Is This Entertainment Stock A Buy-the-Dip Opportunity?

Table of Contents

Understanding the Current Market Conditions for Disney

Recent Stock Performance Analysis

Disney's stock price has experienced significant fluctuations recently. (Insert a chart here showing Disney's stock price performance over the past 6-12 months, clearly marking key support and resistance levels.) Several factors have contributed to this volatility. These include: fluctuating box office performance of its theatrical releases, the growth trajectory (or lack thereof) of its Disney+ streaming subscriber base, and broader macroeconomic conditions impacting consumer spending and investor sentiment.

- Recent News and Events: Disney's recent earnings reports, announcements regarding new streaming content, and any significant leadership changes have all played a role in shaping investor perception and influencing the stock price. Consider the impact of any recent controversies or legal battles on the company's image and market valuation.

- Financial Health: Analyzing Disney's revenue, earnings, and debt levels provides critical insight into its financial stability. A strong balance sheet and consistent profitability are vital indicators of a company's resilience during market downturns.

- Competitive Analysis: Comparing Disney's performance to its major competitors, such as Netflix, Warner Bros. Discovery, and Paramount Global, is essential. Assessing its market share and competitive advantages in various entertainment segments (streaming, theme parks, theatrical releases) helps evaluate its long-term prospects.

Evaluating the Fundamentals of Disney

Business Model and Competitive Advantage

Disney's business model relies on a diverse portfolio of entertainment assets. This includes its iconic intellectual property (IP), theme parks, studios, and streaming services. The company’s strength lies in its vast library of beloved characters and franchises, giving it a considerable competitive advantage. However, increasing competition in the streaming landscape and the high cost of content creation pose challenges.

- Intellectual Property (IP): The value of Disney's IP, encompassing franchises like Marvel, Star Wars, and Pixar, is immense and provides a long-term foundation for revenue generation.

- Diversification Strategy: Disney's diversification across different entertainment segments helps mitigate risks. A downturn in one area might be offset by stronger performance in others.

- Management Team: The competence and experience of Disney's leadership team are crucial for navigating the complex entertainment industry. Analyzing their track record and strategic vision offers insight into the company's future trajectory.

Assessing the Risk Factors Involved in a Buy-the-Dip Strategy

Potential Downsides and Risks

Investing in any stock, especially during a dip, involves inherent risks. While a buy-the-dip strategy can be lucrative, it's not without potential downsides.

- Further Price Declines: There's always a risk that the stock price could decline further before recovering. Thorough due diligence and a well-defined risk tolerance are essential.

- External Factors: Economic recessions, changing consumer preferences (e.g., a shift away from traditional media), and geopolitical events can all impact Disney's performance and stock price negatively.

- Portfolio Diversification: It is crucial to remember that diversification is key to mitigating risk. Don't put all your eggs in one basket. A well-diversified portfolio helps cushion the impact of potential losses in any single investment.

Comparing the Current Valuation to Historical Data

Price-to-Earnings Ratio (P/E) and Other Key Metrics

Analyzing Disney's valuation metrics, such as its Price-to-Earnings (P/E) ratio, provides insight into whether the current stock price is justified relative to its earnings. (Insert charts and graphs comparing Disney's current P/E ratio to its historical average and industry competitors.)

- Valuation Metrics: Understanding the significance of various valuation metrics (P/E ratio, Price-to-Sales ratio, etc.) is crucial for determining whether a stock is undervalued or overvalued.

- Historical Comparison: Comparing the current valuation to historical data helps identify potential bargains or overbought situations.

- Bargain Potential: A low P/E ratio compared to historical data and industry averages might suggest that the stock is currently undervalued, presenting a potential buy-the-dip opportunity.

Conclusion: Is Disney a Buy-the-Dip Opportunity? A Final Verdict

Based on our analysis, Disney presents a moderate buy-the-dip opportunity. Its strong IP, diversified business model, and potential for future growth are attractive. However, the current market volatility, competition in the streaming sector, and the risks associated with any investment need to be carefully considered. The current valuation, compared to historical data, suggests a potential undervaluation, but further price declines remain a possibility.

Consider if this entertainment stock aligns with your risk tolerance and investment goals before considering a buy-the-dip strategy. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions. Learn more about Disney and other buy-the-dip opportunities by exploring reputable financial news sources and investment platforms. (Include links to relevant resources here.)

Featured Posts

-

Prepare For Sinners A Louisiana Horror Movies Theatrical Debut

May 29, 2025

Prepare For Sinners A Louisiana Horror Movies Theatrical Debut

May 29, 2025 -

Hogyan Lehet Megallapitani Egy 100 Forintos Bankjegy Erteket

May 29, 2025

Hogyan Lehet Megallapitani Egy 100 Forintos Bankjegy Erteket

May 29, 2025 -

Joshlin Smith Trial Prosecution Nears Conclusion

May 29, 2025

Joshlin Smith Trial Prosecution Nears Conclusion

May 29, 2025 -

Queensland Music Awards Night Marred By Antisemitism Claims

May 29, 2025

Queensland Music Awards Night Marred By Antisemitism Claims

May 29, 2025 -

Annuals Vs Perennials Which Flowers Are Right For Your Garden

May 29, 2025

Annuals Vs Perennials Which Flowers Are Right For Your Garden

May 29, 2025

Latest Posts

-

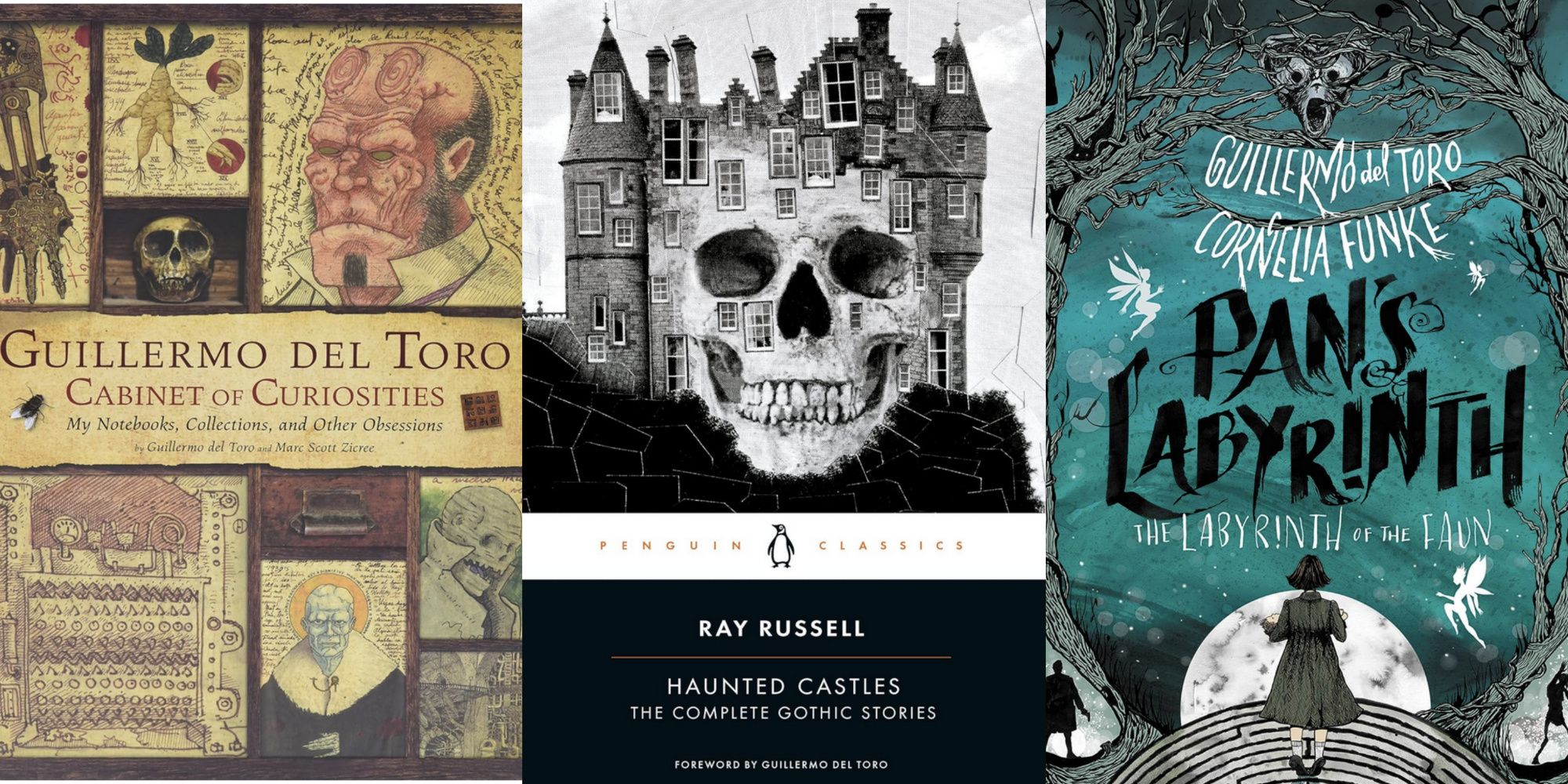

Director Guillermo Del Toro Highlights Exceptional Worldbuilding In Popular Shooter

May 30, 2025

Director Guillermo Del Toro Highlights Exceptional Worldbuilding In Popular Shooter

May 30, 2025 -

Guillermo Del Toro On Best Video Game Worldbuilding A Shooter Stands Out

May 30, 2025

Guillermo Del Toro On Best Video Game Worldbuilding A Shooter Stands Out

May 30, 2025 -

Del Toro Names Top Video Game World A Fully Realized Vision

May 30, 2025

Del Toro Names Top Video Game World A Fully Realized Vision

May 30, 2025 -

Documentary Spotlight Sangre Del Toro By Guillermo Del Toro Launches At Cannes

May 30, 2025

Documentary Spotlight Sangre Del Toro By Guillermo Del Toro Launches At Cannes

May 30, 2025 -

Global Investors Courted By Deutsche Bank In Saudi Arabias Growing Market

May 30, 2025

Global Investors Courted By Deutsche Bank In Saudi Arabias Growing Market

May 30, 2025