Is $5 Realistic? XRP Price Prediction And Future Analysis

Table of Contents

H2: Current Market Conditions and XRP's Position

The current market landscape significantly impacts any XRP price prediction. Several key factors are at play:

H3: Ripple's Ongoing Legal Battle

The SEC lawsuit against Ripple Labs casts a long shadow over XRP's price. The outcome will dramatically influence market sentiment and price action.

- Positive Outcome: A favorable ruling could unleash pent-up demand, leading to a significant surge in XRP's price. This could potentially unlock institutional investment previously hesitant due to regulatory uncertainty.

- Negative Outcome: An unfavorable ruling could further depress XRP's price, potentially leading to prolonged volatility and investor uncertainty. This scenario would likely negatively impact XRP's long-term prospects and future price predictions.

H3: Adoption and Partnerships

XRP's adoption rate by financial institutions is a critical factor in its price trajectory. The extent of its partnerships will play a vital role in its long-term success.

- Increased Partnerships: Growing collaborations with banks and payment processors could fuel demand and drive price appreciation. This demonstrates market confidence and increases the utility of XRP.

- Limited Adoption: Lack of widespread adoption could stifle price growth, as the demand for XRP would remain relatively low, limiting upward price pressure.

H3: Overall Market Sentiment

The broader cryptocurrency market sentiment significantly impacts XRP's price. Bitcoin's performance and overall regulatory developments influence investor confidence. Bearish market sentiment generally dampens XRP's price, while a bullish market tends to drive it higher.

H2: Technical Analysis of XRP

Technical analysis provides valuable insights into potential price movements. Examining XRP's charts and indicators helps predict future trends.

H3: Chart Patterns and Indicators

Analyzing XRP's price charts using indicators like moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) reveals potential support and resistance levels. Breakouts above resistance levels often signal bullish momentum, while breakdowns below support levels indicate bearish pressure. (Include relevant charts and visuals here)

H3: Historical Price Performance

Reviewing XRP's past price action identifies trends and patterns. Note significant historical highs and lows to gauge potential price targets. Analyzing historical volatility can also offer insights into expected future price swings.

H3: Volume and Liquidity

Examining trading volume and liquidity is essential. High trading volume accompanying price increases usually confirms a strong upward trend. Low liquidity can lead to significant price swings, increasing risk for investors.

H2: Fundamental Analysis of XRP

Fundamental analysis focuses on XRP's underlying technology, business model, and regulatory environment.

H3: Ripple's Technology and Use Cases

XRP's technology and its potential use cases in cross-border payments are vital to its long-term value. Its speed, efficiency, and low transaction costs are key advantages. However, competition from other cryptocurrencies and payment solutions needs to be considered.

H3: Ripple's Business Model and Revenue Streams

Ripple's financial health and ability to sustain the XRP ecosystem are crucial. Analyzing its revenue streams and overall financial stability provides insights into its long-term viability.

H3: Regulatory Landscape and Compliance

The regulatory landscape significantly impacts XRP's future. Changes in regulations in various jurisdictions can have a considerable effect on price predictions.

H2: $5 XRP: A Realistic Scenario?

Reaching a $5 XRP price hinges on several interacting factors.

H3: Factors Supporting a $5 Price

- Widespread adoption by financial institutions and businesses

- A positive resolution to the SEC lawsuit

- Sustained bullish market sentiment for cryptocurrencies

- Significant technological advancements and improved utility

H3: Challenges and Obstacles

- Continued legal battles and regulatory uncertainty

- Increased competition from other cryptocurrencies

- Market volatility and potential bear markets

- Lack of widespread adoption outside specific use cases

H3: Probability Assessment

Based on our analysis, reaching a $5 XRP price is possible but not guaranteed. Several favorable conditions need to align simultaneously. The likelihood hinges significantly on the resolution of the SEC lawsuit and the broader adoption of XRP by mainstream financial players.

3. Conclusion

This XRP price prediction analysis highlights the complex interplay of factors influencing XRP's price. While a $5 XRP price is a possibility, it's crucial to acknowledge significant challenges and uncertainties. The ongoing legal battle, market sentiment, and level of adoption all play pivotal roles in determining XRP's future price. Therefore, conducting thorough research and understanding the risks associated with XRP price prediction is crucial before making any investment decisions. Remember, all XRP price predictions are speculative, and investing in cryptocurrencies carries substantial risk.

Featured Posts

-

Addressing The Urgent Mental Health Crisis Among Canadian Youth Lessons Learned Globally

May 02, 2025

Addressing The Urgent Mental Health Crisis Among Canadian Youth Lessons Learned Globally

May 02, 2025 -

Ai Chip Export Restrictions Nvidia Ceos Urgent Appeal To Trump

May 02, 2025

Ai Chip Export Restrictions Nvidia Ceos Urgent Appeal To Trump

May 02, 2025 -

Digitaliser Vos Thes Dansants Simplifiez Votre Evenement

May 02, 2025

Digitaliser Vos Thes Dansants Simplifiez Votre Evenement

May 02, 2025 -

South Korean Supreme Court Reverses Lees Acquittal Casting Doubt On Election Run

May 02, 2025

South Korean Supreme Court Reverses Lees Acquittal Casting Doubt On Election Run

May 02, 2025 -

Hasbro Debuts Highly Anticipated Dash Rendar Figure From Star Wars Shadow Of The Empire

May 02, 2025

Hasbro Debuts Highly Anticipated Dash Rendar Figure From Star Wars Shadow Of The Empire

May 02, 2025

Latest Posts

-

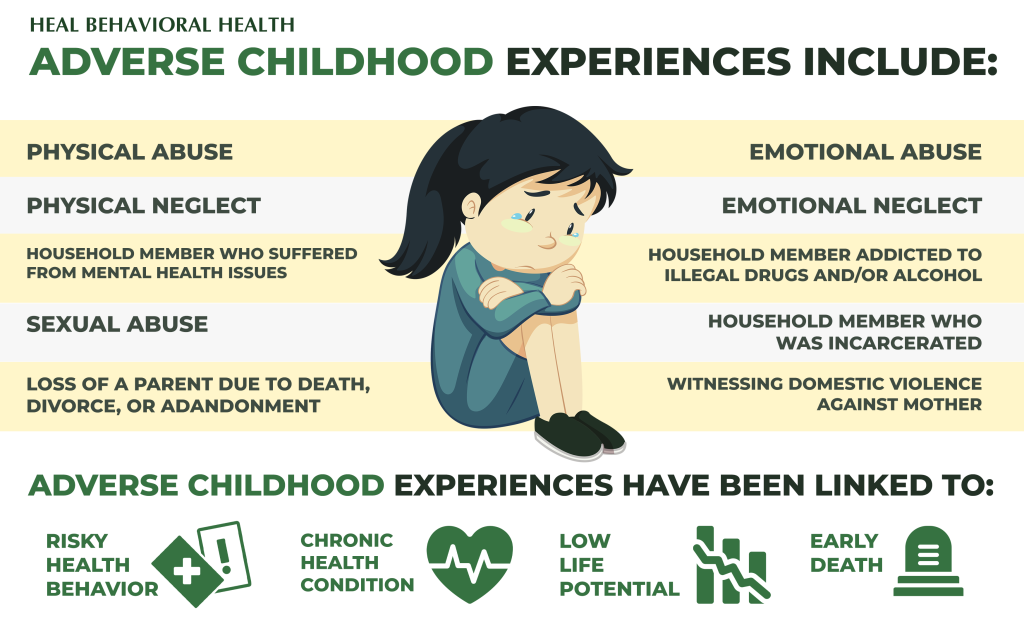

Protecting Our Future The Importance Of Investing In Childhood Mental Well Being

May 02, 2025

Protecting Our Future The Importance Of Investing In Childhood Mental Well Being

May 02, 2025 -

Childhood Mental Health An Urgent Call For Investment And Prevention

May 02, 2025

Childhood Mental Health An Urgent Call For Investment And Prevention

May 02, 2025 -

The High Cost Of Neglect Why Investing In Childhood Mental Health Matters

May 02, 2025

The High Cost Of Neglect Why Investing In Childhood Mental Health Matters

May 02, 2025 -

Investing In Childhood Mental Health A Critical Investment For The Future

May 02, 2025

Investing In Childhood Mental Health A Critical Investment For The Future

May 02, 2025 -

Invest In Childhood Preventing A Generations Mental Health Crisis

May 02, 2025

Invest In Childhood Preventing A Generations Mental Health Crisis

May 02, 2025