Is XRP A Good Investment? Understanding Ripple's Potential

Table of Contents

XRP is the native cryptocurrency of Ripple, a company focused on providing solutions for global financial transactions. RippleNet, Ripple's payment network, utilizes XRP to facilitate faster and cheaper cross-border payments. While XRP and Ripple are closely linked, they are distinct entities. Ripple develops the technology and infrastructure, while XRP serves as a crucial component within that ecosystem. This article aims to analyze XRP's viability as an investment, considering both its technological advantages and inherent risks.

XRP's Technological Advantages and Use Cases

XRP boasts several technological advantages that contribute to its potential.

RippleNet and its Impact on Cross-Border Payments

RippleNet revolutionizes international transactions by offering faster and more cost-effective solutions compared to traditional banking systems. It leverages XRP's speed and efficiency to facilitate near-instant settlements, drastically reducing processing times and associated fees. This has led to significant adoption by financial institutions globally.

- Increased Efficiency: RippleNet streamlines the complex process of international money transfers, minimizing delays and paperwork.

- Reduced Costs: Lower transaction fees compared to SWIFT and other traditional methods make it an attractive option for businesses.

- Enhanced Transparency: The blockchain technology underlying RippleNet provides a transparent and auditable record of transactions.

Examples of Banks and Financial Institutions Using RippleNet: Many major banks have partnered with Ripple, including Santander, Bank of America, and several others. The exact list changes as partnerships evolve, so independent verification is advised.

XRP's Role in Facilitating Instant Settlements

XRP's speed is a key differentiator. Unlike Bitcoin or Ethereum, which can experience transaction delays, XRP offers near-instant settlement times. This is crucial for businesses requiring rapid cross-border payments and real-time transactions.

- Faster Payments: Businesses can receive and send payments almost instantly, improving cash flow and operational efficiency.

- Reduced Delays: Eliminating lengthy processing times associated with traditional systems accelerates international trade and commerce.

- Improved Liquidity: The speed of XRP transactions enhances liquidity in global markets.

Specific Use Cases: Imagine a business exporting goods; XRP could expedite payment, reducing delays and improving operational efficiency. Similarly, remittances could be sent near-instantly, benefiting both senders and recipients.

Scalability and Energy Efficiency of XRP

XRP's consensus mechanism, known as the Ripple Protocol Consensus Algorithm (RPCA), is designed for high scalability and low energy consumption. This contrasts sharply with proof-of-work cryptocurrencies like Bitcoin which require significant energy resources.

- High Transaction Throughput: XRP can handle a significantly larger volume of transactions compared to other cryptocurrencies.

- Low Energy Consumption: RPCA uses far less energy than proof-of-work systems, making it a more environmentally friendly option.

- Faster Transaction Speeds: Transactions are processed much quicker than those on Bitcoin or Ethereum networks.

Data Comparison: While precise data can fluctuate, XRP generally boasts significantly faster transaction times and drastically lower energy consumption compared to Bitcoin and Ethereum. Independent research is recommended to obtain the most up-to-date figures.

Regulatory Landscape and Legal Challenges Facing XRP

The regulatory landscape surrounding XRP is complex and significantly impacts its investment prospects.

The SEC Lawsuit Against Ripple and its Potential Impact on XRP's Price

The SEC's lawsuit against Ripple Labs alleging that XRP is an unregistered security has created significant uncertainty in the market. The outcome of this case will profoundly influence XRP's price and future trajectory.

- Key Arguments: The SEC argues XRP is a security, while Ripple contends it is a currency. The legal arguments are intricate and involve complex financial regulations.

- Potential Outcomes: A ruling in favor of the SEC could negatively impact XRP's price and adoption. A victory for Ripple could lead to increased investor confidence.

- Regulatory Uncertainty: The lawsuit's ongoing nature adds to the inherent volatility of XRP, making investment riskier.

Key Developments and Legal Arguments: Closely following news and legal updates related to the SEC lawsuit is crucial for informed decision-making.

Regulatory Uncertainty in Different Jurisdictions and its Effect on XRP Adoption

Regulatory frameworks for cryptocurrencies vary significantly worldwide. This inconsistency influences XRP's adoption rate in different markets.

- Varying Approaches: Some countries are more crypto-friendly than others, leading to different levels of regulatory scrutiny for XRP.

- Impact on Adoption: Stringent regulations can hinder XRP's integration into mainstream financial systems within certain regions.

- Geographical Differences: The regulatory landscape shapes the level of XRP adoption and use in diverse global markets.

Examples of Countries with Different Regulatory Stances: Research the regulatory stance of various countries towards cryptocurrencies, paying close attention to how this affects XRP specifically.

Market Analysis and Price Prediction for XRP

Predicting XRP's price is inherently speculative. Market sentiment, technological developments, and regulatory decisions all significantly influence its value.

- Current Market Trends: Analyze recent price fluctuations and trading volumes to understand current market sentiment.

- Influencing Factors: Consider the progress of RippleNet adoption, the outcome of the SEC lawsuit, and overall cryptocurrency market trends.

- Risk Disclaimer: Investing in cryptocurrencies like XRP involves significant risk, and price predictions are not guarantees.

Key Indicators and Projections: While long-term and short-term projections are available from numerous sources, treat all predictions with caution. Due diligence is essential before making any investment decisions.

Investing in XRP: Risks and Rewards

Investing in XRP presents both significant risks and potential rewards. A well-informed decision requires careful consideration of both aspects.

The Volatility of the Cryptocurrency Market and the Potential for Significant Losses

The cryptocurrency market is extremely volatile. XRP's price can experience dramatic fluctuations, leading to substantial potential losses.

- Market Fluctuations: Sudden price drops are common in the cryptocurrency market.

- Security Risks: Cryptocurrency exchanges can be targets for hacking and security breaches.

- Regulatory Changes: Changes in regulations can significantly impact the price of XRP.

Potential Risks Associated with Investing in XRP: Understand that the potential for loss is substantial and should never be underestimated.

Potential for High Returns and Long-Term Growth

Despite the risks, the potential for substantial returns on XRP investment exists if RippleNet achieves widespread adoption and XRP gains wider acceptance as a means of facilitating global payments.

- Wider Adoption: Increased use of XRP in cross-border payments could significantly drive up its price.

- Technological Advancements: Further development of Ripple's technology could enhance XRP's value.

- Positive Regulatory Outcomes: A favorable outcome in the SEC lawsuit could boost investor confidence.

Potential Scenarios for High Returns: While highly speculative, imagining scenarios of widespread adoption allows for a more thorough risk assessment.

Conclusion: Is XRP a Good Investment for You?

Whether XRP is a good investment depends entirely on your individual circumstances and risk tolerance. We've examined its technological advantages, significant regulatory challenges, and inherent market volatility. Thorough research and a deep understanding of the risks involved are paramount before making any investment decisions. Consider your personal financial goals, risk appetite, and overall investment strategy. Remember, this analysis does not constitute financial advice. Continue your research and decide if XRP aligns with your investment strategy.

Featured Posts

-

Verdeeldstation Oostwold Protesten Ondanks Definitieve Beslissing

May 02, 2025

Verdeeldstation Oostwold Protesten Ondanks Definitieve Beslissing

May 02, 2025 -

Addressing The Play Station Christmas Voucher Glitch Sony Provides Free Credit

May 02, 2025

Addressing The Play Station Christmas Voucher Glitch Sony Provides Free Credit

May 02, 2025 -

Stratigiki P Syxikis Ygeias 2025 2028 Kritikes Kai Analysi

May 02, 2025

Stratigiki P Syxikis Ygeias 2025 2028 Kritikes Kai Analysi

May 02, 2025 -

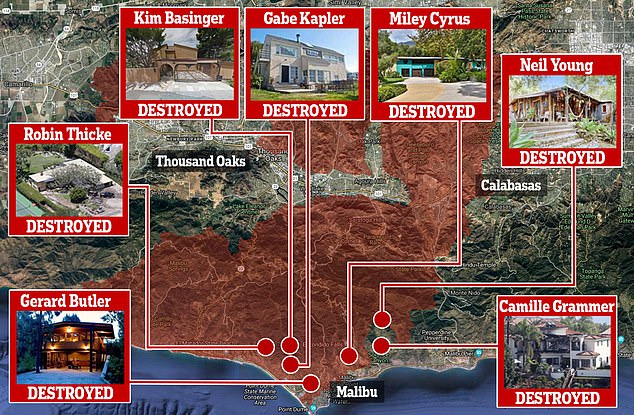

Homes Destroyed Celebrities Impacted By The Palisades Fire

May 02, 2025

Homes Destroyed Celebrities Impacted By The Palisades Fire

May 02, 2025 -

The Urgent Need For Mental Health Reform In Ghana Addressing The Psychiatrist Shortage

May 02, 2025

The Urgent Need For Mental Health Reform In Ghana Addressing The Psychiatrist Shortage

May 02, 2025

Latest Posts

-

Riot Fest Announces 2025 Lineup Featuring Green Day And Weezer

May 02, 2025

Riot Fest Announces 2025 Lineup Featuring Green Day And Weezer

May 02, 2025 -

Riot Fest 2025 Green Day Weezer And More Announced

May 02, 2025

Riot Fest 2025 Green Day Weezer And More Announced

May 02, 2025 -

Green Day And Weezer To Headline Riot Fest 2025

May 02, 2025

Green Day And Weezer To Headline Riot Fest 2025

May 02, 2025 -

Riot Fest 2025 Lineup Green Day Weezer Headline

May 02, 2025

Riot Fest 2025 Lineup Green Day Weezer Headline

May 02, 2025 -

The End Of A School Desegregation Order And The Potential For Further Changes

May 02, 2025

The End Of A School Desegregation Order And The Potential For Further Changes

May 02, 2025