Jerome Powell's Warning: Tariffs And The Fed's Tightrope Walk

Table of Contents

The Impact of Tariffs on Inflation

Tariffs, essentially taxes on imported goods, directly contribute to inflationary pressures within an economy. By increasing the cost of imported goods, tariffs lead to higher prices for consumers, reducing purchasing power and potentially slowing economic growth. This impact is further exacerbated by supply chain disruptions often caused by the imposition of tariffs. Countries targeted by tariffs may retaliate with their own tariffs, creating a tangled web of trade restrictions that disrupt global supply chains and increase production costs for businesses.

- Increased Costs for Consumers: Tariffs on everyday goods, from clothing to electronics, directly increase the cost of living for American families.

- Supply Chain Disruptions: Tariffs can lead to delays and shortages of imported goods, forcing businesses to seek more expensive alternatives or reduce production.

- Specific Examples:

- Increased tariffs on steel and aluminum have impacted the automotive industry, leading to higher vehicle prices.

- Tariffs on consumer goods from China have contributed to higher prices for a wide range of products.

These effects are reflected in key economic indicators like the Consumer Price Index (CPI) and the Producer Price Index (PPI), which have shown significant increases in recent years, partly attributed to the impact of tariffs. Understanding this direct link between tariffs and inflation is crucial to grasping the challenges faced by the Federal Reserve.

The Fed's Tightrope Walk: Balancing Inflation and Growth

The Federal Reserve operates under a dual mandate: maintaining price stability (controlling inflation) and promoting maximum employment. This presents a significant challenge when inflation is driven by external factors like tariffs, which are beyond the Fed's direct control. The Fed's primary tool for controlling inflation is monetary policy, primarily adjusting interest rates. However, using interest rate hikes to combat inflation driven by tariffs requires a delicate balancing act.

- Raising Interest Rates: While raising interest rates can curb inflation, it also risks slowing economic growth and increasing unemployment.

- Maintaining Low Interest Rates: Conversely, maintaining low interest rates to stimulate the economy risks exacerbating inflation already fueled by tariffs.

- The Delicate Balance: The Fed must carefully calibrate its monetary policy response to avoid tipping the economy into a recession while effectively managing inflation. This is the essence of Jerome Powell's tightrope walk.

Jerome Powell's Statements and Actions

Jerome Powell has consistently acknowledged the inflationary pressures stemming from tariffs in his public statements and press conferences. He has emphasized the challenges these pressures pose to the Fed's ability to achieve its dual mandate. The Fed's policy responses have involved a combination of interest rate adjustments and other monetary policy tools.

- Interest Rate Adjustments: The Fed has implemented several interest rate increases in recent years in an attempt to combat inflation. (Specific dates and percentage changes should be added here based on current data.)

- Quantitative Easing (QE): While less prominent in the current environment, the Fed has utilized QE in the past to inject liquidity into the financial system. (Details on specific QE programs implemented should be added here based on current data.) However, the use of QE to combat tariff-induced inflation might be less effective.

Potential Long-Term Economic Consequences

The long-term economic consequences of tariffs extend beyond immediate inflationary pressures. The ongoing trade tensions and retaliatory tariffs create uncertainty, negatively impacting business investment and international trade.

- Reduced International Trade: Tariffs can lead to a decline in global trade, reducing economic interdependence and potentially harming long-term economic growth.

- Increased Costs: Higher prices for imported goods and materials translate into increased costs for businesses, potentially leading to reduced competitiveness and job losses.

- Trade Wars and Retaliation: The imposition of tariffs can escalate into trade wars, leading to a cycle of retaliatory tariffs that harms all involved economies.

Conclusion

Jerome Powell's warning regarding the significant impact of tariffs on the US economy highlights the precarious position the Federal Reserve finds itself in. The Fed's tightrope walk between controlling inflation and maintaining economic growth is made significantly more challenging by external factors such as tariffs. Understanding the complex interplay between tariffs, inflation, and monetary policy is crucial for navigating the current economic landscape. Staying informed about the ongoing developments related to the Fed's monetary policy and the effects of tariffs on the economy is vital. Continue to follow economic news and analysis to better understand the implications of Jerome Powell's warning and its impact on your financial future.

Featured Posts

-

Avrupa Borsalari Ecb Faiz Kararindan Sonra Piyasa Hareketleri

May 25, 2025

Avrupa Borsalari Ecb Faiz Kararindan Sonra Piyasa Hareketleri

May 25, 2025 -

Staying Safe With Flood Alerts A Practical Guide

May 25, 2025

Staying Safe With Flood Alerts A Practical Guide

May 25, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Nav Calculation And Analysis

May 25, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Nav Calculation And Analysis

May 25, 2025 -

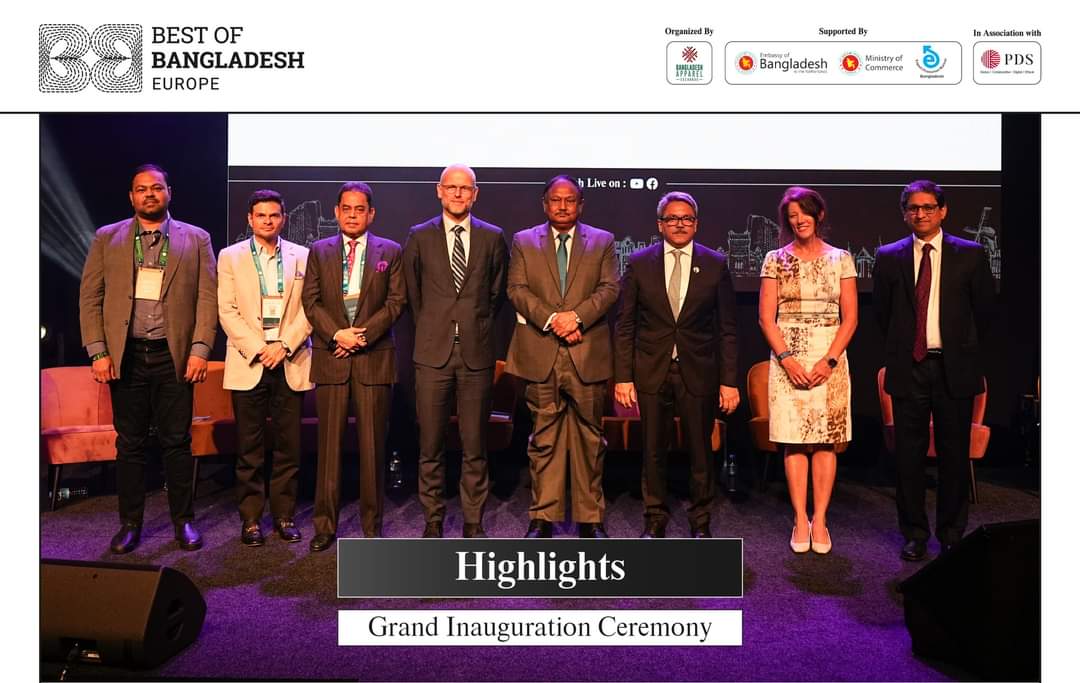

Collaboration And Growth Take Center Stage At The 2nd Best Of Bangladesh In Europe

May 25, 2025

Collaboration And Growth Take Center Stage At The 2nd Best Of Bangladesh In Europe

May 25, 2025 -

Thierry Ardisson Et Laurent Baffie La Verite Sur Leur Dispute

May 25, 2025

Thierry Ardisson Et Laurent Baffie La Verite Sur Leur Dispute

May 25, 2025

Latest Posts

-

Iannuccis Shifting Satire Exploring A Decline In Impact

May 25, 2025

Iannuccis Shifting Satire Exploring A Decline In Impact

May 25, 2025 -

Has Armando Iannucci Lost His Touch A Critical Examination

May 25, 2025

Has Armando Iannucci Lost His Touch A Critical Examination

May 25, 2025 -

Armando Iannuccis Creative Evolution A Loss Of Sharpness

May 25, 2025

Armando Iannuccis Creative Evolution A Loss Of Sharpness

May 25, 2025 -

The Diminishing Edge Analyzing Armando Iannuccis Recent Work

May 25, 2025

The Diminishing Edge Analyzing Armando Iannuccis Recent Work

May 25, 2025 -

The Best British Pop Films Of All Time A Ranked List

May 25, 2025

The Best British Pop Films Of All Time A Ranked List

May 25, 2025