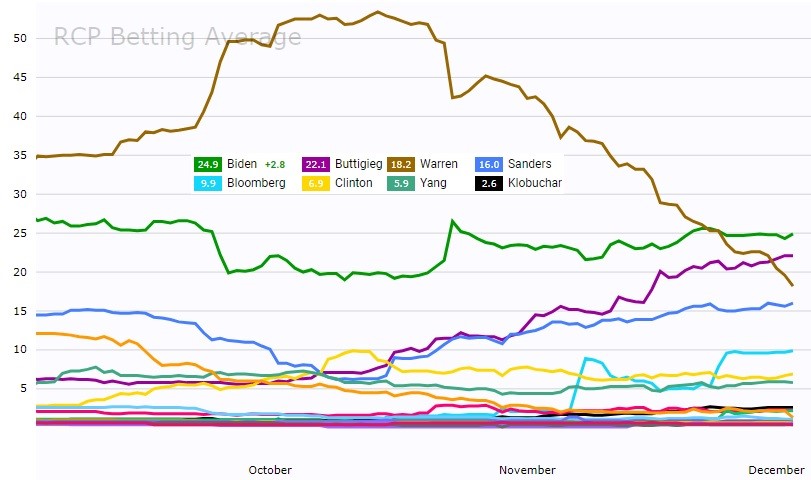

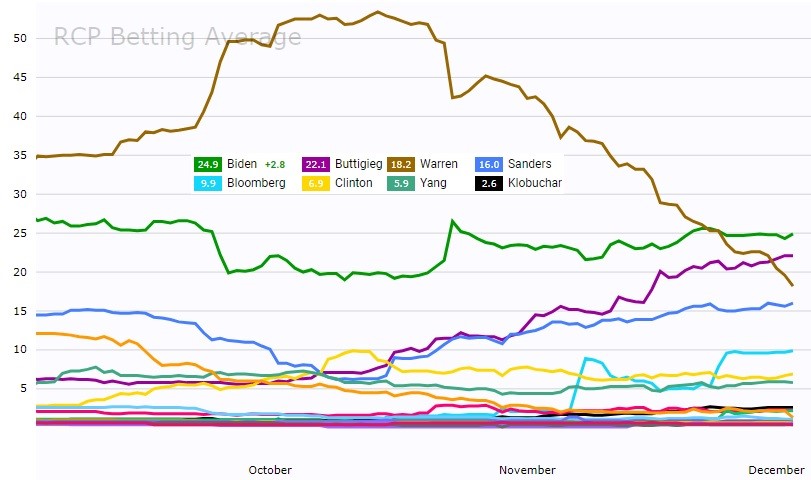

Market Response: The immediate market response included slight fluctuations in currency exchange rates and bond yields. However, the impact was relatively muted, suggesting that markets had partially anticipated this possibility.

-

Expert Opinions: Experts have offered varying opinions on the longer-term implications. Some believe it will have minimal impact, while others highlight potential risks associated with future trade negotiations involving asset sales.

-

Spillover Effects: The decision could have spillover effects on other countries and trade agreements. Other nations may reconsider using similar strategies in their trade negotiations.

-

Investor Confidence: While investor confidence remained largely stable initially, sustained tensions could negatively impact investor sentiment in the long run.

Alternative Strategies for Trade Deal Success

Both Japan and the US need to explore alternative strategies to achieve mutually beneficial outcomes.

-

Diplomatic Solutions: Prioritizing diplomatic channels and open communication is essential for finding common ground. This would involve careful consideration of each other's concerns and a commitment to resolving disagreements peacefully.

-

Economic Cooperation: Focusing on areas of mutual economic benefit can foster a more cooperative environment. Joint ventures, technological collaborations, and investments can create shared prosperity and reduce the incentive for confrontational tactics.

-

Win-Win Solutions: The ultimate goal should be win-win solutions that benefit both economies. This requires a flexible approach and a willingness to compromise on specific issues.

Conclusion

Kato's firm rejection of using US Treasury Sales as a trade negotiation tactic represents a significant shift in strategy and a clear statement of fiscal prudence. The implications for US-Japan relations are far-reaching, with potential impacts on the negotiation dynamics and the broader economic relationship. While the immediate market reaction was relatively muted, the longer-term effects on global markets and investor confidence remain to be seen. Understanding the implications of US Treasury Sales in trade negotiations is crucial for investors and policymakers alike.

Call to Action: Stay informed on the evolving dynamics of US-Japan trade relations and the implications of Kato's stance on the use of US Treasury Sales in future trade deals. Follow [Source/Publication, e.g., The Nikkei Asian Review] for further updates and analysis on this developing situation. Understanding the implications of US Treasury Sales in trade negotiations is crucial for investors and policymakers alike.

Featured Posts

-

Celtics Vs Heat April 2nd Where To Watch And Stream The Game

May 06, 2025

Celtics Vs Heat April 2nd Where To Watch And Stream The Game

May 06, 2025 -

Gambling On Natural Disasters The Troubling Trend Of Wildfire Betting

May 06, 2025

Gambling On Natural Disasters The Troubling Trend Of Wildfire Betting

May 06, 2025 -

Exploring The Environmental Dangers Of Abandoned Gold Mines

May 06, 2025

Exploring The Environmental Dangers Of Abandoned Gold Mines

May 06, 2025 -

The Truth Behind Patrick Schwarzenegger And Abby Champions Wedding Delay

May 06, 2025

The Truth Behind Patrick Schwarzenegger And Abby Champions Wedding Delay

May 06, 2025 -

How Aritzia Is Navigating The Challenges Of Trump Tariffs

May 06, 2025

How Aritzia Is Navigating The Challenges Of Trump Tariffs

May 06, 2025

Latest Posts

-

Mindy Kaling A Peplum Moment On The Hollywood Walk Of Fame

May 06, 2025

Mindy Kaling A Peplum Moment On The Hollywood Walk Of Fame

May 06, 2025 -

Mindy Kalings Boyfriends From Bj Novak To Present

May 06, 2025

Mindy Kalings Boyfriends From Bj Novak To Present

May 06, 2025 -

Mindy Kalings Peplum Power Hollywood Walk Of Fame Style

May 06, 2025

Mindy Kalings Peplum Power Hollywood Walk Of Fame Style

May 06, 2025 -

Mindy Kalings Dating History A Look At Her Past Relationships

May 06, 2025

Mindy Kalings Dating History A Look At Her Past Relationships

May 06, 2025 -

Mindy Kalings Dramatic Weight Loss A New Look At The Premiere

May 06, 2025

Mindy Kalings Dramatic Weight Loss A New Look At The Premiere

May 06, 2025