Jerome Powell: Trade Protectionism And The Challenges For Monetary Policy

Table of Contents

The Impact of Trade Protectionism on Inflation

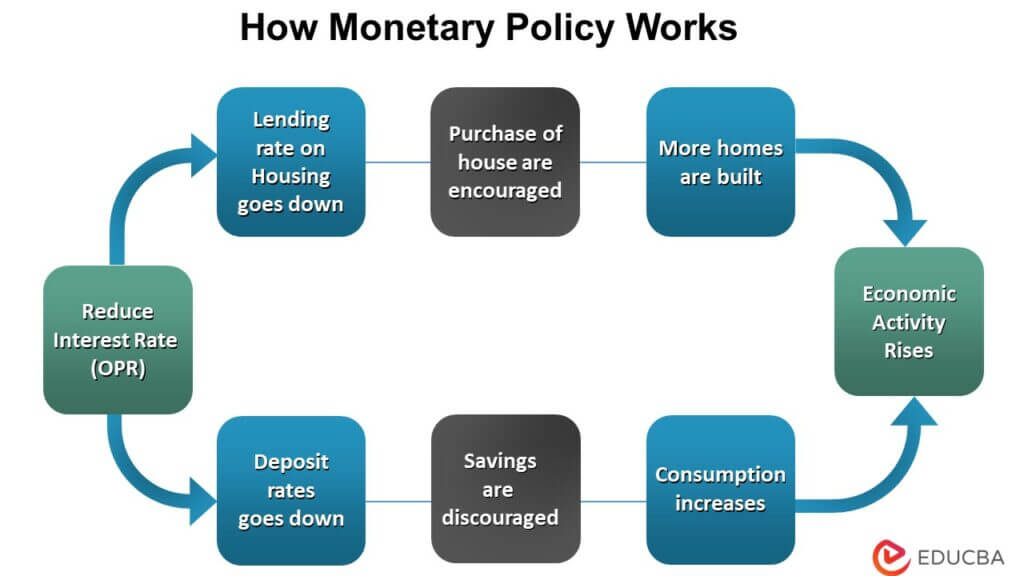

Trade wars and protectionist policies create significant headwinds for the Federal Reserve's mandate of price stability and full employment. The resulting economic instability directly impacts inflation in several key ways.

Supply Chain Disruptions and Price Increases

Trade protectionism, in the form of tariffs and other trade barriers, severely disrupts global supply chains. This leads to a cascade of negative consequences for prices:

- Increased tariffs directly raise the price of imported goods. Consumers face higher costs at the checkout, directly impacting inflation rates. This is particularly true for goods heavily reliant on imported components or raw materials.

- Supply chain bottlenecks cause delays and increase transportation costs. The disruption of established trade routes necessitates finding alternative suppliers and transportation methods, both of which are typically more expensive. This added expense is passed down the supply chain.

- Businesses pass increased costs onto consumers, leading to higher inflation. Faced with higher input costs, businesses have little choice but to raise prices to maintain profitability. This contributes to a broader inflationary spiral.

Uncertainty and Investor Sentiment

The unpredictable nature of trade protectionism creates substantial uncertainty for businesses and investors. This uncertainty undermines economic stability and further complicates the task of managing inflation:

- Volatile markets reduce business confidence and investment. Businesses hesitate to commit to long-term investments when facing unpredictable trade policies, impacting job creation and economic growth.

- Uncertainty makes long-term economic forecasting challenging. The unpredictability makes it extremely difficult for economists and policymakers to accurately forecast economic growth and inflation, hindering effective monetary policy.

- This uncertainty can contribute to both inflationary and deflationary pressures depending on the market reaction. Fear of future price increases can lead to hoarding and increased demand, fueling inflation. Conversely, fear of economic slowdown can lead to decreased spending and deflationary pressures.

The Fed's Response to Trade-Related Economic Shocks

The Federal Reserve's response to trade-related economic shocks necessitates a delicate balancing act. Jerome Powell and the FOMC must consider various factors to mitigate the impact of protectionism on the US economy.

Balancing Economic Growth and Inflation Control

The primary challenge for the Fed is to manage inflation without stifling economic growth. This is particularly difficult when the root cause of economic instability is external:

- Monetary policy tools are less effective when the root cause of economic instability is external, such as trade wars. Raising interest rates to combat inflation might lead to a recession if the underlying issue is not addressed.

- The Fed must carefully consider the magnitude and persistence of inflation before adjusting interest rates. A premature or overly aggressive response could have severe consequences for employment and overall economic activity.

- Misjudging the impact of trade protectionism can lead to policy errors with significant economic consequences. The Fed needs accurate assessments of the impact of trade policies on inflation and economic growth to make informed decisions.

Communication and Market Expectations

Clear and consistent communication from the Fed is essential, especially during periods of heightened uncertainty. Jerome Powell's public statements play a critical role:

- Transparent communication helps to mitigate market volatility. Clear explanations of the Fed's assessment of the economic situation and its policy intentions help to stabilize markets and investor sentiment.

- Powell's public statements shape investor sentiment and influence market behavior. His pronouncements are closely scrutinized by investors and markets worldwide, impacting investment decisions and exchange rates.

- Effective communication is vital in navigating the complexities of interconnected global markets affected by trade policy. Open dialogue with other central banks is crucial for managing global economic risks.

The Global Implications of US Trade Policy under Powell's Leadership

US trade policy under Powell’s leadership has significant global implications, affecting international cooperation and emerging market economies.

International Cooperation and Coordination

Trade protectionism often requires international cooperation to mitigate its negative effects. The Fed's actions are intertwined with global monetary policy coordination:

- The effectiveness of US monetary policy is influenced by the actions of other central banks. Coordination with other central banks is crucial for managing global economic risks.

- International cooperation on trade and financial regulation is crucial to manage global economic risks. Joint efforts to address global challenges are essential to maintain stability.

- A lack of global cooperation exacerbates the challenges for monetary policy in a globalized economy. Without collaboration, the impact of trade protectionism is amplified, making monetary policy significantly more challenging.

Emerging Market Vulnerabilities

Emerging market economies are disproportionately affected by changes in US trade policy and monetary policy decisions:

- Changes in interest rates can trigger capital flight from emerging markets. Higher US interest rates attract investment, leading to capital outflow from emerging economies.

- Trade wars can disrupt export markets for developing countries. Protectionist measures in the US can severely impact the economies of countries relying on exports to the US.

- Powell's decisions have far-reaching consequences for global economic stability and equity. His policies can have a significant impact on the global distribution of wealth and economic opportunity.

Conclusion

The relationship between Jerome Powell's monetary policy decisions and the effects of trade protectionism is intricate and highly consequential. Navigating the challenges of inflation, economic growth, and global economic stability amidst escalating trade tensions requires a nuanced and adaptive approach. Understanding the impact of trade protectionism on supply chains, investor sentiment, and global economic cooperation is crucial for effective monetary policy. Further research into the dynamic relationship between trade policy, monetary policy, and emerging market vulnerabilities is essential to fully grasp the complexities involved. Continue to follow developments in Jerome Powell's approach to monetary policy amidst trade protectionism to stay informed on this critical economic issue.

Featured Posts

-

Claire Williams And George Russell A Complex Professional Relationship

May 25, 2025

Claire Williams And George Russell A Complex Professional Relationship

May 25, 2025 -

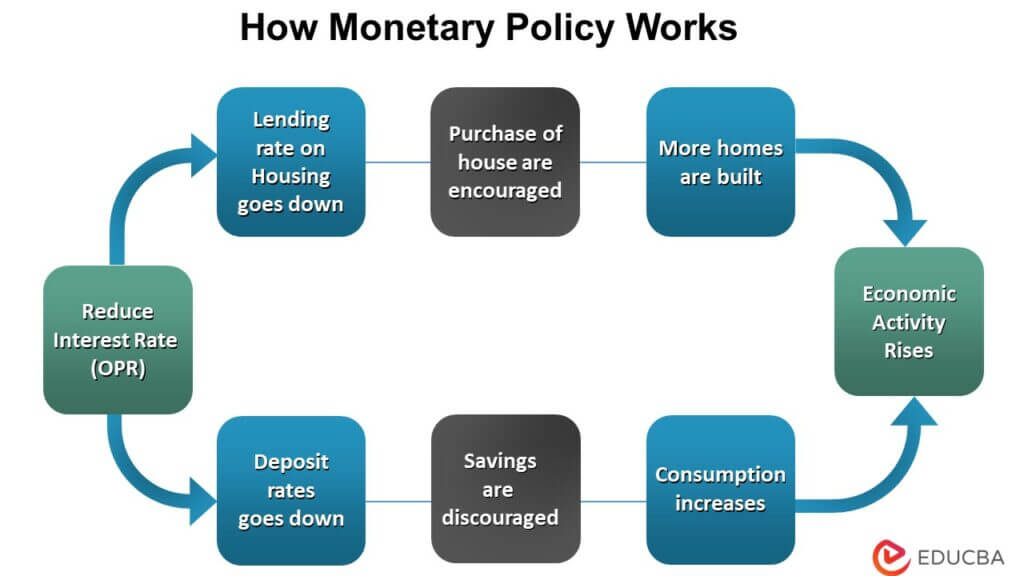

Sejarah Porsche 356 Warisan Zuffenhausen Jerman

May 25, 2025

Sejarah Porsche 356 Warisan Zuffenhausen Jerman

May 25, 2025 -

Ferrari 296 Speciale Um Vislumbre Do Motor Hibrido De 880 Cv

May 25, 2025

Ferrari 296 Speciale Um Vislumbre Do Motor Hibrido De 880 Cv

May 25, 2025 -

Soerloth Un La Liga Daki Etkisi 30 Dakikada 4 Gol

May 25, 2025

Soerloth Un La Liga Daki Etkisi 30 Dakikada 4 Gol

May 25, 2025 -

Kiefer Sutherland Casting News Sends Fans Into Frenzy

May 25, 2025

Kiefer Sutherland Casting News Sends Fans Into Frenzy

May 25, 2025

Latest Posts

-

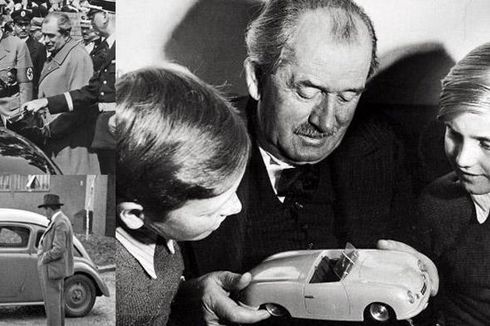

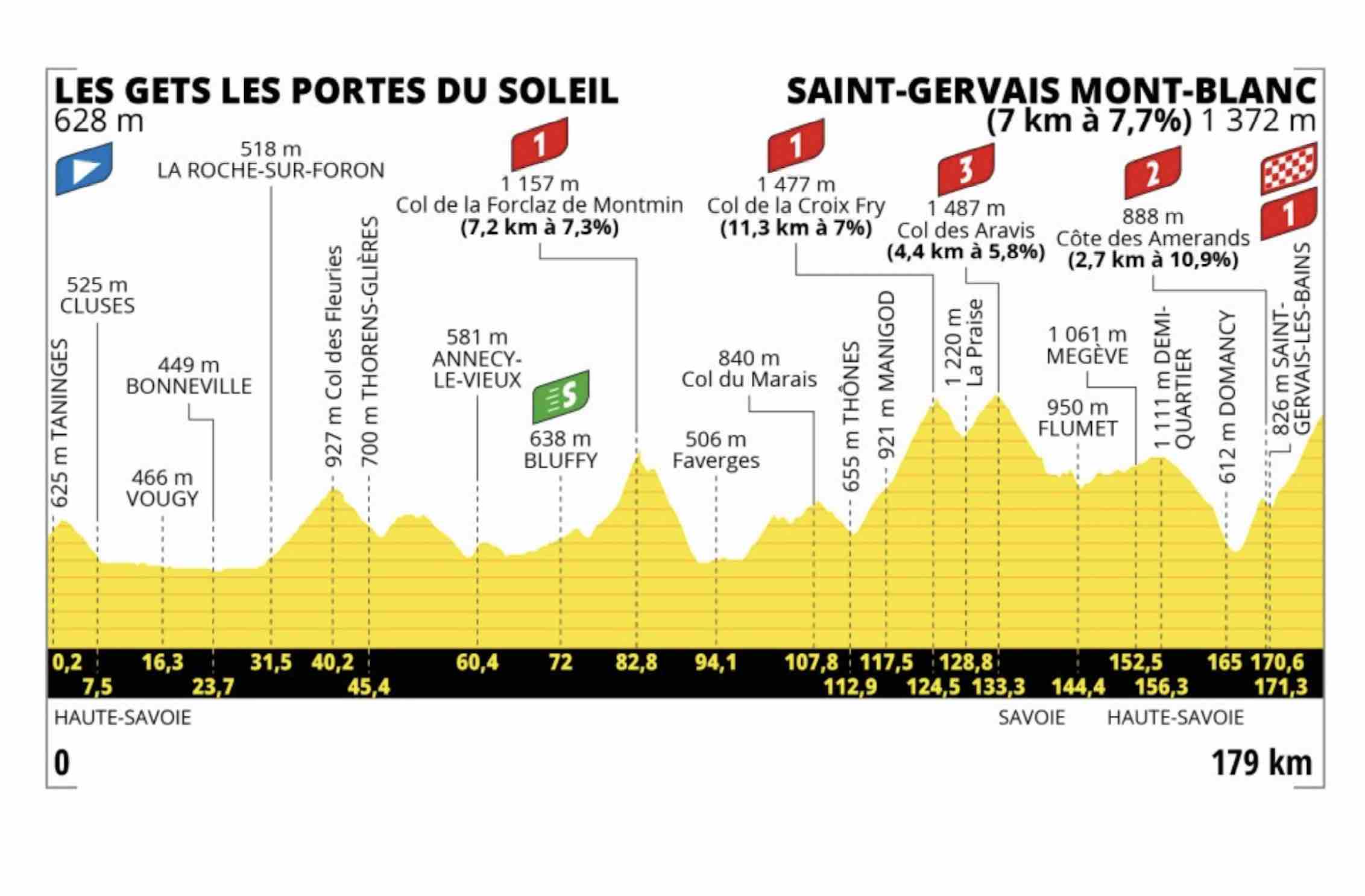

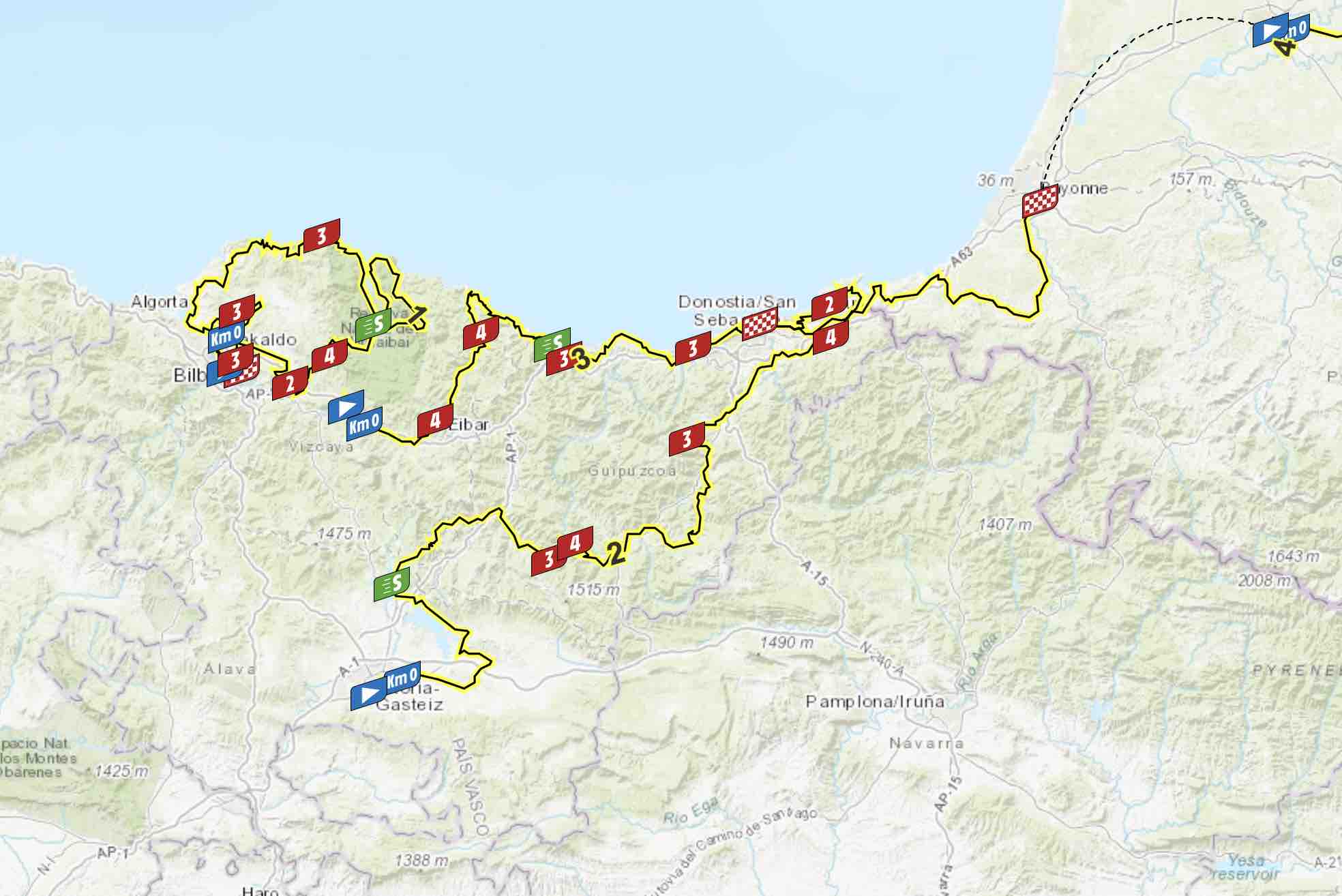

Le Tour De France Un Nouveau Jeu De Management Cycliste Par La Rtbf

May 26, 2025

Le Tour De France Un Nouveau Jeu De Management Cycliste Par La Rtbf

May 26, 2025 -

Devenez Manager Cycliste Avec Le Jeu Rtbf Le Tour De France Vous Attend

May 26, 2025

Devenez Manager Cycliste Avec Le Jeu Rtbf Le Tour De France Vous Attend

May 26, 2025 -

Jouez Au Jeu De Management Cycliste Rtbf Vivez Le Tour De France

May 26, 2025

Jouez Au Jeu De Management Cycliste Rtbf Vivez Le Tour De France

May 26, 2025 -

Le Jeu Officiel Du Tour De France Par La Rtbf Une Experience De Management Cycliste

May 26, 2025

Le Jeu Officiel Du Tour De France Par La Rtbf Une Experience De Management Cycliste

May 26, 2025 -

Tour De France Le Jeu De Management Cycliste De La Rtbf Arrive

May 26, 2025

Tour De France Le Jeu De Management Cycliste De La Rtbf Arrive

May 26, 2025