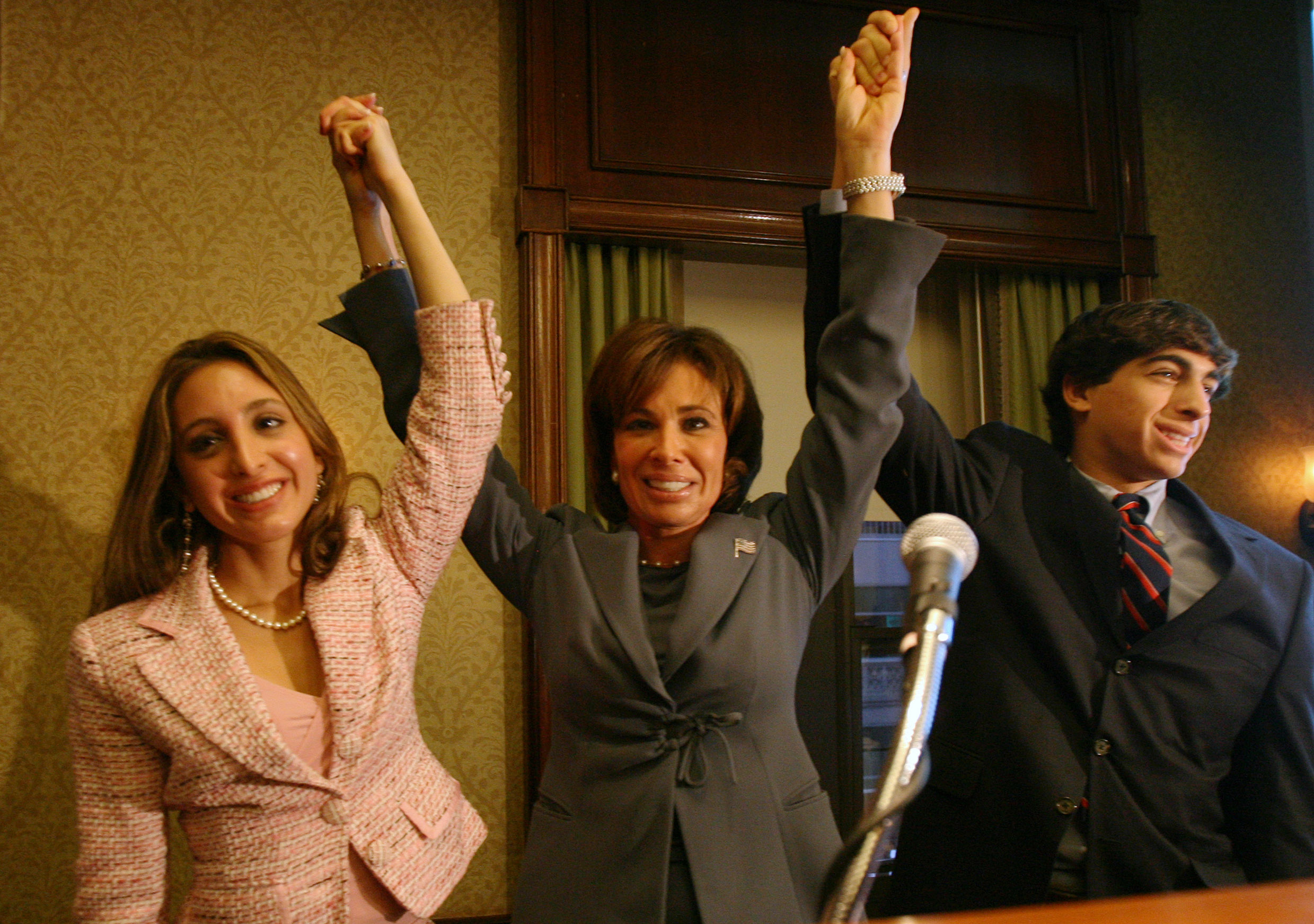

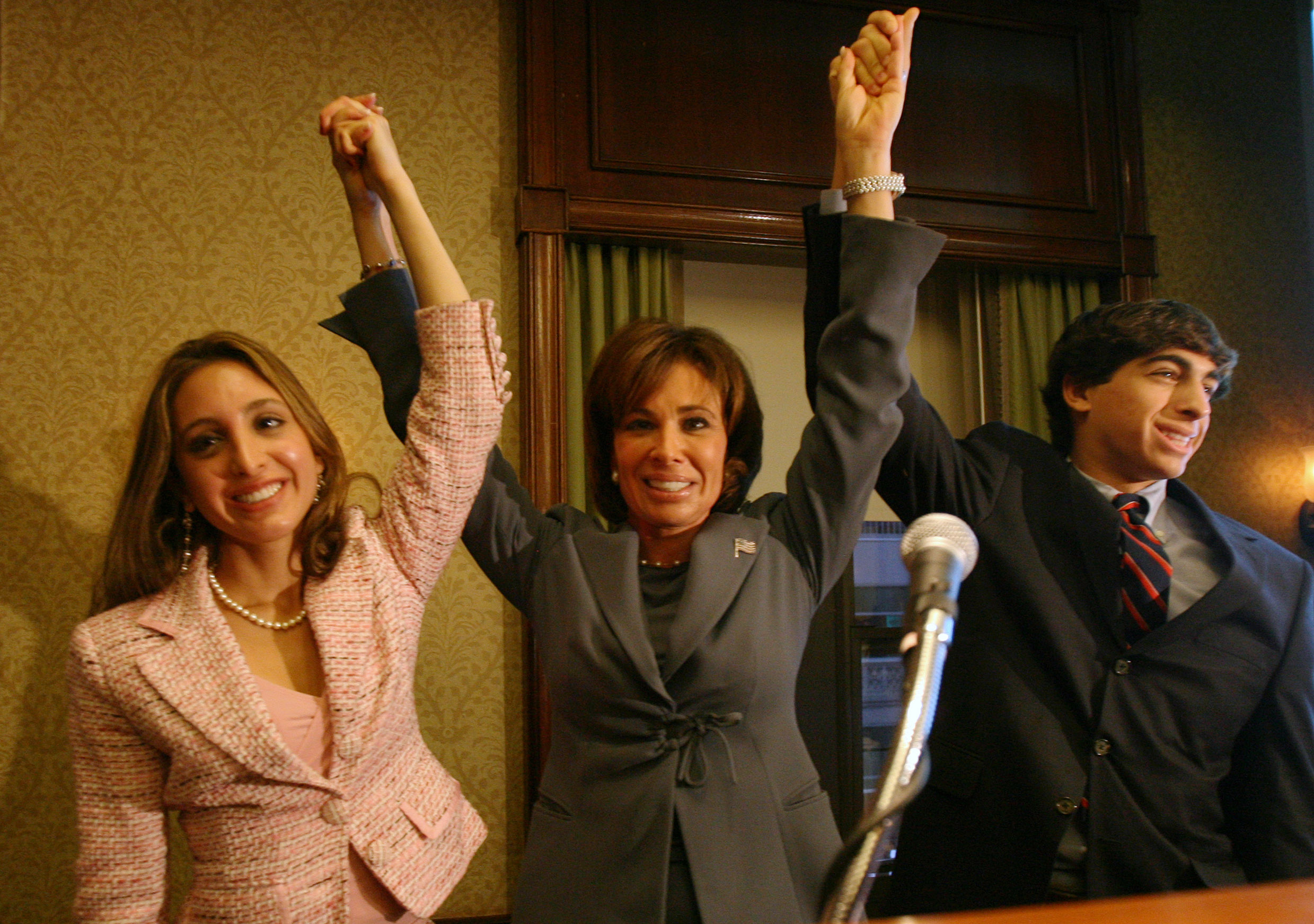

Jeanine Pirro's Market Warning: Ignore Stocks For Weeks?

Table of Contents

Analyzing Jeanine Pirro's Market Prediction

Understanding Jeanine Pirro's market warning requires examining her specific statements and the context surrounding them. While precise quotes may vary depending on the source, her concerns generally revolve around the current economic climate and potential market instability. For example, she may have expressed anxieties about rising inflation, increasing interest rates, or looming recessionary fears. These concerns, whether explicitly stated or implied, form the foundation of her prediction. It’s crucial to note the specific timeframe mentioned – usually a period of weeks, potentially stretching into months – to understand the scope of her warning.

- Key concerns cited by Pirro: Inflation, interest rate hikes, geopolitical instability (e.g., the war in Ukraine), and potential corporate earnings disappointments.

- Underlying economic factors: High inflation eroding purchasing power, aggressive interest rate increases by central banks to combat inflation, and fears of a potential recession impacting corporate profits.

- Geopolitical risks highlighted: The ongoing war in Ukraine and its impact on global supply chains and energy prices.

Evaluating the Risks and Rewards of Ignoring Stocks

Deciding whether to heed Jeanine Pirro's market warning involves weighing the potential risks and rewards of temporarily exiting the stock market. Staying out of the market for several weeks carries the significant risk of missing potential gains if the market continues its upward trajectory. This represents an opportunity cost – the potential profits you forgo by not participating.

Conversely, temporarily withdrawing from the stock market could offer a degree of protection if a significant market correction or downturn occurs. This strategy could mitigate potential losses. However, timing the market perfectly is notoriously difficult, and attempting to do so carries inherent risks.

- Potential for missed gains during a bullish market: A missed opportunity to profit from rising stock prices.

- Risk of a missed recovery: The possibility of missing the start of a market rebound after a correction.

- Potential for reduced losses during a bear market: Mitigation of losses if the market experiences a significant decline.

Alternative Investment Strategies During Market Uncertainty

During periods of market uncertainty, like those suggested by Jeanine Pirro's market warning, diversifying your portfolio and considering alternative investment strategies becomes crucial. Instead of solely relying on stocks, explore lower-risk options.

- Examples of less volatile investments: High-yield savings accounts, certificates of deposit (CDs), money market accounts, and government bonds. These options offer stability and preserve capital, although returns might be lower than those offered by stocks.

- Benefits of diversification: Spreading investments across different asset classes helps mitigate risk. A diversified portfolio can better weather market fluctuations.

- The importance of a sound financial plan: A well-defined financial plan that aligns with your risk tolerance, investment goals, and time horizon is essential in navigating market volatility.

Expert Opinions on Jeanine Pirro's Stock Market Outlook

To gain a comprehensive understanding, it’s essential to consider opinions from other financial experts. While Jeanine Pirro's warning highlights specific concerns, comparing her assessment with the views of other analysts provides a broader perspective on the current market situation. Do other financial experts share her concerns? Or do they offer a more optimistic outlook? Analyzing the consensus or divergence of opinions helps create a more nuanced picture of the current market risks.

- Quotes from other financial experts: Incorporating views from reputable financial analysts and economists helps to balance the perspective presented by Jeanine Pirro's market analysis.

- Comparison of predictions: Comparing predictions helps to identify potential areas of agreement or disagreement, highlighting the range of possible outcomes.

- Overall market sentiment analysis: Assessing the general mood and expectations within the financial community provides valuable context for interpreting Jeanine Pirro’s market warning and making informed investment decisions.

Conclusion: Should You Heed Jeanine Pirro's Stock Market Warning?

Jeanine Pirro's market warning prompts investors to carefully consider their risk tolerance and investment strategies. While her concerns regarding inflation, interest rate hikes, and geopolitical instability are valid points, the decision to temporarily withdraw from the stock market is highly personal. It depends significantly on your individual risk profile, investment goals, and time horizon. This article does not constitute financial advice.

Call to action: Before making any investment decisions, conduct thorough research, consult with a qualified financial advisor, and stay informed about Jeanine Pirro's market analysis and other expert opinions. Make informed decisions based on your own risk tolerance and thorough research of Jeanine Pirro's market warning and other expert opinions.

Featured Posts

-

The Future Of Apple Ai Innovation And Market Dominance

May 10, 2025

The Future Of Apple Ai Innovation And Market Dominance

May 10, 2025 -

Harry Styles Responds To A Truly Bad Snl Impression

May 10, 2025

Harry Styles Responds To A Truly Bad Snl Impression

May 10, 2025 -

Your Guide To Live Music And Events In Lake Charles For Easter Weekend

May 10, 2025

Your Guide To Live Music And Events In Lake Charles For Easter Weekend

May 10, 2025 -

Analyzing Palantirs 30 Price Drop Investment Implications

May 10, 2025

Analyzing Palantirs 30 Price Drop Investment Implications

May 10, 2025 -

Elizabeth City Apartment Complex Car Break Ins Dozens Of Vehicles Targeted

May 10, 2025

Elizabeth City Apartment Complex Car Break Ins Dozens Of Vehicles Targeted

May 10, 2025