Is Palantir Stock A Buy Right Now? A Comprehensive Analysis

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir Technologies operates primarily through two distinct revenue streams: government contracts and commercial sector partnerships. A thorough understanding of both is essential when considering whether to buy Palantir stock.

Palantir Government Contracts

Palantir's success is significantly tied to its substantial government contracts, particularly within the US government. These contracts represent a large portion of its overall revenue and provide a stable, albeit sometimes unpredictable, income stream. However, this reliance also presents inherent risks.

- Specific Examples: Palantir works with various US intelligence agencies, the Department of Defense, and other government bodies on critical data analysis projects. Contract sizes vary significantly, ranging from millions to hundreds of millions of dollars.

- Renewal Rates and Future Wins: While renewal rates are generally high, the nature of government contracting means that future wins are never guaranteed. Budgetary constraints and shifting political priorities can impact contract renewals and new opportunities.

- Keywords: Palantir government contracts, US government contracts, defense contracts, intelligence agencies, Palantir revenue streams

Palantir Commercial Sector Growth

Beyond its government work, Palantir is actively expanding its presence in the commercial sector. This diversification is crucial for mitigating risks associated with its government contract dependence and represents a significant opportunity for future growth. Whether or not this expansion will be enough to make Palantir stock a buy will depend on its performance in the years to come.

- Successful Commercial Partnerships: Palantir has secured partnerships with various companies across diverse industries, including fintech, healthcare, and manufacturing. These collaborations showcase its ability to adapt its platform to different business needs.

- Market Penetration Strategies: Palantir’s strategy involves targeting large enterprises with complex data challenges. Their focus is on establishing long-term partnerships and demonstrating substantial value propositions.

- Keywords: Palantir commercial clients, commercial sector growth, Palantir partnerships, private sector contracts, fintech, healthcare

Financial Performance and Valuation

Assessing Palantir's financial health and valuation is crucial when deciding whether to buy Palantir stock. While past performance doesn’t guarantee future results, it provides valuable insights into the company's trajectory.

Recent Financial Results

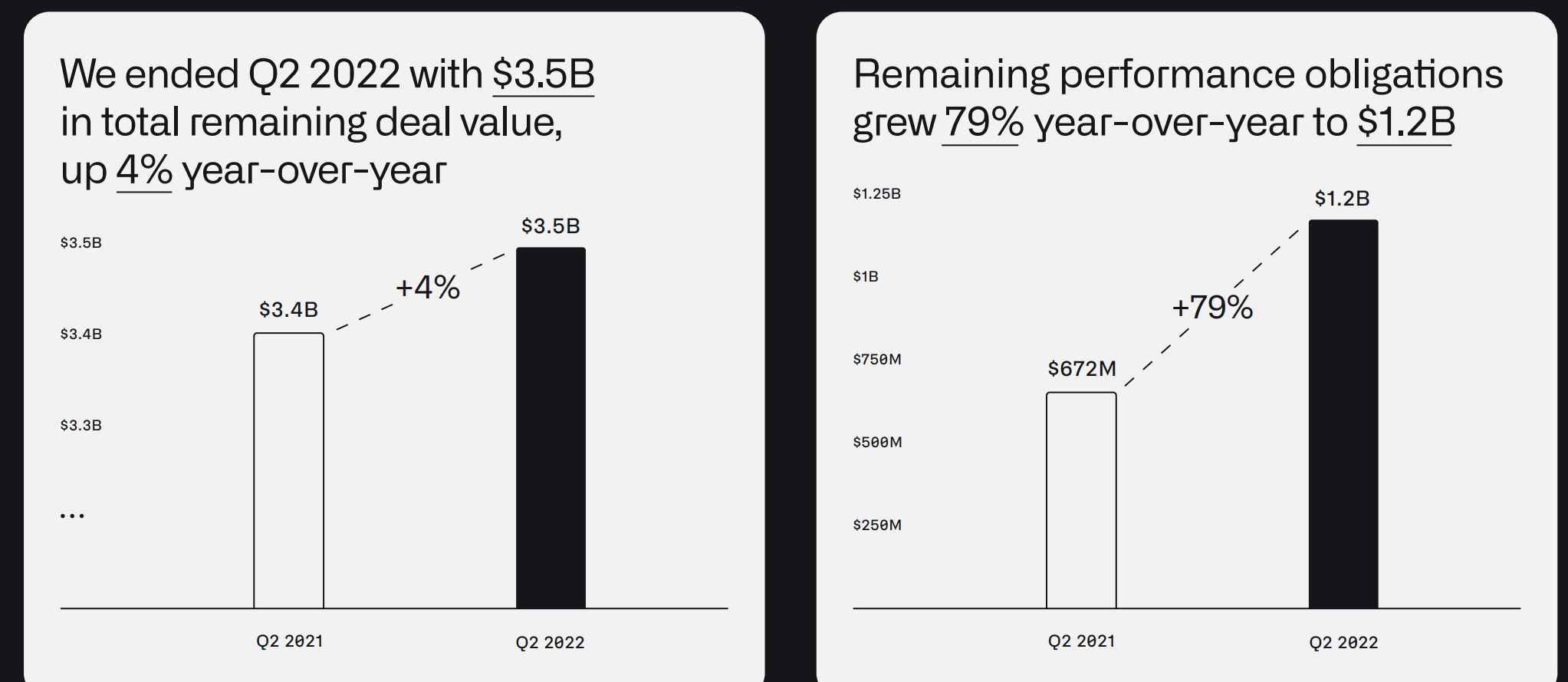

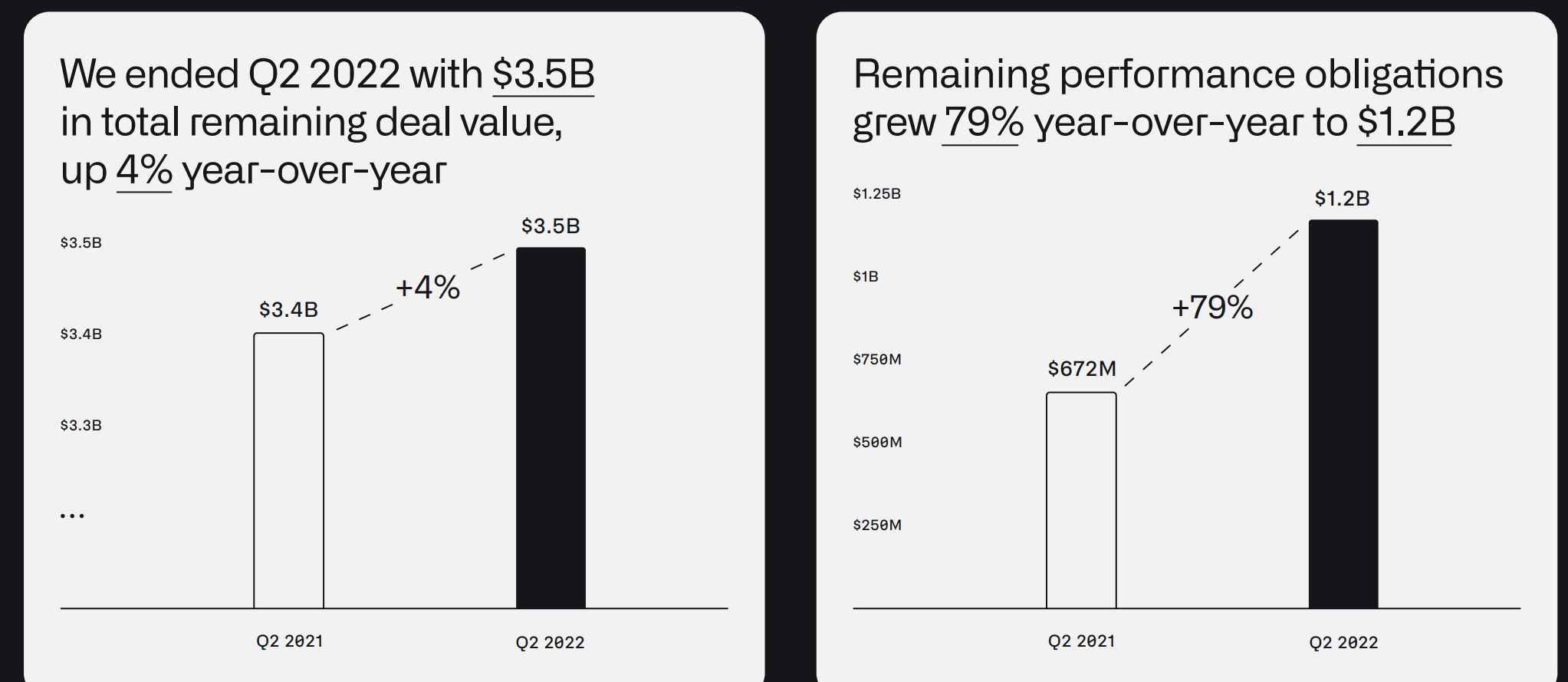

Analyzing Palantir's recent financial reports reveals key trends influencing its stock price. Examining metrics like revenue growth, profitability, and cash flow provides a comprehensive picture. Remember that these figures should be viewed in context with industry benchmarks and the company’s growth stage.

- Key Financial Metrics: Investors should monitor revenue growth rate, operating margins, free cash flow generation, and the company’s debt-to-equity ratio. Significant shifts in any of these areas warrant careful consideration.

- Data and Charts: Referencing Palantir's publicly available financial statements (10-K, 10-Q) and incorporating relevant charts and graphs will help visualize the trends and provide a more robust analysis.

- Keywords: Palantir financials, PLTR earnings, Palantir revenue growth, Palantir profit margin, Palantir financial statements, Palantir valuation

Stock Valuation and Price Targets

Evaluating Palantir’s stock valuation requires using various metrics, comparing them to industry peers, and considering analyst price targets. This process is essential in determining whether the current stock price is justified by the company's fundamentals and potential.

- Valuation Methods: Common valuation techniques include Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and discounted cash flow (DCF) analysis. Each has limitations, so a multi-faceted approach is best.

- Comparison with Competitors: Comparing Palantir's valuation metrics to those of its competitors (e.g., Databricks, Snowflake) helps establish a relative benchmark.

- Keywords: Palantir stock price, PLTR price target, Palantir valuation metrics, Palantir stock forecast, Palantir P/E ratio, Palantir market capitalization

Risks and Challenges

Investing in Palantir stock, like any investment, involves inherent risks. Understanding these potential challenges is crucial before deciding whether to buy Palantir stock.

Competition and Market Saturation

The data analytics and artificial intelligence market is highly competitive. Palantir faces competition from established tech giants and emerging startups. This competitive landscape presents risks to its market share and profitability.

- Key Competitors: Identifying and analyzing the strengths and weaknesses of key competitors (e.g., AWS, Google Cloud, Microsoft Azure) is vital to assess Palantir's competitive positioning.

- Potential for Market Disruption: Rapid technological advancements and the emergence of new players could disrupt the market and impact Palantir’s growth trajectory. Investors should monitor these trends closely.

- Keywords: Palantir competitors, data analytics competition, AI competition, market share, competitive landscape

Dependence on Key Clients and Contracts

Palantir's reliance on a relatively small number of key clients, particularly government agencies, presents significant risk. Loss of or failure to renew these contracts could severely impact its revenue.

- Contract Renewal Risks: Government contracts are often subject to stringent renewal processes and budgetary considerations. Any delays or failures to secure renewals could negatively affect Palantir’s performance.

- Strategies to Mitigate Risks: Palantir’s strategy of diversifying into the commercial sector aims to mitigate this risk. However, the success of this strategy remains to be fully realized.

- Keywords: Palantir client concentration, contract risk, Palantir diversification strategy

Future Growth Potential and Outlook

Despite the risks, Palantir possesses significant growth potential. Its advanced data analytics capabilities, expansion into new markets, and investments in AI offer promising prospects for long-term investors. However, whether this will ultimately make Palantir stock a buy depends on how it performs in the coming years.

Expansion into New Markets

Palantir is actively pursuing growth opportunities in new markets and sectors globally. Successful expansion into these areas would significantly increase its revenue streams and reduce reliance on existing clients.

- New Market Opportunities: Identifying potential areas for expansion, such as specific industries or geographic regions, is crucial to assess Palantir's growth prospects.

- International Expansion: Expanding into international markets could unlock significant growth potential, but also presents challenges related to regulatory compliance and cultural adaptation.

- Keywords: Palantir growth strategy, Palantir market expansion, international expansion, Palantir future prospects, technological innovation

Technological Innovation and AI

Palantir is investing heavily in artificial intelligence and machine learning, which is crucial for maintaining its competitive edge and driving future growth.

- Palantir's AI Capabilities: Understanding Palantir's AI capabilities and how they are integrated into its platform is critical in assessing its competitive advantage.

- Investment in R&D: Monitoring Palantir’s investment in research and development demonstrates its commitment to innovation and suggests a focus on long-term growth.

- Keywords: Palantir AI, artificial intelligence, machine learning, Palantir technology, technological advancements, data analytics

Conclusion

Whether Palantir stock is a buy right now is a complex question with no easy answer. The company has a strong position in government contracts, but its reliance on these contracts and competition in the commercial sector represent significant risks. Its expansion into new markets and AI investments hold potential for future growth, yet uncertainty remains. While the financial performance shows potential, its valuation remains a subject of debate.

Ultimately, the decision of whether to buy Palantir stock is yours. However, this comprehensive analysis should provide you with the necessary insights to make an informed investment decision regarding Palantir stock. Remember to conduct your own thorough due diligence before investing in Palantir Technologies (PLTR) stock. Consider consulting a financial advisor before making any investment decisions.

Featured Posts

-

Vu Viec Bao Mau Bao Hanh Tre Em Tien Giang Bai Hoc Ve An Toan Cho Tre

May 09, 2025

Vu Viec Bao Mau Bao Hanh Tre Em Tien Giang Bai Hoc Ve An Toan Cho Tre

May 09, 2025 -

Inter Milans Shock Win Against Bayern Munich In Champions League

May 09, 2025

Inter Milans Shock Win Against Bayern Munich In Champions League

May 09, 2025 -

Trump Tariffs Impact 174 Billion Loss For Worlds Richest

May 09, 2025

Trump Tariffs Impact 174 Billion Loss For Worlds Richest

May 09, 2025 -

Bitcoin Madenciligi Gelecegi Ve Sonu

May 09, 2025

Bitcoin Madenciligi Gelecegi Ve Sonu

May 09, 2025 -

U S China Trade Talks The Unintended Consequence Of The Fentanyl Crisis

May 09, 2025

U S China Trade Talks The Unintended Consequence Of The Fentanyl Crisis

May 09, 2025