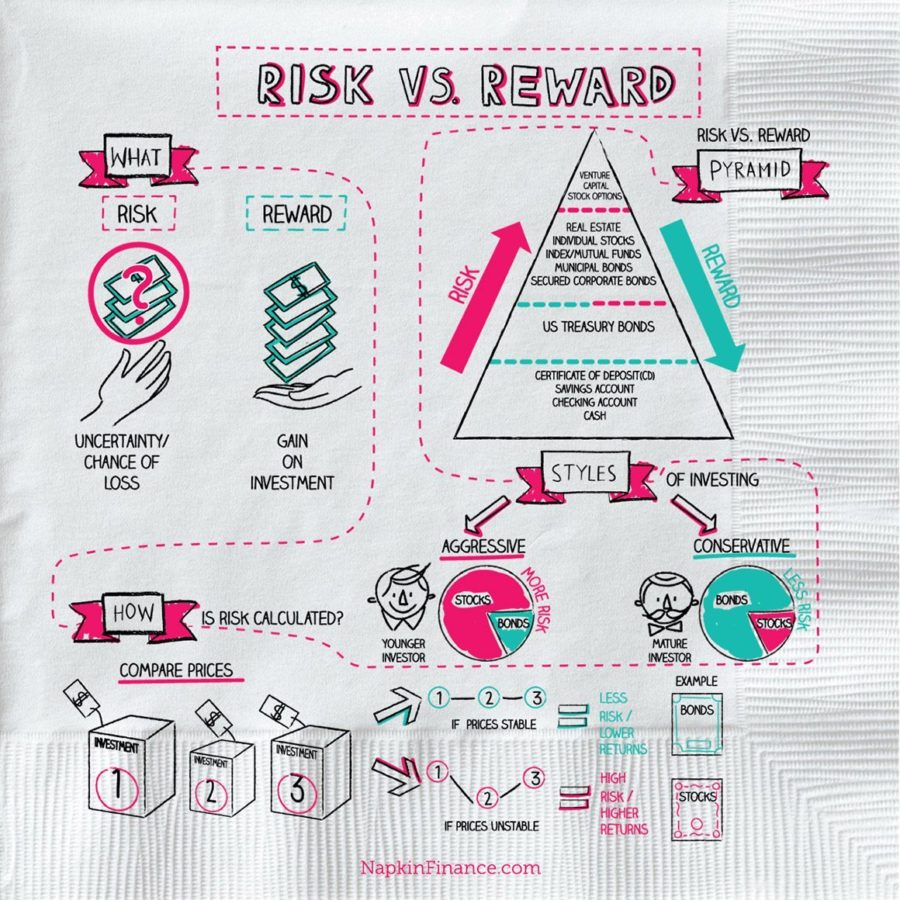

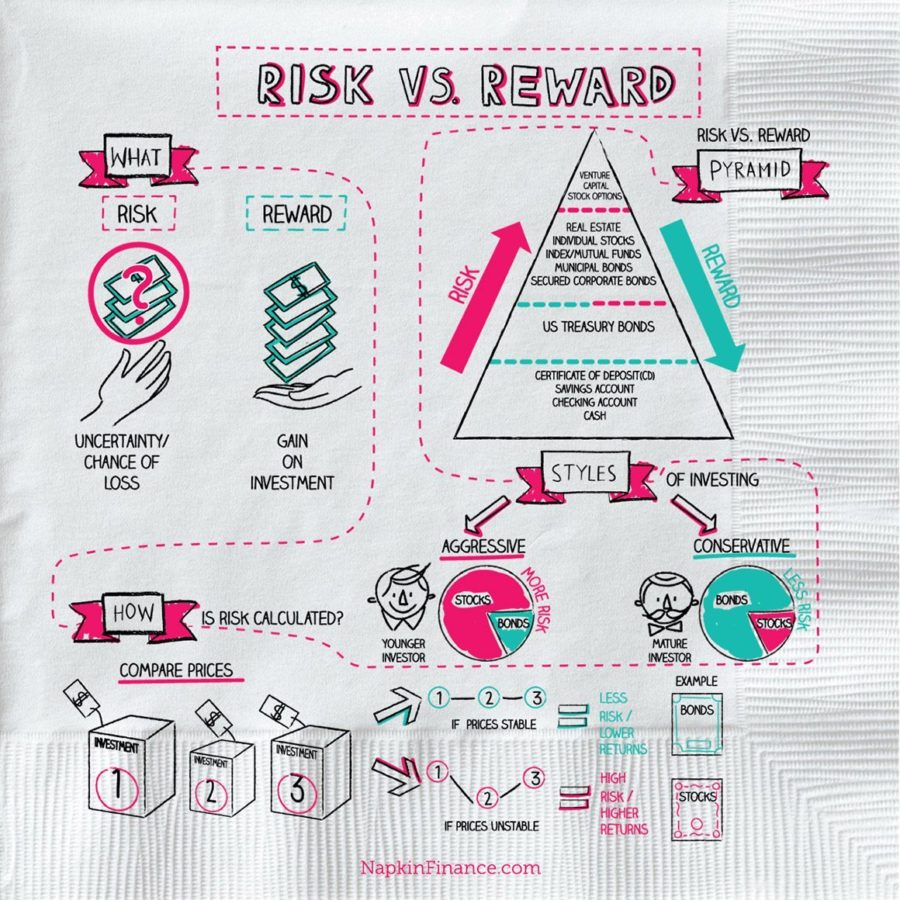

Is This Really A Safe Bet? Evaluating Risk And Reward

Table of Contents

Understanding Your Risk Tolerance

Before diving into any decision involving risk and reward, understanding your own risk tolerance is paramount. Risk tolerance refers to your comfort level with the possibility of losing money or facing other negative consequences in pursuit of a potential gain. It's crucial for effective risk assessment and making sound financial plans.

Different individuals fall into different risk tolerance categories:

- Risk-averse: These individuals prioritize capital preservation and are uncomfortable with the possibility of loss, even if it means missing out on potentially higher returns. They favor low-risk investments and stable career paths.

- Risk-neutral: These individuals are equally likely to accept or reject a risky proposition depending on the expected return compared to the risk. Their decision-making is largely based on objective analysis of risk and reward.

- Risk-seeking: These individuals are comfortable with substantial risk in pursuit of potentially high rewards. They might be more inclined toward aggressive investment strategies or entrepreneurial endeavors.

Your risk tolerance influences your choices across many areas:

- Investing: A risk-averse investor might choose low-yield savings accounts or government bonds, while a risk-seeking investor might invest heavily in stocks or cryptocurrency.

- Career: A risk-averse individual might prefer a stable, well-paying job with predictable growth, whereas a risk-seeking individual might launch their own business.

- Personal finance: A risk-averse person will prioritize saving and debt reduction, while a risk-seeking individual might be more comfortable with high-interest debt for faster wealth accumulation.

Assessing your personal risk tolerance involves self-reflection and potentially using questionnaires available online. Honest self-assessment is key to making informed decisions aligned with your comfort level.

Identifying Potential Rewards

Once you understand your risk tolerance, the next step is to carefully identify the potential rewards associated with your decision. Rewards come in various forms:

-

Financial rewards: These are the most tangible and often the easiest to quantify. Examples include return on investment (ROI), potential profit margins, and increased income. Calculating ROI involves comparing the net profit to the initial investment. For example, a $10,000 investment that yields a $2,000 profit has a 20% ROI.

-

Personal rewards: These are less easily quantifiable but equally important. They include increased job satisfaction, skill development, improved well-being, and personal growth. A career change might involve a temporary salary reduction but lead to significant long-term personal fulfillment.

-

Social rewards: These rewards stem from the impact your decision has on others or the community. Examples include strengthening relationships, contributing to a charitable cause, or enhancing your reputation.

It's crucial to try and quantify potential rewards as much as possible, even if it's a rough estimate. This allows for a more objective comparison with potential risks.

Analyzing Potential Risks

Every decision carries some degree of risk. It’s essential to identify and analyze all potential risks before making a choice. Risks can be categorized into:

-

Financial risks: These include the potential loss of money, decreased investment value, or unexpected expenses. Proper diversification of investments can help mitigate financial risk.

-

Reputational risks: These involve potential damage to your credibility, professional standing, or public image. Careful consideration of ethical implications can help minimize reputational risk.

-

Health risks: Certain decisions, particularly those involving physical activities or business ventures with high stress levels, may pose health risks. Addressing health concerns proactively can help manage these risks.

-

Opportunity cost: This refers to the potential benefits you forgo by choosing one option over another. This is an often overlooked but crucial aspect of risk assessment.

For each identified risk, assess its probability and potential impact. High-probability, high-impact risks require more attention and mitigation strategies. These strategies include:

- Diversification: Spreading your investments across various assets to reduce the impact of any single investment's poor performance.

- Insurance: Transferring some of the financial risk to an insurance company.

- Contingency planning: Developing alternative plans to handle potential setbacks or unexpected events.

Comparing Risk and Reward: A Framework for Decision-Making

A simple risk/reward matrix can help visualize and compare potential risks and rewards. This framework plots potential outcomes on a graph, with risks on one axis and rewards on the other. Decisions falling into the high-reward, low-risk quadrant are ideal. Those in the high-risk, low-reward quadrant should be avoided.

Remember to consider the time horizon. A higher risk might be acceptable for a long-term investment with a potentially greater reward, while a shorter time horizon might demand a more risk-averse approach.

Is This a Safe Bet? Making Informed Choices About Risk and Reward

Understanding your personal risk tolerance, accurately identifying potential rewards and risks, and utilizing a framework for comparing them are critical components of sound decision-making. Remember that a "safe bet" is subjective. What's safe for one person might be risky for another. By applying the principles discussed here—actively evaluating risk and reward in your future choices—you can make more informed decisions that align with your goals and comfort level. Further research into investment strategies or risk management techniques can help you refine your approach to risk and reward evaluation. So, the next time you face a decision, remember to ask: Is this really a safe bet? And then, carefully analyze the risk and reward before proceeding.

Featured Posts

-

Trumps Imminent Trade Deal Announcement With Britain Key Details And Implications

May 09, 2025

Trumps Imminent Trade Deal Announcement With Britain Key Details And Implications

May 09, 2025 -

Adae Markw Fyraty Me Alerby Thlyl Bed Antqalh Mn Alahly

May 09, 2025

Adae Markw Fyraty Me Alerby Thlyl Bed Antqalh Mn Alahly

May 09, 2025 -

Mans 3 K Babysitting Bill Leads To 3 6 K Daycare Cost A Costly Lesson

May 09, 2025

Mans 3 K Babysitting Bill Leads To 3 6 K Daycare Cost A Costly Lesson

May 09, 2025 -

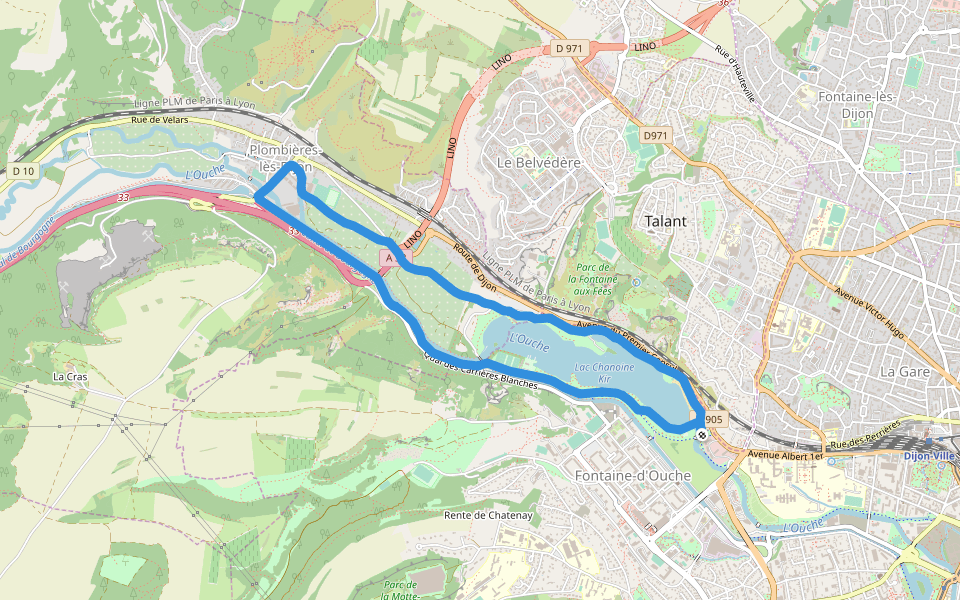

Dijon Enquete Apres Une Agression Au Lac Kir Bilan De Trois Blesses

May 09, 2025

Dijon Enquete Apres Une Agression Au Lac Kir Bilan De Trois Blesses

May 09, 2025 -

Understanding Jeanine Pirro Education Net Worth And Public Profile

May 09, 2025

Understanding Jeanine Pirro Education Net Worth And Public Profile

May 09, 2025