Is Apple Stock A Buy? Q2 Earnings And Key Support Levels

Table of Contents

Apple's Q2 2024 Earnings Report: A Deep Dive

Apple's Q2 2024 earnings report provided a mixed bag for investors. While some areas exceeded expectations, others fell short, creating a complex picture for assessing the current value of Apple stock. Analyzing key financial metrics is crucial to understanding this complexity. Let's examine the numbers:

-

Revenue Growth or Decline: [Insert actual data here – e.g., Revenue was up/down X% compared to Q2 2023, totaling $Y billion. This represents a Z% increase/decrease compared to analyst predictions]. This change can be attributed to [mention key factors, e.g., strong iPhone sales, weaker Mac demand].

-

EPS Performance: [Insert actual data here – e.g., Earnings per share came in at $X, compared to $Y last year and analyst expectations of $Z]. A higher/lower EPS than anticipated suggests [explain the implication, e.g., positive investor sentiment/concerns about future profitability].

-

Product Segment Performance: The iPhone remains Apple's flagship product, and its performance [explain the performance - e.g., continued to be the revenue driver, exceeding expectations]. The Mac segment, however, showed [explain the performance - e.g., weaker-than-expected sales, likely due to the current macroeconomic climate]. The Services segment, a crucial driver of long-term growth, [explain performance - e.g., continues to perform strongly, showing consistent year-over-year growth].

-

Significant Announcements/Guidance: Apple's management provided [summarize key announcements and guidance for the coming quarters – e.g., guidance for future quarters was cautious, reflecting global economic uncertainty]. This outlook should be factored into any investment decision.

These Apple Q2 earnings and Apple financial results paint a nuanced picture, requiring a careful consideration of Apple EPS and Apple revenue growth before forming a conclusion on whether to buy Apple stock.

Identifying Key Support Levels for Apple Stock

Understanding Apple support levels is essential for any investor considering buying Apple stock. Support levels represent price points where buying pressure is expected to outweigh selling pressure, potentially preventing further declines. Several technical indicators help identify these levels:

-

Moving Averages: Analyzing 50-day and 200-day moving averages can reveal potential support areas. [Explain the current state of these averages and their implication for support levels].

-

Fibonacci Retracements: This technical tool identifies potential support and resistance levels based on Fibonacci ratios. [Explain the results of a Fibonacci analysis on the Apple stock chart].

-

Psychological Support Levels: Round numbers like $150, $160, and $170 often act as significant psychological support levels. [Discuss the significance of these levels based on the current chart].

Based on this technical analysis of Apple, potential Apple support levels are identified at [list specific price points]. Breaking below these levels could indicate further downward pressure, while holding above them could suggest a potential rebound. The Apple stock chart needs to be carefully monitored to observe the stock's behavior around these levels. A breakdown of these key support levels would significantly impact Apple stock price prediction.

Assessing the Risk and Reward of Investing in Apple Stock

The decision of whether to buy Apple stock requires weighing potential risks and rewards within the context of the broader market.

-

Market Conditions: Current macroeconomic conditions [describe the current economic climate – e.g., high inflation, rising interest rates] present challenges but also opportunities for strategic investments.

-

Competitive Landscape: Apple faces competition from [list key competitors – e.g., Samsung, Google] in various product categories. However, Apple's strong brand loyalty and innovative products give it a competitive edge.

-

Long-Term Growth Prospects: Apple's continued expansion into new markets, such as augmented reality/virtual reality, and its strong performance in the services segment suggest considerable long-term growth potential.

-

Valuation, Dividend Yield, and Future Innovation: [Discuss the current valuation of Apple stock, its dividend yield, and expectations for future innovation]. These factors need to be considered alongside the risks.

Potential risks include economic downturns impacting consumer spending and increased competition. Potential rewards include long-term growth, dividend payments, and capital appreciation. A comparative analysis with other tech stocks will help investors determine if Apple offers a favorable Apple stock valuation. Understanding Apple stock risks is just as crucial as identifying Apple long-term growth opportunities to formulate a sound Apple investment strategy.

Conclusion: Is Apple Stock a Buy? The Verdict

Our analysis of Apple's Q2 earnings and key support levels paints a complex picture. While the Q2 report offered mixed results, the presence of identifiable support levels provides a potential cushion against further significant declines. The long-term growth prospects for Apple remain compelling, but the current macroeconomic climate introduces considerable uncertainty. Considering the risks and rewards, at this time, we [state your recommendation – e.g., lean towards a cautiously optimistic view, suggesting it might be a good time to consider adding Apple stock to a diversified portfolio]. However, remember, this is just an analysis; thorough individual research is essential before making any investment decision.

What are your thoughts on whether Apple stock is a buy? Share your analysis in the comments below! Remember to continue following updates on Apple stock and conduct your own Apple stock analysis before making any investment decisions. Consider whether buying Apple stock aligns with your personal Apple stock investment goals.

Featured Posts

-

Rising Gold Prices A Direct Result Of Trumps Eu Trade Actions

May 25, 2025

Rising Gold Prices A Direct Result Of Trumps Eu Trade Actions

May 25, 2025 -

2023 And Newer Porsche Macan Buyers Guide A Comprehensive Overview

May 25, 2025

2023 And Newer Porsche Macan Buyers Guide A Comprehensive Overview

May 25, 2025 -

A Focus On Collaboration Bangladeshs European Partnerships For Development

May 25, 2025

A Focus On Collaboration Bangladeshs European Partnerships For Development

May 25, 2025 -

A Fathers Determination Rowing Across Oceans For Sons 2 2 Million Medical Bill

May 25, 2025

A Fathers Determination Rowing Across Oceans For Sons 2 2 Million Medical Bill

May 25, 2025 -

Country Living Under 1m Buyer Success Stories

May 25, 2025

Country Living Under 1m Buyer Success Stories

May 25, 2025

Latest Posts

-

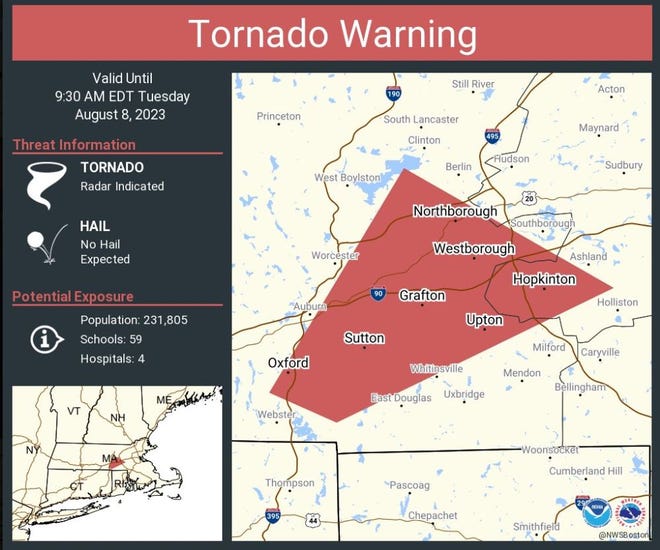

Flash Flood Watch Take Action Now In Hampshire And Worcester Counties

May 25, 2025

Flash Flood Watch Take Action Now In Hampshire And Worcester Counties

May 25, 2025 -

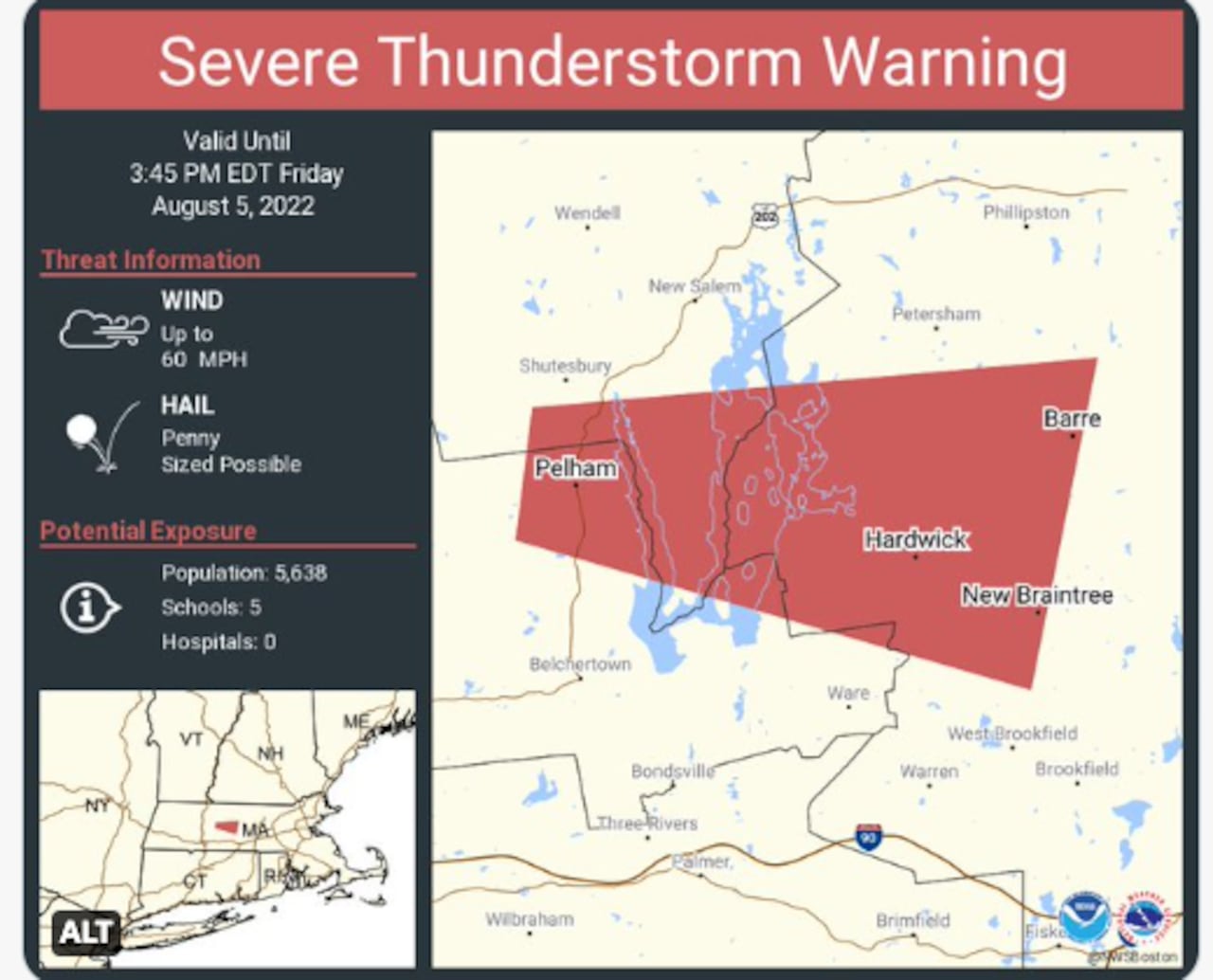

Severe Thunderstorms Bring Flash Flood Warning To Hampshire And Worcester

May 25, 2025

Severe Thunderstorms Bring Flash Flood Warning To Hampshire And Worcester

May 25, 2025 -

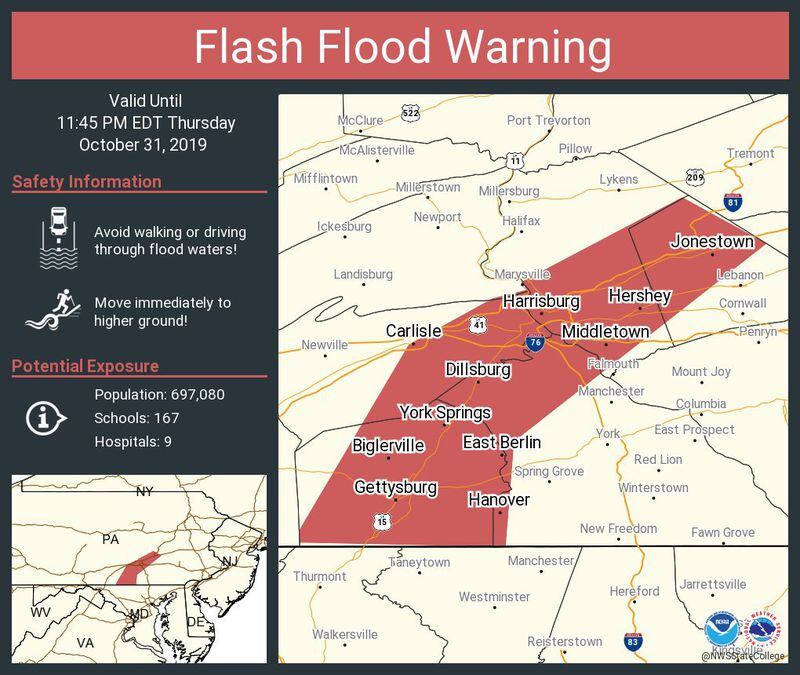

Urgent Flash Flood Warning Issued For Parts Of Pennsylvania

May 25, 2025

Urgent Flash Flood Warning Issued For Parts Of Pennsylvania

May 25, 2025 -

Flash Flood Warning Hampshire And Worcester Counties Thursday Night

May 25, 2025

Flash Flood Warning Hampshire And Worcester Counties Thursday Night

May 25, 2025 -

Pennsylvania Flash Flood Warning Extended To Thursday Morning

May 25, 2025

Pennsylvania Flash Flood Warning Extended To Thursday Morning

May 25, 2025