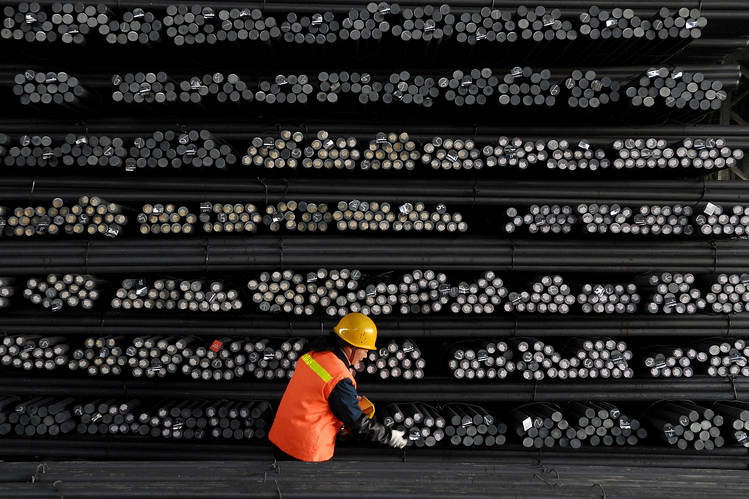

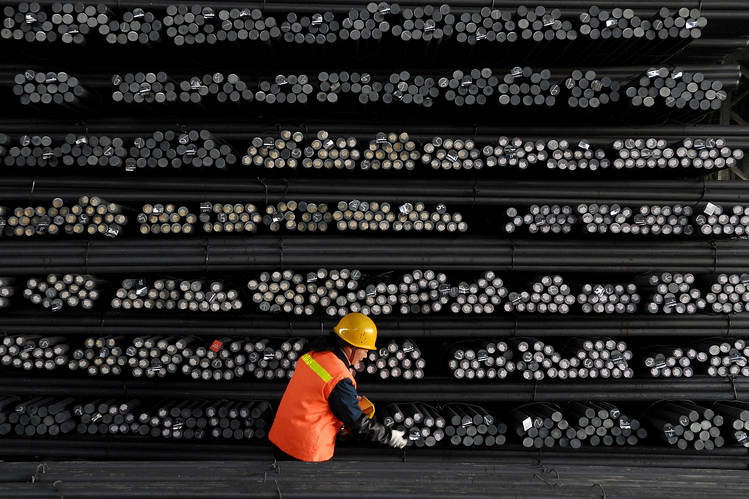

Iron Ore Falls As China Curbs Steel Output: Market Impact Analysis

Table of Contents

China's Steel Production Cuts: The Driving Force

China's actions are the primary catalyst for the current iron ore price downturn. Two key factors are at play: stringent environmental regulations and a slowdown in the real estate sector.

Environmental Regulations and Their Impact

China's commitment to environmental sustainability is significantly impacting steel production. The government has implemented stricter emission standards, leading to several consequences:

- Stricter emission standards lead to plant closures and production limitations: Many steel mills, particularly those with outdated or less efficient technologies, are facing closures or significant production cuts to meet these new standards. This directly reduces the demand for iron ore, a key raw material in steelmaking.

- Increased scrutiny of illegal and polluting steel production activities: The crackdown extends to illegal and polluting steel production, further squeezing overall output and impacting iron ore demand. Authorities are actively targeting operations that fail to comply with environmental regulations.

- Government initiatives promoting green steel production methods (but with slower implementation): While China is investing in greener steel production technologies, the transition is gradual. The immediate impact remains a reduction in overall steel output and consequently, a decrease in iron ore demand in the short term.

Real Estate Slowdown and its Ripple Effect

The ongoing slump in China's real estate sector is another significant contributor to the weakening demand for steel. The ripple effects are substantial:

- Reduced construction activity leads to lower steel consumption: The real estate slowdown directly translates into reduced construction activity, significantly impacting the demand for steel used in building infrastructure.

- Impact on infrastructure projects and related steel demand: The interconnectedness between real estate and infrastructure development means that a slowdown in one sector inevitably impacts the other, leading to further declines in steel and, consequently, iron ore demand.

- The interconnectedness of the real estate and steel sectors: These two sectors are heavily intertwined in China's economy. A weakening real estate market inevitably triggers a domino effect, impacting steel consumption and ultimately affecting iron ore prices.

Impact on Iron Ore Prices and Market Dynamics

The reduced demand from China has had a profound impact on iron ore prices and the overall market dynamics.

Price Volatility and Market Uncertainty

The decrease in Chinese steel production has created significant price volatility and uncertainty in the iron ore market:

- Sharp decline in iron ore spot prices: Spot prices for iron ore have experienced a sharp decline, reflecting the reduced demand from China.

- Increased market uncertainty and speculation: The uncertainty surrounding future Chinese steel production levels has fueled speculation and increased market volatility.

- Impact on iron ore mining companies and their profitability: Iron ore mining companies, particularly those heavily reliant on the Chinese market, are facing reduced profitability due to the lower prices.

Supply Chain Disruptions and Global Implications

The price fluctuations in the iron ore market are not confined to China; they're disrupting global supply chains:

- Impact on iron ore exporting nations (Australia, Brazil): Australia and Brazil, major iron ore exporters, are significantly affected by the reduced demand from China.

- Effects on steel prices and manufacturing costs globally: The decreased iron ore prices have an impact on global steel prices and manufacturing costs, potentially triggering adjustments across various industries.

- Potential for strategic adjustments by iron ore producers: Iron ore producers are likely to make strategic adjustments, including potential production cuts or diversification of their markets.

Future Outlook and Potential Scenarios

Predicting the future trajectory of iron ore prices requires careful consideration of several factors.

Projections for Steel Production and Iron Ore Demand

Analyzing future predictions for Chinese steel production is critical to understanding the iron ore market outlook:

- Forecasts from various market analysts and research firms: Different market analysts offer varying forecasts, reflecting the inherent uncertainties in the market.

- Potential for a rebound in steel demand (and thus, iron ore): While a decline is currently observed, some analysts predict a potential rebound in steel demand driven by infrastructure projects or a recovery in the real estate sector.

- Consideration of alternative steel production methods and their impact: The adoption of alternative steel production methods, such as green steel technologies, could influence future demand for iron ore.

Strategies for Market Participants

Navigating this challenging market requires strategic adjustments for various stakeholders:

- Risk mitigation strategies for iron ore producers: Producers need to implement risk mitigation strategies, such as diversification of markets or cost-cutting measures.

- Opportunities for investors in the changing market landscape: The current volatility creates both risks and opportunities for investors who can carefully assess the market dynamics.

- Potential for mergers and acquisitions in the industry: The changing market landscape could lead to consolidation through mergers and acquisitions among iron ore producers.

Conclusion

The decline in iron ore prices is a direct consequence of China's efforts to curb steel output, driven by environmental concerns and economic factors. This situation presents both challenges and opportunities for market participants. Understanding the complex interplay of environmental regulations, economic conditions, and market dynamics is crucial for navigating this volatile period. Staying informed about the latest developments in iron ore prices and China's steel production is essential for making informed decisions. Continue to monitor the situation and adapt your strategies accordingly to successfully navigate the evolving landscape of iron ore market analysis.

Featured Posts

-

Mestarien Liiga Bayern Muenchen Inter Ja Psg Seuraavassa Vaiheessa

May 09, 2025

Mestarien Liiga Bayern Muenchen Inter Ja Psg Seuraavassa Vaiheessa

May 09, 2025 -

Warren Buffetts Canadian Successor A Billionaires Berkshire Free Path

May 09, 2025

Warren Buffetts Canadian Successor A Billionaires Berkshire Free Path

May 09, 2025 -

Political Clash Aocs Criticism Of Trump And Fox News Response

May 09, 2025

Political Clash Aocs Criticism Of Trump And Fox News Response

May 09, 2025 -

Nhl News Leon Draisaitl Injured Impact On Oilers Offense

May 09, 2025

Nhl News Leon Draisaitl Injured Impact On Oilers Offense

May 09, 2025 -

Trumps Kennedy Center Visit Potential Les Miserables Cast Boycott

May 09, 2025

Trumps Kennedy Center Visit Potential Les Miserables Cast Boycott

May 09, 2025