Is Soaring Federal Debt About To Crash The Housing Market?

Table of Contents

The Link Between Federal Debt and Interest Rates

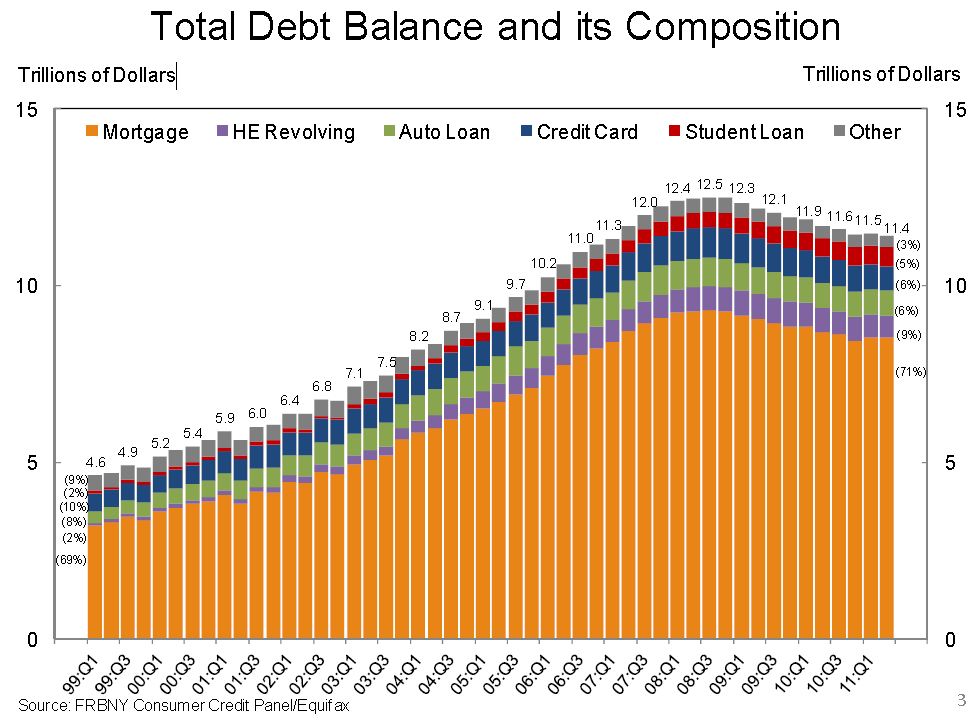

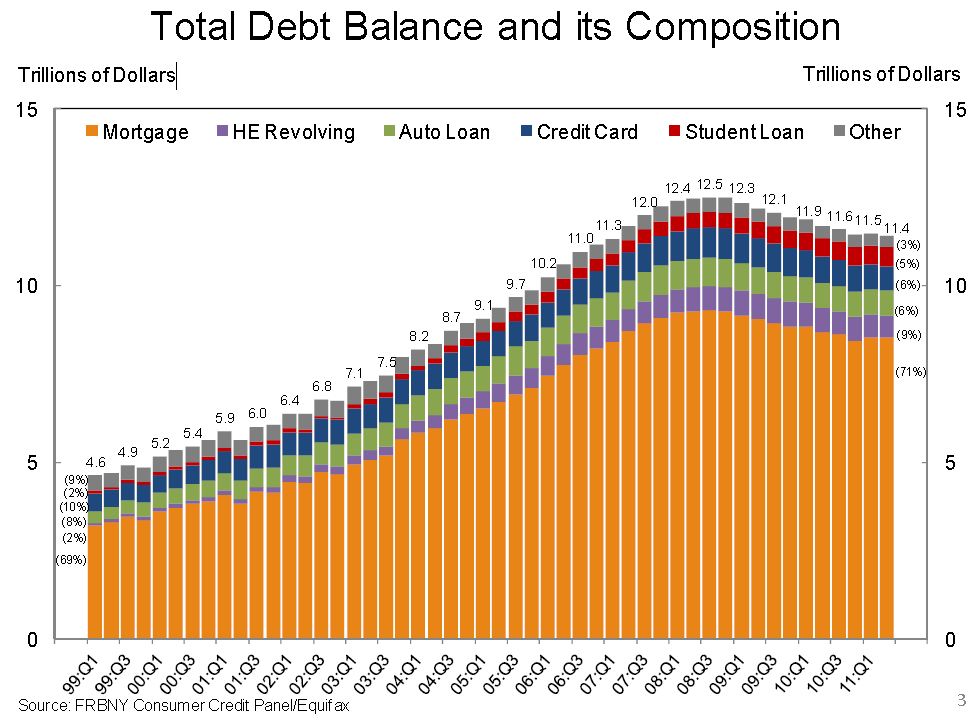

Increased federal borrowing directly impacts interest rates. The government competes with businesses and individuals for loanable funds. When the government borrows heavily, it increases the demand for loans, driving up interest rates across the board.

- Increased demand for loans drives up rates: More borrowing means higher competition for available capital, forcing lenders to increase interest rates to maintain profitability.

- Federal Reserve actions to combat inflation: The Federal Reserve (the Fed) often raises interest rates to combat inflation. High inflation, often fueled by excessive government spending, necessitates tighter monetary policy, which further increases borrowing costs.

- Impact of higher interest rates on mortgage rates: Higher interest rates directly translate into higher mortgage rates. This makes borrowing money to buy a house more expensive, impacting affordability. Recent increases in mortgage rates have already started to cool the once-hot housing market. For example, the average 30-year fixed mortgage rate rose from around 3% in 2020 to over 7% in 2022, significantly reducing purchasing power for many prospective homebuyers.

This decreased affordability significantly impacts the housing market, potentially leading to a slowdown or even a crash if rates remain high for an extended period.

Inflation's Role in a Potential Housing Market Crash

Inflation erodes purchasing power, affecting housing prices in several ways.

- How high inflation erodes purchasing power: When prices rise faster than wages, consumers have less disposable income to spend on housing, reducing demand.

- Impact on construction costs and material prices: Inflation increases the cost of building materials and labor, making new homes more expensive and potentially slowing down construction.

- The effect of inflation on consumer confidence and spending: High inflation can lead to uncertainty and reduced consumer confidence, impacting overall spending, including spending on housing.

High inflation, potentially exacerbated by government spending needed to service the growing national debt, could create a perfect storm. Reduced consumer spending coupled with higher construction costs could depress housing demand and prices, leading to a market downturn.

Government Intervention and Market Stability

The government has several tools to potentially mitigate a housing market crash.

- Government-backed mortgage programs: Programs like Fannie Mae and Freddie Mac help ensure the availability of mortgages, potentially stabilizing the market during times of economic uncertainty.

- Regulatory measures to stabilize the market: The government can implement regulations to prevent excessive speculation and risky lending practices that could destabilize the market.

- Potential fiscal policies to address debt and inflation: Fiscal policies aimed at reducing the deficit and controlling inflation, such as tax increases or spending cuts, could help stabilize the economy and the housing market.

However, the effectiveness of past government interventions varies depending on the severity of the economic crisis and the specific policies implemented. Careful analysis of past interventions is critical to understanding the potential impact of future actions.

Alternative Economic Scenarios and Their Impact on Housing

Several economic scenarios could unfold, each with different implications for the housing market:

- Scenario 1: A controlled decline in housing prices with manageable debt: This scenario involves a gradual cooling of the market, with prices adjusting to a more sustainable level, and manageable levels of debt.

- Scenario 2: A sharp downturn due to uncontrolled inflation and rising interest rates: This pessimistic scenario involves a significant drop in housing prices, potentially leading to a market crash due to uncontrolled inflation and sharply rising interest rates.

- Scenario 3: A soft landing with moderated interest rate hikes and stable inflation: This optimistic scenario involves a slow and controlled adjustment of the housing market, with moderate interest rate hikes and stable inflation preventing a sharp decline.

Predicting the most likely scenario is difficult, requiring careful monitoring of economic indicators and government policies.

Conclusion: Understanding the Soaring Federal Debt and Housing Market Risk

This article explored the complex relationship between soaring federal debt, interest rates, inflation, and their potential impact on the housing market. We restated the key question: Is soaring federal debt about to crash the housing market? The answer, unfortunately, remains uncertain. The potential risks are significant, ranging from a controlled decline in housing prices to a sharp downturn. The likelihood of each scenario depends heavily on government policy responses and the evolution of inflation and interest rates.

Key Takeaways: The connection between federal debt, interest rates, and inflation presents significant risks to the housing market. The potential outcomes range from a soft landing to a sharp market downturn. The level of uncertainty is high.

Call to Action: Stay informed! Monitor economic indicators like interest rates, inflation, and government debt levels. Conduct further research using keywords such as "federal debt," "housing market crash," "interest rates," and "inflation" to better understand the potential risks associated with soaring federal debt and the housing market. Your financial well-being depends on it.

Featured Posts

-

Ahtfalat Alqyamt Fy Dyr Sydt Allwyzt Bth Mbashr Mn Alwkalt Alwtnyt Llielam

May 19, 2025

Ahtfalat Alqyamt Fy Dyr Sydt Allwyzt Bth Mbashr Mn Alwkalt Alwtnyt Llielam

May 19, 2025 -

Gazze Ye Yardim Malzemesi Tasiyan Tirlarin Sinira Girisi Devam Ediyor

May 19, 2025

Gazze Ye Yardim Malzemesi Tasiyan Tirlarin Sinira Girisi Devam Ediyor

May 19, 2025 -

Kibris Ta Sehitlerimiz Ve Fatih Erbakandan Oenemli Aciklama

May 19, 2025

Kibris Ta Sehitlerimiz Ve Fatih Erbakandan Oenemli Aciklama

May 19, 2025 -

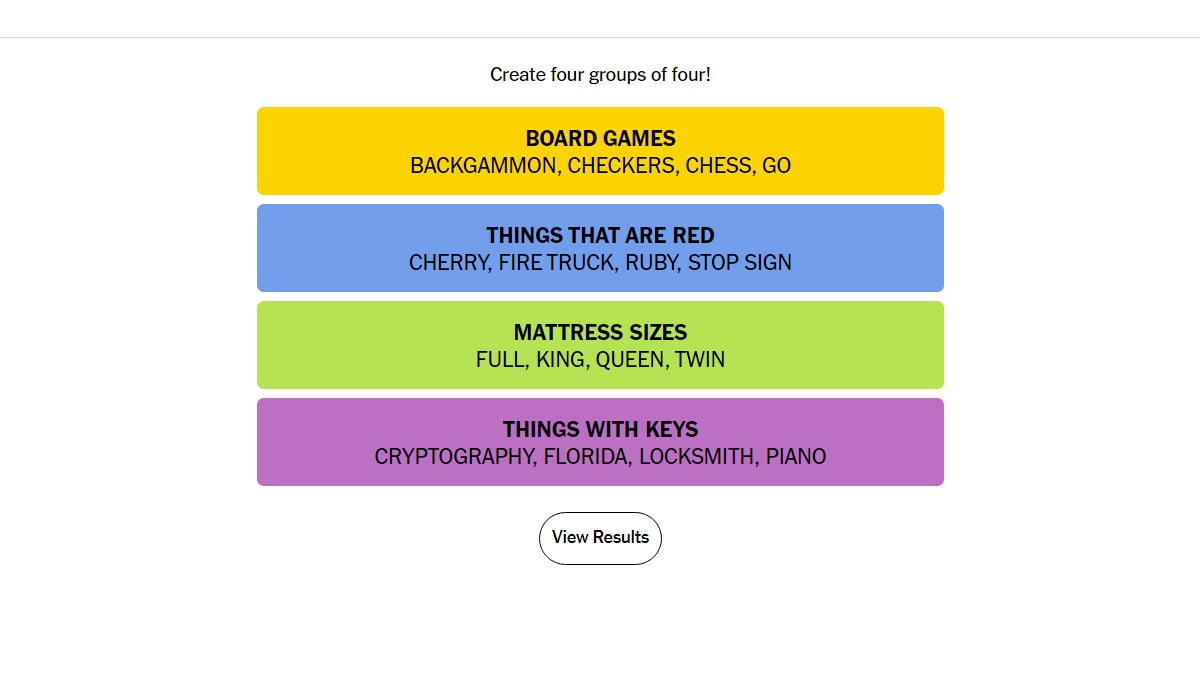

Nyt Connections April 17 676 Hints And Answers Explained

May 19, 2025

Nyt Connections April 17 676 Hints And Answers Explained

May 19, 2025 -

China Trade Deal U S Allies Still Facing Tariff Delays

May 19, 2025

China Trade Deal U S Allies Still Facing Tariff Delays

May 19, 2025