Is Novo Nordisk Losing Its Edge? Ozempic And The Competitive Weight-Loss Market

Table of Contents

Novo Nordisk's Ozempic has revolutionized the weight-loss market, becoming a household name and a blockbuster drug. However, its reign as the undisputed champion is facing a significant challenge. A wave of new competitors, armed with innovative strategies and compelling data, are entering the arena, raising the question: is Novo Nordisk losing its edge in this rapidly expanding sector? This article delves into the intensifying competition, analyzing the strengths and weaknesses of key players and exploring the future of the weight-loss market.

The Rise of Ozempic and its Impact

Ozempic's Market Dominance

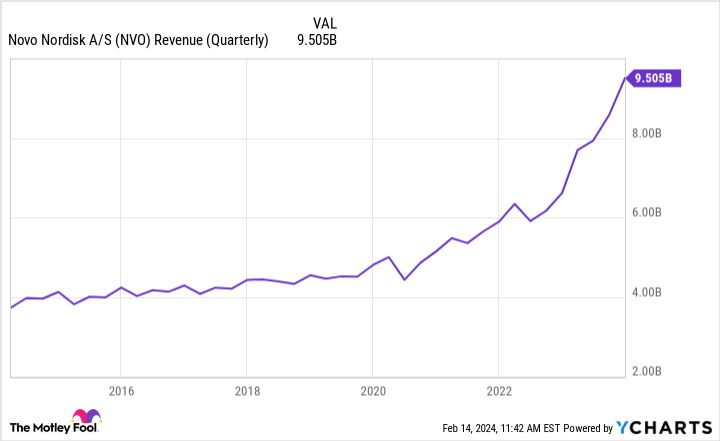

Ozempic's success is undeniable. Its high efficacy in promoting weight loss, coupled with strong brand recognition built through extensive marketing campaigns, gave it a significant first-mover advantage. This translated into substantial market share, making it the leading GLP-1 receptor agonist in the weight-loss space. While precise sales figures fluctuate, Ozempic's impact on Novo Nordisk's overall revenue is substantial, solidifying its position as a major player in the pharmaceutical industry.

- High efficacy: Proven weight loss results in clinical trials.

- Brand recognition: Strong brand awareness among patients and healthcare providers.

- Extensive marketing campaigns: Successful promotion and education around the drug's benefits.

- First-mover advantage: Early market entry allowed for establishing brand loyalty and market share.

The Mechanism of Action of GLP-1 Receptor Agonists

Ozempic, and similar drugs like Wegovy (also from Novo Nordisk), work by mimicking the effects of glucagon-like peptide-1 (GLP-1), a natural hormone in the body. GLP-1 agonists work through several mechanisms:

- Appetite suppression: They reduce feelings of hunger, leading to decreased food intake.

- Insulin secretion: They stimulate insulin release when blood sugar levels are high, improving glucose control.

- Weight loss mechanism: The combined effects of reduced appetite and improved glucose regulation contribute to significant weight loss.

This relatively straightforward mechanism, combined with its efficacy, has contributed significantly to Ozempic’s success.

Emerging Competitors and their Strategies

Eli Lilly's Mounjaro

Mounjaro (tirzepatide), developed by Eli Lilly, poses a serious threat to Ozempic's dominance. Clinical trials have demonstrated superior weight loss results compared to Ozempic, and its dual mechanism of action – targeting both GLP-1 and GIP (glucose-dependent insulinotropic polypeptide) receptors – may offer a broader therapeutic benefit.

- Superior weight loss results: Clinical trial data showing greater weight loss compared to Ozempic.

- Dual mechanism of action (GLP-1 and GIP receptor agonist): Potentially leading to enhanced efficacy and broader patient benefits.

- Potential for broader patient base: Its dual mechanism could make it suitable for a wider range of patients with obesity and related conditions.

Other Competitors in the Weight-Loss Market

The weight-loss market is becoming increasingly crowded. Other notable competitors include:

- Wegovy (Novo Nordisk): A higher-dose version of semaglutide, also a GLP-1 receptor agonist, offering significant weight loss potential. Its higher dose, however, also increases the risk of side effects, leading to a steeper price point and perhaps limiting market penetration.

- Saxenda (liraglutide): Another GLP-1 receptor agonist, though generally showing less weight loss than Ozempic or Mounjaro.

- Other emerging therapies: Research is ongoing in areas like new hormonal therapies and bariatric surgery enhancements, representing potential future threats.

The Role of Generics and Biosimilars

The looming threat of generic and biosimilar versions of Ozempic will undoubtedly impact Novo Nordisk's market share. While the timeline for generic entry remains uncertain, it will likely lead to significant price reductions, creating intense pressure on Novo Nordisk's profit margins.

- Timeline for generic entry: The regulatory pathway for biosimilars is complex and lengthy, but the race to bring alternatives to market is well underway.

- Potential price reductions: Generics will introduce price competition, altering the current market dynamics.

- Impact on Novo Nordisk's market share: The entry of cheaper alternatives will inevitably affect Novo Nordisk's sales and dominance.

Challenges Faced by Novo Nordisk

Increased Competition

The intensified competition is the most immediate challenge for Novo Nordisk. The entry of Mounjaro, along with other potential competitors and the looming threat of generics, puts pressure on pricing and leads to a potential decline in Ozempic's market share.

- Price wars: Competitors may engage in price wars to gain market share, squeezing profit margins for all players.

- Loss of market share: The introduction of equally or more effective drugs could significantly diminish Ozempic's dominance.

- Pressure on profit margins: Price competition will inevitably reduce profitability.

Supply Chain Issues and Demand

The explosive demand for Ozempic and similar drugs has exposed vulnerabilities in Novo Nordisk's supply chain. Meeting this unprecedented demand requires significant manufacturing capacity and robust distribution networks.

- Manufacturing capacity: Scaling up production to meet global demand is a significant operational challenge.

- Distribution networks: Efficient and reliable distribution is crucial to ensure timely access for patients.

- Potential for shortages: If supply cannot keep pace with demand, shortages and unmet patient needs can arise.

Safety Concerns and Side Effects

While GLP-1 receptor agonists offer significant benefits, they also carry potential side effects. Concerns regarding pancreatitis, gallstones, and thyroid tumors, though relatively rare, are being closely monitored by regulatory authorities.

- Pancreatitis: A rare but serious side effect that requires close monitoring.

- Gallstones: Increased risk of gallstone formation is a potential complication.

- Thyroid tumors: Ongoing research is evaluating the long-term risk of thyroid tumors.

Conclusion

The weight-loss market, once dominated by Novo Nordisk's Ozempic, is rapidly evolving. The emergence of strong competitors like Mounjaro, the potential for biosimilars, and the need to address supply chain and safety concerns present significant challenges for Novo Nordisk. While Ozempic remains a significant player, maintaining its leading position will require continued innovation, strategic adaptation, and a proactive response to the growing competition. Stay informed about the developments in the weight-loss market and the competition surrounding Ozempic and other GLP-1 receptor agonists. Continue to follow this space for updates on the future of weight loss medication and Novo Nordisk's continued role in this dynamic sector.

Featured Posts

-

Torwart Transfer Garteig Verlaesst Ingolstadt Fuer Augsburg

May 30, 2025

Torwart Transfer Garteig Verlaesst Ingolstadt Fuer Augsburg

May 30, 2025 -

Hanwha And Oci Capitalize On Us Solar Import Tariffs

May 30, 2025

Hanwha And Oci Capitalize On Us Solar Import Tariffs

May 30, 2025 -

March Rainfall Insufficient To Alleviate Water Deficit

May 30, 2025

March Rainfall Insufficient To Alleviate Water Deficit

May 30, 2025 -

Ticketmaster Virtual Venue Vista Previa De Tu Asiento Antes De Comprar

May 30, 2025

Ticketmaster Virtual Venue Vista Previa De Tu Asiento Antes De Comprar

May 30, 2025 -

Preoccupations Parents D Eleves Bouton D Or Remplacement Des Rats A Florange

May 30, 2025

Preoccupations Parents D Eleves Bouton D Or Remplacement Des Rats A Florange

May 30, 2025

Latest Posts

-

Detroits Memorial Day Weekend A 150 000 Visitor Forecast

May 31, 2025

Detroits Memorial Day Weekend A 150 000 Visitor Forecast

May 31, 2025 -

150 000 Expected In Detroit For Crowded Memorial Day Weekend

May 31, 2025

150 000 Expected In Detroit For Crowded Memorial Day Weekend

May 31, 2025 -

Detroit Expects 150 000 Visitors For Busy Memorial Day Weekend

May 31, 2025

Detroit Expects 150 000 Visitors For Busy Memorial Day Weekend

May 31, 2025 -

Updated Schedule Tigers To Play Doubleheader After Friday Game Delay

May 31, 2025

Updated Schedule Tigers To Play Doubleheader After Friday Game Delay

May 31, 2025 -

White Stripes Jack White Discusses Baseball And The Hall Of Fame On Tigers Broadcast

May 31, 2025

White Stripes Jack White Discusses Baseball And The Hall Of Fame On Tigers Broadcast

May 31, 2025