Investors Are Piling Into This Hot New SPAC Stock: Should You Follow?

Table of Contents

First, let's briefly define what a SPAC is. A Special Purpose Acquisition Company (SPAC) is a publicly traded company with no commercial operations, formed solely to raise capital through an IPO to acquire or merge with an existing private company. This allows private companies to go public without undergoing a traditional IPO process. This article will help you determine if XYZ SPAC is the right investment for you.

The Allure of SPACs: Why Investors Are Drawn to This Stock

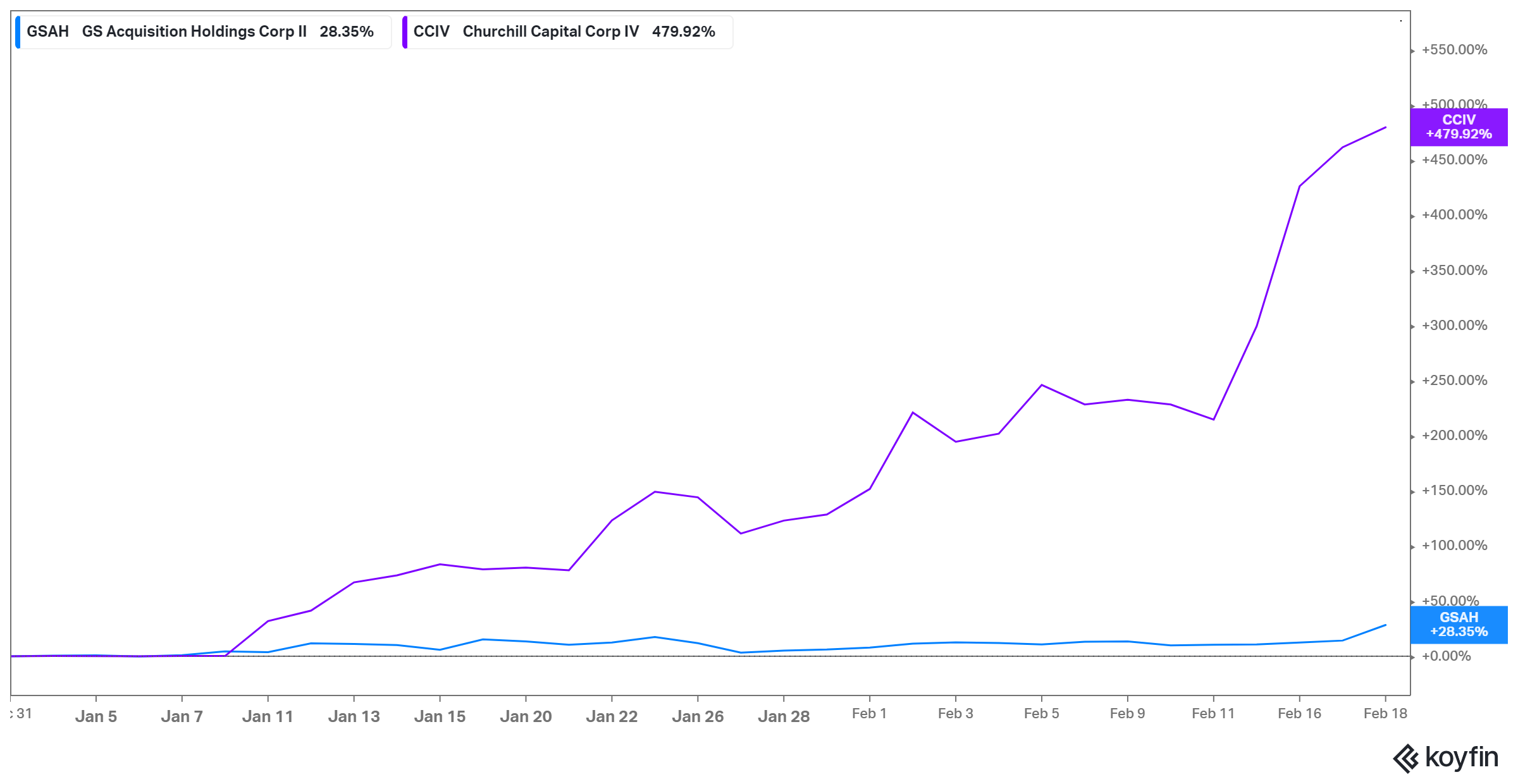

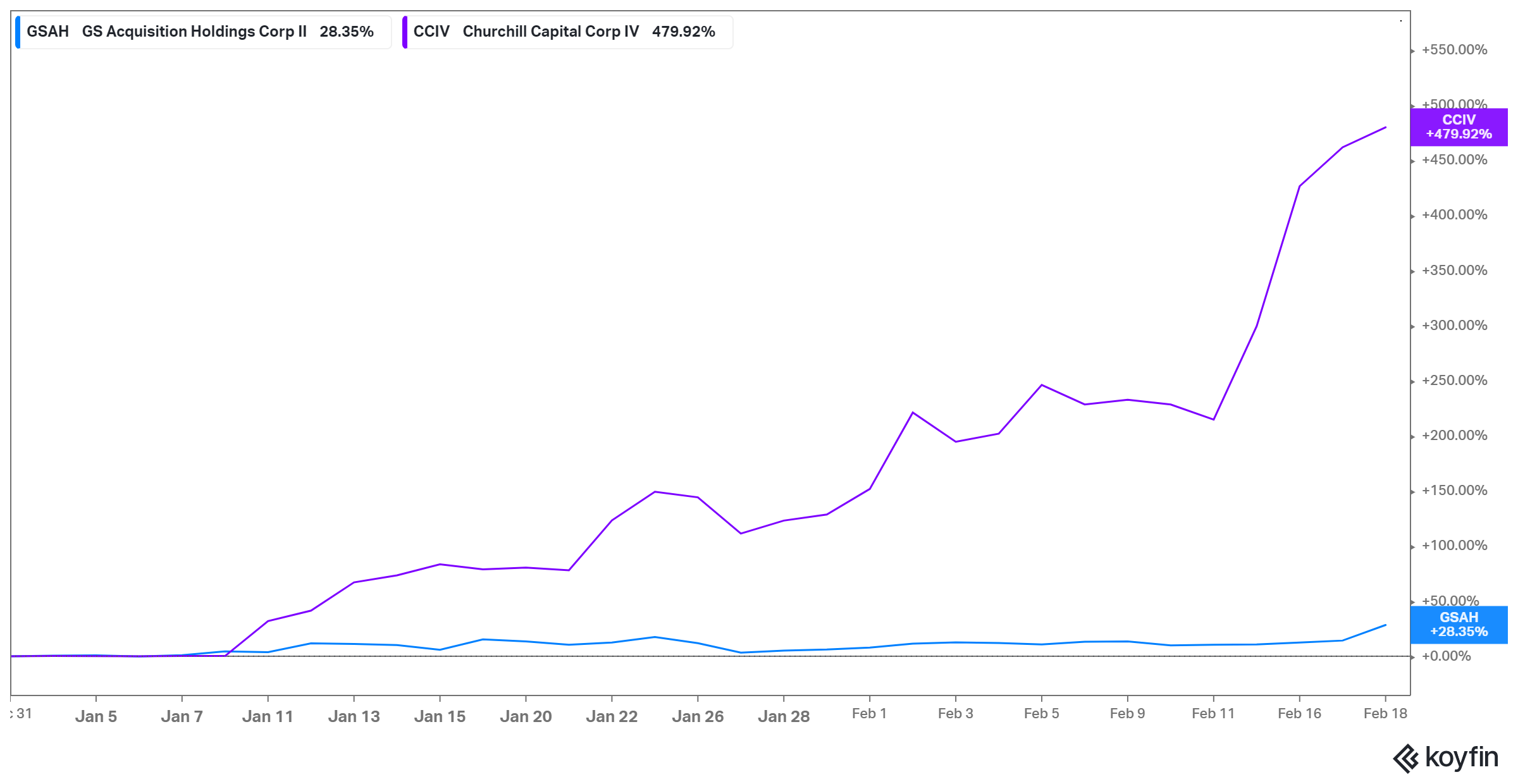

SPACs have become increasingly popular due to several key advantages, making XYZ SPAC particularly attractive to many investors. One of the primary reasons for their appeal is the potential for high returns. Successful SPAC mergers can lead to significant price appreciation for investors who got in early.

- High-Growth Potential: SPACs often target companies in high-growth sectors, offering investors a chance to participate in rapid expansion.

- Lower Barrier to Entry: Compared to traditional IPOs, investing in SPACs often requires a lower initial investment, making them accessible to a wider range of investors. This lowers the barrier for participation in the SPAC stock market.

- Pre-IPO Access: SPACs provide investors with access to promising private companies before they go public, potentially securing higher returns than a traditional IPO.

- Diversification: Investing in a diversified portfolio of SPACs can offer a way to diversify your investment portfolio and reduce overall risk. This makes strategic SPAC investment a viable option.

XYZ SPAC, specifically, boasts several features making it a compelling investment opportunity:

- Strong Management Team: XYZ SPAC's leadership comprises experienced executives with proven track records in [mention relevant industry]. This contributes to investor confidence in a successful SPAC IPO.

- Promising Target Company: While the target company may not yet be publicly known, [insert any information released about potential targets or industries they are pursuing. E.g., "rumors suggest the target operates in the burgeoning renewable energy sector"]. This element is a crucial part of the SPAC investment process.

- Favorable Market Conditions: The current market climate is [describe the current market conditions and how they favorably impact the SPAC, e.g., "characterized by strong investor appetite for technology companies and a positive outlook for the renewable energy sector"]. This indicates a positive outlook for the SPAC stock market as a whole.

Recent stock performance data [insert relevant data, e.g., "shows a 20% increase in share price since its IPO"], positive analyst ratings, and a market capitalization of [insert market cap] further bolster the case for XYZ SPAC.

Understanding the Risks: Potential Downsides of SPAC Investment

Despite the allure, SPAC investments carry significant risks. It's crucial to understand these before considering investing in XYZ SPAC or any other SPAC.

- Target Company Risk: The greatest risk is the target company failing to meet expectations after the merger. Thorough due diligence is essential before investing.

- Lack of Transparency: Before a merger, there is often limited information about the target company. This lack of complete transparency is a key risk associated with SPAC investments.

- Share Dilution: The issuance of new shares after a merger can dilute the value of existing shares, impacting the returns for early investors.

- Market Volatility: SPAC prices, like other stocks, are subject to significant market volatility. Understanding the nature of SPAC volatility is crucial.

Specifically, concerning XYZ SPAC: [Mention any red flags, such as potential conflicts of interest, concerns expressed by analysts, or lack of information regarding the target company. Be cautious and cite your sources for any claims].

Due Diligence: How to Evaluate This SPAC Stock Before Investing

Before investing in XYZ SPAC, thorough due diligence is paramount. This should involve:

- Financial Statement Analysis: Scrutinize the SPAC's financial statements and filings to assess its financial health and identify any potential red flags.

- Management Team Research: Research the management team's track record to gauge their experience and competence. Thorough SPAC research needs to include this.

- Target Company Assessment: If the target company is known, thoroughly research its business model, financials, and competitive landscape.

- Market Analysis: Consider the overall market conditions and the outlook for the industry the target company operates in.

Understanding the SPAC's terms and conditions, including the redemption rights for investors, is crucial before committing your capital. Proper SPAC analysis requires careful consideration of all relevant factors. Follow best practices for SPAC investing strategies for optimal results.

Conclusion

Investing in XYZ SPAC presents both exciting opportunities and considerable risks. The potential for high returns is enticing, driven by factors such as a strong management team and favorable market conditions. However, the lack of transparency before the merger and the inherent risks associated with the target company’s success require careful consideration. Remember, thorough due diligence, including analyzing financial statements, researching the management team, and assessing the target company's potential (if known), is absolutely essential.

While the allure of this hot new SPAC stock is undeniable, remember to perform your own thorough due diligence before investing. Carefully weigh the potential rewards against the significant risks involved. Only invest in SPACs, like this one, if they align with your overall investment strategy and risk tolerance. Successful investing in SPAC stocks requires caution and careful evaluation.

Featured Posts

-

Why Dogecoin Shiba Inu And Sui Are Soaring This Week A Market Analysis

May 08, 2025

Why Dogecoin Shiba Inu And Sui Are Soaring This Week A Market Analysis

May 08, 2025 -

The Sonos Ikea Partnership Is Over Impact On Smart Home Systems

May 08, 2025

The Sonos Ikea Partnership Is Over Impact On Smart Home Systems

May 08, 2025 -

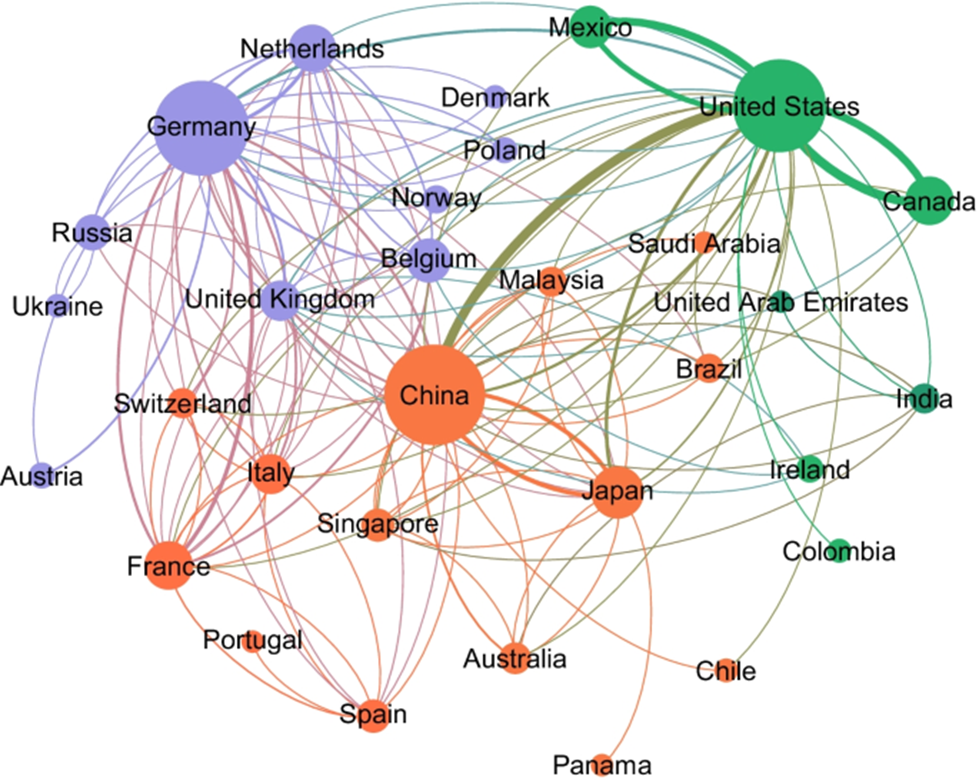

The Great Decoupling Rethinking Globalization And Supply Chains

May 08, 2025

The Great Decoupling Rethinking Globalization And Supply Chains

May 08, 2025 -

Informe Sobre La Situacion Del Club Atletico Central Cordoba Perspectivas Desde El Gigante De Arroyito

May 08, 2025

Informe Sobre La Situacion Del Club Atletico Central Cordoba Perspectivas Desde El Gigante De Arroyito

May 08, 2025 -

Office365 Breach Nets Millions Crooks Insider Attack Revealed

May 08, 2025

Office365 Breach Nets Millions Crooks Insider Attack Revealed

May 08, 2025