Jim Cramer's Foot Locker (FL) Pick: Is It A Genuine Winner?

Table of Contents

Foot Locker's Current Financial Performance & Market Position

Foot Locker's recent financial performance provides a crucial context for evaluating Jim Cramer's recommendation. Examining key metrics such as revenue, earnings, and profit margins is essential. While Foot Locker remains a major player in the athletic footwear and apparel retail space, understanding its market share compared to giants like Nike and Adidas is equally important. Recent partnerships and strategic initiatives can significantly influence its performance.

- Foot Locker Financials: Analyzing recent quarterly and annual reports reveals trends in revenue growth, profitability, and overall financial health. For example, a declining profit margin might indicate challenges despite strong revenue figures. Detailed scrutiny of these reports is necessary for informed investing.

- Market Share: Foot Locker faces stiff competition. Assessing its market share against competitors like Nike, Adidas, Under Armour, and online retailers provides crucial context. A shrinking market share may signal weakening market position and potential future challenges for FL stock. Let's say Foot Locker's market share has slightly decreased in the past year compared to the previous year, which could signify a need for a strategic change.

- Strategic Initiatives: Foot Locker's success depends on adapting to evolving consumer preferences and technological advancements. Recent partnerships, such as collaborations with specific brands or initiatives in the e-commerce sector, significantly affect its growth trajectory. For instance, a strategic partnership with a rising athletic apparel brand could potentially boost sales and revenue.

Jim Cramer's Rationale Behind the Foot Locker Recommendation

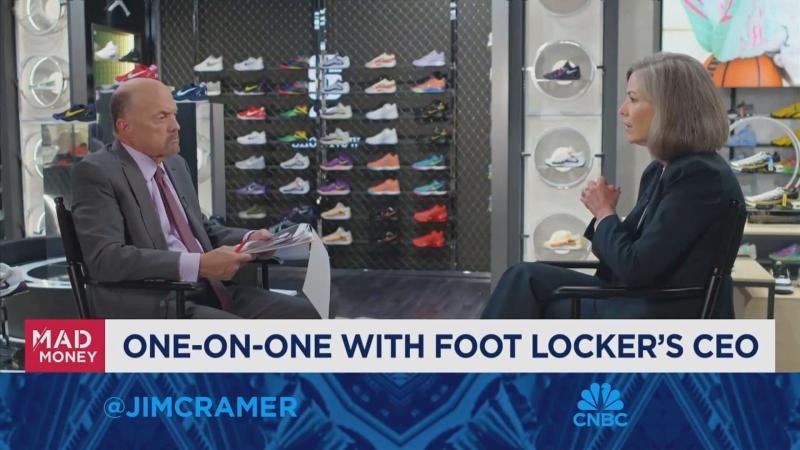

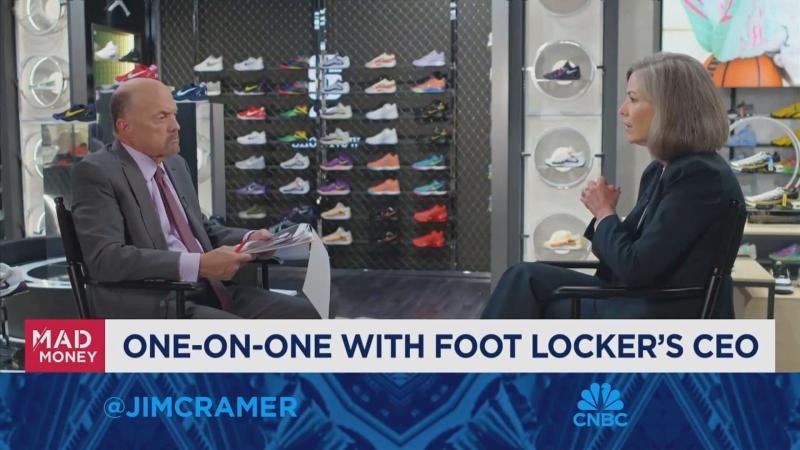

Understanding Jim Cramer's rationale is crucial. By examining his statements on Mad Money and other media appearances, we can dissect his arguments. What key factors did he highlight? What predictions did he make regarding Foot Locker's future growth? However, it's equally critical to analyze potential risks based on past predictions. While Jim Cramer offers valuable insights, it is important to analyze his track record critically.

- Mad Money Mentions: A careful review of Jim Cramer's commentary on Foot Locker reveals his specific reasons for recommending the stock. Direct quotes and analysis of his arguments should form the basis of our understanding. For example, he might have highlighted potential growth in e-commerce or a successful marketing campaign as crucial factors.

- Growth Predictions: What growth rate did Cramer predict for FL stock? Are these predictions realistic considering the current market conditions and Foot Locker's financial performance? We need to critically evaluate if his projections are overly optimistic or grounded in solid evidence.

- Past Performance Analysis: Reviewing Cramer's past recommendations can provide context for his current Foot Locker pick. His previous successes and failures can offer valuable insights into the reliability of his predictions and potential risk factors associated with this recommendation. For instance, if his past predictions for similar stocks were inaccurate, caution is warranted.

Analyzing the Strengths and Weaknesses of Foot Locker as an Investment

A balanced analysis necessitates examining both the strengths and weaknesses of Foot Locker as an investment opportunity. This comprehensive approach is crucial for making informed decisions.

Strengths

- Brand Recognition: Foot Locker enjoys strong brand recognition and loyalty among consumers. This established brand equity provides a significant advantage in the competitive retail landscape.

- E-commerce Potential: Foot Locker’s investment in its online platform presents potential for significant growth. A strong e-commerce presence is vital in today's market.

- Marketing Campaigns: Successful marketing campaigns play a significant role in driving sales and brand visibility. Effective marketing strategies can attract new customers and enhance brand loyalty.

- International Expansion: Expansion into new international markets offers significant growth opportunities and diversification. Exploring untapped markets can increase revenue and profitability.

Weaknesses

- Online Retail Competition: Intense competition from online giants such as Amazon and specialized online retailers poses a significant challenge.

- Changing Consumer Preferences: Evolving consumer preferences and trends in athletic footwear and apparel require adaptability and innovation to remain competitive.

- Supply Chain Issues: Supply chain disruptions can significantly impact inventory levels and profitability. Effective supply chain management is essential.

- Brand Dependence: Over-reliance on specific brands can make Foot Locker vulnerable to changes in those brands' strategies or performance. Diversifying brand offerings is prudent.

Alternative Investment Options and Comparative Analysis

Before committing to Foot Locker, exploring alternative investment options in the same sector provides essential context. Comparing Foot Locker with competitors such as Dick's Sporting Goods or other athletic apparel retailers allows for a comparative analysis of projected returns, risks, dividend payouts, and growth potential. This will aid in determining if Foot Locker offers the best risk-adjusted return.

- Competitor Analysis: A detailed comparison of Foot Locker's financial performance with its competitors provides valuable insights into its relative strengths and weaknesses. Key metrics to consider include revenue growth, profitability, and market share. For example, comparing Foot Locker's dividend yield to that of Dick's Sporting Goods helps gauge the potential for passive income generation.

- Risk Assessment: Assessing the risk associated with investing in Foot Locker, such as the volatility of its stock price and potential external factors, is essential. A thorough risk assessment, considering various scenarios, should be conducted before making any investment decisions. Comparing this to other potential investments will help investors determine their risk tolerance.

Conclusion

Jim Cramer's endorsement of Foot Locker (FL) stock warrants a thorough analysis. While Foot Locker boasts strengths like brand recognition and e-commerce potential, weaknesses such as online competition and evolving consumer preferences must be considered. The presented financial data, market analysis, and consideration of alternative investment options suggest a need for careful assessment before investing in FL stock. The evidence does not unequivocally support a wholly positive outlook. Therefore, while Jim Cramer's pick is noteworthy, independent research is crucial. Conduct your own in-depth research before making any investment decisions regarding Foot Locker (FL) stock. Informed investing, based on a thorough understanding of the company's financials and market position, is essential for success. Remember, this article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Analisi Della Presenza Di Microplastiche Nelle Diverse Acque

May 15, 2025

Analisi Della Presenza Di Microplastiche Nelle Diverse Acque

May 15, 2025 -

Jimmy Butlers Golden State Influence Impact On Miami Heats Future Star Power

May 15, 2025

Jimmy Butlers Golden State Influence Impact On Miami Heats Future Star Power

May 15, 2025 -

The Amber Heard Elon Musk Twin Controversy A Timeline

May 15, 2025

The Amber Heard Elon Musk Twin Controversy A Timeline

May 15, 2025 -

Kid Cudi Auction Personal Items Sell For Unexpectedly High Amounts

May 15, 2025

Kid Cudi Auction Personal Items Sell For Unexpectedly High Amounts

May 15, 2025 -

Npo Vertrouwen College Van Omroepen Werkt Aan Herstel

May 15, 2025

Npo Vertrouwen College Van Omroepen Werkt Aan Herstel

May 15, 2025