Is Jim Cramer Right About CoreWeave (CRWV)? Analyzing Its AI Infrastructure Potential

Table of Contents

CoreWeave's Business Model and Competitive Advantages

H3: Data Center Infrastructure and GPU Power: CoreWeave's foundation lies in its impressive data center infrastructure, specifically its massive deployment of NVIDIA GPUs. These Graphics Processing Units (GPUs) are the workhorses of modern AI, crucial for the computationally intensive tasks of AI model training and inference. CoreWeave's platform boasts exceptional scalability, allowing it to handle the ever-increasing demands of sophisticated AI applications. This focus on GPU computing, a critical component of cloud computing for AI, positions CoreWeave as a key player in the high-performance computing landscape.

H3: Targeting the AI Market: CoreWeave has strategically positioned itself to serve the rapidly expanding AI market. Its client base includes both burgeoning AI startups, eager to leverage its powerful infrastructure, and established large enterprises seeking to bolster their own AI initiatives. CoreWeave's services extend to various stages of the AI lifecycle, from AI model training demanding immense computing power to AI inference, the real-time application of AI models. This comprehensive approach to servicing the machine learning and broader AI market is a major competitive advantage.

- Examples: CoreWeave has partnered with several prominent AI companies, including [Insert specific examples of partnerships if available].

- Competition: While facing stiff competition from giants like AWS, Google Cloud, and Azure, CoreWeave differentiates itself through its specialized focus on GPU-powered cloud computing specifically tailored for AI workloads. Its pricing models and support for specialized AI frameworks offer unique selling propositions.

- Unique Selling Propositions: CoreWeave's dedication to providing highly optimized infrastructure for AI, coupled with its scalable and cost-effective solutions, sets it apart in a crowded market.

Analyzing CoreWeave's Financial Performance and Growth Potential

H3: Revenue Growth and Profitability: [Insert analysis of CoreWeave's financial statements, if publicly available, focusing on revenue growth, profitability margins, and key financial ratios. Include specific data points and visual representations like charts and graphs to support the analysis. For example: "CoreWeave's Q[quarter] revenue showed a [percentage]% increase compared to the same period last year, indicating strong growth in the AI infrastructure sector." or "Profit margins, while still developing, show a promising trajectory, suggesting increasing operational efficiency."]

H3: Future Projections and Market Valuation: Industry analysts offer varied predictions for CoreWeave's future growth, with some forecasting significant expansion driven by increased demand for AI infrastructure. [Insert analysis of market projections, mentioning specific figures and sources. Discuss whether the current market capitalization aligns with these growth projections and the company's potential. For example: "Analyst projections suggest a market valuation of [X] within the next [Y] years, indicating significant potential for growth. However, achieving this valuation hinges on CoreWeave's ability to maintain its current momentum and navigate the competitive landscape effectively."]

- Financial Data Points: [Include specific financial metrics like revenue growth rate, EBITDA margins, etc., and cite the source of this data].

- Charts and Graphs: [Include visual representations of financial data to aid understanding and engagement].

- Risks and Challenges: The rapid evolution of AI technology and intense competition from established cloud providers pose significant challenges. Maintaining its technological edge and securing strategic partnerships will be crucial for CoreWeave's continued success.

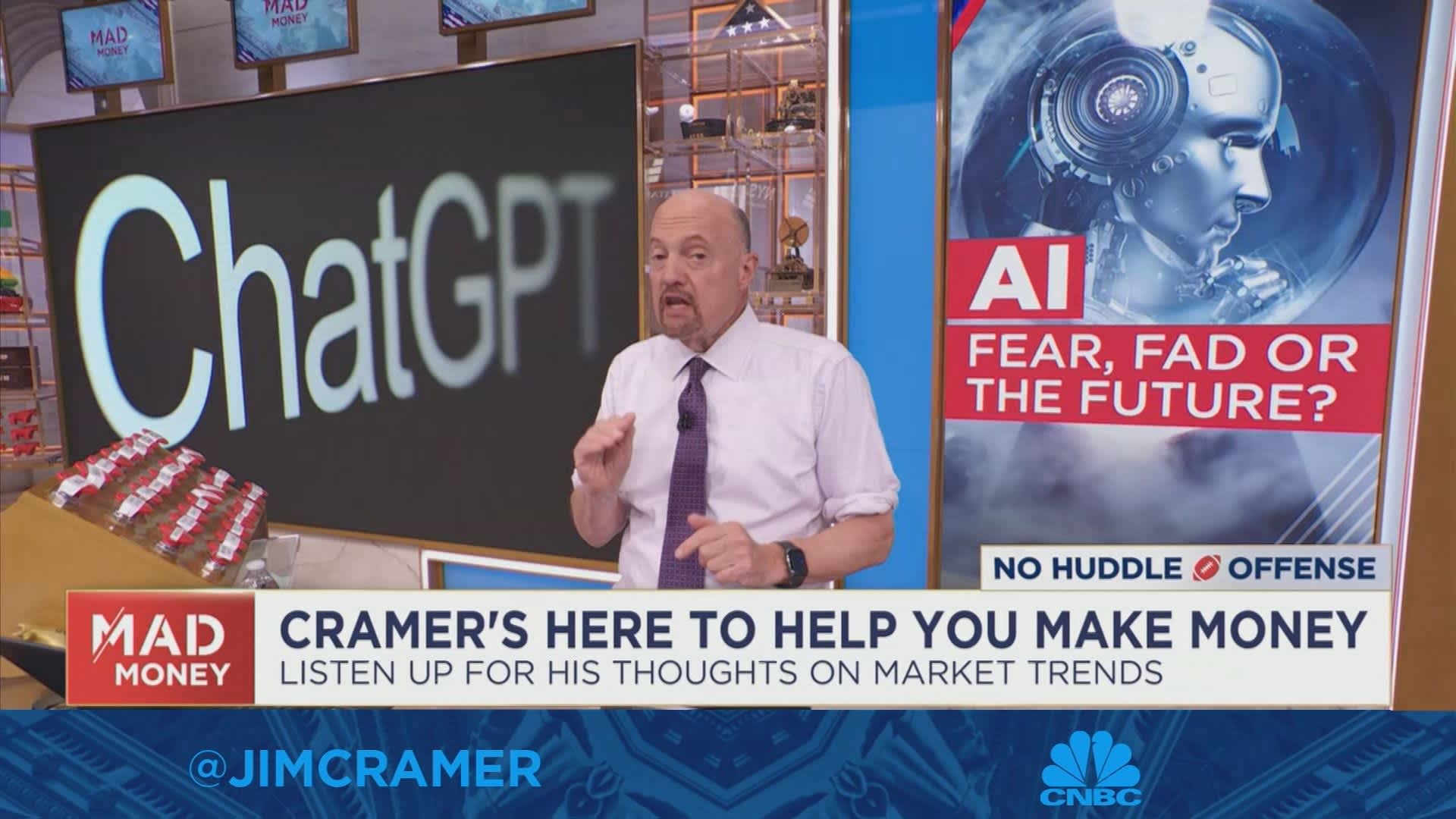

Evaluating Jim Cramer's Investment Advice in Light of CoreWeave's Potential

H3: Jim Cramer's Statements on CoreWeave: [Summarize Jim Cramer's public statements or opinions on CoreWeave (CRWV), citing specific sources, like specific show segments or articles. Provide a balanced overview, including both positive and negative remarks if any exist].

H3: Comparing Cramer's View with Market Analysis: [Compare and contrast Jim Cramer's assessment with independent market analyses and expert opinions on CoreWeave's future prospects. Include various perspectives to offer a comprehensive picture. Consider whether the general consensus among analysts aligns with Cramer's view].

- Cramer's Track Record: [Briefly discuss Jim Cramer's historical track record to provide context to his opinions, acknowledging his influence but also his occasional inconsistencies].

- Analyst Sentiment: [Summarize the overall sentiment of financial analysts and industry experts regarding CoreWeave's potential and market prospects].

- Alignment with Data: [Analyze whether Cramer's prediction aligns with the objective data and analysis presented in the preceding sections, highlighting points of agreement and disagreement].

Conclusion: Is CoreWeave (CRWV) a Smart AI Infrastructure Investment?

Our analysis suggests that CoreWeave's AI infrastructure potential is significant, driven by its strong data center infrastructure, strategic focus on the AI market, and impressive growth potential. However, whether this potential justifies the current market valuation and fully aligns with Jim Cramer's assessment is a nuanced question. While CoreWeave possesses significant strengths, investors must carefully consider the risks inherent in the volatile AI infrastructure market and the intense competition.

The central argument remains that CoreWeave’s prospects in the AI infrastructure sector are compelling, though whether its valuation currently reflects this potential and entirely concurs with Jim Cramer's prediction requires thorough investigation.

Therefore, before investing in CoreWeave (CRWV), we strongly encourage further research on CoreWeave (CRWV), assessing the AI infrastructure market as a whole, and adopting diligent investment strategies. The information provided here should serve as a starting point for your own comprehensive due diligence. Remember, investing in the rapidly evolving AI infrastructure market requires a thorough understanding of the risks and potential rewards.

Featured Posts

-

Heartwarming Meaning Behind Peppa Pigs New Baby Sisters Name Revealed

May 22, 2025

Heartwarming Meaning Behind Peppa Pigs New Baby Sisters Name Revealed

May 22, 2025 -

Cassis Blackcurrant From Vine To Glass A Journey Of Taste

May 22, 2025

Cassis Blackcurrant From Vine To Glass A Journey Of Taste

May 22, 2025 -

Analysis Of Thames Water Executive Bonuses Value For Money

May 22, 2025

Analysis Of Thames Water Executive Bonuses Value For Money

May 22, 2025 -

Peppa Pigs New Baby Sister A Girl

May 22, 2025

Peppa Pigs New Baby Sister A Girl

May 22, 2025 -

Jim Cramer And Core Weave Crwv Is It A Winning Ai Infrastructure Investment

May 22, 2025

Jim Cramer And Core Weave Crwv Is It A Winning Ai Infrastructure Investment

May 22, 2025

Latest Posts

-

Tough Wordle Today March 26 Nyt Wordle Answer Revealed

May 22, 2025

Tough Wordle Today March 26 Nyt Wordle Answer Revealed

May 22, 2025 -

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025 -

Todays Nyt Wordle Answer March 26 A Tough One To Crack

May 22, 2025

Todays Nyt Wordle Answer March 26 A Tough One To Crack

May 22, 2025 -

How To Solve Wordle 1366 Hints And Answer For March 16th

May 22, 2025

How To Solve Wordle 1366 Hints And Answer For March 16th

May 22, 2025 -

Wordle Hints And Answer For March 18th 2024 1368

May 22, 2025

Wordle Hints And Answer For March 18th 2024 1368

May 22, 2025