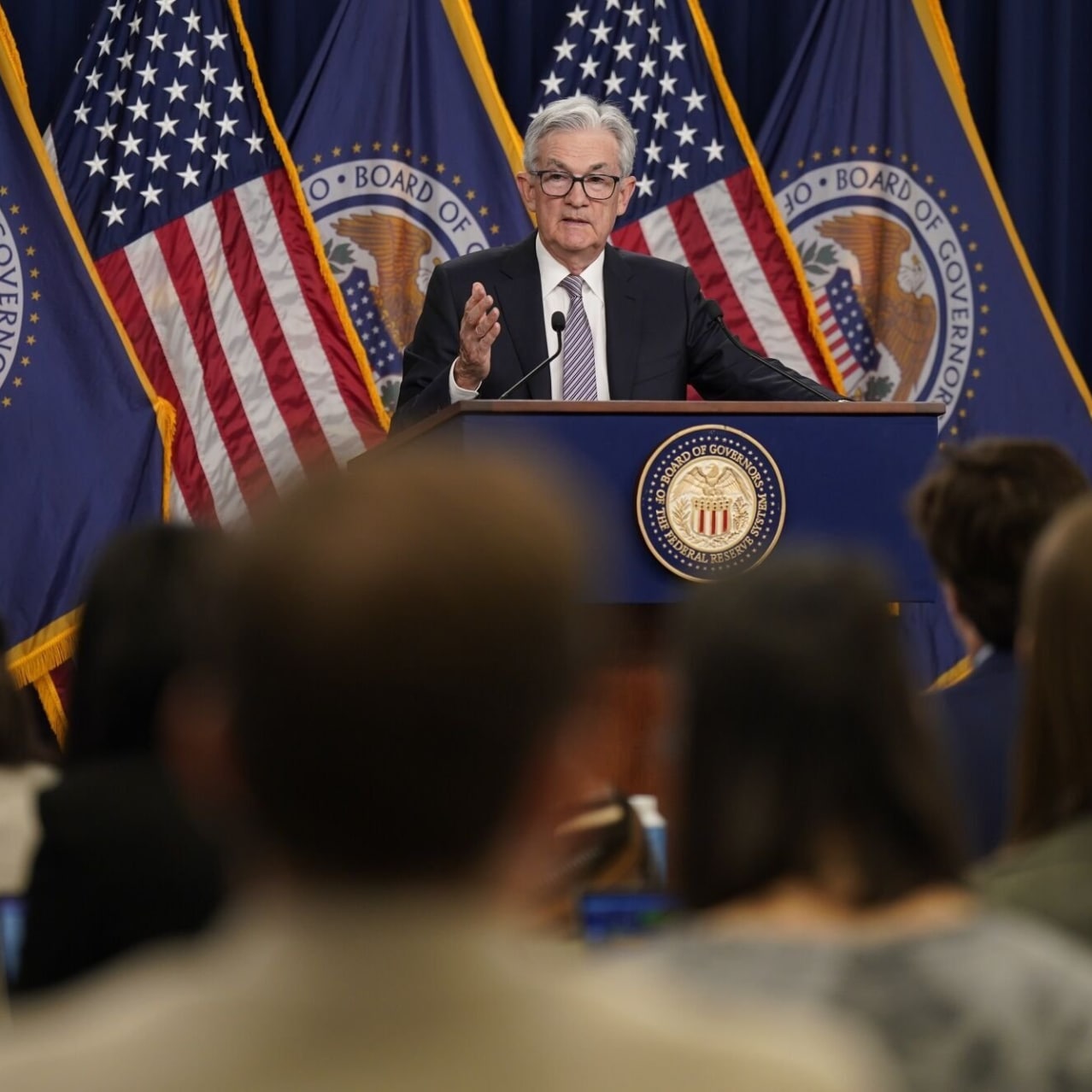

Jerome Powell And Tariffs: A Threat To Federal Reserve Goals

Table of Contents

Tariffs and Inflation

Tariffs directly increase the cost of imported goods, leading to higher consumer prices and potentially fueling inflation. This directly contradicts the Federal Reserve's mandate of maintaining price stability, a core element of its dual mandate alongside maximum employment. The increase in import prices, a direct consequence of tariffs, ripples through the economy.

- Increased import costs are passed onto consumers: Businesses facing higher input costs due to tariffs often pass these increased expenses to consumers in the form of higher prices for goods and services.

- Higher inflation erodes purchasing power: Sustained inflation diminishes the purchasing power of consumers, reducing their ability to purchase goods and services, potentially leading to decreased consumer spending and slower economic growth.

- The Federal Reserve may need to raise interest rates to combat tariff-induced inflation: To curb inflation spurred by tariffs, the Federal Reserve might resort to raising interest rates. This is a classic monetary policy tool to cool down an overheating economy.

- This can stifle economic growth and investment: Higher interest rates, however, can also have a negative impact on economic growth by making borrowing more expensive for businesses and consumers, thus potentially hindering investment and expansion.

Tariffs and Economic Growth

Trade disputes and tariffs create uncertainty for businesses, impacting investment decisions and potentially slowing economic growth. This undermines the Federal Reserve's goal of promoting maximum employment, as businesses react to uncertainty by delaying investments, hiring freezes, and potentially even layoffs. The effects extend beyond the immediate impact on specific industries.

- Uncertainty discourages business investment and expansion: Businesses hesitate to invest in expansion or new projects when facing unpredictable trade policies and potential future tariff increases. This hesitancy directly translates into reduced capital expenditures and slower economic growth.

- Reduced trade can lead to job losses in export-oriented industries: Retaliatory tariffs from other countries can harm US export-oriented industries, resulting in job losses and reduced economic output.

- Supply chain disruptions due to tariffs can increase production costs: Tariffs can disrupt established supply chains, forcing businesses to seek alternative, potentially more expensive, suppliers, thus impacting production costs and ultimately consumer prices.

- Slowed economic growth necessitates a more cautious approach by the Federal Reserve: Slower economic growth, fueled by tariff-related uncertainty, requires a more cautious and potentially less aggressive approach from the Federal Reserve in its monetary policy decisions.

The Federal Reserve's Response

The Federal Reserve must carefully navigate the economic fallout from tariffs, potentially adjusting its monetary policy tools to counteract inflationary pressures or stimulate growth. This requires a nuanced understanding of the complex interactions between tariffs, inflation, and the broader economy. Jerome Powell's leadership is crucial in this delicate balancing act.

- Interest rate adjustments to manage inflation: The Fed may raise or lower interest rates to manage inflation caused by tariffs. Raising rates combats inflation but can slow economic growth, while lowering rates stimulates growth but risks higher inflation.

- Potential use of quantitative easing or other unconventional monetary policies: In extreme scenarios, the Federal Reserve might resort to unconventional monetary policies like quantitative easing (QE) to inject liquidity into the market and stimulate economic activity.

- Communication strategy to manage market expectations and maintain confidence: Clear and transparent communication from the Federal Reserve is crucial to manage market expectations and maintain business and consumer confidence during periods of economic uncertainty caused by tariffs.

- Balancing the need to control inflation with supporting economic growth: This is the core challenge for the Federal Reserve – striking a balance between controlling inflation and fostering economic growth in the face of unpredictable tariff policies.

Predicting the Impact: The Challenges for Powell

Accurately predicting the impact of tariffs on the US economy is challenging due to their unpredictable nature and the complexity of global economic interactions. This makes it difficult for Jerome Powell to formulate effective monetary policy. The complexities involved make precise forecasting difficult, requiring a high degree of flexibility and adaptability in the Federal Reserve’s approach.

- Difficulty in modeling the complex effects of tariffs on various sectors: Economic models struggle to fully capture the cascading effects of tariffs across different sectors of the economy.

- Data lags can make it challenging to respond promptly to economic shifts: The time lag between implementing tariffs and observing their full economic impact can hinder timely responses from the Federal Reserve.

- Unforeseen consequences of trade policy can disrupt economic forecasts: Unanticipated retaliatory tariffs or other unforeseen global events can significantly disrupt economic forecasts and necessitate adjustments in monetary policy.

- The need for adaptability and a flexible approach to monetary policy: The unpredictable nature of tariffs necessitates a highly adaptable and flexible approach from the Federal Reserve, capable of swiftly adjusting its monetary policy tools to address evolving economic conditions.

Conclusion

The impact of tariffs on the US economy presents a significant challenge to Jerome Powell and the Federal Reserve's ability to achieve its dual mandate of price stability and maximum employment. The uncertainty created by trade disputes necessitates careful monitoring and a flexible approach to monetary policy. Tariffs, through their impact on inflation and economic growth, require a nuanced understanding and response from the Federal Reserve. Jerome Powell's leadership in navigating these complex economic currents is paramount.

Call to Action: Understanding the complex relationship between Jerome Powell, the Federal Reserve, and the effects of tariffs is crucial for navigating the current economic landscape. Stay informed about economic developments and the Federal Reserve's actions to better understand how these forces impact your financial well-being. Continue to follow updates on Jerome Powell and tariffs to remain informed on this critical economic issue.

Featured Posts

-

Integrer La Communaute Des Gens D Ici Conseils Et Strategies

May 26, 2025

Integrer La Communaute Des Gens D Ici Conseils Et Strategies

May 26, 2025 -

Trumps Hardball Tactics A Republican Deal In The Making

May 26, 2025

Trumps Hardball Tactics A Republican Deal In The Making

May 26, 2025 -

New Details Emerge Mercedes Investigates Lewis Hamilton

May 26, 2025

New Details Emerge Mercedes Investigates Lewis Hamilton

May 26, 2025 -

Rehoboth Beach The Ultimate Stress Relief Destination

May 26, 2025

Rehoboth Beach The Ultimate Stress Relief Destination

May 26, 2025 -

What Is A Flash Flood Understanding Flood Warnings And Alerts

May 26, 2025

What Is A Flash Flood Understanding Flood Warnings And Alerts

May 26, 2025

Latest Posts

-

Analysis Mc Kenna Tuanzebe Phillips Cajuste Ipswich Towns Week In Review

May 28, 2025

Analysis Mc Kenna Tuanzebe Phillips Cajuste Ipswich Towns Week In Review

May 28, 2025 -

Mc Kenna Impresses Tuanzebes Strong Week Phillips And Cajuste Face Challenges Ipswich Town Update

May 28, 2025

Mc Kenna Impresses Tuanzebes Strong Week Phillips And Cajuste Face Challenges Ipswich Town Update

May 28, 2025 -

Phillips Potential Leeds Return Examining The Transfer Talk

May 28, 2025

Phillips Potential Leeds Return Examining The Transfer Talk

May 28, 2025 -

Leeds United Transfer News Kalvin Phillips Return On The Cards

May 28, 2025

Leeds United Transfer News Kalvin Phillips Return On The Cards

May 28, 2025 -

Is A Kalvin Phillips Return To Leeds United On The Cards This Summer

May 28, 2025

Is A Kalvin Phillips Return To Leeds United On The Cards This Summer

May 28, 2025