Is Betting On Natural Disasters Like The LA Wildfires The Next Big Thing?

Table of Contents

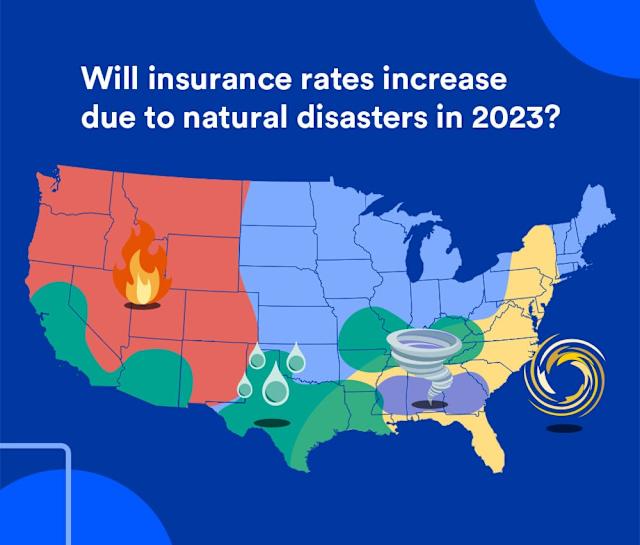

The Growing Market for Disaster Prediction and Insurance Derivatives

The insurance industry, long attuned to assessing and managing risk, is at the forefront of natural disaster prediction. Their sophisticated use of data underpins the potential for a thriving disaster betting market.

How Insurance Companies Use Data

Insurance companies leverage a wealth of data to predict and price risk. This includes:

- Sophisticated algorithms and AI: These powerful tools analyze historical wildfire patterns, climate data, and real-time weather information to predict wildfire severity and spread with increasing accuracy.

- Predictive modeling: These models help estimate the likelihood of payouts, influencing the potential for accurate betting markets. The more precise the prediction, the more attractive the market becomes for investors.

- Catastrophe bonds and other financial instruments: These instruments are linked to the occurrence of specific catastrophic events, offering a way to transfer risk and potentially create a market for speculative investment. The pricing of these bonds directly reflects the predicted likelihood of a disaster.

This intricate interplay between data analysis, risk assessment, and financial instruments creates fertile ground for the emergence of a disaster betting market.

The Ethical Quandaries of Betting on Natural Disasters

The prospect of profiting from the destruction caused by natural disasters raises significant ethical concerns.

Profiting from Suffering

Betting on disasters like the LA wildfires carries a weighty moral burden.

- Trivializing human suffering: Critics argue that such betting markets trivialize the immense suffering and loss experienced by victims. The focus shifts from empathy and aid to financial speculation.

- Exacerbating societal inequalities: Those who can afford to bet might profit from the misfortunes of those least able to recover. This could deepen existing societal inequalities and further marginalize vulnerable populations.

- Impact on disaster relief efforts: Large-scale bets against disaster occurrences could potentially discourage investment in robust disaster relief efforts, as some might see profit in the event of a catastrophe.

These ethical considerations cast a long shadow over the potential growth of disaster betting and demand careful consideration.

The Legal Landscape of Disaster Betting

The legal status of disaster betting remains largely uncharted territory.

Current Regulations and Future Possibilities

Current gambling regulations are often ill-equipped to address the unique challenges posed by betting on natural disasters.

- Market manipulation and insider trading: Concerns exist about the potential for market manipulation and insider trading, particularly with access to advanced prediction models and privileged information.

- Existing gambling regulations: Existing frameworks may not adequately address the specific risks associated with disaster betting. The unpredictable nature of natural events creates unique challenges for regulation.

- Future legislation: The unique ethical and financial implications of disaster betting may necessitate the creation of specific legislation to regulate this emerging market.

Navigating the legal complexities is crucial for the responsible development (or prevention) of a disaster betting market.

The Future of Disaster Betting: Opportunities and Challenges

Technological advancements are playing a key role in shaping the future of disaster betting.

Technological Advancements and Market Growth

Increased accuracy in forecasting is a double-edged sword, presenting both opportunities and challenges.

- AI-powered prediction: AI and machine learning are rapidly improving the accuracy of natural disaster prediction, making disaster betting markets potentially more efficient and attractive.

- Specialized disaster betting markets: The creation of niche markets, focusing on specific events or regions, might emerge as prediction models become more refined.

- Factors influencing market growth: The growth of this market depends on factors like regulatory frameworks, public perception, and the continued advancement of predictive technologies. Ethical concerns will also play a significant role.

Conclusion

The possibility of betting on natural disasters like the LA wildfires presents a fascinating, albeit ethically complex, scenario. While advancements in natural disaster prediction create opportunities for new financial markets, the potential for exploitation and the trivialization of human suffering cannot be ignored. Understanding the complexities of disaster betting, examining the ethical dimensions of wildfire betting, and considering the social impact are crucial steps in navigating this emerging and contentious field. We encourage readers to further investigate the ethical considerations, examine current disaster relief efforts, and continue to follow developments in disaster prediction technologies to fully grasp the implications of this evolving market.

Featured Posts

-

Todays Nyt Mini Crossword Answers March 20 2025

May 21, 2025

Todays Nyt Mini Crossword Answers March 20 2025

May 21, 2025 -

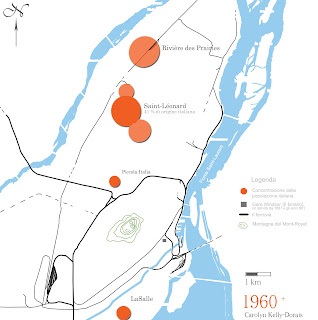

Decouvrir La Petite Italie De L Ouest Architecture Toscane Et Charme Inattendu

May 21, 2025

Decouvrir La Petite Italie De L Ouest Architecture Toscane Et Charme Inattendu

May 21, 2025 -

L Essor Des Tours A Nantes Et Ses Consequences Sur Le Metier De Cordiste

May 21, 2025

L Essor Des Tours A Nantes Et Ses Consequences Sur Le Metier De Cordiste

May 21, 2025 -

Occasionverkoop Abn Amro Flinke Groei Dankzij Meer Autobezit

May 21, 2025

Occasionverkoop Abn Amro Flinke Groei Dankzij Meer Autobezit

May 21, 2025 -

Trans Australia Run Challenging The Existing World Record

May 21, 2025

Trans Australia Run Challenging The Existing World Record

May 21, 2025

Latest Posts

-

Avauskokoonpano Julkistettu Glen Kamara Ja Teemu Pukki Vaihdossa

May 21, 2025

Avauskokoonpano Julkistettu Glen Kamara Ja Teemu Pukki Vaihdossa

May 21, 2025 -

Avauskokoonpano Paljastui Kamara Ja Pukki Vaihtopenkillae

May 21, 2025

Avauskokoonpano Paljastui Kamara Ja Pukki Vaihtopenkillae

May 21, 2025 -

Jacob Friis Julkisti Avauskokoonpanonsa Kamara Ja Pukki Vaihdossa

May 21, 2025

Jacob Friis Julkisti Avauskokoonpanonsa Kamara Ja Pukki Vaihdossa

May 21, 2025 -

Jalkapallo Kamara Ja Pukki Sivussa Avauskokoonpanosta

May 21, 2025

Jalkapallo Kamara Ja Pukki Sivussa Avauskokoonpanosta

May 21, 2025 -

Endgueltige Formgebung Die Architektin Entscheidet Am Bau

May 21, 2025

Endgueltige Formgebung Die Architektin Entscheidet Am Bau

May 21, 2025