Is Microsoft The Safest Software Stock During Tariff Uncertainty?

Table of Contents

Microsoft's Diversified Revenue Streams as a Hedge Against Tariff Risks

Microsoft's strength lies in its incredibly diversified revenue streams. Unlike companies heavily reliant on manufacturing and physical goods, Microsoft's business model is less susceptible to the direct impacts of tariffs. Let's break down the key components:

Cloud Computing Dominance (Azure)

- Global Reach: Azure boasts a massive global infrastructure, minimizing dependence on any single geographic market. This contrasts sharply with hardware manufacturers, whose supply chains can be severely disrupted by tariffs.

- Strong Growth: Azure's consistent and impressive growth trajectory further strengthens its position as a major cloud provider. This continuous expansion mitigates the risk of reliance on any single region affected by tariffs.

- Diversification Minimizes Risk: By operating globally and not relying on a specific location, Azure significantly reduces the financial impact of tariff fluctuations.

Productivity and Business Processes (Office 365, Dynamics 365)

- Subscription Model: The subscription-based model of Office 365 and Dynamics 365 ensures consistent revenue streams, unlike one-time hardware sales vulnerable to market shifts.

- SaaS Advantage: As Software-as-a-Service (SaaS) offerings, these products are less affected by tariffs impacting physical goods. The digital nature of these products allows for seamless global delivery.

- Global Adoption: The widespread global adoption of these productivity tools ensures resilience to regional economic downturns.

Gaming and Other Diversified Revenue

- Xbox and Beyond: Xbox and other gaming revenues offer a substantial and relatively tariff-insensitive supplemental revenue stream.

- LinkedIn and More: Other business segments, such as LinkedIn and enterprise solutions, add further layers of diversification, cushioning the impact of any sector-specific tariff increases.

- Buffer Against Negative Impacts: This diverse portfolio acts as a powerful buffer, significantly reducing the potential negative impacts from specific industry tariffs.

Microsoft's Global Presence and Strategic Adaptability

Microsoft's vast global reach and strategic adaptability are crucial factors contributing to its perceived safety during tariff uncertainty.

International Market Presence

- Established Global Footprint: Microsoft enjoys a well-established presence across numerous global markets, allowing it to navigate differing regulatory environments effectively.

- Minimized Regional Risk: This broad geographic diversification minimizes the risk of over-reliance on any single region heavily affected by tariffs.

- Strategic Partnerships & Adaptation: Strategic partnerships and local adaptations further enhance resilience, allowing Microsoft to navigate unique market conditions effectively.

Long-Term Growth Potential

- Continuous R&D Investment: Microsoft's commitment to ongoing research and development (R&D) fuels innovation and positions the company for long-term growth.

- Adaptability to Change: These investments in emerging technologies contribute to the company's adaptability in the face of external challenges like tariff fluctuations.

- Sustained Growth & Profitability: This commitment to innovation translates into sustained growth and profitability, reinforcing its position as a stable investment.

Comparing Microsoft to Other Tech Stocks During Tariff Uncertainty

While Microsoft presents a relatively safe investment option, comparing it to other tech stocks further clarifies its advantages.

Hardware-dependent companies

Companies more reliant on hardware manufacturing are considerably more vulnerable to tariffs due to increased production costs and disrupted supply chains. Think of companies heavily involved in semiconductor production or consumer electronics manufacturing.

Software-only companies

Even within the software sector, Microsoft’s diversified portfolio distinguishes it from companies with less diversified revenue streams. These companies may be more vulnerable to specific market downturns or changes in consumer behavior.

Risk assessment

While Microsoft offers a degree of protection against tariff uncertainty, it’s crucial to remember that no investment is entirely risk-free. Factors like macroeconomic conditions, competition, and evolving technological landscapes could still impact Microsoft's stock price.

Conclusion

Microsoft's diversified business model, encompassing cloud computing (Azure), productivity software (Office 365, Dynamics 365), gaming (Xbox), and other ventures, offers a considerable buffer against the negative impacts of tariff uncertainty. Its substantial global presence and continuous investment in R&D further enhance its resilience. While no investment is without risk, Microsoft's relative stability and strong market position make it a compelling option for investors seeking a safer software stock investment during periods of market volatility. Consider adding Microsoft to your diversified portfolio as a potentially safer software stock investment. However, conduct thorough research and consult a financial advisor before making any investment decisions.

Featured Posts

-

Nba Fans React To Jimmy Butlers Injury Game 4 Implications

May 16, 2025

Nba Fans React To Jimmy Butlers Injury Game 4 Implications

May 16, 2025 -

Sigue En Directo El Partido Crystal Palace Nottingham Forest

May 16, 2025

Sigue En Directo El Partido Crystal Palace Nottingham Forest

May 16, 2025 -

Mlb Betting Padres Vs Pirates Prediction And Best Odds Today

May 16, 2025

Mlb Betting Padres Vs Pirates Prediction And Best Odds Today

May 16, 2025 -

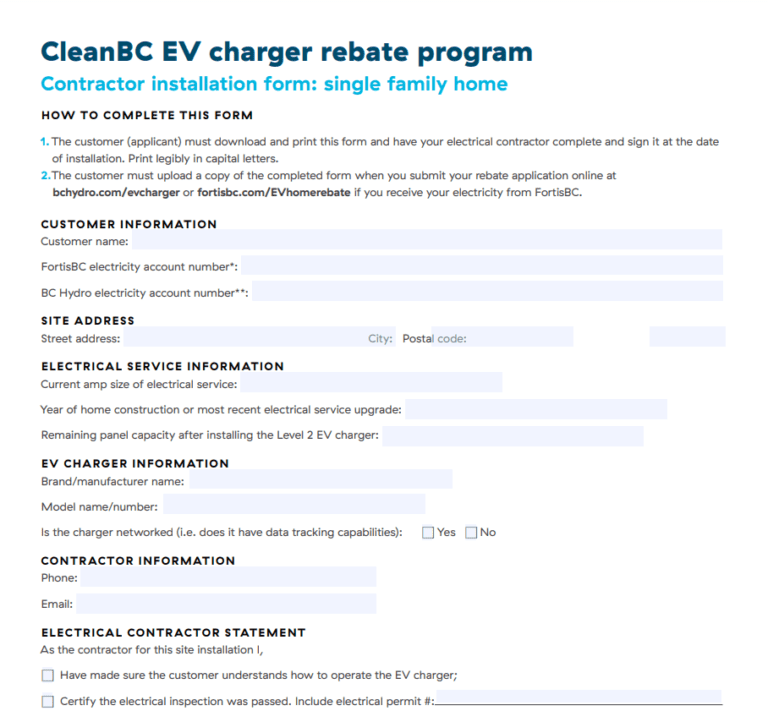

15 Billion Question Hondas Ontario Ev Plant On Hold

May 16, 2025

15 Billion Question Hondas Ontario Ev Plant On Hold

May 16, 2025 -

Paddy Pimbletts Road To Ufc 314 Will He Become Champion

May 16, 2025

Paddy Pimbletts Road To Ufc 314 Will He Become Champion

May 16, 2025

Latest Posts

-

Padres Vs Yankees Prediction Will San Diego Extend Their Winning Streak To Seven Games

May 16, 2025

Padres Vs Yankees Prediction Will San Diego Extend Their Winning Streak To Seven Games

May 16, 2025 -

Mlb Prediction Giants Vs Padres Padres Win Probability

May 16, 2025

Mlb Prediction Giants Vs Padres Padres Win Probability

May 16, 2025 -

Predicting The Giants Padres Game Padres Outright Win Or Narrow Defeat

May 16, 2025

Predicting The Giants Padres Game Padres Outright Win Or Narrow Defeat

May 16, 2025 -

Giants Vs Padres Game Prediction Analyzing A Potential Padres Victory

May 16, 2025

Giants Vs Padres Game Prediction Analyzing A Potential Padres Victory

May 16, 2025 -

Mlb Prediction Braves Vs Padres Atlantas Winning Strategy

May 16, 2025

Mlb Prediction Braves Vs Padres Atlantas Winning Strategy

May 16, 2025