Is Lack Of Funds Limiting Your Potential? Effective Ways To Manage Your Finances

Table of Contents

Understanding Your Current Financial Situation

Before you can start tackling financial limitations, you need a clear picture of your current financial health. This involves understanding your income, expenses, and debt.

Creating a Realistic Budget

Tracking your income and expenses is the cornerstone of effective financial management. Understanding where your money goes allows you to identify areas where you can cut back and allocate funds towards your goals. There are several methods to help you create a realistic budget.

- The 50/30/20 rule: Allocate 50% of your income to needs (housing, utilities, food), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment.

- Zero-based budgeting: Assign every dollar of your income to a specific category, ensuring your expenses equal your income. This approach helps eliminate unnecessary spending.

- Budgeting apps: Numerous apps (Mint, YNAB, Personal Capital) can automate tracking, categorize expenses, and provide insights into your spending habits.

Examples of Expense Categories:

- Housing (rent or mortgage)

- Transportation (car payments, gas, public transport)

- Food (groceries, eating out)

- Utilities (electricity, water, internet)

- Entertainment (movies, concerts, subscriptions)

- Debt Repayment (credit cards, loans)

Tips for Identifying Areas to Cut Back:

- Review bank and credit card statements meticulously.

- Identify recurring subscriptions you don't use.

- Cook at home more often instead of eating out.

- Explore cheaper entertainment options.

Assessing Your Debt

Understanding your debt is crucial for effective financial planning. Different types of debt come with varying interest rates and repayment terms.

- Credit card debt: High-interest debt that needs prompt attention.

- Student loans: Often have lower interest rates than credit cards, but still require strategic repayment.

- Mortgages: Long-term debt with lower interest rates but significant monthly payments.

Understanding your interest rates and repayment terms is crucial for developing an effective debt repayment strategy.

Strategies for Paying Down Debt:

- Debt snowball: Pay off your smallest debt first, then roll that payment amount into the next smallest debt, creating momentum.

- Debt avalanche: Pay off the debt with the highest interest rate first to minimize total interest paid.

Resources for Debt Consolidation: Consider debt consolidation loans or balance transfer credit cards to simplify repayment and potentially lower interest rates.

Increasing Your Income Streams

Addressing a lack of funds often involves increasing your income. Exploring additional income opportunities and negotiating a higher salary are key strategies.

Exploring Additional Income Opportunities

Side hustles and freelance work can significantly boost your income. The internet offers numerous platforms for finding freelance gigs.

Examples of Side Hustles:

- Driving for a ride-sharing service

- Selling crafts or goods online (Etsy, eBay)

- Tutoring or teaching online

- Freelance writing, editing, or graphic design

- Pet sitting or dog walking

Online Platforms for Freelance Gigs:

- Upwork

- Fiverr

- Freelancer.com

Negotiating a Raise or Seeking a Higher-Paying Job

Negotiating a salary increase with your current employer or seeking a higher-paying job can substantially improve your financial situation.

Tips for Negotiating a Salary Increase:

- Research salary ranges for your position and experience level.

- Highlight your accomplishments and contributions to the company.

- Prepare a confident and professional presentation of your value.

Resources for Job Searching and Career Advancement:

- Indeed

- Glassdoor

Smart Spending Habits and Saving Strategies

Effective financial management hinges on smart spending and robust saving strategies.

Identifying and Reducing Unnecessary Expenses

Analyze your spending habits to identify areas where you can cut back without sacrificing your quality of life.

Common Areas of Overspending:

- Eating out frequently

- Unnecessary subscriptions

- Impulse purchases

Tips for Saving Money:

- Plan your meals and grocery shop strategically.

- Negotiate lower rates for utilities.

- Utilize free or low-cost entertainment options.

Building an Emergency Fund

Having 3-6 months of living expenses saved in an emergency fund provides a financial safety net. This prevents debt accumulation during unexpected events like job loss or medical emergencies.

Methods for Saving:

- Automatic transfers from your checking to savings account.

- Setting specific savings goals and tracking your progress.

Benefits of an Emergency Fund:

- Reduces stress during financial crises.

- Avoids accumulating high-interest debt.

- Provides peace of mind.

Seeking Professional Financial Advice

For complex financial situations, seeking professional advice is invaluable.

When to Consult a Financial Advisor

A financial advisor can provide personalized guidance on various financial matters.

Benefits of Working with a Financial Advisor:

- Personalized financial plan tailored to your specific needs and goals.

- Expert guidance on investments, retirement planning, and debt management.

- Objective perspective on your financial situation.

When to Seek Professional Advice:

- Complex financial situations

- Significant debt

- Retirement planning

- Investing in the stock market

Questions to Ask a Financial Advisor:

- What are your fees and services?

- What is your experience and specialization?

- What is your investment philosophy?

Conclusion: Overcoming Financial Limitations and Reaching Your Full Potential

Building a budget, managing debt effectively, increasing income streams, and adopting smart spending habits are crucial steps in overcoming financial limitations. Proactive financial management is essential for achieving your personal and professional goals. Don't let lack of funds limit your potential any longer! Take control of your finances today by implementing the strategies outlined in this article. Start budgeting, explore additional income streams, and work towards a brighter financial future. Learn more about effective budgeting and financial planning at [link to relevant resource].

Featured Posts

-

The Goldbergs Behind The Scenes Facts And Trivia

May 22, 2025

The Goldbergs Behind The Scenes Facts And Trivia

May 22, 2025 -

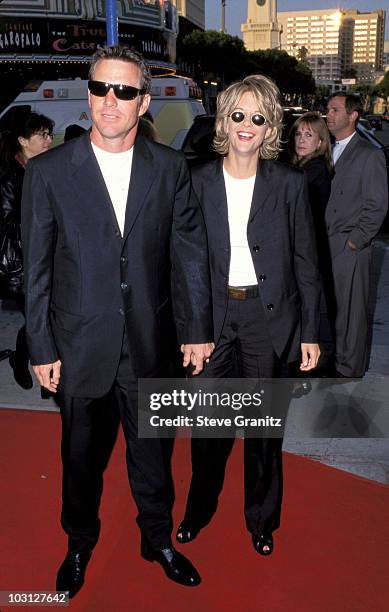

Dennis Quaid Meg Ryan And James Caans Forgotten Western Neo Noir

May 22, 2025

Dennis Quaid Meg Ryan And James Caans Forgotten Western Neo Noir

May 22, 2025 -

Abn Amro Analyse Van De Stijgende Occasionmarkt En Groeiend Autobezit

May 22, 2025

Abn Amro Analyse Van De Stijgende Occasionmarkt En Groeiend Autobezit

May 22, 2025 -

Eu Trade Shift Macrons Plea For European Made Goods

May 22, 2025

Eu Trade Shift Macrons Plea For European Made Goods

May 22, 2025 -

Half Domes Victory Winning The Abn Group Victoria Pitch

May 22, 2025

Half Domes Victory Winning The Abn Group Victoria Pitch

May 22, 2025

Latest Posts

-

Antiques Roadshow Arrest Couple Charged With Trafficking National Treasure Following Shocking Appraisal

May 22, 2025

Antiques Roadshow Arrest Couple Charged With Trafficking National Treasure Following Shocking Appraisal

May 22, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Results In Couples Arrest

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Results In Couples Arrest

May 22, 2025 -

Antiques Roadshow Appraisal Uncovers Crime Results In Arrest

May 22, 2025

Antiques Roadshow Appraisal Uncovers Crime Results In Arrest

May 22, 2025 -

Antiques Roadshow Couple Arrested After Jaw Dropping Appraisal Reveals National Treasure Trafficking

May 22, 2025

Antiques Roadshow Couple Arrested After Jaw Dropping Appraisal Reveals National Treasure Trafficking

May 22, 2025 -

Stolen Goods Confession Antiques Roadshows Unexpected Legal Ramifications

May 22, 2025

Stolen Goods Confession Antiques Roadshows Unexpected Legal Ramifications

May 22, 2025