Is This XRP's Big Moment? ETF Approvals, SEC Developments, And Market Impact

Table of Contents

H2: The Ripple-SEC Lawsuit: A Turning Point for XRP?

The Ripple-SEC lawsuit has cast a long shadow over XRP, creating significant regulatory uncertainty. Understanding its trajectory is crucial to assessing XRP's potential.

H3: The Case's History and Implications:

The SEC sued Ripple in December 2020, alleging that XRP was an unregistered security offering. This case has dragged on, significantly impacting XRP's price and hindering wider adoption. However, recent developments have injected a renewed sense of optimism.

- Key allegations against Ripple: The SEC argued that Ripple's sale of XRP constituted an unregistered securities offering, violating federal securities laws.

- Judge Torres's partial ruling and its significance: Judge Analisa Torres's partial ruling in July 2023 delivered a mixed verdict. While she ruled that institutional sales of XRP were unregistered securities, she deemed programmatic sales not to be. This partial victory for Ripple significantly altered the landscape.

- Potential ramifications of a settlement or a court decision in Ripple’s favor: A favorable ruling could lead to a surge in XRP's price, increased institutional investment, and broader acceptance by exchanges and payment processors. A settlement, while potentially less impactful, could still provide much-needed regulatory clarity.

H3: How the Ruling Could Shape the Crypto Regulatory Landscape:

The Ripple-SEC case has implications far beyond XRP. Its outcome will significantly influence how regulators approach other cryptocurrencies and could shape future regulatory frameworks.

- Impact on other crypto projects: The ruling sets a precedent that could affect other projects facing similar SEC scrutiny. Many projects are now closely watching the case's outcome.

- Potential for future regulatory frameworks: A clear ruling could provide much-needed regulatory clarity in the US, fostering a more stable and predictable environment for cryptocurrency innovation.

- Increased investor confidence following a favorable ruling: A positive outcome could boost investor confidence, leading to increased investment in XRP and the broader crypto market.

H2: The Impact of ETF Approvals on XRP's Price and Liquidity:

The recent approval of spot Bitcoin ETFs marks a significant milestone for cryptocurrency adoption. This could pave the way for increased institutional investment and liquidity, potentially impacting XRP as well.

H3: Understanding the Role of ETFs in Crypto Markets:

Spot Bitcoin ETF approvals represent a watershed moment. They introduce a regulated and accessible investment vehicle for institutional investors, drastically increasing market liquidity.

- Increased accessibility for retail investors: ETFs make crypto investing easier for everyday investors, broadening market participation.

- Higher trading volumes and liquidity: Increased institutional involvement will drive up trading volumes and improve market liquidity, reducing price volatility.

- Potential for price appreciation: Greater demand and accessibility could lead to price appreciation across the crypto market, including XRP.

H3: XRP's Potential Inclusion in Future ETFs:

While no XRP ETFs currently exist, the possibility is not far-fetched. The outcome of the Ripple-SEC lawsuit will be a critical factor in determining XRP's eligibility.

- Analysis of XRP's market capitalization and trading volume: XRP's significant market cap and trading volume make it a potential candidate for future ETF inclusion.

- Comparison with other cryptocurrencies already included in ETFs: Comparing XRP's attributes to those of cryptocurrencies already featured in ETFs provides insights into its potential inclusion.

- Discussion of the regulatory hurdles for XRP ETF listings: Regulatory clarity is paramount. A favorable resolution to the Ripple-SEC lawsuit will significantly enhance XRP's chances of being included in ETFs.

H2: Market Analysis: Predicting XRP's Future Performance:

Analyzing XRP's current market position and long-term prospects is crucial for investors.

H3: Current Market Sentiment and Price Action:

XRP's price remains volatile, influenced by the Ripple-SEC lawsuit, broader market trends, and investor sentiment.

- Analysis of technical indicators: Technical analysis of XRP's charts can provide insights into short-term price movements.

- Review of recent price trends: Tracking XRP's price action helps understand recent market dynamics.

- Overview of investor sentiment: Gauging investor sentiment through social media and other channels can reveal market expectations.

H3: Long-Term Growth Potential of XRP:

XRP's underlying technology and potential use cases contribute to its long-term growth potential.

- Potential for wider adoption in the payments industry: XRP's fast and low-cost transactions make it an attractive option for cross-border payments.

- Technological advancements and developments in the XRP Ledger: Ongoing improvements to the XRP Ledger enhance its efficiency and scalability.

- Potential partnerships and collaborations: Strategic partnerships could accelerate XRP's adoption and expand its utility.

3. Conclusion:

The future of XRP hinges on the resolution of the Ripple-SEC lawsuit and the evolving regulatory landscape. The potential approval of XRP-related ETFs could significantly boost its price and adoption. While uncertainty remains, the potential for significant growth is undeniable. Stay updated on the latest developments in the Ripple-SEC case and broader market trends to make informed decisions. Is this XRP's big moment? The stage is set, and the coming months will be critical in determining XRP's next chapter. Continue researching and monitoring the XRP market for the latest updates.

Featured Posts

-

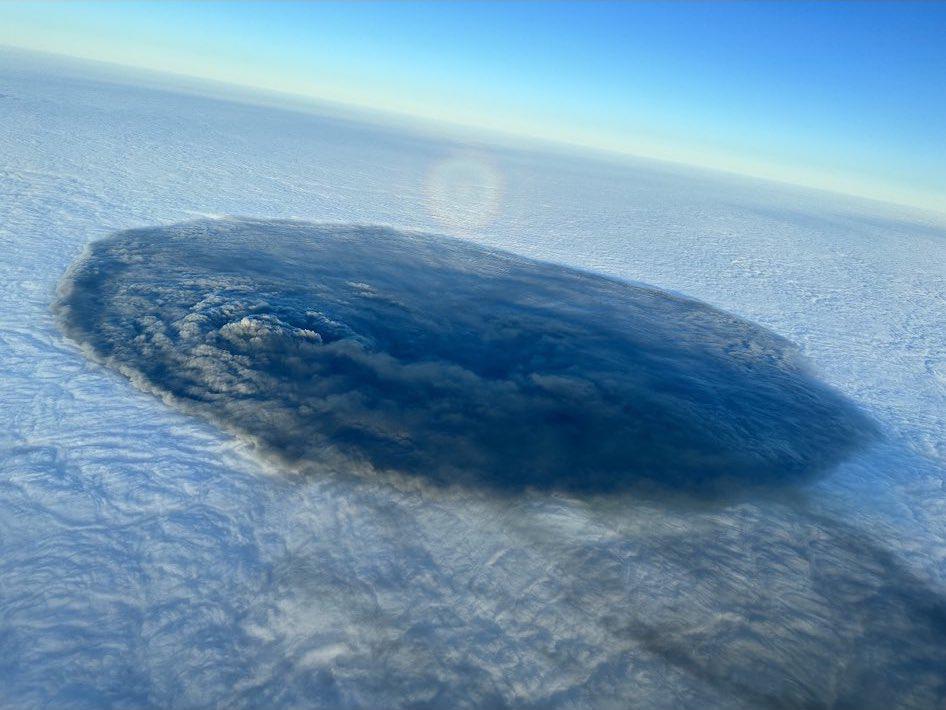

Analysis Impact Of Warmer Weather On Russias Offensive In Ukraine

May 01, 2025

Analysis Impact Of Warmer Weather On Russias Offensive In Ukraine

May 01, 2025 -

The Future Of Xrp Predictions And Market Trends

May 01, 2025

The Future Of Xrp Predictions And Market Trends

May 01, 2025 -

Escape To Italys Little Tahiti A Guide To The Perfect Beach Getaway

May 01, 2025

Escape To Italys Little Tahiti A Guide To The Perfect Beach Getaway

May 01, 2025 -

Ohio Train Derailment Toxic Chemical Lingering In Buildings

May 01, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings

May 01, 2025 -

Arc Raider Tech Test 2 Sign Ups Open Coming To Consoles This Month

May 01, 2025

Arc Raider Tech Test 2 Sign Ups Open Coming To Consoles This Month

May 01, 2025

Latest Posts

-

Canadas Next Prime Minister Top Economic Challenges

May 01, 2025

Canadas Next Prime Minister Top Economic Challenges

May 01, 2025 -

Resistance Mounts Car Dealerships Fight Back Against Ev Mandates

May 01, 2025

Resistance Mounts Car Dealerships Fight Back Against Ev Mandates

May 01, 2025 -

Open Ai Integrates Chat Gpt For Shopping A Direct Threat To Google

May 01, 2025

Open Ai Integrates Chat Gpt For Shopping A Direct Threat To Google

May 01, 2025 -

Chat Gpt Vs Google Shopping How Open Ais Ai Is Disrupting E Commerce

May 01, 2025

Chat Gpt Vs Google Shopping How Open Ais Ai Is Disrupting E Commerce

May 01, 2025 -

Open Ais Chat Gpt Takes On Google Shoppings New Challenger

May 01, 2025

Open Ais Chat Gpt Takes On Google Shoppings New Challenger

May 01, 2025