Is Palantir Technologies Stock A Buy Now? A Comprehensive Analysis

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir Technologies is a data analytics software company known for its two primary platforms: Gotham and Foundry. Gotham caters primarily to government clients, assisting in national security and intelligence operations, while Foundry serves commercial clients across diverse sectors like finance, healthcare, and manufacturing. Both platforms leverage Palantir's expertise in big data integration and analysis to provide actionable insights. Understanding Palantir's revenue streams is crucial to assessing its investment potential.

-

Government Contracts: This sector historically formed a significant portion of Palantir's revenue, providing a stable, albeit sometimes unpredictable, income stream. These government contracts often involve long-term partnerships and substantial contract values.

-

Commercial Contracts: Palantir is actively expanding its commercial presence, diversifying its revenue sources and reducing reliance on government funding. Commercial contracts offer significant growth potential but may involve shorter contract cycles and higher competition.

-

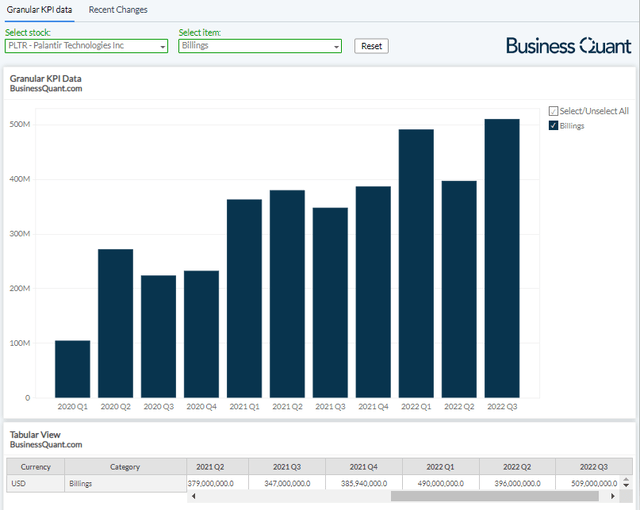

Palantir Revenue Growth: While Palantir has demonstrated substantial revenue growth, particularly in its commercial sector, analysts' projections for Palantir revenue vary considerably, reflecting the inherent uncertainties in the big data analytics market. Analyzing historical Palantir revenue trends and comparing them to Gotham platform and Foundry platform adoption rates is essential for predicting future performance.

-

Key Metrics:

- Government sector revenue currently comprises approximately [insert percentage] of total revenue, while the commercial sector accounts for approximately [insert percentage]. (Note: Replace bracketed information with current figures.)

- Key clients include [list some prominent clients, emphasizing their impact on Palantir's financial standing].

- Palantir's revenue growth rate has been [insert growth rate percentage] over the past [insert time period], comparing favorably/unfavorably (choose appropriate option) to competitors like [list competitors].

Financial Performance and Valuation

Analyzing Palantir's financial statements is crucial for evaluating its Palantir stock valuation. While revenue growth is impressive, profitability remains a key focus for investors. Examining key metrics like profit margins and cash flow is necessary for a complete understanding of its financial health.

-

Key Financial Metrics: Review Palantir's income statements to assess revenue, cost of revenue, and operating expenses. Track trends in Palantir financial performance such as gross profit margin, operating income, and net income over time.

-

Debt Levels and Financial Health: Assess Palantir's balance sheet to understand its debt levels and overall financial health. Analyze its debt-to-equity ratio and its ability to service its debt.

-

Valuation Metrics: Compare Palantir's P/E ratio Palantir and market cap Palantir to industry benchmarks and competitors. A high P/E ratio might suggest a premium valuation based on growth expectations, but also carries higher risk.

-

Key Metrics:

- Palantir's P/E ratio currently stands at [insert current P/E ratio].

- Its market capitalization is approximately [insert current market cap].

- [Insert a comparison to competitor's financial performance here; for example, “Compared to competitors like Snowflake, Palantir shows a higher/lower P/E ratio, reflecting [reason for difference].”]

Competitive Landscape and Future Growth Potential

Palantir operates in a competitive landscape encompassing established tech giants and emerging data analytics firms. Understanding its competitive advantages and the big data analytics market is vital.

-

Competitors: Major competitors include [list key competitors, highlighting their strengths and weaknesses]. Palantir's success depends on maintaining a competitive advantage Palantir through innovation and strong client relationships.

-

Palantir's Competitive Advantages: Palantir’s competitive advantage Palantir stems from its strong technology, deep data expertise, and established relationships with key government and commercial clients. Its ability to integrate and analyze complex datasets is a significant strength.

-

Future Growth Potential: The big data analytics market is predicted to experience significant growth in the coming years, presenting a substantial opportunity for Palantir. However, realizing this Palantir growth potential depends on its ability to successfully navigate competitive pressures and maintain its technological edge.

-

Key Metrics:

- Competitors' market share: [List competitors and their estimated market share].

- Analysis of Palantir’s technological edge: [Describe Palantir's unique technological capabilities and how they differentiate it from competitors.]

- Market growth projections: [Cite relevant market research reports predicting the future growth of the big data analytics market.]

Risks and Challenges Facing Palantir

Investing in Palantir involves inherent risks. Understanding these potential pitfalls is crucial before making an investment decision.

-

Market Volatility: The tech sector is notoriously volatile, making Palantir stock susceptible to market fluctuations.

-

Competition: Intense competition from established players and emerging startups poses a significant challenge to Palantir's growth.

-

Dependence on Large Contracts: Palantir's reliance on substantial government and commercial contracts exposes it to contract losses or delays, impacting revenue and profitability.

-

Geopolitical Risks: International tensions or policy changes could impact Palantir's government contracts.

-

Key Risks:

- [Describe specific examples of potential risks and assess their likelihood.]

- [Discuss strategies Palantir is implementing to mitigate these risks.]

- [Analyze the potential impact of geopolitical events on Palantir’s operations.]

Conclusion

This analysis examined Palantir Technologies' business model, financial performance, competitive landscape, and inherent risks. While Palantir exhibits strong revenue growth and operates in a rapidly expanding market, it also faces significant challenges, including competition and market volatility. Whether Palantir Technologies stock is a buy now depends on your individual risk tolerance and investment strategy. A balanced approach, considering both the opportunities and risks, is advised. Is Palantir Technologies stock a buy now for your portfolio? Conduct your own due diligence before making any investment decisions. Learn more about Palantir Technologies and make an informed decision about whether to buy Palantir stock, considering your individual financial goals and risk tolerance.

Featured Posts

-

Fox News Host Jesse Watters Accused Of Hypocrisy After Infidelity Joke

May 09, 2025

Fox News Host Jesse Watters Accused Of Hypocrisy After Infidelity Joke

May 09, 2025 -

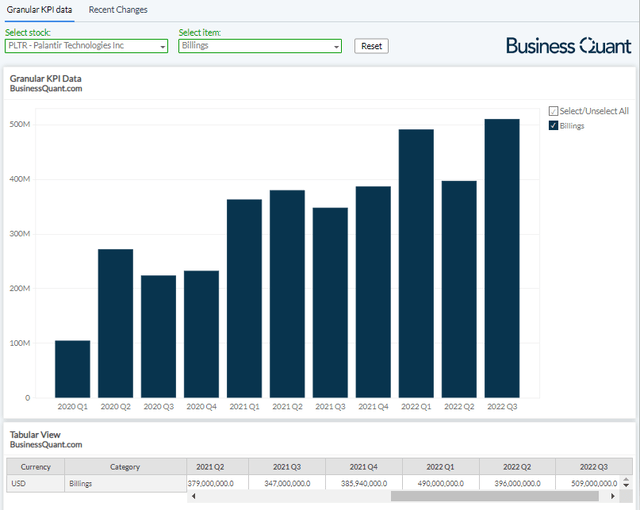

Imalaia Elaxista Xionia 23etes Xamilo

May 09, 2025

Imalaia Elaxista Xionia 23etes Xamilo

May 09, 2025 -

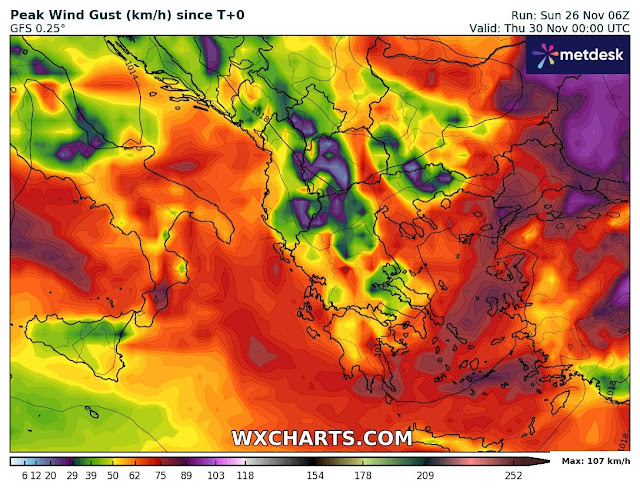

Aprel 2025 V Permi I Permskom Krae Prognoz Pogody Snegopady Pokholodanie

May 09, 2025

Aprel 2025 V Permi I Permskom Krae Prognoz Pogody Snegopady Pokholodanie

May 09, 2025 -

Oilers Vs Kings Prediction Game 1 Playoffs Picks And Odds

May 09, 2025

Oilers Vs Kings Prediction Game 1 Playoffs Picks And Odds

May 09, 2025 -

Stock Market Freefall Understanding The Fallout From Operation Sindoor

May 09, 2025

Stock Market Freefall Understanding The Fallout From Operation Sindoor

May 09, 2025