Is Klarna's $1 Billion IPO A Good Investment?

Table of Contents

Klarna's Financial Performance and Growth Prospects

Klarna's success hinges on its financial performance and future growth potential within the rapidly expanding BNPL market. Understanding its historical trends and future projections is crucial for any potential investor.

Revenue Growth and Profitability

Klarna has experienced significant revenue growth in recent years, fueled by the increasing popularity of its BNPL services. However, profitability remains a challenge. Analyzing historical financial data is crucial for understanding its long-term sustainability.

- Year-over-year revenue growth: While Klarna has shown impressive year-over-year revenue growth, detailed figures require accessing their financial reports. Sustaining this growth rate amidst increasing competition is key.

- Net income/loss: Klarna has historically operated at a loss, focusing on rapid expansion and market share capture. Achieving profitability will be a critical factor in its long-term success and investor appeal.

- Key financial ratios: Analyzing ratios like the debt-to-equity ratio is vital to assessing Klarna's financial health and risk profile. High debt levels could hinder its ability to weather economic downturns.

Future projections for Klarna's growth are optimistic, predicated on continued adoption of BNPL services and successful expansion into new markets. However, these projections need to be viewed with caution, considering the inherent uncertainties in the financial markets and the competitive landscape.

Market Share and Competition

Klarna is a major player in the global BNPL market, but it faces stiff competition from established players and emerging fintech startups. Understanding its market position and competitive advantages is vital.

- Market share data: Klarna holds a significant market share, but precise figures vary depending on the region and methodology. Maintaining and growing this share will require ongoing innovation and strategic expansion.

- Competitive advantages and disadvantages: Klarna's strong brand recognition and extensive merchant network are significant advantages. However, competitors like Affirm and Afterpay are also rapidly expanding, posing a considerable challenge.

- Potential for market disruption: The BNPL market is dynamic and prone to disruption. Klarna needs to continuously innovate and adapt to remain ahead of the curve.

Risks and Challenges Facing Klarna

While Klarna presents exciting growth potential, several risks and challenges could impact its future performance. Investors must carefully consider these factors.

Regulatory Scrutiny and Legal Risks

The BNPL industry faces increasing regulatory scrutiny globally due to concerns about consumer debt and financial protection. This poses a significant risk to Klarna.

- Government regulations on consumer credit: Governments worldwide are implementing stricter regulations on consumer credit, potentially limiting the reach and profitability of BNPL services.

- Potential lawsuits: Klarna could face lawsuits related to its lending practices or data privacy. These legal challenges could be costly and damaging to its reputation.

- International expansion challenges: Expanding into new markets requires navigating different regulatory frameworks and consumer preferences, which presents significant challenges.

Economic Downturn and Default Rates

Economic downturns can significantly increase default rates on BNPL loans, impacting Klarna's profitability and financial stability.

- Correlation between economic downturns and BNPL default rates: Historical data shows a strong correlation between economic recessions and increased defaults on BNPL loans. Klarna's risk management strategies will be crucial during economic uncertainty.

- Klarna's risk management strategies: Klarna employs various risk management strategies to mitigate default risk, but their effectiveness during a severe recession remains to be seen.

- Potential impact on profitability: Increased default rates directly impact Klarna's profitability, potentially leading to losses. Its ability to manage risk effectively will significantly determine its financial resilience.

Valuation and Investment Considerations

Klarna's IPO valuation is a critical aspect for potential investors. Analyzing its valuation metrics against industry benchmarks helps determine if the price is justified.

IPO Pricing and Valuation Metrics

Determining whether Klarna's IPO price is justified requires a careful analysis of its valuation metrics.

- Price-to-earnings ratio (P/E): Since Klarna is not yet profitable, a traditional P/E ratio is not applicable. Other valuation metrics need to be used.

- Price-to-sales ratio (P/S): The P/S ratio provides a relative valuation based on revenue. Comparing this to competitors helps assess whether Klarna is overvalued or undervalued.

- Other relevant valuation metrics: Other metrics, such as revenue growth rate and market share, need to be considered alongside the P/S ratio to gain a comprehensive picture.

Investment Strategy and Risk Tolerance

Klarna's suitability as an investment depends on individual investor profiles and risk tolerances.

- Long-term vs. short-term investment horizons: Investing in Klarna requires a long-term perspective, given its current focus on growth over immediate profitability.

- Risk tolerance levels: Klarna is a relatively high-risk investment due to its dependence on a rapidly evolving market and exposure to regulatory changes and economic fluctuations.

- Diversification strategies: Investors should consider diversifying their portfolios to mitigate the risks associated with investing in a single company, especially one in a relatively new and volatile sector.

Conclusion: Is Klarna a Good Investment for You?

Klarna's $1 billion IPO presents a complex investment proposition. While its significant revenue growth and market position are attractive, substantial risks exist related to regulatory scrutiny, economic vulnerability, and intense competition. The valuation, even using alternative metrics like P/S ratio, requires careful consideration against future projections and the inherent uncertainties of the BNPL market.

Whether Klarna is a "good" investment depends heavily on your individual risk tolerance, investment horizon, and diversification strategy. While the potential for growth in the BNPL market is undeniable, thorough due diligence is crucial before investing in Klarna's IPO or any other buy now, pay later stock. Weigh the risks and rewards carefully before making your decision.

Featured Posts

-

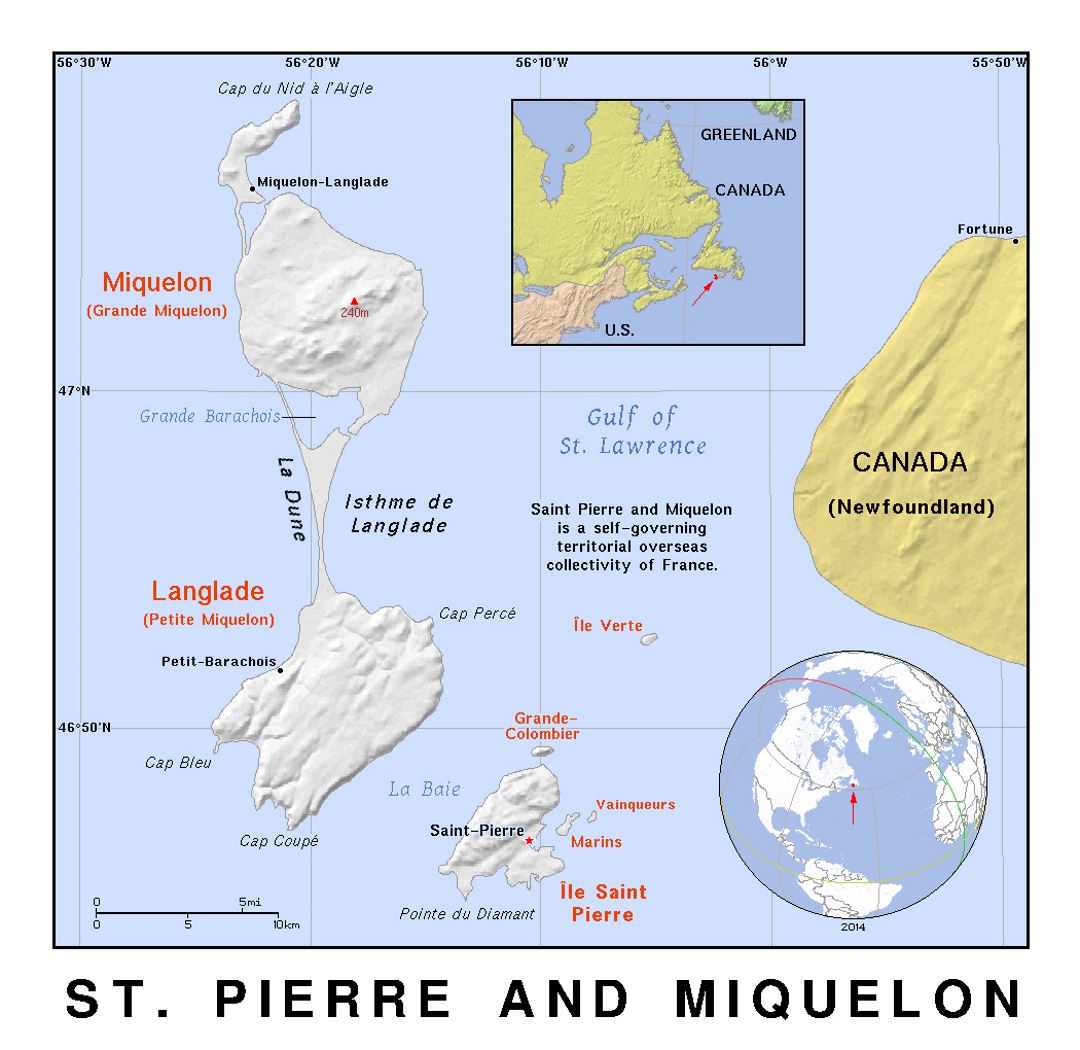

Saint Pierre Et Miquelon Humour Et Reponse Aux Oqtf De Wauquiez

May 14, 2025

Saint Pierre Et Miquelon Humour Et Reponse Aux Oqtf De Wauquiez

May 14, 2025 -

Global Tech Ipo Market Slowdown The Impact Of Tariffs

May 14, 2025

Global Tech Ipo Market Slowdown The Impact Of Tariffs

May 14, 2025 -

Le Nombre De Droits De Vote Eramet Acces Aux Informations

May 14, 2025

Le Nombre De Droits De Vote Eramet Acces Aux Informations

May 14, 2025 -

Depart D Alexis Kohler Emmanuel Macron Perd Un Pilier Cle

May 14, 2025

Depart D Alexis Kohler Emmanuel Macron Perd Un Pilier Cle

May 14, 2025 -

Giants Franchise A Legacy Forged In Legend

May 14, 2025

Giants Franchise A Legacy Forged In Legend

May 14, 2025