Jeanine Pirro Urges Viewers To Avoid The Stock Market Short-Term

Table of Contents

Pirro's Concerns Regarding Short-Term Market Volatility

The stock market is inherently volatile. While long-term trends generally show upward growth, short-term fluctuations can be dramatic and unpredictable. Jeanine Pirro's cautionary remarks stem from this inherent instability. Sudden market drops, fueled by economic news, geopolitical events, or even social media trends, can wipe out short-term gains in a matter of days or even hours. Consider the flash crashes and market corrections we've witnessed in recent years; these events highlight the unpredictable nature of short-term market behavior.

- Increased risk of losses due to rapid price changes: Short-term trades expose investors to significant losses if the market moves against them quickly.

- Difficulty in predicting short-term market trends accurately: Even seasoned professionals struggle to consistently predict short-term market movements. Trying to time the market is a risky gamble.

- Emotional decision-making often leads to poor investment outcomes: Fear and greed can drive impulsive decisions, leading to poor investment choices and significant losses.

- Transaction costs can significantly eat into profits on short-term trades: The fees associated with frequent buying and selling can quickly erode any potential gains.

The Importance of a Long-Term Investment Strategy

In contrast to the unpredictable nature of short-term trading, a long-term investment strategy offers significant advantages. Jeanine Pirro's message implicitly promotes this approach. By adopting a long-term perspective, investors can ride out market fluctuations and benefit from the power of compounding returns.

- Compounded returns over time significantly outweigh short-term gains: The consistent growth of your investments over years, even decades, far surpasses the potential of short-term gains, which are often offset by fees and losses.

- Long-term investing minimizes the impact of market corrections: Market corrections are inevitable, but their impact is significantly lessened when viewed within a long-term investment horizon.

- A diversified long-term portfolio reduces overall risk: Spreading investments across various asset classes minimizes the impact of losses in any single sector.

- Long-term investing allows for a more disciplined and less emotional approach: This reduces the likelihood of making rash, impulsive decisions based on short-term market noise.

Alternative Investment Options to Short-Term Stock Trading

If you’re heeding Jeanine Pirro’s advice and avoiding short-term stock market investments, there are several less volatile alternatives to consider. These options generally offer lower returns but also significantly reduce risk:

- High-yield savings accounts: These accounts offer a relatively safe place to park your money while earning a modest return.

- Certificates of deposit (CDs): CDs offer fixed interest rates for a specified period, providing a predictable return with limited risk.

- Bonds: Bonds are generally considered less volatile than stocks and offer a fixed income stream.

- Real estate (long-term): Real estate can be a good long-term investment, but it's important to consider the associated costs and risks.

Seeking Professional Financial Advice

Before making any investment decisions, it's crucial to seek professional financial advice. This is a key takeaway from understanding Jeanine Pirro's warning against short-term stock market involvement. A qualified financial advisor can help you create a personalized investment plan tailored to your individual needs, risk tolerance, and financial goals.

- A financial advisor can create a customized investment plan based on individual needs and risk tolerance.

- They can provide objective advice and help navigate market complexities.

- They can help diversify your portfolio effectively.

Conclusion: Heeding Jeanine Pirro's Advice and Avoiding Short-Term Stock Market Risks

Jeanine Pirro's cautionary message regarding short-term stock market investments is a valuable reminder of the inherent risks involved. By understanding the volatility of the short-term market, embracing a long-term investment strategy, and seeking professional financial guidance, you can significantly reduce your risk and work towards achieving your financial goals. Take Jeanine Pirro’s advice seriously; avoid short-term stock market risks by developing a long-term investment plan and consulting a financial advisor today. Remember, consistent, well-informed long-term investing is key to building lasting wealth.

Featured Posts

-

Fate Of Historic Broad Street Diner Hyatt Hotel Project

May 09, 2025

Fate Of Historic Broad Street Diner Hyatt Hotel Project

May 09, 2025 -

Boosting Capital Market Cooperation Pakistan Sri Lanka And Bangladesh Join Forces

May 09, 2025

Boosting Capital Market Cooperation Pakistan Sri Lanka And Bangladesh Join Forces

May 09, 2025 -

Palantir Stock Should You Invest Before May 5th Wall Streets Verdict

May 09, 2025

Palantir Stock Should You Invest Before May 5th Wall Streets Verdict

May 09, 2025 -

Julia Wandelts Madeleine Mc Cann Claim Leads To Uk Arrest

May 09, 2025

Julia Wandelts Madeleine Mc Cann Claim Leads To Uk Arrest

May 09, 2025 -

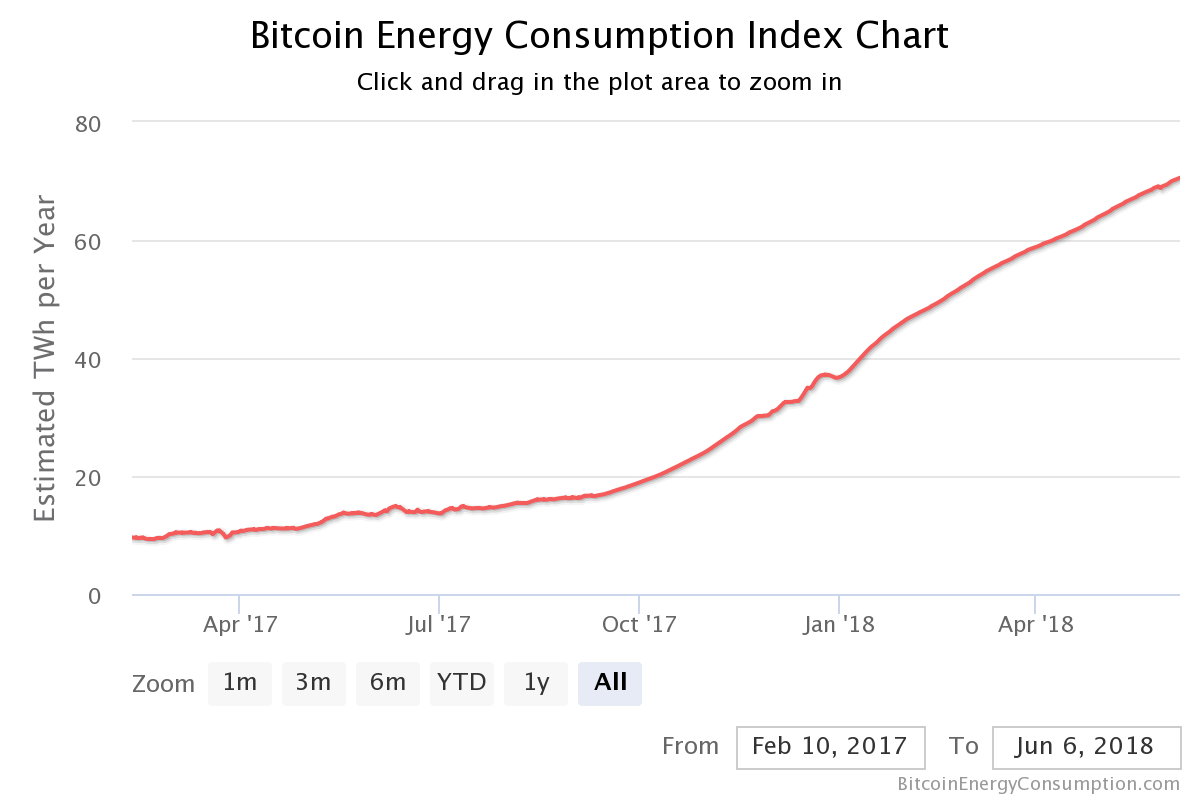

Exploring The Factors Contributing To The Recent Bitcoin Mining Increase

May 09, 2025

Exploring The Factors Contributing To The Recent Bitcoin Mining Increase

May 09, 2025