Is Riot Platforms Stock (RIOT) A Buy At Its 52-Week Low?

Table of Contents

Riot Platforms' Current Financial Situation and Performance

Understanding Riot Platforms' current financial standing is crucial for assessing its investment potential. Analyzing its recent performance provides valuable insights into its operational efficiency and future prospects.

Revenue and Profitability Analysis

Riot Platforms' revenue is heavily tied to the price of Bitcoin and its mining capacity. Recent quarterly and annual reports reveal fluctuations in profitability directly correlated with Bitcoin's price movements. When Bitcoin's price rises, RIOT's revenue and profitability increase, and vice-versa. Careful evaluation of operational efficiency and cost management is therefore essential.

- Mining hashrate growth: Tracking the growth of Riot's mining hashrate indicates its capacity to generate Bitcoin and, consequently, its potential revenue. Higher hashrates generally translate to increased Bitcoin production.

- Energy costs: Energy costs represent a significant expense for Bitcoin mining companies. Riot's ability to manage these costs effectively directly impacts its profitability.

- Production costs per Bitcoin: Analyzing the cost of mining each Bitcoin reveals the company's efficiency and competitiveness within the industry. Lower production costs translate to higher profit margins.

- Debt levels: High debt levels can pose a significant risk to a company's financial stability. Assessing Riot's debt burden is crucial for evaluating its long-term sustainability.

Recent Developments and News

Staying abreast of recent news and announcements concerning Riot Platforms is vital for informed investment decisions. Positive developments, such as the opening of new mining facilities or strategic partnerships, can significantly boost the stock price. Conversely, negative news, like regulatory changes or operational setbacks, can negatively impact its valuation.

- New mining facility openings: Expansion into new mining facilities increases Riot's Bitcoin mining capacity, potentially leading to higher revenue.

- Technology upgrades: Investments in advanced mining technology can enhance efficiency and lower production costs, improving profitability.

- Any legal battles or regulatory hurdles: Legal challenges or regulatory changes in the cryptocurrency sector can significantly impact Riot's operations and stock price.

Bitcoin's Price and Its Impact on RIOT Stock

The price of Bitcoin is undeniably the most significant factor influencing Riot Platforms' stock performance. Their fortunes are intrinsically linked.

Correlation between Bitcoin Price and RIOT Stock Price

A strong positive correlation exists between Bitcoin's price and RIOT's stock price. Historically, when Bitcoin's price rises, RIOT's stock price tends to follow suit, and vice-versa. Analyzing historical price charts clearly demonstrates this relationship. This correlation highlights the inherent volatility of investing in Bitcoin mining stocks.

Bitcoin Market Predictions and Their Influence

Market predictions regarding Bitcoin's future price significantly influence the perceived risk and reward associated with investing in RIOT. Bullish predictions often lead to increased investor interest, driving up the stock price. Conversely, bearish predictions can result in decreased investor confidence and a drop in the stock price.

- Bullish vs. bearish predictions for Bitcoin: Understanding the varying perspectives on Bitcoin's future price is crucial for assessing potential returns.

- Potential catalysts for Bitcoin price increases or decreases: Factors such as regulatory changes, institutional adoption, and technological advancements can significantly influence Bitcoin's price and, consequently, RIOT's stock performance.

Competitive Landscape and Future Outlook for Riot Platforms

Analyzing Riot Platforms' position within the competitive landscape of the Bitcoin mining industry is crucial for evaluating its long-term prospects.

Analysis of Competitors in the Bitcoin Mining Industry

Riot Platforms competes with other major players in the Bitcoin mining sector. Comparing Riot's strengths and weaknesses against its competitors helps determine its competitive advantage or disadvantage. Factors such as mining hashrate, energy costs, and operational efficiency play significant roles in determining market share and profitability.

Long-Term Growth Potential and Investment Risks

The long-term growth potential of the Bitcoin mining industry, and Riot Platforms' place within it, depends on several factors, including the continued adoption of Bitcoin, technological advancements in mining, and regulatory clarity. However, significant risks are associated with investing in RIOT stock.

- Regulatory risks: Changes in cryptocurrency regulations could significantly impact the profitability and operations of Bitcoin mining companies.

- Technological disruption: Advancements in mining technology could render existing equipment obsolete, impacting Riot's profitability.

- Volatility of Bitcoin price: The inherent volatility of Bitcoin's price poses a significant risk to RIOT's stock price.

- Competition: Intense competition within the Bitcoin mining industry could put pressure on profit margins.

Conclusion

Determining whether Riot Platforms (RIOT) stock is a buy at its 52-week low requires a careful consideration of its financial health, the correlation between its performance and Bitcoin's price, the competitive landscape, and the inherent risks involved. While the current low price might seem attractive, the volatility of the cryptocurrency market and the industry's specific challenges cannot be overlooked. This analysis provides a framework for your own due diligence. Conduct thorough research before making any investment decisions concerning RIOT stock or any other Bitcoin mining stock. Weigh the potential gains against the considerable risks before deciding if RIOT is a buy at its 52-week low.

Featured Posts

-

Lotto 6aus49 Mittwoch 9 4 2025 Die Aktuellen Gewinnzahlen

May 03, 2025

Lotto 6aus49 Mittwoch 9 4 2025 Die Aktuellen Gewinnzahlen

May 03, 2025 -

Gaza Preoccupations De Macron Concernant La Militarisation De L Aide Humanitaire Par Israel

May 03, 2025

Gaza Preoccupations De Macron Concernant La Militarisation De L Aide Humanitaire Par Israel

May 03, 2025 -

The Photoshop Debate Christina Aguileras Latest Photos Under Scrutiny

May 03, 2025

The Photoshop Debate Christina Aguileras Latest Photos Under Scrutiny

May 03, 2025 -

George Floyd Protest Fbi Responds To Agents Kneeling Photo

May 03, 2025

George Floyd Protest Fbi Responds To Agents Kneeling Photo

May 03, 2025 -

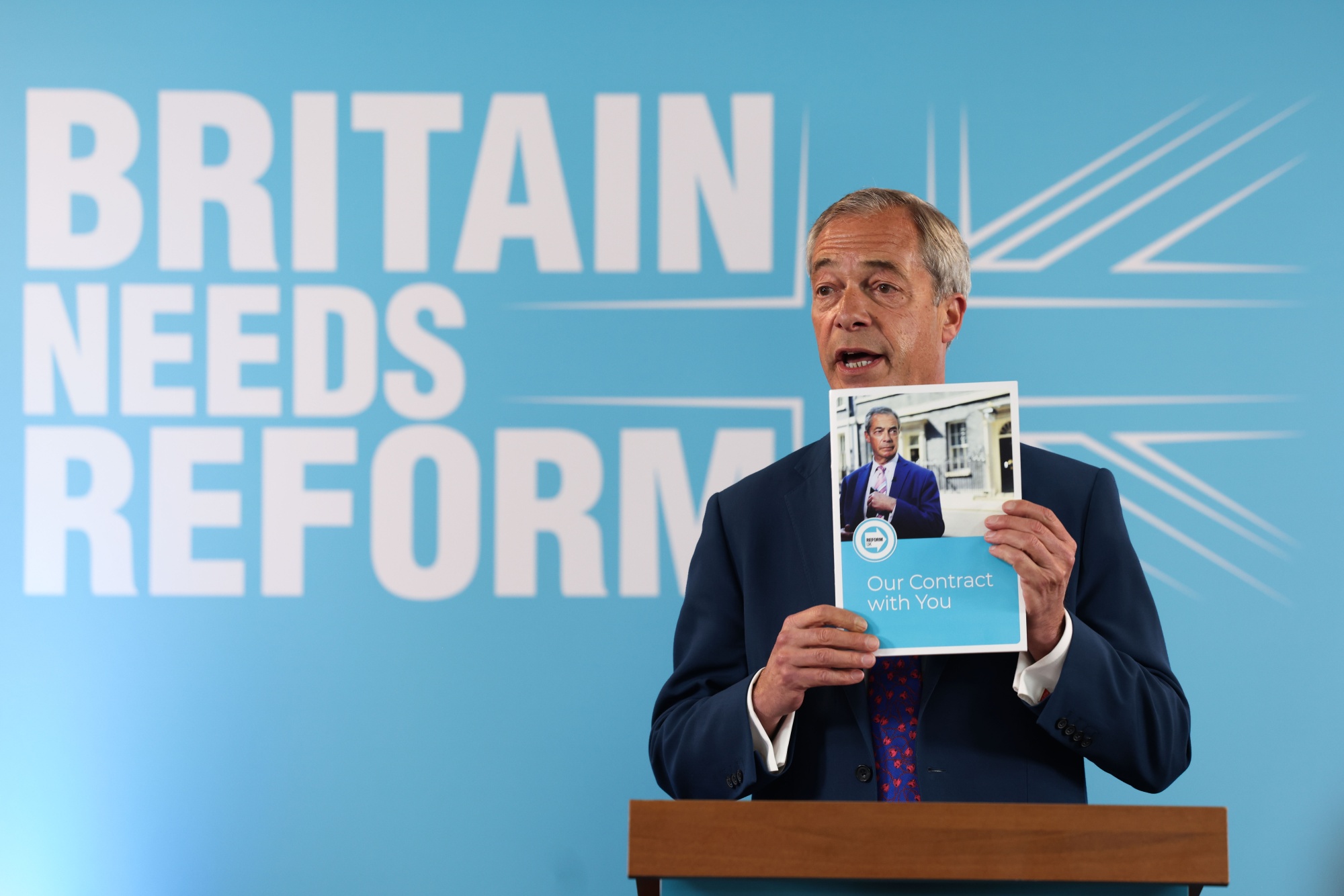

Analysis Farages Reform Uk And Their Support For The Snp

May 03, 2025

Analysis Farages Reform Uk And Their Support For The Snp

May 03, 2025