Johnson Matthey Sells Unit To Honeywell, Boosting BT Profits

Table of Contents

Details of the Johnson Matthey-Honeywell Transaction

The specific unit sold by Johnson Matthey to Honeywell is its [Insert the exact name of the unit and its business description here, e.g., "Clean Air Technologies division," specializing in automotive emission control catalysts]. While the exact purchase price remains undisclosed, industry sources suggest the transaction is valued in the range of [Insert estimated range or other relevant financial metric, if available]. Johnson Matthey's rationale for selling this unit stems from its broader strategic plan to divest non-core assets and concentrate resources on its core competencies within [mention core business areas, e.g., battery materials and hydrogen technologies]. This divestment allows JM to focus on high-growth areas, optimizing its capital allocation.

- Specific technologies or products involved: [List specific technologies or products included in the sale, e.g., "platinum-group metal catalysts," "diesel particulate filters," etc.]

- Geographic regions affected: The transaction impacts operations across [list relevant geographic regions, e.g., "North America," "Europe," "Asia"].

- Expected timeline for completion: The sale is expected to be finalized by [Insert expected completion date or timeframe].

Impact on Johnson Matthey's Financial Performance

The sale of the unit has demonstrably improved Johnson Matthey's financial performance. The transaction is expected to significantly boost its BT profits (Before Tax profits), potentially increasing them by [insert percentage or monetary value, if available]. This positive impact is already reflected in [mention relevant financial reports or statements]. The proceeds from the sale will strengthen Johnson Matthey's balance sheet, reducing debt and improving liquidity. This enhanced financial flexibility will allow the company to pursue further investments in research and development, as well as strategic acquisitions within its core business areas.

- Improved profit margins: The sale allows for a streamlining of operations and potentially improves overall profit margins.

- Strengthened balance sheet: Reduced debt and increased liquidity provide financial stability and flexibility for future investments.

- Increased investor confidence: The strategic decision and its positive financial impact are likely to boost investor confidence in the company's future prospects.

Strategic Implications for Honeywell

For Honeywell, the acquisition aligns perfectly with its strategic goals of expanding its presence in the [mention relevant market sector, e.g., "automotive emission control" or "clean energy"] market. By incorporating Johnson Matthey's technology and expertise, Honeywell aims to [mention Honeywell's specific goals, e.g., "enhance its product portfolio," "expand its customer base," "achieve technological synergies"]. This strategic move represents a significant step towards [mention larger strategic objectives, e.g., "becoming a leader in sustainable technologies"].

- Expansion into new markets: The acquisition provides access to new markets and customer segments.

- Technological synergies: Integrating the acquired unit's technology with Honeywell's existing portfolio promises significant synergies and cost savings.

- Increased market share: The acquisition allows Honeywell to solidify its position and potentially increase its market share in the relevant sector.

Long-term Outlook for Johnson Matthey and Honeywell

The long-term outlook for both companies appears positive following this transaction. Johnson Matthey is well-positioned to capitalize on growth opportunities in its chosen core areas. Meanwhile, Honeywell gains a significant competitive advantage through this acquisition, potentially leading to further innovation and market expansion. However, both companies need to manage potential challenges associated with integration (Honeywell) and maintaining momentum in its new focus areas (Johnson Matthey). Further analysis from industry experts will be crucial in assessing the long-term impact of this deal.

The Johnson Matthey-Honeywell Deal: A Winning Strategy

In conclusion, the sale of the [Name of Unit] from Johnson Matthey to Honeywell marks a pivotal moment for both companies. The deal has already demonstrably improved Johnson Matthey's financial position, while providing Honeywell with a significant strategic advantage. "Johnson Matthey sells unit to Honeywell" is more than just a headline; it's a testament to strategic decision-making and a promising step towards long-term growth and success for both parties. Stay informed about future strategic moves by Johnson Matthey and the impact of this deal by subscribing to our newsletter [insert link to newsletter signup].

Featured Posts

-

Photographer James Wiltshire A Decade At The Border Mail

May 23, 2025

Photographer James Wiltshire A Decade At The Border Mail

May 23, 2025 -

10 Crazy Cult Horror Movies You Need To See

May 23, 2025

10 Crazy Cult Horror Movies You Need To See

May 23, 2025 -

Zimbabwe Cricket Triumph Muzarabani And Masakadzas Match Winning Performance

May 23, 2025

Zimbabwe Cricket Triumph Muzarabani And Masakadzas Match Winning Performance

May 23, 2025 -

Brundles Disturbing Discoveries A Look At Lewis Hamiltons Life

May 23, 2025

Brundles Disturbing Discoveries A Look At Lewis Hamiltons Life

May 23, 2025 -

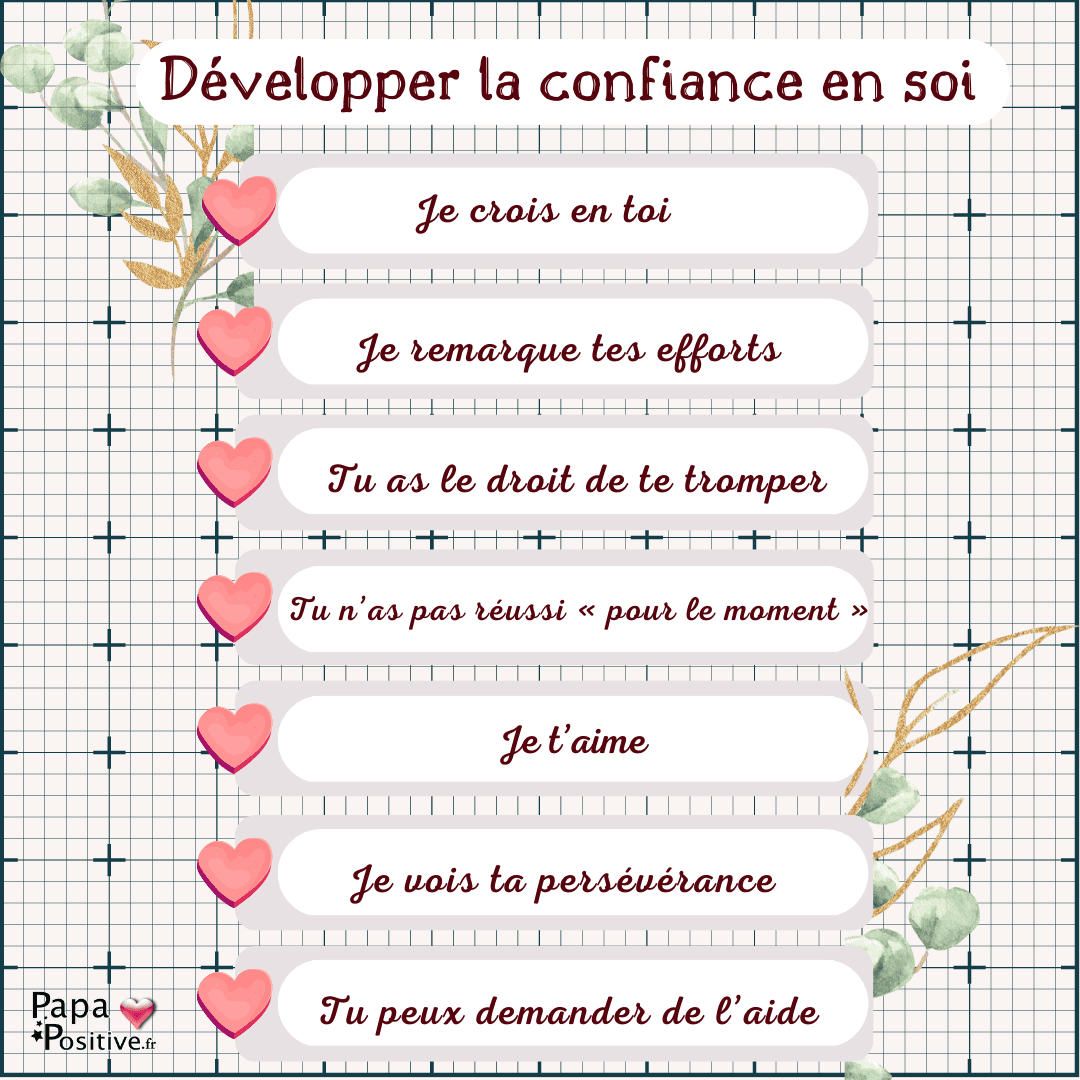

Transformation Maxine Developper La Confiance En Soi Pour L Avenir

May 23, 2025

Transformation Maxine Developper La Confiance En Soi Pour L Avenir

May 23, 2025

Latest Posts

-

Qmrt Mnst Ibdaeyt Lsnaet Alaflam Fy Qtr

May 23, 2025

Qmrt Mnst Ibdaeyt Lsnaet Alaflam Fy Qtr

May 23, 2025 -

Snae Aflam Qtrywn Fy Qmrt Qst Njah

May 23, 2025

Snae Aflam Qtrywn Fy Qmrt Qst Njah

May 23, 2025 -

Ebd Alqadr W Khsart Qtr Amam Alkhwr Baldwry Alqtry

May 23, 2025

Ebd Alqadr W Khsart Qtr Amam Alkhwr Baldwry Alqtry

May 23, 2025 -

Qmrt Qtr Ahtdan Almwahb Alsynmayyt

May 23, 2025

Qmrt Qtr Ahtdan Almwahb Alsynmayyt

May 23, 2025 -

Mbarat Qtr Walkhwr Khsart Murt Rghm Msharkt Ebd Alqadr

May 23, 2025

Mbarat Qtr Walkhwr Khsart Murt Rghm Msharkt Ebd Alqadr

May 23, 2025