Is XRP's 400% Price Jump Sustainable? A Detailed Look

Table of Contents

The recent 400% surge in XRP price has sent shockwaves through the cryptocurrency market. This dramatic increase has left many investors wondering: is this rally sustainable? This detailed analysis dives deep into the factors driving XRP's price jump, examining its potential for long-term growth and the inherent risks involved. We'll dissect Ripple's legal battles, technological advancements, market sentiment, and broader cryptocurrency trends to assess the viability of this remarkable growth and help you understand the future of XRP price.

H2: Ripple's Legal Battle and Its Impact on XRP Price

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) significantly impacts XRP's price and overall market sentiment. The uncertainty surrounding the outcome casts a long shadow on investor confidence.

H3: The SEC Lawsuit and its Resolution

The SEC alleges that Ripple sold XRP as an unregistered security. The outcome of this lawsuit is crucial for XRP's future.

- Potential Scenarios:

- Favorable Ruling: A win for Ripple could lead to a massive surge in XRP price, potentially exceeding the recent 400% jump, as regulatory uncertainty would be significantly reduced. Increased institutional investment could further fuel this growth.

- Settlement: A settlement could bring some clarity but might not fully alleviate concerns, resulting in a moderate price increase or stagnation. The terms of any settlement would be key.

- Negative Ruling: An SEC victory could severely damage XRP's price, potentially causing a significant market crash as investors lose confidence. Delisting from major exchanges is also a real possibility.

- Market Reaction: Past court proceedings and news related to the lawsuit have shown a direct correlation between positive developments and XRP price increases, and vice-versa. Expert opinions are divided, but the general consensus is that a clear resolution, regardless of the outcome, is crucial for price stabilization.

H3: Regulatory Uncertainty and its Effect on Investment

Regulatory uncertainty is a major factor influencing XRP's price volatility. The lack of clear regulatory guidelines in the US and globally creates hesitation among investors.

- Investor Sentiment: Clarity on XRP's regulatory status would significantly boost investor confidence, leading to increased trading volume and potentially higher prices.

- Comparison to other Cryptocurrencies: Other cryptocurrencies have faced similar regulatory scrutiny, highlighting the challenges and potential risks associated with navigating the regulatory landscape. How XRP handles this compared to its competitors will affect its long-term outlook.

- Long-Term Implications: A clear regulatory framework, either through a court decision or legislative action, is crucial for the long-term stability and growth of XRP.

H2: Technological Advancements and Ripple's Ecosystem

Ripple's technology and its expanding ecosystem play a crucial role in determining XRP's long-term viability.

H3: On-Demand Liquidity (ODL) and its Adoption

ODL, Ripple's innovative payment solution, utilizes XRP to facilitate faster and cheaper cross-border transactions.

- ODL Use Cases: ODL is being adopted by financial institutions worldwide, reducing reliance on traditional correspondent banking and streamlining international payments.

- Adoption Rate: The increasing number of financial institutions adopting ODL demonstrates a growing demand for XRP's utility, which is a positive sign for future price appreciation.

- Future Potential: Continued expansion of ODL into new markets and further integration with existing financial systems could significantly boost XRP's value proposition.

H3: XRP Ledger (XRPL) Improvements and Developments

The XRPL, the underlying technology powering XRP, is continuously being upgraded and improved.

- XRPL Upgrades: Recent upgrades focus on improved transaction speed, scalability, and enhanced security features, enhancing its overall efficiency and competitiveness.

- Impact on Transaction Speed and Scalability: These improvements are crucial for addressing the limitations of older blockchain technology and fostering wider adoption.

- Future Enhancements: Planned future enhancements, such as improved programmability and the integration of new decentralized finance (DeFi) applications, could further strengthen the XRPL ecosystem.

H2: Market Sentiment and Speculative Trading

Market sentiment, fueled by social media hype and speculative trading, significantly influences XRP's price.

H3: Social Media Influence and FOMO

Social media platforms are major drivers of market sentiment. Positive news and hype can quickly lead to price increases, while negative sentiment can trigger sell-offs.

- Social Media Sentiment Analysis: Analyzing social media sentiment towards XRP reveals correlations between positive narratives and price increases, and vice versa.

- FOMO (Fear Of Missing Out): FOMO often contributes to rapid price increases as investors rush to buy before potentially missing out on gains. This, however, can lead to unsustainable price bubbles.

- Potential for Manipulation: Social media can be manipulated to artificially inflate or deflate prices through coordinated campaigns, highlighting the importance of critical analysis and avoiding emotional decision-making.

H3: Institutional Investment and Whale Activity

Large institutional investors and "whales" (individuals or entities holding significant amounts of XRP) wield considerable influence on XRP's price.

- Evidence of Institutional Investment: While anecdotal evidence exists, a clear picture of institutional holdings remains somewhat unclear. Increased transparency in this area would be beneficial for stabilizing the market.

- Analysis of Large Trades: Significant trading activity by whales can create price volatility, both upwards and downwards, impacting shorter-term price movements.

- Potential for Future Institutional Inflows: Increased regulatory clarity and a positive resolution to the SEC lawsuit could encourage greater institutional investment, providing a more stable foundation for long-term growth.

H2: Macroeconomic Factors and the Broader Crypto Market

Broader macroeconomic factors and trends within the overall cryptocurrency market influence XRP's performance.

H3: Overall Crypto Market Trends

XRP's price is often correlated with the price of Bitcoin and the overall health of the cryptocurrency market.

- Correlation with Bitcoin: Positive trends in the overall crypto market, often mirrored by Bitcoin's performance, generally lead to higher XRP prices.

- Influence of Overall Market Sentiment: Positive market sentiment tends to drive investment across the crypto market, benefitting XRP alongside other cryptocurrencies.

- Impact of Regulatory Changes: Broader regulatory changes in the crypto industry can impact XRP's price, reflecting the interconnectedness of the market.

H3: Alternative Investments and Competition

The presence of competing cryptocurrencies and other investment opportunities influences investor choices.

- Comparison with Other Altcoins: XRP competes with other altcoins offering similar use cases, creating a dynamic competitive landscape.

- Analysis of the Competitive Landscape: XRP's continued success relies on its ability to innovate, differentiate itself, and maintain a strong value proposition compared to its competitors.

- Potential for Market Share Shifts: Shifts in market sentiment or technological advancements could lead to changes in the relative market share of XRP and other cryptocurrencies.

3. Conclusion:

XRP's 400% price jump is remarkable, but its sustainability hinges on several interconnected factors. Technological advancements like ODL offer long-term growth potential, but the SEC lawsuit and regulatory uncertainty pose significant risks. Speculative trading and market sentiment further complicate the outlook. Before investing in XRP, carefully assess Ripple's legal situation, technological progress, and broader market trends. Thorough research and risk assessment are paramount. Do your own research and understand the risks involved before considering XRP as part of your investment portfolio.

Featured Posts

-

Will Iconic Band Play Only If Its Life Or Death

May 02, 2025

Will Iconic Band Play Only If Its Life Or Death

May 02, 2025 -

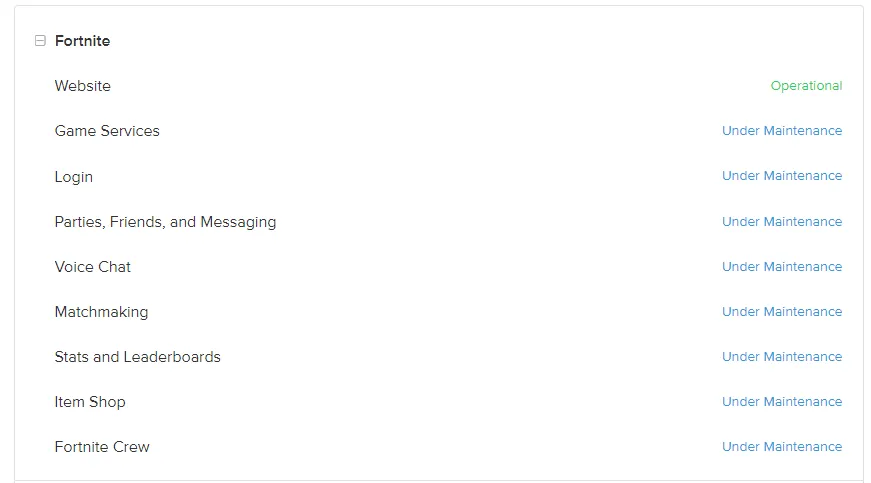

Is Fortnite Experiencing Server Issues Update 34 20 Downtime And Whats New

May 02, 2025

Is Fortnite Experiencing Server Issues Update 34 20 Downtime And Whats New

May 02, 2025 -

Fortnite Update V34 30 Sabrina Carpenter Collaboration Gameplay Changes And Downtime

May 02, 2025

Fortnite Update V34 30 Sabrina Carpenter Collaboration Gameplay Changes And Downtime

May 02, 2025 -

Daily Lotto Results Thursday 17th April 2025

May 02, 2025

Daily Lotto Results Thursday 17th April 2025

May 02, 2025 -

Tulsa Firefighters Respond To 800 Winter Weather Calls

May 02, 2025

Tulsa Firefighters Respond To 800 Winter Weather Calls

May 02, 2025

Latest Posts

-

Celebrity Traitors Uk Early Departures Confirmed

May 02, 2025

Celebrity Traitors Uk Early Departures Confirmed

May 02, 2025 -

Two Celebrity Traitors Uk Contestants Have Left The Show

May 02, 2025

Two Celebrity Traitors Uk Contestants Have Left The Show

May 02, 2025 -

Cooper Siblings Land New Bbc Show Following Celeb Traitors Exit

May 02, 2025

Cooper Siblings Land New Bbc Show Following Celeb Traitors Exit

May 02, 2025 -

Celebrity Traitors Uk Two Stars Quit The Game

May 02, 2025

Celebrity Traitors Uk Two Stars Quit The Game

May 02, 2025 -

Celebrity Traitors Major Setback For Bbc Show

May 02, 2025

Celebrity Traitors Major Setback For Bbc Show

May 02, 2025