Japan's Central Bank Lowers Economic Growth Projection Due To Trade Tensions

Table of Contents

Impact of Trade Tensions on Japanese Exports

Global trade disputes have significantly hampered Japanese exports, leading to a noticeable decline in export volume and value. Tensions with major trading partners, particularly the ongoing US-China trade war, have created a ripple effect across various sectors.

-

Automotive Industry: Japanese car manufacturers, major exporters globally, have faced reduced demand and increased tariffs in key markets, resulting in a substantial decline in export revenue. The added costs associated with tariffs have squeezed profit margins and hindered expansion plans.

-

Electronics Sector: Similarly, the electronics industry, another pillar of Japanese exports, has experienced a slowdown due to reduced demand and disruptions in global supply chains. The uncertainty surrounding trade policies has made it challenging for businesses to plan long-term investments and strategies.

-

Impact of Tariffs and Trade Barriers: The imposition of tariffs and other trade barriers has directly increased the cost of Japanese goods in international markets, making them less competitive compared to products from other countries. This has forced some Japanese businesses to absorb the added costs, reducing profit margins, while others have had to raise prices, impacting global demand. This decline in Japanese exports directly impacts GDP growth. The consequences of these trade disputes and associated trade barriers are far-reaching.

Weakening Consumer Spending and Domestic Demand

The economic uncertainty caused by trade tensions has significantly dampened consumer confidence in Japan. This translates into a reduction in consumer spending, a critical driver of domestic demand.

-

Retail Sales Decline: Reports indicate a decline in retail sales across various sectors, reflecting consumers' hesitancy to spend amid economic instability. Uncertainty about future job security and income levels is influencing purchasing decisions.

-

Tourism Sector Impact: The tourism industry, a significant contributor to Japan's economy, is also feeling the pinch. Global economic slowdown and uncertainty have deterred international tourists, impacting revenue for hotels, restaurants, and related businesses. This further weakens domestic demand.

-

Impact on Consumer Confidence: Surveys show a decline in consumer confidence, indicating a pessimistic outlook on the economy. This pessimism translates directly into reduced consumer spending and weakens the overall economic growth projection.

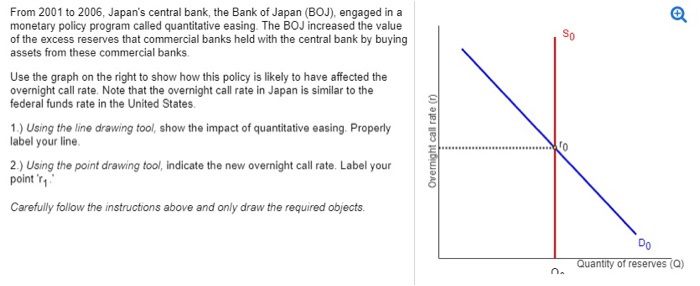

BOJ's Response and Monetary Policy Adjustments

In response to the lowered economic growth projection, the BOJ is likely to consider various monetary policy adjustments. While the exact measures remain to be seen, potential options include:

-

Interest Rate Changes: The BOJ might consider further lowering interest rates to stimulate borrowing and investment. However, with interest rates already near zero, the effectiveness of this measure might be limited.

-

Quantitative Easing: The BOJ could expand its quantitative easing program, purchasing more government bonds and other assets to inject liquidity into the market. The goal is to encourage lending and investment, thereby boosting economic activity.

The effectiveness of the BOJ's measures in mitigating the impact of trade tensions on Japan's economy will depend on various factors, including the overall global economic environment and the resolution of the underlying trade disputes. The success of these economic stimulus efforts is crucial for maintaining stable GDP growth.

Government Initiatives and Fiscal Measures

The Japanese government is also expected to implement fiscal measures to counteract the economic slowdown. These might include:

-

Economic Stimulus Packages: The government may announce new fiscal stimulus packages, potentially focusing on infrastructure development, tax cuts, or direct cash handouts to consumers. These measures aim to boost aggregate demand and create jobs.

-

Investment in Infrastructure: Investing in infrastructure projects can create jobs and stimulate economic activity. This is a common approach during economic downturns.

The effectiveness of these government spending initiatives will depend on their design and implementation. Well-targeted fiscal policy can effectively stimulate economic growth, but poorly designed measures might have limited impact or even negative consequences.

Analyzing Japan's Economic Outlook Amidst Trade Tensions

In summary, trade tensions are significantly impacting Japan's economic growth projection. The decline in Japanese exports, weakening consumer spending, and the overall economic uncertainty necessitate a proactive response from both the BOJ and the Japanese government. While the BOJ's monetary policy adjustments and the government's fiscal measures aim to stimulate the economy, the ultimate success will depend on resolving the underlying trade disputes and restoring global economic stability. It's crucial to continue monitoring the evolving trade situation and its effects on Japan's economy. The future economic projections for Japan are heavily reliant on navigating these complex global trade dynamics. Stay informed about Japan's economic growth and the ongoing effects of trade tensions by subscribing to our updates or following relevant news sources. Understanding the implications of these developments is vital for navigating the complexities of Japan's economy.

Featured Posts

-

Shrimp Ramen Stir Fry Quick And Flavorful Weeknight Dinner

May 02, 2025

Shrimp Ramen Stir Fry Quick And Flavorful Weeknight Dinner

May 02, 2025 -

Kort Geding Kampen Vs Enexis Stroomvoorziening Duurzaam Schoolgebouw

May 02, 2025

Kort Geding Kampen Vs Enexis Stroomvoorziening Duurzaam Schoolgebouw

May 02, 2025 -

Daly Late Show Englands Six Nations Victory Over France

May 02, 2025

Daly Late Show Englands Six Nations Victory Over France

May 02, 2025 -

Moskva Temnaya Storona Eskorta Zhizn V Kladovkakh

May 02, 2025

Moskva Temnaya Storona Eskorta Zhizn V Kladovkakh

May 02, 2025 -

Real Housewives Melissa Gorga Exclusive Look At Beach House Guest List

May 02, 2025

Real Housewives Melissa Gorga Exclusive Look At Beach House Guest List

May 02, 2025

Latest Posts

-

Newsround On Bbc Two Hd What Time And Day To Watch

May 02, 2025

Newsround On Bbc Two Hd What Time And Day To Watch

May 02, 2025 -

A Doctor Who Production Pause Interpreting Russell T Davies Statements

May 02, 2025

A Doctor Who Production Pause Interpreting Russell T Davies Statements

May 02, 2025 -

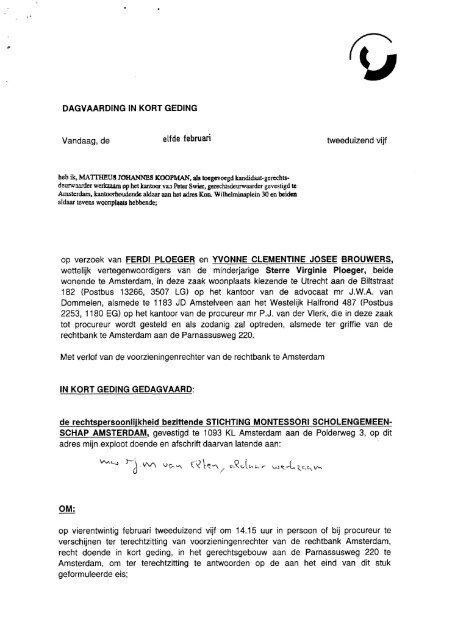

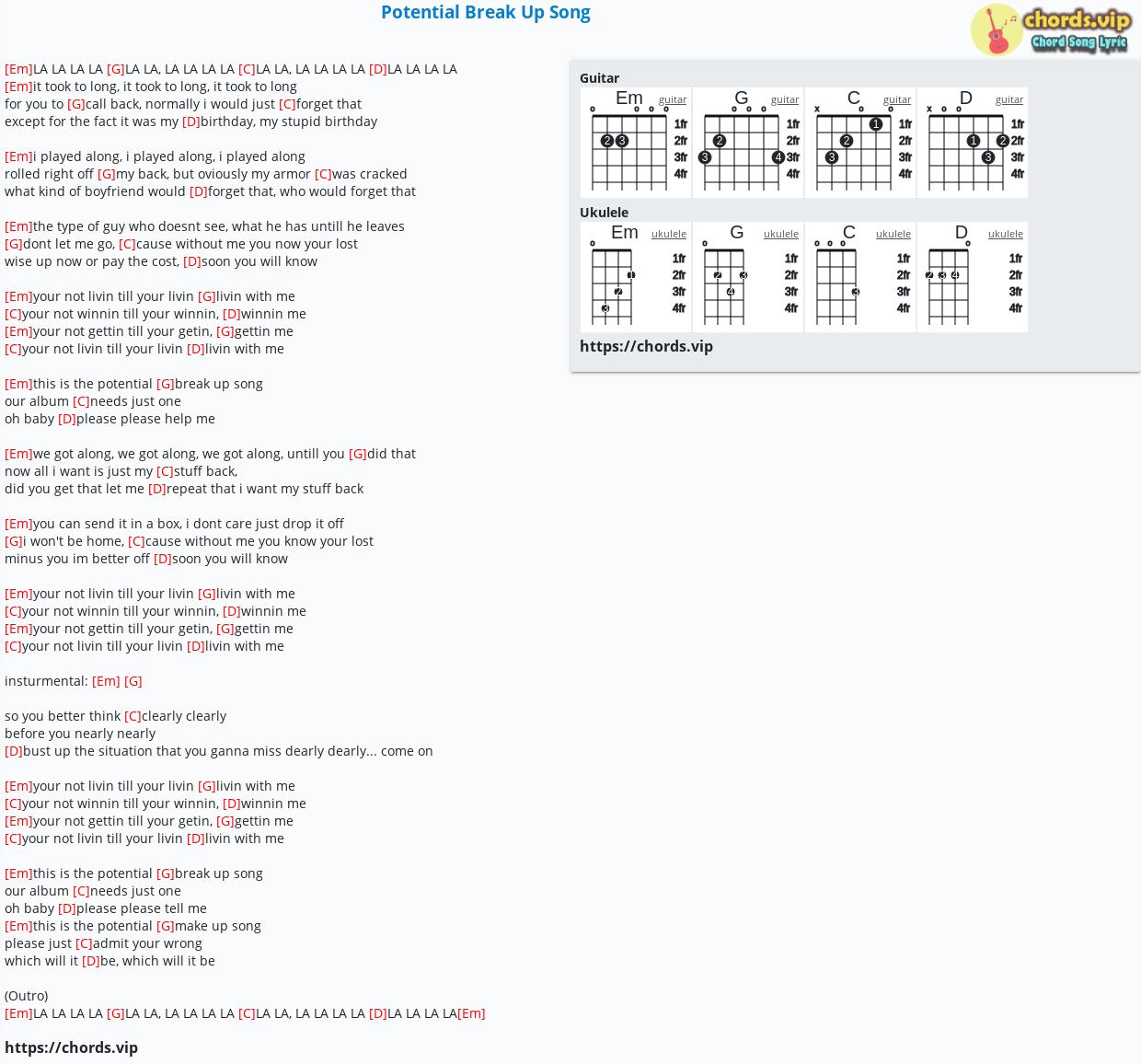

Doctor Who Future A Potential Break In Production

May 02, 2025

Doctor Who Future A Potential Break In Production

May 02, 2025 -

Doctor Who Future Uncertain Showrunner Hints At Potential Hiatus

May 02, 2025

Doctor Who Future Uncertain Showrunner Hints At Potential Hiatus

May 02, 2025 -

Is Doctor Who Going On Pause Russell T Davies Offers Clues

May 02, 2025

Is Doctor Who Going On Pause Russell T Davies Offers Clues

May 02, 2025