Is This Bitcoin Rebound A Sign Of Market Recovery?

Table of Contents

Analyzing the Current Bitcoin Rebound

Examining the Magnitude and Duration of the Rebound

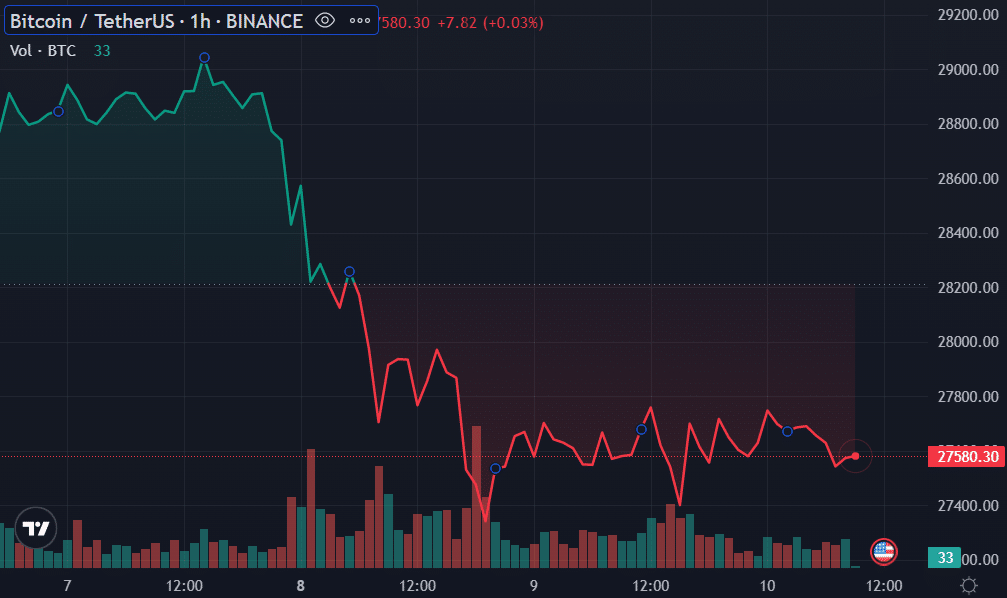

The recent Bitcoin price increase represents a substantial jump, exceeding 15% within a relatively short period. While impressive, we must consider the timeframe to gauge its significance. Is this a sustained rally, or a short-term pump? Comparing this rebound to previous Bitcoin price fluctuations is crucial. Historically, Bitcoin has seen sharp rises and falls, so context is key. A simple comparison is insufficient; we need to analyze the underlying volume and market capitalization alongside the price changes.

- Percentage Increase: The exact percentage will fluctuate, but let's assume a 15% increase over [Timeframe - e.g., 7 days].

- Timeframe: Was this increase sustained over several weeks, or was it a rapid, short-lived surge?

- Comparison to Previous Fluctuations: Analyzing historical data reveals that similar spikes were often followed by corrections. The image below illustrates Bitcoin's price movement over the last year. [Insert chart/graph here with alt text: "Bitcoin Price Chart Showing Recent Rebound and Historical Fluctuations"].

Identifying Potential Catalysts for the Rebound

Several factors could have contributed to this Bitcoin rebound. Understanding these catalysts is vital for predicting the future trajectory of the Bitcoin price.

- Regulatory Developments: Positive regulatory news, particularly from major economies, can significantly influence Bitcoin's price. [Example: Cite specific positive regulatory developments if any].

- Institutional Investment: Increased investment from large financial institutions adds to the stability and legitimacy of Bitcoin. [Example: Mention specific reports of institutional investment].

- Technological Advancements: New developments in Bitcoin's underlying technology, such as improvements in scaling solutions, can boost investor confidence. [Example: Mention specific technological advancements, like the Lightning Network improvements].

- Macroeconomic Factors: Global economic factors, such as inflation rates and interest rate changes, can significantly impact Bitcoin's price as investors seek alternative assets. [Example: Mention the impact of current inflation or interest rate environments].

- Social Media Sentiment: Positive sentiment and news coverage on social media platforms can create a buying frenzy, leading to price increases. [Example: Refer to any significant social media trends impacting Bitcoin price].

Factors Suggesting a Potential Market Recovery

Increased Institutional Interest

A growing number of large financial institutions are accumulating Bitcoin, suggesting a shift towards broader adoption and long-term investment. This institutional interest indicates a potential increase in market stability, counteracting the inherent volatility of cryptocurrencies.

- Investment Reports: [Cite specific reports detailing institutional investments in Bitcoin].

- Implications for Price Stability: Large-scale investment can act as a buffer against sudden price drops.

- Data on Institutional Holdings: [Include data and statistics on institutional Bitcoin holdings].

Growing Adoption and Use Cases

Beyond investment, the expanding use cases of Bitcoin are contributing to its market recovery. Increased adoption by businesses and individuals solidifies its position as a viable alternative to traditional financial systems.

- Payment Systems: The use of Bitcoin as a payment method is expanding in some sectors. [Provide examples].

- Decentralized Finance (DeFi): Bitcoin's integration into DeFi applications broadens its utility.

- Statistics on Adoption and Transactions: [Include relevant statistics, if available, about Bitcoin transactions and adoption rates].

Improving Market Sentiment

A positive shift in market sentiment towards Bitcoin and cryptocurrencies in general is fueling the current rebound. This improved perception is reflected in social media trends, news coverage, and investor surveys.

- Social Media Trends: [Discuss trends and sentiment analysis results from social media platforms].

- News Coverage: Positive media coverage can influence public perception and encourage investment.

- Investor Sentiment Surveys: [Cite relevant surveys that reflect improving market sentiment].

Factors Suggesting a Temporary Rebound

Volatility and Price Fluctuations

Despite the current upswing, it's crucial to acknowledge Bitcoin's inherent volatility. Past price rallies have been followed by significant corrections, so caution is warranted.

- Historical Data: [Include charts showing past examples of short-lived Bitcoin price rallies].

- Potential for Correction: The possibility of a short-term price surge followed by a market correction should be considered.

Unresolved Regulatory Uncertainty

Regulatory uncertainty remains a significant challenge, and future regulations could have a profound impact on Bitcoin's price. Uncertainty can create volatility and deter investment.

- Regulatory Challenges: [Discuss specific regulatory challenges and uncertainties facing Bitcoin in various jurisdictions].

- Potential Impact of Future Regulations: Analyze the potential for both positive and negative impacts of upcoming regulations.

Macroeconomic Headwinds

Global macroeconomic conditions, such as inflation and the potential for recession, could negatively impact Bitcoin's price. These factors can influence investor behavior and capital flows.

- Inflation and Recession: [Discuss the impact of inflation and potential recession on Bitcoin price].

- Economic Forecasts: [Cite economic forecasts and their implications for Bitcoin's price].

Conclusion: Is This Bitcoin Rebound a Sign of Market Recovery? A Final Verdict

Analyzing the current Bitcoin rebound requires considering both positive and negative factors. While increased institutional interest, growing adoption, and improving market sentiment suggest a potential for long-term recovery, the inherent volatility of Bitcoin, regulatory uncertainty, and macroeconomic headwinds highlight the risk of a temporary surge followed by a correction. Whether this rebound signals a sustained market recovery or a brief respite remains uncertain. The situation requires continuous monitoring.

Stay informed about the ongoing Bitcoin rebound and its implications for market recovery by subscribing to our newsletter for the latest analysis and price predictions.

Featured Posts

-

Confrontacion Entre Flamengo Y Botafogo Una Batalla Campal En El Estadio

May 08, 2025

Confrontacion Entre Flamengo Y Botafogo Una Batalla Campal En El Estadio

May 08, 2025 -

Lahore Schools Adjust Timings For Psl Matches

May 08, 2025

Lahore Schools Adjust Timings For Psl Matches

May 08, 2025 -

Extradition Bid Malaysia Targets Disgraced Ex Goldman Partner In 1 Mdb Case

May 08, 2025

Extradition Bid Malaysia Targets Disgraced Ex Goldman Partner In 1 Mdb Case

May 08, 2025 -

X Men Rogues Unexpected Power Mimicry

May 08, 2025

X Men Rogues Unexpected Power Mimicry

May 08, 2025 -

Thunder Bulls Offseason Trade Separating Fact From Fiction

May 08, 2025

Thunder Bulls Offseason Trade Separating Fact From Fiction

May 08, 2025