Investor Concerns About Stock Market Valuations: BofA's Response

Table of Contents

H2: BofA's Assessment of Current Stock Market Valuations

Bank of America's assessment of current stock market valuations provides a nuanced perspective, acknowledging both the potential risks and opportunities. While they haven't explicitly declared the market as definitively "overvalued," "undervalued," or "fairly valued" with a single label, their analysis points towards a cautious optimism. Their reports often utilize a variety of valuation metrics to reach a comprehensive conclusion.

- Bullet Points:

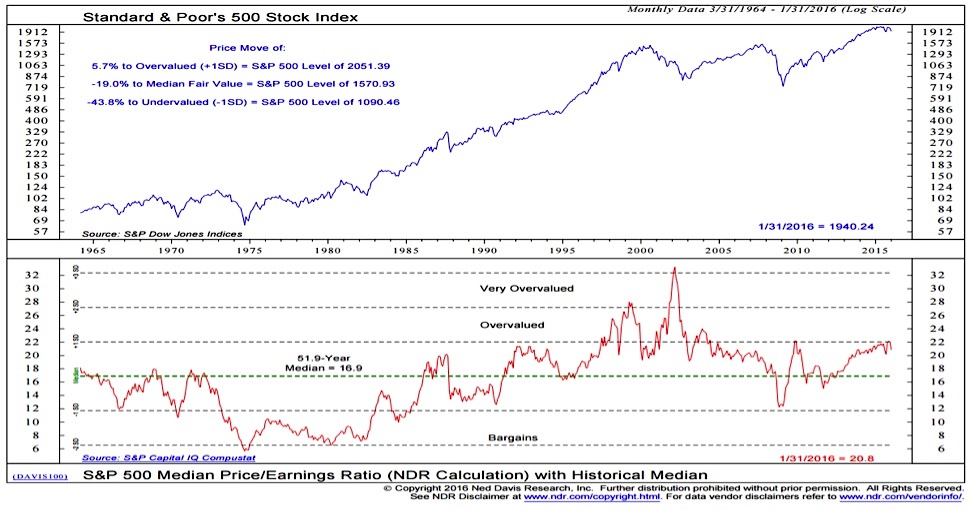

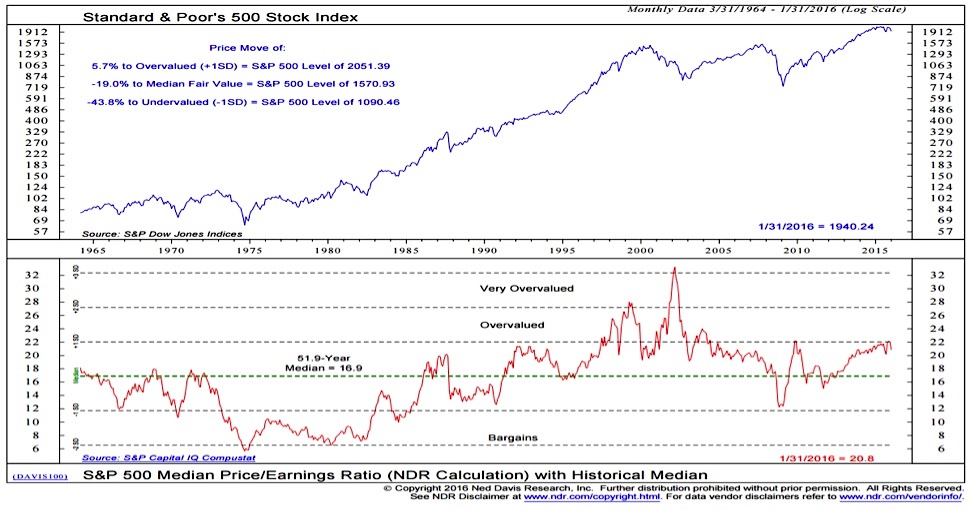

- Summary of BofA's valuation metrics: BofA utilizes a range of metrics, including the price-to-earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and other forward-looking measures to assess valuations. They often analyze these metrics across different sectors and compare them to historical averages and industry benchmarks. Specific numbers will vary based on the report's release date, so always refer to the most recent BofA publications for up-to-date figures.

- Comparison to historical valuations: BofA frequently compares current valuations to historical levels to gauge whether current prices represent a significant departure from long-term averages. This contextualization helps investors understand whether current valuations are unusually high or low compared to historical norms, providing perspective on potential risks and rewards.

- Specific sectors: BofA's analysis often highlights specific sectors they view as potentially overvalued or undervalued based on their unique fundamentals and growth prospects. For example, they might identify technology stocks as potentially overvalued in a high-interest rate environment while highlighting value sectors as potentially undervalued.

- Charts and graphs: BofA reports typically include charts and graphs illustrating their valuation findings. These visual aids facilitate understanding of complex data, allowing investors to quickly grasp the key takeaways from the analysis. Looking for these visuals in their published research is highly recommended.

H2: Key Factors Driving Investor Anxiety

Several macroeconomic factors contribute to investor apprehension about stock valuations. These anxieties are often intertwined and influence each other, creating a complex investment landscape.

- Bullet Points:

- Inflation's impact: High inflation erodes purchasing power and impacts future corporate earnings, making it harder to justify high stock prices. This uncertainty leads to volatility in stock market valuations.

- Rising interest rates: Higher interest rates increase borrowing costs for companies and reduce the present value of future cash flows, impacting discounted cash flow models used to value stocks. This can lead to lower stock valuations.

- Geopolitical uncertainty: Geopolitical events, such as wars or trade disputes, introduce uncertainty into the market, influencing investor sentiment and impacting stock prices.

- Supply chain disruptions: Supply chain bottlenecks increase production costs and limit the availability of goods, negatively affecting corporate profitability and consequently stock valuations.

- Recession potential: The possibility of a recession significantly impacts investor confidence and leads to lower stock valuations as future earnings are projected to decline.

H2: BofA's Outlook and Recommendations

BofA's outlook and recommendations are crucial for investors navigating the current market environment. Their analyses typically provide a range of potential scenarios, highlighting both upside and downside risks.

- Bullet Points:

- Market growth forecast: BofA's forecasts usually encompass a range of potential outcomes, acknowledging the uncertainty inherent in market predictions. They often provide scenarios for various levels of economic growth and inflation.

- Investment strategies: BofA typically advocates for diversification, suggesting investors spread their investments across various asset classes to mitigate risk. Sector rotation, adjusting portfolio allocations based on market conditions and sector performance, is often recommended.

- Asset classes: Depending on the market outlook, BofA may suggest favoring specific asset classes, such as bonds or alternative investments, to balance the portfolio's risk-reward profile.

- Risk management: Effective risk management is crucial in any market environment, especially during times of uncertainty. BofA often emphasizes the importance of understanding your risk tolerance and investing accordingly.

H3: Addressing Specific Investor Concerns

Many investors have specific questions regarding their portfolios and investment strategies. Addressing common concerns, based on BofA’s analysis, offers practical guidance.

- Bullet Points: (Q&A Format)

- Q: What should I do with my portfolio? A: BofA generally advises maintaining a diversified portfolio and reassessing your risk tolerance. Consider your time horizon and adjust your portfolio allocation based on your risk appetite and the current market conditions. (This answer should be considered general advice; consult a financial professional for personalized guidance.)

- Q: Is now a good time to buy or sell? A: The optimal time to buy or sell depends on individual circumstances and risk tolerance. BofA's research can help inform your decision, but it's not a definitive buy/sell signal. Consider your long-term investment goals and consult a financial advisor before making major changes to your portfolio.

Conclusion:

BofA's assessment of stock market valuations highlights the significant influence of inflation, rising interest rates, and geopolitical uncertainty on investor sentiment. While their analysis doesn't offer a simple "overvalued" or "undervalued" conclusion, it emphasizes the importance of a cautious and diversified approach. Their recommendations stress the need for thorough research, risk management, and potentially seeking professional financial advice. While BofA offers valuable insights into stock market valuations, understanding your risk tolerance and conducting your own research are paramount. Continuously monitor stock market valuations and adapt your strategy accordingly. Remember, actively managing your investments and staying informed are crucial for long-term success.

Featured Posts

-

Stream Untucked Ru Pauls Drag Race Season 17 Episode 8 Free Online

Apr 30, 2025

Stream Untucked Ru Pauls Drag Race Season 17 Episode 8 Free Online

Apr 30, 2025 -

Stuttgart In Bueyuek Capli Atff Futbol Altyapi Secmeleri

Apr 30, 2025

Stuttgart In Bueyuek Capli Atff Futbol Altyapi Secmeleri

Apr 30, 2025 -

The Amanda Owen Clive Divorce A Look At The Latest Heated Exchange

Apr 30, 2025

The Amanda Owen Clive Divorce A Look At The Latest Heated Exchange

Apr 30, 2025 -

Nebraskas Destination Act Impact On The Rod Yates Project In Gretna

Apr 30, 2025

Nebraskas Destination Act Impact On The Rod Yates Project In Gretna

Apr 30, 2025 -

Vusion Group Document Amf Cp 2025 E1027277 Rapport Du 24 Mars 2025

Apr 30, 2025

Vusion Group Document Amf Cp 2025 E1027277 Rapport Du 24 Mars 2025

Apr 30, 2025

Latest Posts

-

Johnstons Record Setting Goal Fuels Stars 6 2 Victory Over Avalanche

Apr 30, 2025

Johnstons Record Setting Goal Fuels Stars 6 2 Victory Over Avalanche

Apr 30, 2025 -

Obnovlenniy Prognoz N Kh L Skolko Esche Ovechkinu Do Rekorda Grettski

Apr 30, 2025

Obnovlenniy Prognoz N Kh L Skolko Esche Ovechkinu Do Rekorda Grettski

Apr 30, 2025 -

Ovechkin I Rekord Grettski Noviy Prognoz N Kh L

Apr 30, 2025

Ovechkin I Rekord Grettski Noviy Prognoz N Kh L

Apr 30, 2025 -

N Kh L Obnovila Prognoz Kogda Ovechkin Pobet Rekord Grettski

Apr 30, 2025

N Kh L Obnovila Prognoz Kogda Ovechkin Pobet Rekord Grettski

Apr 30, 2025 -

Garcia And Witts Key Plays Lift Royals To 4 3 Win Over Guardians

Apr 30, 2025

Garcia And Witts Key Plays Lift Royals To 4 3 Win Over Guardians

Apr 30, 2025