Is Apple Stock A Buy Ahead Of Q2 Results? Key Levels To Watch

Table of Contents

Analyzing Apple's Q1 Performance and Recent Trends

Apple's Q1 2024 performance provides crucial insights into the current state of the company and offers clues about the potential for future growth. Examining this performance is vital for any Apple stock forecast.

Revenue Growth and Key Product Performance

Apple's Q1 results revealed a mixed bag. While the iPhone continues to be a significant revenue driver, growth rates varied across product lines.

- iPhone Sales: While iPhone sales remained strong, year-over-year growth was slightly lower than anticipated, indicating potential market saturation or economic slowdown impacting consumer spending. Specific data on exact sales figures and growth percentages will be crucial for a precise Apple stock analysis once Q2 results are released.

- Mac Sales: Mac sales experienced a more significant decline compared to the previous year, potentially reflecting the global economic uncertainty and reduced consumer demand for higher-priced electronics. This trend needs close monitoring in the Apple stock forecast.

- Services Revenue: Apple's Services segment continues to be a significant growth area, demonstrating the company's recurring revenue streams and strong ecosystem. This consistently strong performance is a key factor in Apple investment decisions. The growth rate of this segment will be a key metric in future Apple stock price predictions.

- Wearables Performance: The Wearables, Home, and Accessories segment showcased solid growth, demonstrating the sustained popularity of Apple Watch and AirPods. This segment's continued strength contributes positively to overall Apple stock analysis.

Supply Chain and Economic Headwinds

Several external factors could influence Apple's Q2 performance.

- Supply Chain Disruptions: Although supply chain issues have eased compared to previous years, potential disruptions remain a risk. Geopolitical instability and unforeseen events could still create challenges for Apple's production and delivery timelines.

- Inflation and Consumer Spending: Persistently high inflation and rising interest rates are impacting consumer spending. This could lead to decreased demand for Apple products, particularly in higher-priced segments.

- Currency Fluctuations: Changes in foreign exchange rates can affect Apple's profitability, as a significant portion of its revenue comes from international markets.

Competitor Analysis

Apple faces ongoing competition from several tech giants.

- Samsung: Remains a key competitor, particularly in the smartphone and tablet markets. Samsung's aggressive pricing strategies and innovative features put pressure on Apple's market share.

- Google: Google's Android operating system continues to dominate the global smartphone market share, presenting an ongoing challenge for Apple's iOS ecosystem.

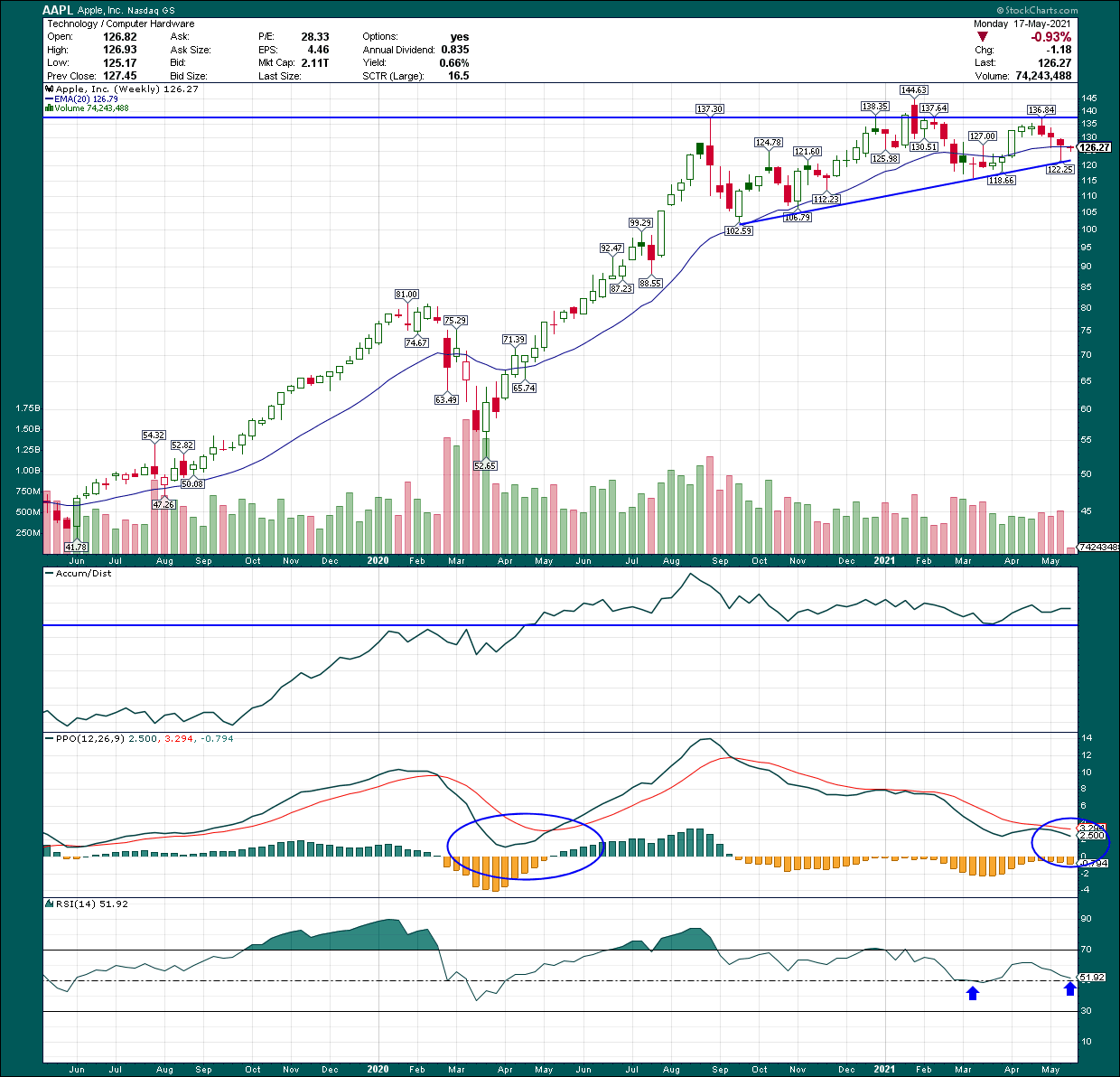

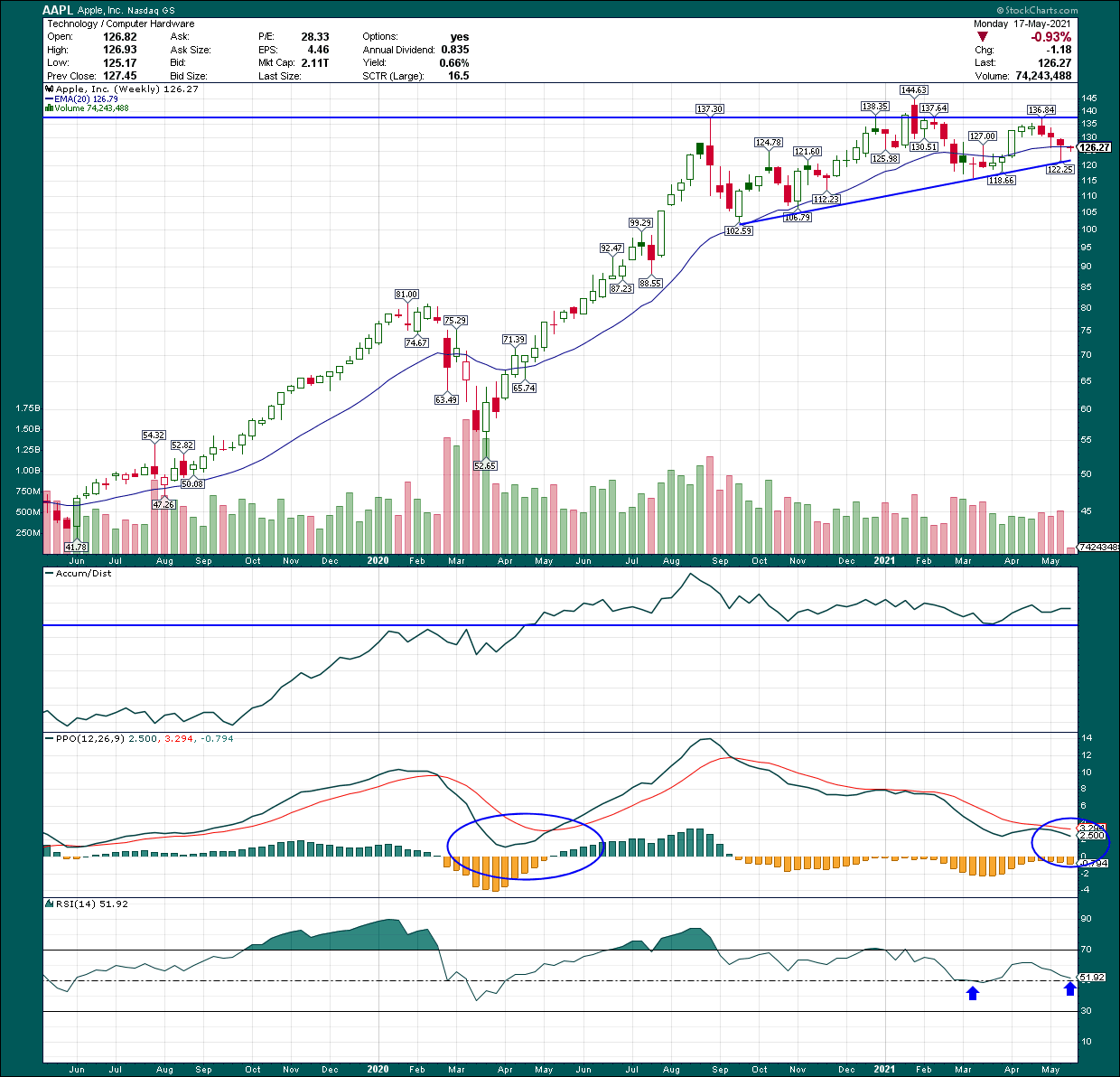

Key Price Levels to Watch Before and After Q2 Results

Analyzing key price levels is crucial for making informed investment decisions on Apple stock.

Technical Analysis of Apple Stock

Technical indicators suggest several key levels to watch for Apple stock.

- Support Levels: Prices around $150 and $160 could act as support levels, meaning a potential bounce back if the price drops to these levels. These support levels are based on previous price action and technical indicators such as moving averages.

- Resistance Levels: $170 and $180 might act as resistance levels, meaning potential selling pressure if the price attempts to break through these levels. These resistance levels are based on various technical analyses, which should be considered alongside fundamental analysis.

Market Sentiment and Investor Expectations

Market sentiment towards Apple is generally positive but subject to change based on the Q2 results.

- Analyst Ratings: Analyst ratings and price targets will be significantly influenced by the Q2 earnings report. Positive surprises could lead to upward revisions, while negative surprises could trigger downward revisions.

- Investor Expectations: High expectations surrounding the Q2 earnings could lead to volatility, even if the actual results are positive but fall slightly short of projections. Managing these expectations is crucial for any Apple investment.

Potential Catalysts and Risks for Apple Stock

Several factors could influence Apple's stock price in the coming months.

New Product Launches and Innovation

New product launches are potential catalysts for Apple stock.

- iPhone 15: The anticipated launch of the iPhone 15 series could significantly boost sales and investor confidence, potentially driving the Apple stock price higher. Innovative features and improved performance will be crucial for this success.

- Apple Watch and Other Products: New features and updates to existing product lines like the Apple Watch and AirPods will play a supporting role, contributing to the overall positive momentum in Apple stock.

Regulatory Risks and Geopolitical Concerns

Several risks could negatively impact Apple's performance.

- Antitrust Concerns: Ongoing antitrust investigations and regulatory scrutiny could lead to fines or other penalties, impacting profitability.

- Geopolitical Uncertainty: Geopolitical instability and trade disputes could disrupt supply chains and affect sales in various regions.

Conclusion

Analyzing Apple's Q1 performance, key price levels, and potential catalysts and risks suggests a mixed outlook for Apple stock ahead of Q2 results. While the company's strong services segment and anticipated product launches offer potential upside, economic headwinds and competitive pressures remain concerns. Whether Apple stock is a buy before Q2 results depends heavily on the specific numbers reported and the subsequent market reaction. The key price levels identified provide valuable reference points for monitoring Apple stock price movement.

Call to Action: Considering the analysis of Apple's Q1 performance and the key price levels to watch, carefully decide if Apple stock is a suitable addition to your investment portfolio before the Q2 results are announced. Conduct thorough research and consult with a financial advisor before making any investment decisions related to Apple stock or other tech stocks. Continue to monitor the Apple stock price and related news for further insights, using this analysis as a starting point for your own informed Apple stock investment strategy.

Featured Posts

-

Dax Fall Bei Frankfurter Aktienmarktoeffnung Am 21 Maerz 2025

May 24, 2025

Dax Fall Bei Frankfurter Aktienmarktoeffnung Am 21 Maerz 2025

May 24, 2025 -

Investigation Into La Landlord Practices Following Recent Wildfires

May 24, 2025

Investigation Into La Landlord Practices Following Recent Wildfires

May 24, 2025 -

2026 Porsche Cayenne Ev Spy Photos Reveal First Glimpses

May 24, 2025

2026 Porsche Cayenne Ev Spy Photos Reveal First Glimpses

May 24, 2025 -

Mia Farrows Career Revival The Influence Of Ronan Farrow

May 24, 2025

Mia Farrows Career Revival The Influence Of Ronan Farrow

May 24, 2025 -

Tathyr Atfaq Altjart Byn Washntn Wbkyn Ela Mwshr Daks Alalmany Qfzt Ila 24 Alf Nqtt

May 24, 2025

Tathyr Atfaq Altjart Byn Washntn Wbkyn Ela Mwshr Daks Alalmany Qfzt Ila 24 Alf Nqtt

May 24, 2025

Latest Posts

-

En Tutumlu 3 Burc Paranizi Nasil Koruyorlar

May 24, 2025

En Tutumlu 3 Burc Paranizi Nasil Koruyorlar

May 24, 2025 -

Financial Strain Impacts Auto Theft Prevention Measures Across Canada

May 24, 2025

Financial Strain Impacts Auto Theft Prevention Measures Across Canada

May 24, 2025 -

Londons Odd Burger A New Vegan Option At 7 Eleven In Canada

May 24, 2025

Londons Odd Burger A New Vegan Option At 7 Eleven In Canada

May 24, 2025 -

Rising Living Costs Lead To Compromised Vehicle Security In Canada

May 24, 2025

Rising Living Costs Lead To Compromised Vehicle Security In Canada

May 24, 2025 -

Odd Burgers Vegan Expansion A Nationwide 7 Eleven Launch

May 24, 2025

Odd Burgers Vegan Expansion A Nationwide 7 Eleven Launch

May 24, 2025