Is Palantir Stock A Good Investment? Risks And Rewards

Table of Contents

Palantir's Business Model and Competitive Advantage

Palantir operates primarily through two software platforms: Gotham and Foundry. Gotham caters to government agencies, offering sophisticated data analytics tools for national security and intelligence purposes. Foundry, on the other hand, targets commercial clients, providing a platform for data integration, analysis, and operational improvement across various industries.

Palantir's competitive advantage lies in its expertise in handling big data analytics, particularly for complex and sensitive information. Its strong relationships with government entities, particularly in the US, have secured substantial contracts and provide a reliable revenue stream. The company focuses on integrating disparate data sources, providing actionable insights that other platforms struggle to deliver.

However, limitations exist. The company faces stiff competition from established tech giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, all offering similar, albeit often less specialized, data analytics solutions. Furthermore, growth in certain market segments might be slower than expected, presenting a potential challenge to consistent revenue expansion.

- Big data analytics platform expertise: Palantir's core competency is its ability to manage and analyze massive, complex datasets.

- Strong government contracts and relationships: A significant portion of Palantir's revenue comes from long-term contracts with government agencies.

- Focus on complex data integration and analysis: Palantir excels at integrating data from diverse sources and generating meaningful insights.

- Competition from established tech giants (e.g., AWS, Microsoft Azure): These competitors offer competing data analytics services, often at a larger scale and with broader functionalities.

- Potential for slower growth in specific market segments: Market saturation or economic downturns could impact growth in certain sectors.

Financial Performance and Growth Potential

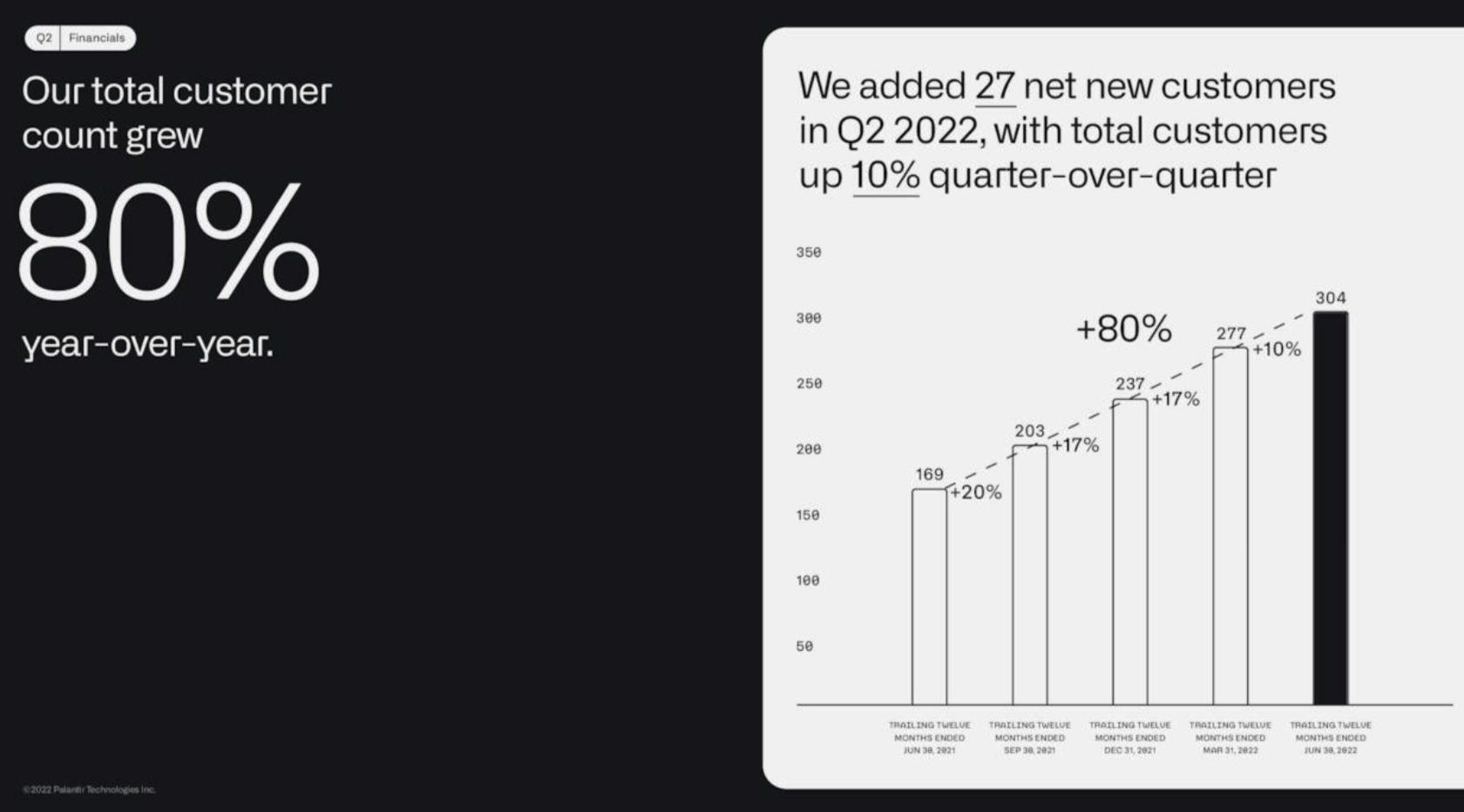

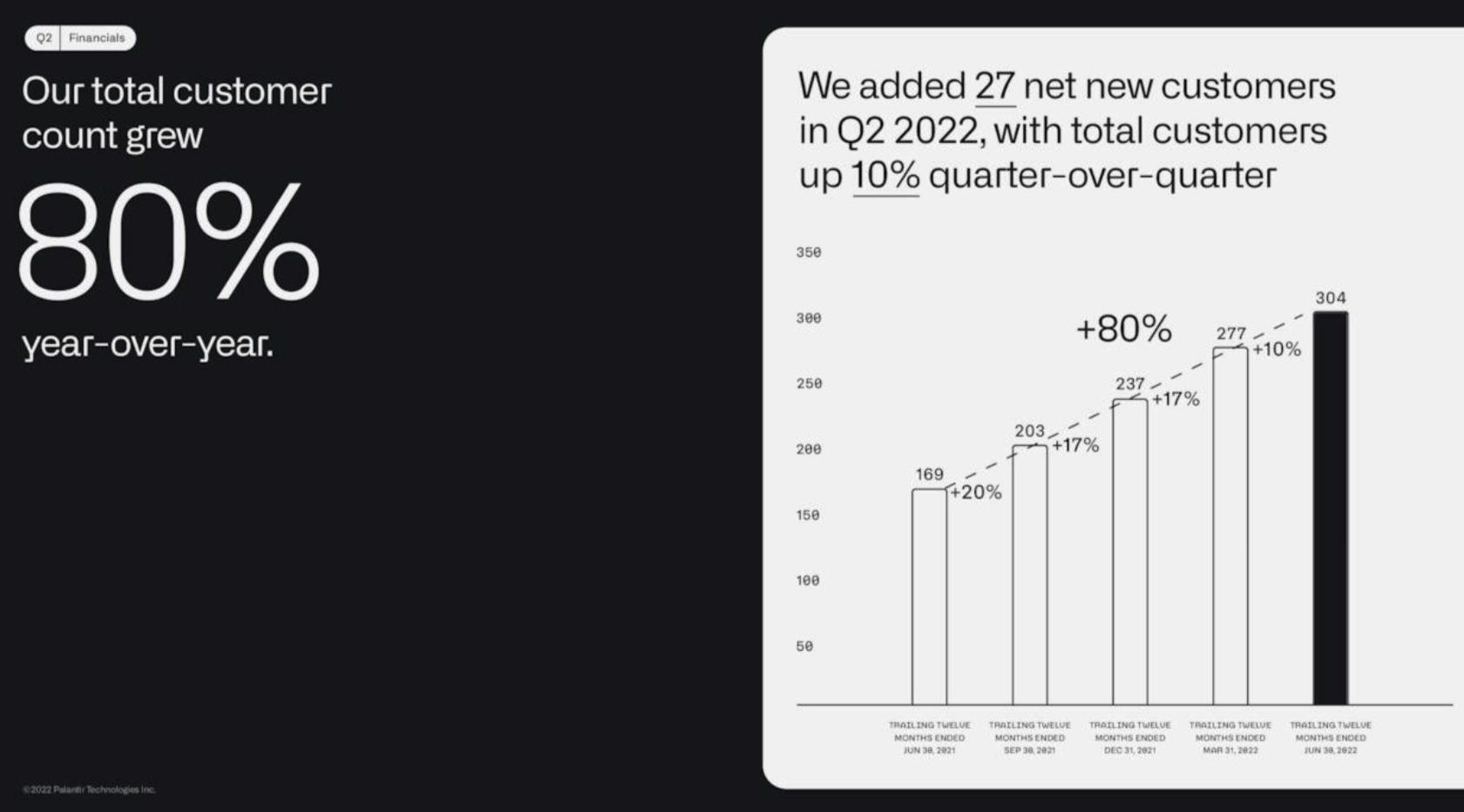

Palantir's revenue growth has been impressive, demonstrating significant year-on-year increases in recent years. However, profitability remains a key focus for the company. Analyzing key financial metrics like revenue growth trajectory, profitability margins, cash flow generation, customer acquisition and retention rates is crucial to understanding the overall financial health. Investors need to examine these indicators to evaluate whether Palantir's valuation aligns with its actual performance and future growth potential. The company's strategic initiatives, such as expanding into new markets and developing innovative products, will significantly influence its future financial performance. Comparing Palantir's valuation to its peers in the data analytics market provides further context for investment decisions.

- Revenue growth trajectory: Examining historical revenue figures is key to understanding the trend and predicting future growth.

- Profitability margins and trends: Analyzing profit margins helps assess the efficiency of Palantir's operations and its ability to generate profits.

- Cash flow generation and debt levels: A strong cash flow is vital for sustainable growth and reinvestment. High debt levels can pose a risk.

- Customer acquisition and retention rates: High retention rates signal customer satisfaction and provide a stable revenue base.

- Potential for future revenue streams (new products/markets): Expanding into new markets and developing new products are key drivers for future revenue growth.

Risks Associated with Investing in Palantir Stock

Investing in Palantir stock carries several inherent risks. Understanding these risks is crucial before making an investment decision.

Valuation Risk

Palantir's stock valuation has historically been high relative to its earnings. This means that investors are paying a premium for future growth. A downturn in the market or failure to meet growth expectations could lead to a significant drop in the stock price.

Dependence on Government Contracts

A considerable portion of Palantir's revenue stems from government contracts. This dependence creates vulnerability to changes in government spending, policy shifts, and geopolitical events.

Competitive Landscape

The competitive landscape in the data analytics market is intensely competitive. Established tech giants pose a significant threat, potentially limiting Palantir's market share and growth prospects.

Geopolitical Risks

Geopolitical instability and international relations can directly impact Palantir's government contracts and overall business operations.

Cybersecurity Risks

Palantir handles sensitive data, making cybersecurity a critical concern. A data breach could severely damage the company's reputation and financial performance.

Palantir's Long-Term Outlook and Future Prospects

Palantir's long-term outlook hinges on several factors. Growth in the commercial sector, expansion into new geographic markets, and continuous technological innovation are all key determinants of its future success. The feasibility of its long-term strategic goals will influence investor confidence and ultimately, the stock price. The adoption of its products across diverse industries, from finance and healthcare to aerospace and defense, will be crucial for sustained growth. Furthermore, the company's ability to adapt to the ever-evolving technological landscape, incorporating new AI and machine learning capabilities into its platforms, will significantly impact its long-term competitiveness.

- Potential for growth in the commercial sector: Expanding its commercial customer base is crucial for diversification and reduced reliance on government contracts.

- Expansion into new geographic markets: International expansion provides access to new customer bases and revenue streams.

- Technological innovation and product development: Continuous investment in R&D is essential to maintain a competitive edge.

- Long-term strategic goals and their feasibility: A clear and achievable long-term strategy is essential for investor confidence.

Conclusion

Investing in Palantir stock presents both significant opportunities and substantial risks. While its innovative technology and strong government contracts offer growth potential, investors need to carefully weigh the factors like valuation, competition, and geopolitical instability. A thorough understanding of Palantir's business model and financial performance is crucial before making an investment decision.

Call to Action: Before you decide whether Palantir stock is a good investment for your portfolio, conduct thorough due diligence and consider consulting a financial advisor. Carefully assess the risks and rewards outlined in this article to make an informed investment decision regarding Palantir.

Featured Posts

-

Us Economic Factors And Elon Musks Tesla Empire

May 09, 2025

Us Economic Factors And Elon Musks Tesla Empire

May 09, 2025 -

Addressing Investor Concerns Bof A On High Stock Market Valuations

May 09, 2025

Addressing Investor Concerns Bof A On High Stock Market Valuations

May 09, 2025 -

Review St Albert Dinner Theatres Hilarious New Farce

May 09, 2025

Review St Albert Dinner Theatres Hilarious New Farce

May 09, 2025 -

Palantir Stock Should You Invest Before May 5th Wall Streets Verdict

May 09, 2025

Palantir Stock Should You Invest Before May 5th Wall Streets Verdict

May 09, 2025 -

Kaitlin Olson And The Return Of High Potential Episodes On Abc

May 09, 2025

Kaitlin Olson And The Return Of High Potential Episodes On Abc

May 09, 2025