Joint Venture: Saudi Arabia And India Plan Two Major Oil Refineries

Table of Contents

The Strategic Significance of the Saudi-India Oil Refinery Joint Venture

This joint venture represents a significant strengthening of the already close bilateral relationship between Saudi Arabia and India. It's a move driven by mutual benefit and strategic goals.

-

Enhanced Indian Energy Security: India, a rapidly growing economy, has an ever-increasing demand for energy. This joint venture aims to significantly enhance India's energy security by diversifying its oil import sources and reducing its reliance on other regions, thus mitigating geopolitical risks associated with single-source dependence. This diversification strategy is crucial for India's economic stability and growth.

-

Expanded Market Reach for Saudi Arabia: For Saudi Arabia, the world's largest oil exporter, the venture provides a crucial downstream investment opportunity. It allows them to expand their market reach beyond simply exporting crude oil, increasing their influence in the refining and petrochemical sectors. This move allows for greater control over the value chain and potentially higher profit margins.

-

Geopolitical Implications: The partnership holds significant geopolitical implications. It could potentially shift regional power dynamics, especially within the Middle East and Asia, and reshape the global energy market by creating a powerful new player in oil refining and distribution. This new axis of cooperation could influence global energy pricing and policies.

-

Other Benefits:

- Increased energy security for India.

- Enhanced market access and revenue streams for Saudi Arabia.

- Potential for significant job creation in both countries, boosting local economies.

- Strengthened bilateral relations between two major global players, fostering collaboration on other fronts.

Details of the Planned Refineries

While precise details are still emerging, the planned refineries are expected to be significant investments, transforming the energy landscape.

-

Location and Capacity: Specific locations and planned refining capacity (in barrels per day – bpd) are crucial details yet to be fully disclosed. However, reports suggest the refineries will have a combined capacity of hundreds of thousands of barrels per day, potentially exceeding a million bpd. The investment will likely be in the billions of dollars.

-

Technology and Environmental Considerations: The refineries are expected to utilize advanced refining technologies to maximize efficiency and minimize environmental impact. Focus on reducing carbon emissions through technological innovations and adhering to stringent environmental regulations will be crucial. Sustainable practices are likely to be integrated into the design and operation of the refineries.

-

Timeline and Completion Dates: A realistic timeline for project implementation and completion dates are essential. While specific dates haven't been publicly released, the project is expected to unfold over several years, requiring phased construction and commissioning.

-

Key Details (subject to updates as information becomes available):

- Precise location details (e.g., coastal regions for easy import/export).

- Specific refining capacity for each refinery (in bpd).

- Details about the specific refining technology to be used (e.g., hydrocracking, fluid catalytic cracking).

- Estimated total investment cost for both projects.

- Projected completion dates for each refinery.

Economic Impact and Potential Benefits

The joint venture promises substantial economic benefits for both Saudi Arabia and India.

-

Job Creation and Economic Growth: The project is expected to generate thousands of jobs in both countries, across various sectors, from construction and engineering to operation and maintenance. This will contribute significantly to GDP growth and improve living standards.

-

Impact on Global Oil Prices: The increased refining capacity resulting from this joint venture could potentially influence global oil prices, depending on factors like global demand and other supply-side developments. The impact may be subtle or significant, depending on these external factors.

-

Increased Energy Access and Affordability: Increased refining capacity could lead to greater energy access and potentially lower prices for consumers in the region, boosting economic activity and improving quality of life. This would particularly benefit India, given its growing population.

-

Specific Economic Impacts:

- Projected job creation numbers (both direct and indirect).

- Estimated contribution to GDP growth in Saudi Arabia and India.

- Potential impact on global oil prices (positive or negative).

- Potential benefits to consumers in terms of energy affordability and access.

Challenges and Risks Associated with the Project

Despite the immense potential, the project faces several challenges and risks.

-

Geopolitical Risks: Geopolitical instability in the region or global disruptions to supply chains could pose significant risks to the project’s timeline and overall success. Careful risk assessment and mitigation strategies are essential.

-

Financial Risks: Securing financing for such a large-scale venture presents its own set of challenges. Potential financial risks include fluctuations in oil prices, exchange rates, and other economic factors. Robust financial planning and risk management strategies are paramount.

-

Environmental Concerns: Environmental regulations and concerns regarding emissions need to be addressed proactively. The project needs to ensure compliance with stringent environmental standards to maintain social license and avoid regulatory hurdles.

-

Key Risks and Mitigation Strategies:

- Potential geopolitical risks (e.g., regional conflicts, global sanctions).

- Financial risks and mitigation strategies (e.g., diversified funding sources, hedging).

- Environmental impact assessments and mitigation plans (e.g., carbon capture technologies).

- Regulatory hurdles and strategies to overcome them.

Conclusion

The Saudi Arabia and India joint venture to build two major oil refineries is a momentous undertaking with the potential to significantly reshape global energy markets. This strategic partnership promises to enhance India's energy security, provide Saudi Arabia with expanded downstream opportunities, and stimulate economic growth in both countries. However, the successful implementation of this ambitious project requires careful planning, proactive risk management, and a commitment to sustainable practices. Stay informed about the progress of this landmark joint venture and its implications for the future of energy. Learn more about the latest developments in this crucial Saudi-India oil refinery partnership. Understanding this joint venture is key to comprehending future energy dynamics.

Featured Posts

-

Israeli Beach Years Of Shark Sightings Culminate In Tragedy

Apr 24, 2025

Israeli Beach Years Of Shark Sightings Culminate In Tragedy

Apr 24, 2025 -

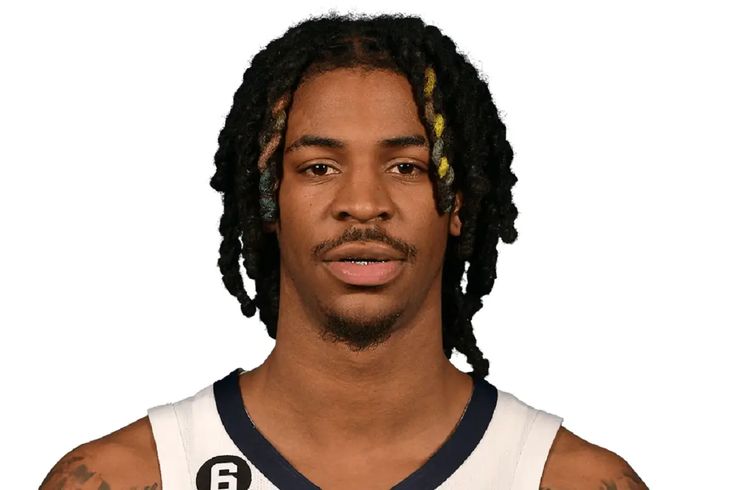

Nba Launches Formal Probe Into Ja Morants Conduct Latest Updates

Apr 24, 2025

Nba Launches Formal Probe Into Ja Morants Conduct Latest Updates

Apr 24, 2025 -

Chinas Impact On Bmw And Porsche Sales Market Headwinds And Future Strategies

Apr 24, 2025

Chinas Impact On Bmw And Porsche Sales Market Headwinds And Future Strategies

Apr 24, 2025 -

Columbia University Student Denied Birth Attendance Mahmoud Khalils Ice Case

Apr 24, 2025

Columbia University Student Denied Birth Attendance Mahmoud Khalils Ice Case

Apr 24, 2025 -

Tesla And Space X Under Epa Scrutiny The Rise Of Elon Musk And Dogecoin

Apr 24, 2025

Tesla And Space X Under Epa Scrutiny The Rise Of Elon Musk And Dogecoin

Apr 24, 2025