Investors: BofA's Take On Elevated Stock Market Valuations

Table of Contents

BofA's Concerns Regarding Current Market Valuations

Bank of America's analysts have expressed concerns about elevated stock market valuations in recent reports. While they haven't explicitly declared the market as definitively "overvalued," they have highlighted specific sectors and valuation metrics that warrant caution. Their assessment often leans towards a cautious outlook, suggesting that current prices reflect a significant degree of optimism baked into future earnings growth. This isn't necessarily a bearish signal, but rather a call for more discerning investment choices.

-

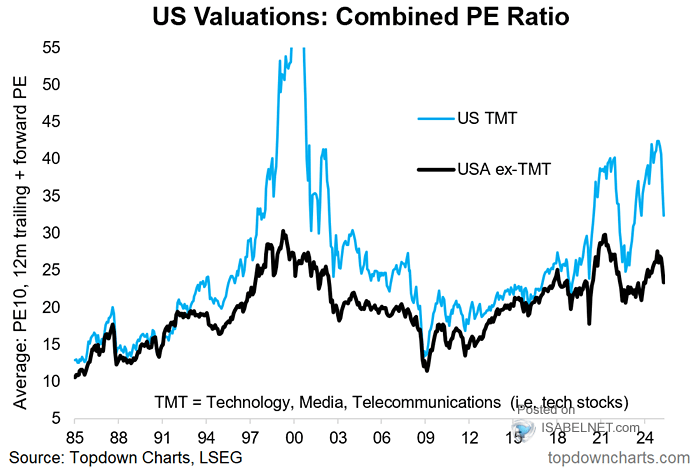

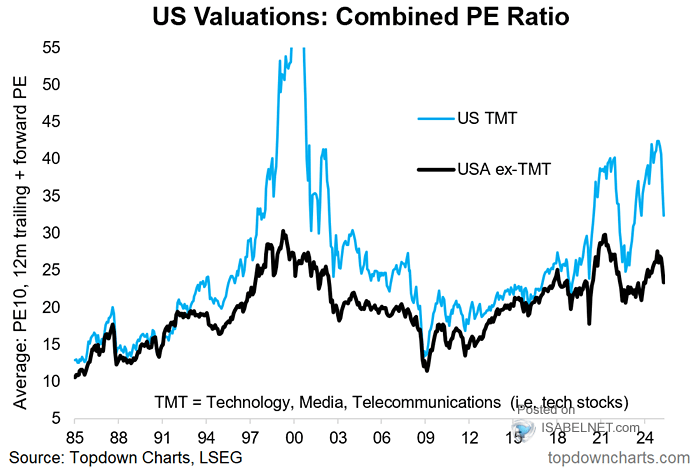

Specific sectors BofA flags as potentially overvalued: Recent BofA reports frequently mention the technology sector and certain segments of the consumer discretionary sector as potentially vulnerable to valuation corrections. These sectors have experienced substantial growth in recent years, leading to higher price-to-earnings ratios compared to historical averages.

-

Key valuation metrics used by BofA: BofA analysts utilize a range of valuation metrics, including the widely used Price-to-Earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio), also known as the CAPE ratio. They often compare current ratios to historical averages and industry benchmarks to assess whether valuations are justified.

-

Reference to BofA reports or analyst comments: To gain a deeper understanding of BofA's specific concerns, refer to their regularly published research notes and investor presentations available on their website. Look for analyses focusing on market valuations, sector outlooks, and macroeconomic forecasts. These reports frequently include detailed explanations of their valuation models and assumptions.

Potential Risks Associated with High Stock Market Valuations

High stock market valuations inherently increase the risk of market corrections or even more significant downturns. When prices are inflated, even a small shift in investor sentiment can trigger a sharp decline.

-

Risk of significant market correction and potential capital losses: A sharp correction could lead to substantial capital losses for investors, particularly those holding positions in overvalued sectors. The potential for losses is directly proportional to the extent of overvaluation.

-

Increased vulnerability to interest rate hikes and inflation: Rising interest rates increase borrowing costs for companies, potentially impacting profitability and reducing the appeal of equities compared to fixed-income investments. High inflation also erodes purchasing power and reduces real returns on investments.

-

Impact on investor sentiment and potential market volatility: Concerns about overvaluation can create a negative feedback loop. As investor confidence wanes, selling pressure can intensify, causing further price declines and increased market volatility.

-

Historical precedents for high valuations and subsequent market adjustments: History provides numerous examples where periods of high stock valuations have been followed by significant market corrections. Examining these historical precedents can provide valuable context for understanding the potential risks.

BofA's Recommendations for Investors

Navigating elevated valuations requires a cautious and strategic approach. BofA generally recommends a more conservative investment strategy during such periods.

-

Suggestions for portfolio diversification: BofA usually advocates for a diversified portfolio across various sectors and asset classes. This helps to mitigate risk by reducing reliance on any single sector or investment type. A balanced approach across different sectors – for example, combining technology with more defensive sectors like consumer staples – is often recommended.

-

Recommendations on specific investment strategies: Value investing, which involves identifying undervalued companies with strong fundamentals, is often favored during periods of high market valuations. Growth investing, while potentially still rewarding, should be approached with more caution, carefully considering valuation metrics.

-

Advice on risk management techniques: Employing risk management techniques, such as setting stop-loss orders to limit potential losses, and considering hedging strategies to protect against market downturns, are crucial components of a prudent investment plan.

-

Importance of long-term investment strategy versus short-term market timing: BofA generally emphasizes the importance of a long-term investment strategy over attempts to time the market. Short-term market fluctuations are often unpredictable, and trying to perfectly time the market frequently leads to suboptimal results.

The Role of Inflation and Interest Rates

Inflation and interest rates significantly impact stock valuations. BofA's analysis usually highlights the negative correlation between rising interest rates and stock prices.

-

How inflation erodes purchasing power and affects company earnings: High inflation erodes the purchasing power of future earnings, reducing the present value of future cash flows, a key component of stock valuation. It can also increase input costs for businesses, squeezing profit margins.

-

The effect of interest rate hikes on corporate borrowing costs and stock valuations: Higher interest rates increase the cost of borrowing for companies, impacting their profitability and potentially leading to lower stock valuations. It also increases the attractiveness of bonds compared to stocks.

-

BofA's predictions (if available) regarding future interest rate movements and inflation: BofA economists regularly publish forecasts for interest rates and inflation. These predictions should be incorporated into investment strategies to help account for the impacts of these macroeconomic factors.

Alternative Investment Opportunities

To balance exposure to potentially overvalued equities, BofA might suggest exploring alternative investment options.

-

Discussion of fixed-income investments (bonds) as a counterbalance: Bonds can offer a degree of stability and potentially higher yields in a rising interest rate environment, providing a counterbalance to the volatility of the equity market.

-

Mentioning other asset classes, like real estate or commodities: Diversification into other asset classes, such as real estate or commodities, can offer further risk mitigation and potential diversification benefits.

-

Highlighting the importance of risk tolerance in choosing alternative investments: The choice of alternative investments should align with an individual's risk tolerance and investment goals. Some alternatives carry more risk than others.

Conclusion

BofA's analysis suggests a cautious approach to the current stock market environment, highlighting the potential risks associated with elevated valuations. Their recommendations emphasize the importance of portfolio diversification, robust risk management, and a long-term investment strategy rather than trying to time the market. Understanding BofA's perspective on elevated stock market valuations is crucial for making informed investment decisions. Use this analysis to carefully review your portfolio and consider adjustments based on your individual risk tolerance. Stay informed about market trends and consult with a financial advisor to develop a robust investment strategy that addresses the current challenges presented by high stock market valuations. Remember to regularly reassess your holdings in light of BofA's insights and evolving market conditions.

Featured Posts

-

Understanding Mr Miyagis Teachings In The Karate Kid

May 23, 2025

Understanding Mr Miyagis Teachings In The Karate Kid

May 23, 2025 -

Grand Ole Opry Londons Royal Albert Hall To Host Historic Broadcast

May 23, 2025

Grand Ole Opry Londons Royal Albert Hall To Host Historic Broadcast

May 23, 2025 -

Al Roker Under Fire Co Hosts Reaction To Off Record Comments

May 23, 2025

Al Roker Under Fire Co Hosts Reaction To Off Record Comments

May 23, 2025 -

Rodriguez Erazo Designada Secretaria Del Departamento De Asuntos Del Consumidor

May 23, 2025

Rodriguez Erazo Designada Secretaria Del Departamento De Asuntos Del Consumidor

May 23, 2025 -

Caesar Flickermans Casting Announced Kieran Culkin Joins Sunrise

May 23, 2025

Caesar Flickermans Casting Announced Kieran Culkin Joins Sunrise

May 23, 2025

Latest Posts

-

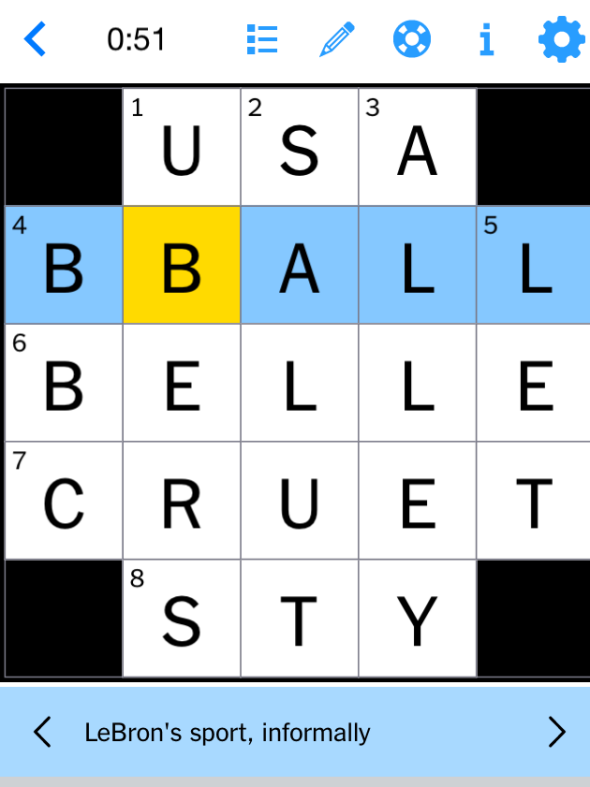

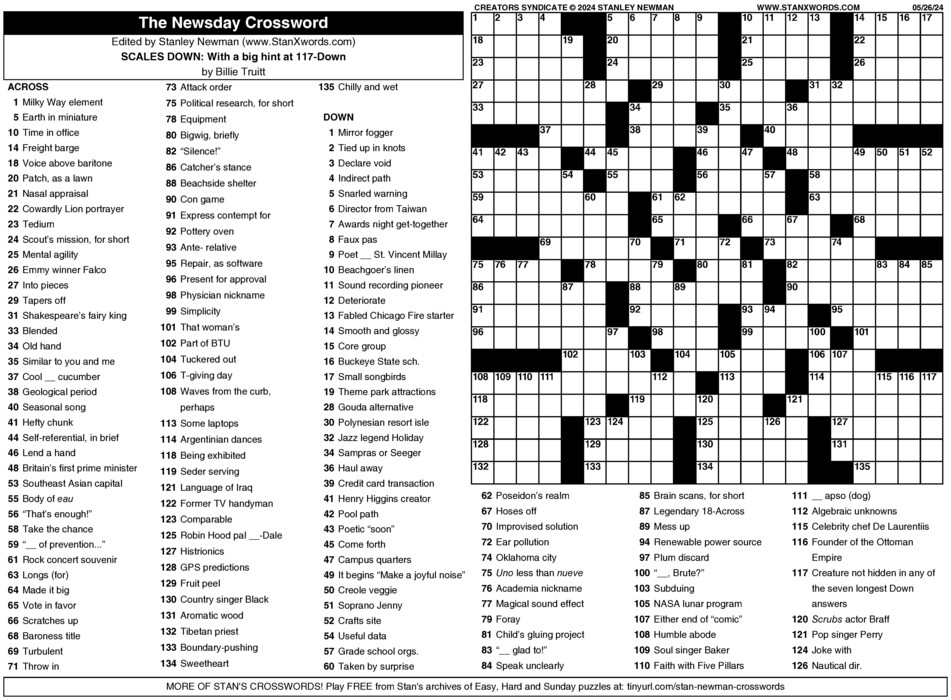

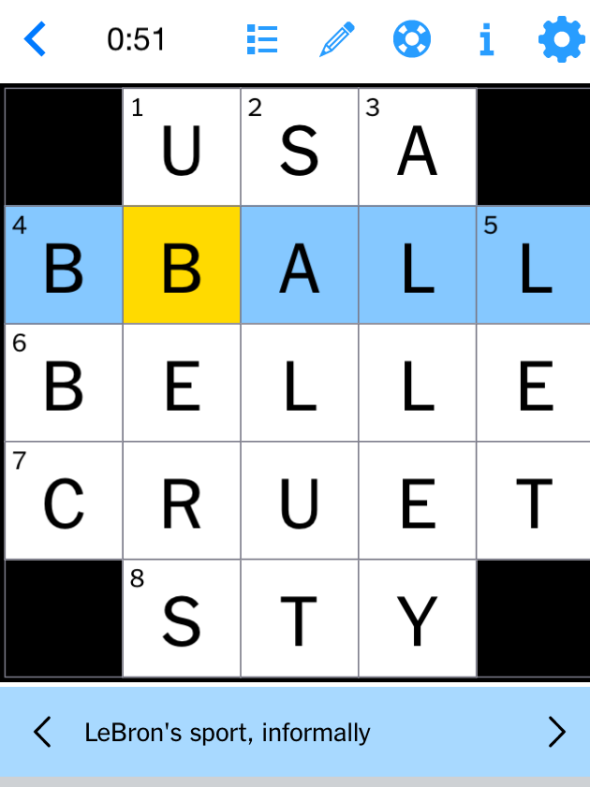

April 8th 2025 Nyt Mini Crossword Hints Clues And Answers

May 23, 2025

April 8th 2025 Nyt Mini Crossword Hints Clues And Answers

May 23, 2025 -

Todays Nyt Mini Crossword March 6 2025 Solutions

May 23, 2025

Todays Nyt Mini Crossword March 6 2025 Solutions

May 23, 2025 -

March 5 2025 Nyt Mini Crossword Answers And Clues

May 23, 2025

March 5 2025 Nyt Mini Crossword Answers And Clues

May 23, 2025 -

Nyt Mini Crossword Sunday May 11 Clues And Solutions

May 23, 2025

Nyt Mini Crossword Sunday May 11 Clues And Solutions

May 23, 2025 -

Solve The Nyt Mini Crossword For April 6 2025 Hints And Answers

May 23, 2025

Solve The Nyt Mini Crossword For April 6 2025 Hints And Answers

May 23, 2025