Investor's Guide To Uber's April Double-Digit Stock Increase

Table of Contents

Analyzing the April Stock Surge: Key Factors Contributing to Uber's Double-Digit Growth

Several key factors contributed to Uber's impressive double-digit stock price increase in April 2023. Understanding these factors is crucial for assessing the current Uber stock performance and predicting future trends in Uber investment.

Improved Financial Performance

Uber's April stock surge was significantly driven by improved financial performance, signaling a positive shift in the company's trajectory. This was reflected in several key metrics:

- Increased Revenue: Uber reported a substantial increase in overall revenue compared to the previous quarter and the same period last year. This growth was driven by increased ride-sharing and Uber Eats orders.

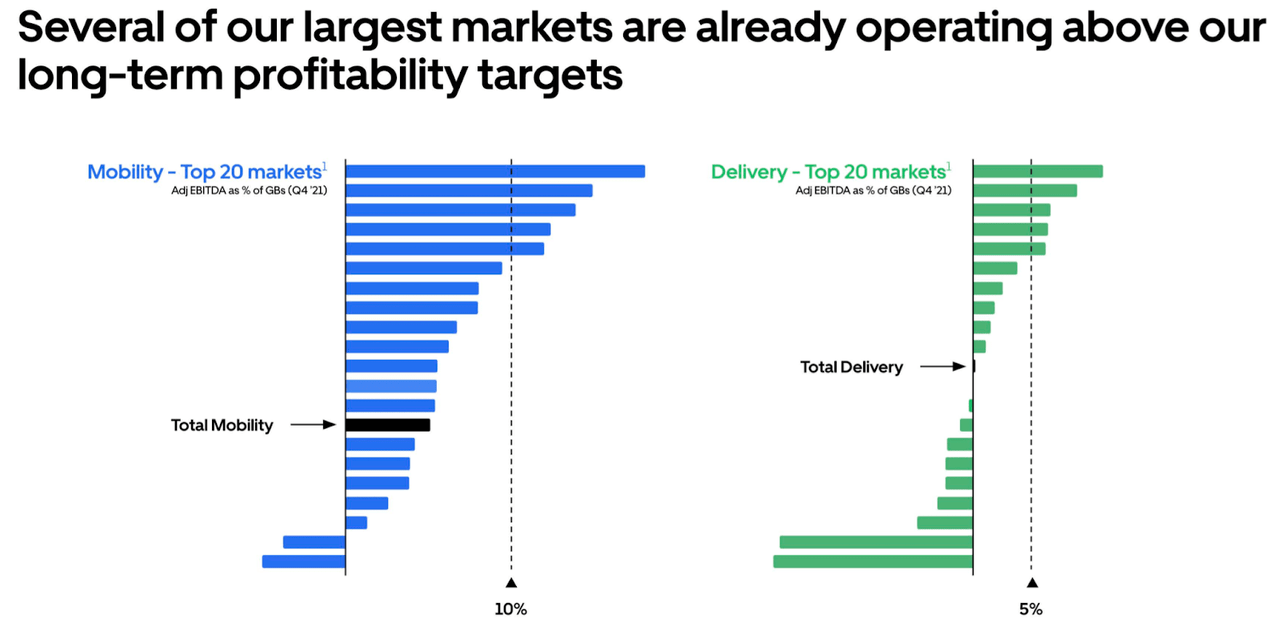

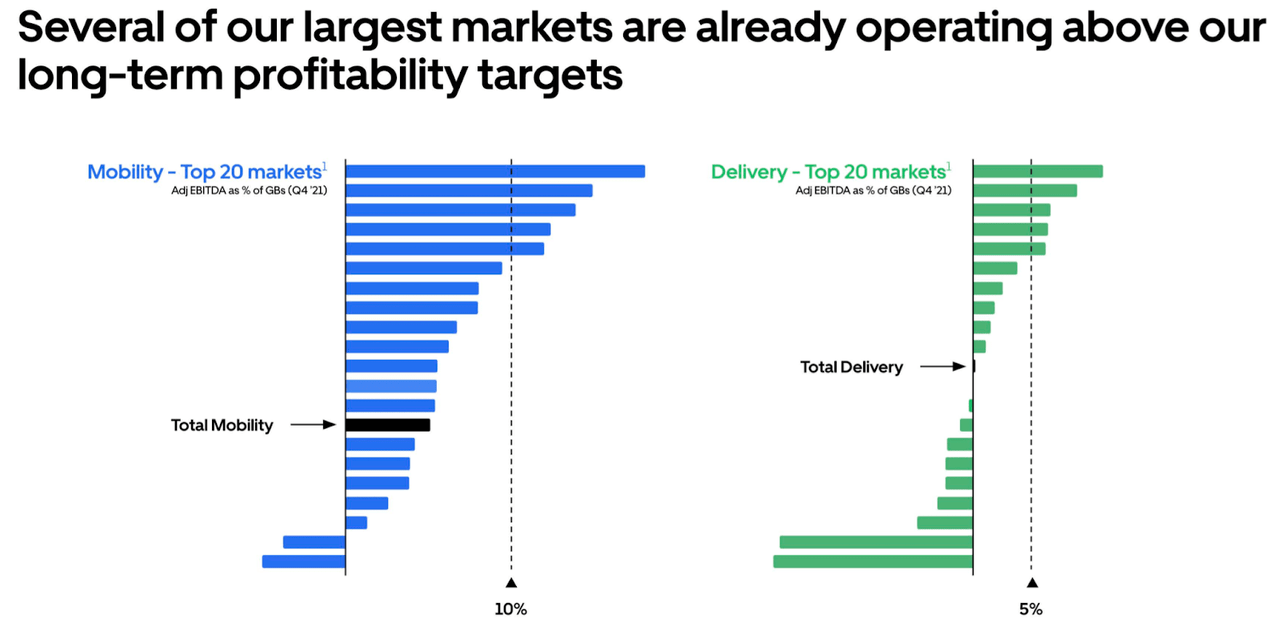

- Improved Profitability Margins (EBITDA): Uber demonstrated improved EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), indicating better cost management and operational efficiency.

- Successful Cost-Cutting Measures: Strategic cost-cutting initiatives contributed to enhanced profitability. These measures included streamlining operations and optimizing marketing spend.

- Growth in Key Markets: Uber saw particularly strong growth in specific geographic regions, demonstrating the effectiveness of its targeted expansion strategies. International markets played a significant role in this overall revenue growth.

- Strong Rider and Driver Numbers: An increase in both riders and drivers contributed to higher transaction volumes and ultimately boosted the company's bottom line.

These improvements in key financial metrics resonated positively with investors, boosting confidence in Uber's future prospects and fueling the April stock price surge. A detailed breakdown of these figures can be found in Uber's official earnings report for the relevant quarter.

Positive Market Sentiment and Investor Confidence

The April Uber stock surge wasn't solely driven by financial results; positive market sentiment and increased investor confidence played a crucial role.

- Positive Analyst Ratings: Several prominent financial analysts upgraded their ratings for Uber stock, citing improved financial performance and positive future outlook. These upgrades signaled increased confidence in the company's prospects.

- Increased Institutional Investment: Large institutional investors increased their holdings in Uber stock, reflecting a belief in the company's long-term growth potential and a positive outlook on Uber investment.

- Improved Outlook for the Ride-Sharing Market: The overall outlook for the ride-sharing market improved, benefiting Uber as a key player in the industry. This was fueled by factors such as increasing consumer demand and easing pandemic restrictions.

- Successful Strategic Initiatives: Uber's successful expansion into new markets and services, like the continued growth of Uber Eats and the development of its freight services, further enhanced investor confidence.

Technological Advancements and Innovation

Uber's ongoing investments in technology and innovation also contributed to the positive market sentiment and subsequent stock price increase.

- Investments in Autonomous Driving Technology: Continued investments in autonomous vehicle technology demonstrate Uber's commitment to long-term innovation and cost reduction, which were viewed favorably by investors.

- Improvements in the Uber App: Enhancements to the user experience and functionality of the Uber app improved customer satisfaction and efficiency, leading to increased usage and revenue generation.

- Expansion of Services: The expansion into new service areas, such as food delivery (Uber Eats), scooter rentals, and freight transportation, diversified Uber's revenue streams and reduced reliance on ride-sharing alone.

- Strategic Partnerships: Strategic partnerships with other companies further enhanced Uber's technological capabilities and market reach, boosting investor confidence.

Understanding the Risks Associated with Investing in Uber Stock

While the April stock surge is encouraging, investors should carefully consider the inherent risks associated with investing in Uber stock.

Market Volatility and Competition

The ride-sharing market is highly competitive and susceptible to volatility.

- Competition from Rivals like Lyft: Intense competition from Lyft and other ride-sharing companies puts pressure on Uber's pricing and market share, creating uncertainty.

- Fluctuating Fuel Prices: Fluctuations in fuel prices directly impact Uber's operational costs and profitability, creating financial uncertainty.

- Regulatory Hurdles in Different Markets: Varying regulations across different geographic regions can pose challenges to Uber's operations and expansion plans.

- Potential Economic Downturns Impacting Ride-Sharing Demand: Economic downturns can significantly reduce demand for ride-sharing services, affecting Uber's revenue and profitability.

These factors underscore the importance of conducting thorough due diligence before investing in Uber stock.

Long-Term Growth Prospects and Sustainability

Uber faces significant long-term challenges that investors must consider.

- Dependence on a Gig Economy Workforce: Uber's reliance on a gig economy workforce raises concerns regarding labor costs and potential regulatory changes impacting driver compensation and benefits.

- Challenges Related to Driver Compensation and Benefits: Ongoing debates around driver classification and benefits could lead to increased costs and potential legal challenges for Uber.

- Potential for Increased Regulation: Increased government regulation of the ride-sharing industry could significantly impact Uber's business model and profitability.

- Sustainability Initiatives and Their Impact on Profitability: Uber's commitment to environmental sustainability will likely involve significant investment and may impact short-term profitability.

Developing an Investment Strategy for Uber Stock

Developing a sound investment strategy is crucial for successfully navigating the complexities of the Uber stock market.

Diversification and Risk Management

Diversification is a cornerstone of successful investing.

- Importance of Diversification: Don't put all your eggs in one basket! Diversify your portfolio across different asset classes to mitigate risk.

- Allocating Appropriate Funds: Invest only what you can afford to lose. Avoid over-leveraging your investments.

- Considering Risk Tolerance: Assess your risk tolerance and choose investment strategies accordingly. Higher potential returns often come with higher risk.

- Setting Realistic Investment Goals: Define your financial goals and create a timeline for achieving them.

- Reviewing Financial News Regularly: Stay informed about market trends and news affecting Uber stock.

Long-Term vs. Short-Term Investment

Your investment timeframe significantly influences your strategy.

- Analyzing Long-Term Growth Potential: Assess Uber's long-term growth prospects based on its innovation, expansion plans, and competitive position.

- Assessing Short-Term Market Fluctuations: Be prepared for short-term volatility. Don't panic-sell during temporary market dips.

- Considering Different Investment Horizons: Determine if you are a long-term or short-term investor and tailor your strategy accordingly.

- Setting Stop-Loss Orders: Consider using stop-loss orders to limit potential losses.

Conclusion

Uber's April double-digit stock increase reflects the company's improving financial performance and positive market sentiment. This surge in Uber stock price signifies a positive shift in investor confidence. However, investors should acknowledge the associated risks, including market volatility, competition, and long-term sustainability challenges. A well-informed investment strategy, emphasizing diversification and risk management, is crucial for navigating the complexities of the stock market. By thoroughly analyzing Uber's financial health, competitive landscape, and long-term growth prospects, investors can make informed decisions regarding their Uber stock investment. Learn more about understanding and capitalizing on future Uber stock price movements and continue researching the Uber investment landscape to make the best choices for your portfolio.

Featured Posts

-

Michael Morales Quick Knockout Ufc Vegas 106 Headliner Reaction

May 18, 2025

Michael Morales Quick Knockout Ufc Vegas 106 Headliner Reaction

May 18, 2025 -

Michael Morales Winning Streak Continues Another Bonus At Ufc Vegas 106

May 18, 2025

Michael Morales Winning Streak Continues Another Bonus At Ufc Vegas 106

May 18, 2025 -

The Economic Benefits Of Large Scale Music Festivals

May 18, 2025

The Economic Benefits Of Large Scale Music Festivals

May 18, 2025 -

Destino Ranch Upgrades Media Infrastructure With Golden Triangle Ventures Lavish Entertainment And Viptio Partnership

May 18, 2025

Destino Ranch Upgrades Media Infrastructure With Golden Triangle Ventures Lavish Entertainment And Viptio Partnership

May 18, 2025 -

Ubers Past Kalanick Reveals Regret Over Specific Project Decision Decision

May 18, 2025

Ubers Past Kalanick Reveals Regret Over Specific Project Decision Decision

May 18, 2025

Latest Posts

-

Ahtfalat Alqyamt Fy Dyr Sydt Allwyzt Bth Mbashr Mn Alwkalt Alwtnyt Llielam

May 19, 2025

Ahtfalat Alqyamt Fy Dyr Sydt Allwyzt Bth Mbashr Mn Alwkalt Alwtnyt Llielam

May 19, 2025 -

Swr Wfydywhat Qdas Alqyamt Fy Dyr Sydt Allwyzt Tghtyt Alwkalt Alwtnyt Llielam

May 19, 2025

Swr Wfydywhat Qdas Alqyamt Fy Dyr Sydt Allwyzt Tghtyt Alwkalt Alwtnyt Llielam

May 19, 2025 -

Alwkalt Alwtnyt Llielam Tnql Mbashrt Qdas Alqyamt Mn Dyr Sydt Allwyzt

May 19, 2025

Alwkalt Alwtnyt Llielam Tnql Mbashrt Qdas Alqyamt Mn Dyr Sydt Allwyzt

May 19, 2025 -

Dyr Sydt Allwyzt Ystdyf Qdas Alqyamt Tqryr Shaml Mn Alwkalt Alwtnyt Llielam

May 19, 2025

Dyr Sydt Allwyzt Ystdyf Qdas Alqyamt Tqryr Shaml Mn Alwkalt Alwtnyt Llielam

May 19, 2025 -

Alwkalt Alwtnyt Llielam Tnql Qdas Alqyamt Mn Dyr Sydt Allwyzt

May 19, 2025

Alwkalt Alwtnyt Llielam Tnql Qdas Alqyamt Mn Dyr Sydt Allwyzt

May 19, 2025