Iron Ore Falls: China's Steel Production Cuts Impact Global Markets

Table of Contents

China's Steel Production Slowdown: The Root Causes

China's reduced steel production is a multifaceted issue stemming from several key factors. Understanding these underlying causes is crucial to comprehending the current volatility in iron ore prices.

Reduced Infrastructure Spending

The Chinese government's commitment to curbing excessive debt and prioritizing sustainable development has led to a significant decrease in infrastructure projects. These large-scale projects, historically massive consumers of steel, are now being scaled back or delayed.

- Examples of reduced infrastructure projects: High-speed rail expansion, new bridge constructions, large-scale dam projects.

- Statistics on the decline in steel demand from infrastructure projects: Reports suggest a decline of X% in steel demand from infrastructure projects in the last year (replace X with actual data if available). This decrease directly translates to lower iron ore requirements.

- Keyword integration: China steel production, infrastructure projects, steel demand, iron ore consumption

Environmental Regulations and Carbon Emission Targets

China's increasingly stringent environmental regulations and ambitious carbon emission reduction targets are significantly impacting the steel industry. Steel production is an energy-intensive process, and efforts to curb pollution and meet emission goals are forcing steel mills to reduce output or adopt cleaner, but often more expensive, production methods.

- Specific examples of environmental regulations affecting steel mills: Stricter limits on emissions of particulate matter, sulfur dioxide, and nitrogen oxides. Increased scrutiny on water usage and wastewater discharge.

- Data on carbon emissions reduction targets and their impact on steel production: China's commitment to carbon neutrality is driving the implementation of stricter emission standards, leading to production cuts in some steel mills to comply.

- Keyword integration: Steel production, carbon emissions, environmental regulations, China steel industry, sustainable steel production

Real Estate Market Slowdown

The slump in China's real estate sector, a major consumer of steel for construction, has further exacerbated the decline in steel demand. The slowdown in property development and construction activities has directly reduced the need for steel, impacting iron ore prices.

- Statistics on the decline in real estate construction and its correlation with steel demand: Data showing a decrease in new housing starts and commercial construction projects, correlating directly with reduced steel demand.

- Analysis of the impact on related industries (cement, construction materials): The slowdown in real estate has created a ripple effect, affecting related industries reliant on steel and construction activity.

- Keyword integration: Real estate market, steel demand, construction activity, iron ore market, Chinese real estate

Impact on Global Iron Ore Prices and Markets

The reduced demand for steel from China has had a profound impact on global iron ore prices and markets, creating significant challenges for producers and consumers alike.

Price Volatility and Fluctuations

The decrease in Chinese steel production has resulted in a significant drop in iron ore prices, leading to considerable price volatility. This instability is creating uncertainty in the market.

- Charts illustrating the fluctuation of iron ore prices over the past year: (Include relevant charts and graphs showcasing price trends. Source the data appropriately).

- Comparison of current prices with historical averages: Highlighting the significant deviation from historical averages to illustrate the impact.

- Keyword integration: Iron ore price, iron ore market, price volatility, iron ore price forecast

Impact on Iron Ore Exporting Countries

Major iron ore exporting countries, such as Australia and Brazil, are heavily reliant on the Chinese market. The reduced demand and subsequent price drops have created significant economic challenges for these nations.

- Economic impact on individual exporting countries: Discuss the impact on GDP growth, employment rates, and government revenue in key exporting nations.

- Government responses and potential solutions: Analyze government strategies to mitigate the impact on their economies.

- Keyword integration: Iron ore exports, Australia iron ore, Brazil iron ore, global iron ore market, iron ore producers

Supply Chain Disruptions

The reduced demand for iron ore has created disruptions across the global supply chain. Shipping companies, logistics providers, and related industries are all feeling the impact.

- Impact on shipping companies and logistics providers: Analyze the effects on freight rates, vessel utilization, and profitability within the shipping industry.

- Potential long-term effects on the iron ore supply chain: Discuss potential restructuring, consolidation, and long-term adjustments within the industry.

- Keyword integration: Supply chain, logistics, iron ore shipping, global supply chain

Conclusion

China's steel production cuts are significantly impacting global iron ore prices and markets. The reduced demand stemming from infrastructure slowdown, environmental regulations, and the real estate market slump is creating volatility and challenges for iron ore exporting nations and the entire global supply chain. Understanding these dynamics is crucial for stakeholders to navigate the evolving landscape of the iron ore market. Stay informed about the latest developments in iron ore prices to make informed decisions in this fluctuating market. Monitoring the Chinese government's policies and the global steel demand is key to predicting future trends in iron ore prices and managing associated risks.

Featured Posts

-

Palantir Stock A Detailed Investment Assessment For 2024

May 10, 2025

Palantir Stock A Detailed Investment Assessment For 2024

May 10, 2025 -

Universitaria Transgenero Arrestada Uso De Bano Femenino Genera Controversia

May 10, 2025

Universitaria Transgenero Arrestada Uso De Bano Femenino Genera Controversia

May 10, 2025 -

Analyzing Elon Musks Net Worth The Role Of Us Economic Conditions

May 10, 2025

Analyzing Elon Musks Net Worth The Role Of Us Economic Conditions

May 10, 2025 -

Analysis Fox News Debate On Trump Tariffs And Economic Consequences

May 10, 2025

Analysis Fox News Debate On Trump Tariffs And Economic Consequences

May 10, 2025 -

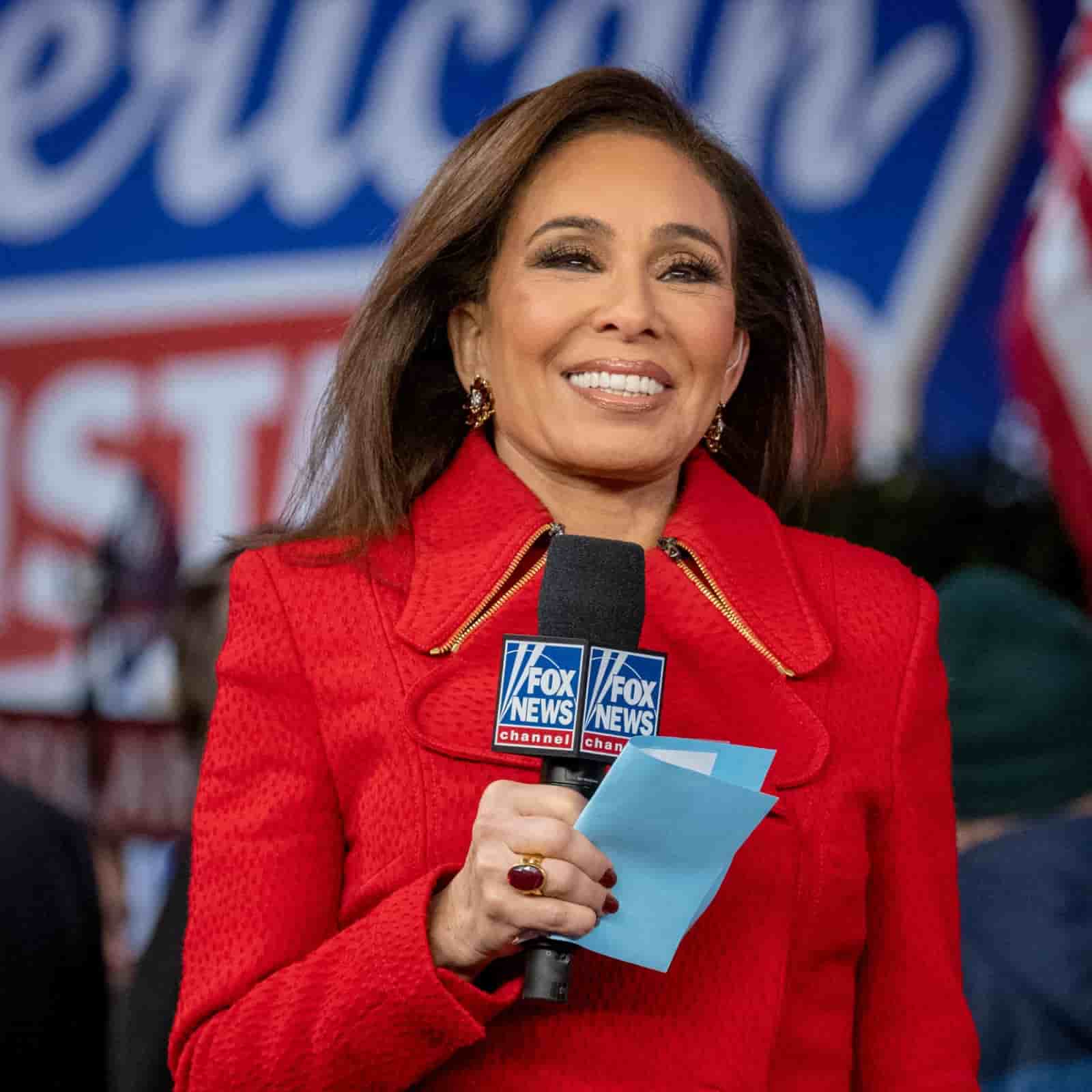

Jeanine Pirro Education Net Worth And Notable Achievements

May 10, 2025

Jeanine Pirro Education Net Worth And Notable Achievements

May 10, 2025